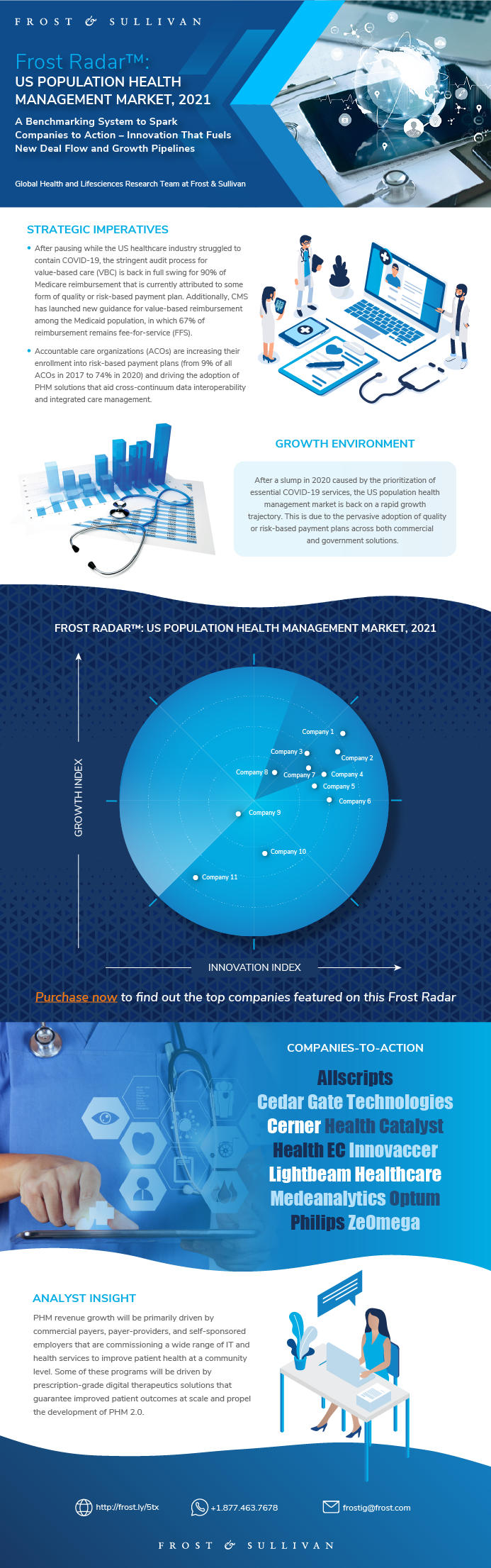

Frost Radar™: US Population Health Management Market, 2021

Frost Radar™: US Population Health Management Market, 2021

A Benchmarking System to Spark Companies to Action - Innovation That Fuels New Deal Flow and Growth Pipelines

01-Jun-2021

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

After pausing while the US healthcare industry struggled to contain COVID-19, the stringent audit process for value-based care (VBC) is back in full swing for 90% of Medicare reimbursement that is currently attributed to some form of quality or risk-based payment plan. Additionally, CMS has launched new guidance for value-based reimbursement among the Medicaid population, in which 67% of reimbursement remains fee-for-service (FFS).

The expanded scope of VBC will compel health systems to invest in a range of public health management (PHM) capabilities that cover all types of government-sponsored health insurance and demonstrate proven ability to meet quality performance criteria for specific insured populations (e.g., Medicare Advantage, Medicaid Advantage, and Long-Term Services and Supports).

Accountable care organizations (ACOs) are increasing their enrollment into risk-based payment plans (from 9% of all ACOs in 2017 to 74% in 2020) and driving adoption of PHM solutions that aid cross-continuum data interoperability and integrated care management.

However, next-generation ACOs (NGACOs) that pioneered adoption of VBC payment plans are failing to report the desired business outcomes. In fact, 50 such NGACOs reported additional spending of $93 million in the first 2 years of their program against savings of $86 million, which they reported in the first year of the same program. Consequently, they are devising PHM strategies that guarantee improved financial outcomes while being clinically result-oriented and operationally streamlined.

In a field of more than 50 industry participants, Frost & Sullivan independently plotted the top 11 companies in this Frost Radar™ analysis. The Radar™ reveals the market positioning of each company using its Growth and Innovation scores as highlighted in the Frost Radar™ methodology. The document presents competitive profiles on each company based on its strengths, opportunities, and market positioning. We discuss strategic market imperatives and the competitive environment that vendors operate in as well as make recommendations for each provider to spur growth.

Author: Koustav Chatterjee

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Strategic Imperative

Strategic Imperative (continued)

Strategic Imperative (continued)

Growth Environment

Growth Environment (continued)

Frost Radar™: US Population Health Management Market, 2021

Frost Radar™: Competitive Environment

Frost Radar™: Competitive Environment (continued)

Allscripts

Cedar Gate Technologies

Cerner

Health Catalyst

Health EC

Innovaccer

Lightbeam Healthcare

Medeanalytics

Optum

Philips

ZeOmega

Strategic Insights

Significance of Being on the Frost Radar™

Frost Radar™ Empowers the CEO’s Growth Team

Frost Radar™ Empowers Investors

Frost Radar™ Empowers Customers

Frost Radar™ Empowers the Board of Directors

Frost Radar™: Benchmarking Future Growth Potential

Frost Radar™: Benchmarking Future Growth Potential

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Koustav Chatterjee |

| Industries | Healthcare |

| WIP Number | K606-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9564-B1,9600-B1,9612-B1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB