Emerging Trends in the European Digital Used Passenger Vehicles Market, 2020

Emerging Trends in the European Digital Used Passenger Vehicles Market, 2020

Focus on Start-ups and White Space Driving Valuations, as 2 Million Used Vehicles Set to be Traded Online

03-Jul-2020

Europe

Market Research

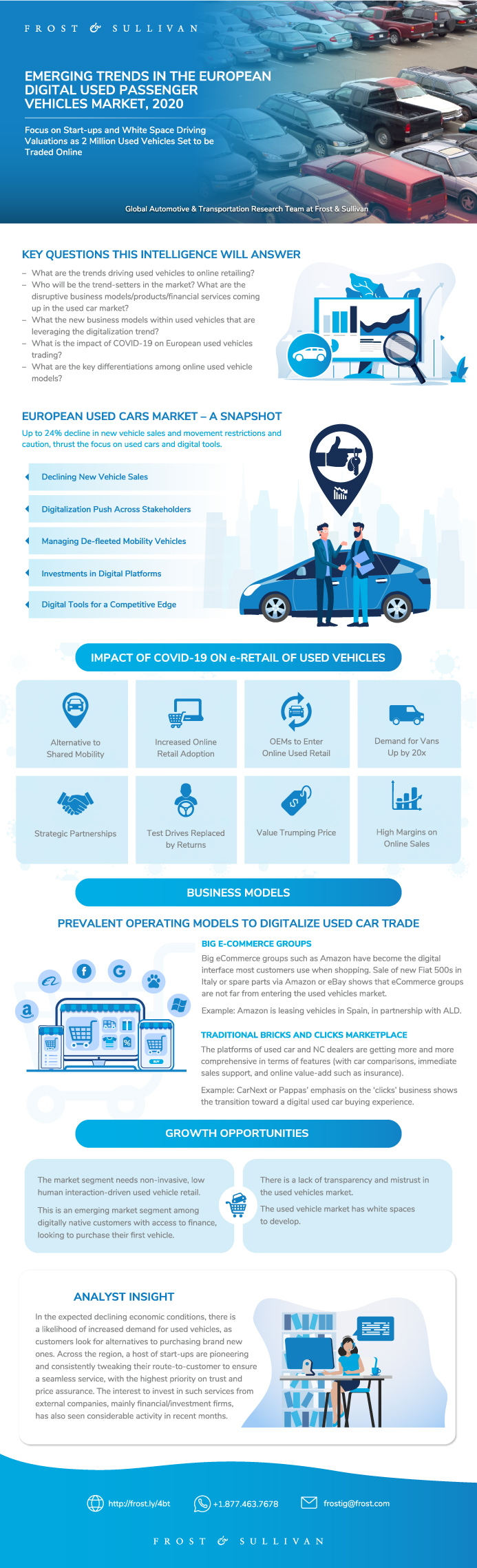

As more and more digitally native customers look to purchase a vehicle, the competition and business models to sell used vehicles online increases. With social distancing norms changing ‘business as usual’, COVID-19 acts as an accelerator for more dealerships, OEMs, and traders to sell online.

There are multiple online used vehicle retail models ranging from peer-to-peer listing services, aggregator listing, and bricks-and-clicks marketplace, not to mention the eCommerce participants who are eager to make a big splash themselves, broker marketplace, and 100% online retail models.

Each of these market segments represent a different customer journey and remain valid in their own right. However, Frost & Sullivan’s analysis identifies the preferred up-scale segments of broker marketplaces and 100% online retail models as among the most looked at by retail customers. In the expected declining economic conditions, there is a likelihood of increased demand for used vehicles, as customers look for alternatives to purchasing brand new ones. Across the region, a host of start-ups are pioneering and consistently tweaking their route-to-customer to ensure a seamless service, with the highest priority on trust and price assurance. The interest to invest in such services from external companies, mainly financial/investment firms, has also seen considerable activity in recent months. The used car marketplace is multi-dimensional, with brokers, auction firms, dealers, direct sellers, and online price and demand assessors, along with the trends of electrification and regulatory pressures that are forcing the retail segment to be on its toes all the time. The need for the right partners to enable a viable trading platform and to perform follow-through services of refurbishment, logistics, and others is a vital factor that helps these companies keep a tab on their costs.

This study captures the prominent modes of route-to-market and the profiles of key used vehicle companies across Europe that have exciting digital used vehicle platforms, besides identifying the key opportunities that are still considered as white spaces. The impact of COVID-19 on the used vehicles market is also covered briefly and more evidence can be gathered from the best practices of the companies profiled.

Frost & Sullivan has a dedicated automotive retail research team that looks into multiple aspects of automotive retailing, ranging from new vehicle sales, used vehicle sales, digital retailing, new store formats, dealer networks, and branding and customer journey.

Key Issues Addressed

- What are the trends driving used vehicles to online retailing?

- Who will be the trend setters in the market? What are the disruptive business models/products/financial services coming up in the used cars market?

- What the new business models within used vehicles that are leveraging the digitalization trend?

- What is the impact of COVID-19 on European used vehicles trading?

- What are the key differentiations among online used vehicle models?

Author: Isaac Abraham

European Used Cars Market—2020 Highlights

European Used Cars Market—Snapshot

Impact of COVID-19 on eRetail of Used Vehicles

COVID-19’s Impact on Used Vehicles

European Used Cars Market—Outlook

Research Scope

Key Questions this Study will Answer

Research Methodology

eRetailers—Key Features

Key Regions and Reactions

Value Chain

Traditional and Digital Business Models

Major Determinants

Broker Marketplace as Business Model

eRetailers as a Business Model

Prevalent Operating Models to Digitalize Used Car Trade

Mapping Digital Used Car Start-ups in Europe

Instamotion

Abracar

Webycar

Auto 1 Group—AutoHero

BuyACar.co.uk

Cazoo

LeasePlan—CarNext

Key Used Car Start-ups—Overview

Other Companies to Watch Out For

Opportunity 1—A Case for Used Car Leasing

Opportunity 2—De-fleeted Shared Mobility Vehicles

Opportunity 3—Cross-border Sales: The Success of Autorola Group

Opportunity 4—Digital Marketing Tools for Dealers

Opportunity 5—Vehicle Auction Financing Tool for Dealers

Opportunity 6—Validating Vehicle Prices with Big Data

Opportunity 7—Online Used Cars Valuation Check

Opportunity 8—OEMs’ Buyback Assurance

Opportunity 9—Used EVs Program: The Unique OEM Proposition

Opportunity 10—Bundle Services to Improve Value Addition

Growth Opportunities

Strategic Imperatives for Success and Growth

Key Conclusions

Top 5 Changes to the Customer Experience and Journey

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Exhibits

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

Key Issues Addressed

- What are the trends driving used vehicles to online retailing?

- Who will be the trend setters in the market? What are the disruptive business models/products/financial services coming up in the used cars market?

- What the new business models within used vehicles that are leveraging the digitalization trend?

- What is the impact of COVID-19 on European used vehicles trading?

- What are the key differentiations among online used vehicle models?

Author: Isaac Abraham

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Isaac Abraham |

| Industries | Automotive |

| WIP Number | MEC3-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9807-A6,9883-A6,9AF6-A6 |