Future of Europe

Future of Europe

Impact of Mega Trends on Europe's Complex Business Environment

18-Apr-2016

Global

Description

Europe is bound by an enormous number of obsolete regulations and systems. New environmental, economic, social, and political developments and trends have challenged these systems, forcing Europe to re-think future strategies. The European Union has set 5 ambitious objectives, namely, employment, innovation, education, social inclusion, and climate/energy, which are to be reached by 2020. This presentation examines these developments, along with other exogenous factors or Mega Trends, that will transform the future of the continent over the next 10 years. It also provides an understanding of the inter-linkages of these Mega Trends and their implications for countries and industries on a macro level and for cities on a micro level.

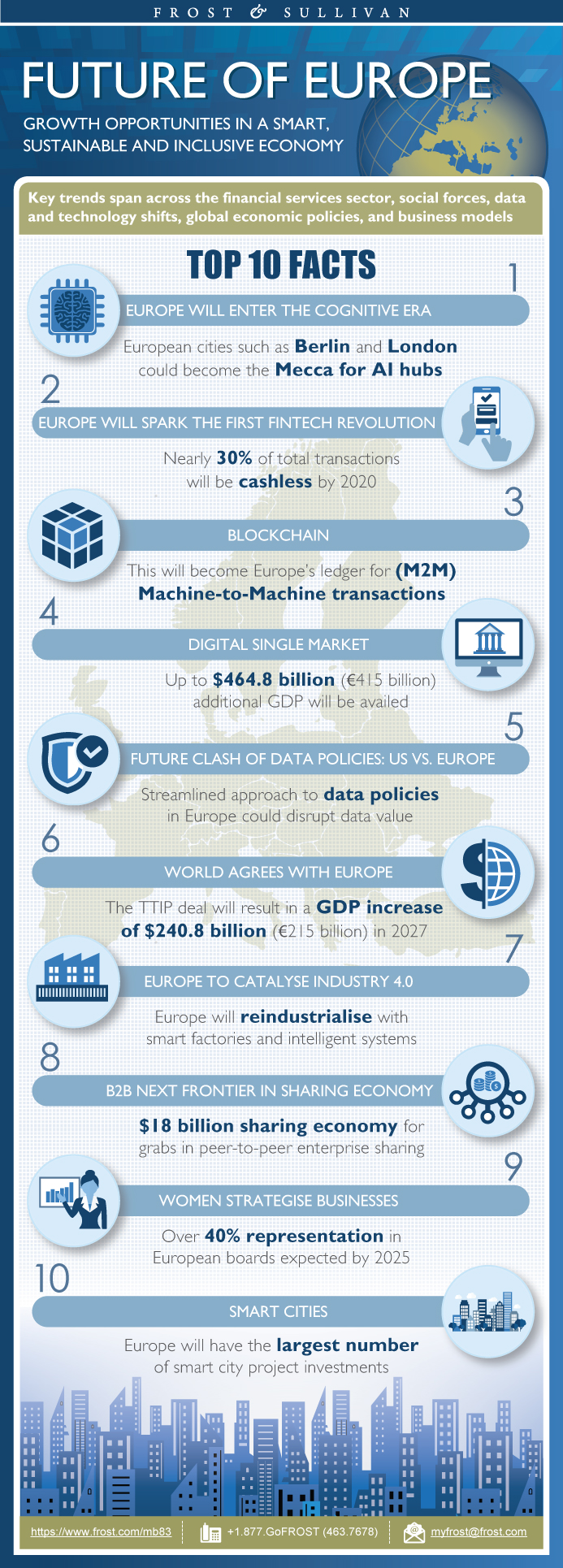

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Top 10 Facts on the Future of Europe

Key Findings

Europe’s Internet Economy

Europe’s Digital Single Market

- Current Issues

- Proposed Solutions/Strategies

Europe’s 5G Rollout

- 5G Technology Roadmap, EU, 2015–2020

- EU 5G Vision

- 4G versus 5G

- 5G Targets

AI Evolution

Human Brain versus Machines—Comparison of Learning

Europe will Move Closer to a Cashless Society by 2020

Europe’s Demographic Crisis—Declining Population Growth

Europe’s Demographic Future—Ageing Society

Future of Europe’s Economy—Global Prospective

Renaissance of Foreign Investment in Europe

Europe’s Manufacturing Dynamics—Shift towards the East

Europe’s Online Retail Landscape

- Dominant Participants

Building New Europe—Need for Infrastructure Investment

Europe’s Mega Cities

Europe’s Mega Regions

Europe’s Mega Corridors, 2025

Future Smart Cities of Europe,2025

- Oslo

- Amsterdam

- London

- Paris

- Others

Traditional Carsharing Services Market in Europe—Country-wise Analysis

European Market—Country-wise Analysis of Peer-to-Peer (P2P) Carsharing Members

European Energy Outlook—Future Energy Mix

Europe’s Renewable Energy Prospects

Upsurge of Healthcare Expenditure in Europe

Escalation of Digital Healthcare in Europe

Research Scope

Research Aims and Objectives

Research Background

Research Methodology

Definitions Used in the Study

Highlights

Europe’s Digital Single Market

Europe’s Transformational Agenda for the Digital Age

Acceptance of Europe’s Digital Single Market in the Business Environment

Europe’s 5G Rollout- Roadmap and vision

Galileo—The European Navigation Satellite System

Mini Satellites—All Set to Transform Space Exploration

EU Data Protection Regulations

Impact of the New EU Data Protection Law on Businesses

Connected Devices Drive in Europe—A Comparative Analysis

Connected Devices Drive in Europe—A Regional Analysis

Europe’s Internet Economy

Big Data in Europe

Big Data—Big Opportunities in Europe

Satellite Broadband in Europe

Aim for Widespread High-speed Broadband Connectivity

Digitising Industry Initiatives across Europe—An Overview

European Mobile Economy—Key Growth Areas

Open Internet—Net Neutrality

Artificial Intelligence(AI)

AI Evolution

Human Brain versus Machines

Human Brain, Computers, and Supercomputers—Computing Powers

Dissecting AI

AI and Automation—Job Threat Mapping

AI-readiness of Industries

Future AI Hubs will Prioritise Innovation over Labour Costs

Future of Banking—Highlights

Europe will be Moving Closer to a Cashless Society by 2020

Mobile Banking in Europe

Europe’s Online Alternative Finance Market

Fintech Renaissance in Europe

Digital Insurance in Europe

Banking without Banks—Peer-to-Peer Lending in Europe

Digitisation of Banking Services in Europe

Introduction to Blockchain

The M2M Ledger

Expected Evolution of the Distributed Ledger

Beyond Bitcoin—New Applications

Blockchain Application by Industries

Highlights

Europe’s Demographic Crisis—Declining Population Growth

Europe’s Demographic Future—Ageing Society

Job Polarisation—AI is Disrupting the Middle Class

Technological Revolution versus Job Trends

Trends Driving Women’s Empowerment

100 Million More Women in the Global Labour Force by 2025

Economic Potential of European Women

Economic Potential of African Women

Roll Reversal in Europe

Women Leaders Dominate Europe’s Services Industries

The Good, the Bad, and the Ugly

Today’s Refugee Crisis Could be an Opportunity for Tomorrow’s Ageing Europe

Millennial Leaders—Today’s Youth are Tomorrow's Leaders

Young Billionaires—The Game Changers

Diminishing Workforce in Germany

Skills Demand Must be Met through Domestic Educational Attainment

Case Study—Flipped Classroom (Khan Academy)

Future Workforce Learning will Adapt to Many Perspectives

Future Economic Trends—Highlights

Future of Europe’s Economy—Global Prospective

Superpower of Europe—The United Kingdom or Germany?

Europe’s GDP—Sectorial Composition

EU Enlargement—Make Way for More

EU Referendum—The Brexit Scenario

EU Restructuring—Britain's Exit

Future of the Euro

Circular Economy—Building a New Europe

Europe Coalition—Dynamics of the Russia-China Alliance

Renaissance of Foreign Investment in Europe

Chinese Investments in Europe—Growing Partnership

Europe—The Largest Trading Power in the World

Transatlantic Trade and Investment Partnership

Top Transformational Shifts Shaping the Industrial Revolution in Europe

Future of Manufacturing in Europe—Made in Europe

Research and Innovation—Horizon 2020 Funding Structure

Manufacturing Dynamics of Europe—Shift towards the East

Poland—Next Growth Engine for European Manufacturing

Czech Republic—Future Hub of Automotive Production

European Manufacturing to Go Green

Future Retail Trends—Highlights

Europe’s Online Retail Landscape

Online Activity of Enterprises in Key Economies

Online Activity of Enterprises in Key Economies—The United Kingdom

Businesses Buy, More than Sell, Online

Enterprise Use of Social Media

Types of B2B Relationships

Types of B2B Business Models

Single Firm-independent Model

Private Network—Case Study: Wal-Mart Retail Link

Industry Consortium—

Public Marketplaces—Industry-specific Case Study

Online Retail in Europe—Dominant Participants

United Kingdom—The Largest e-Commerce Nation in Europe

Online Retail Innovation—New Last-mile Innovations

Click and Collect—Driving More Revenue per Click

Online Retail Boosts the European Parcel Delivery Market

Highlights

Building New Europe—Need for Infrastructure Investment

High-speed Europe—Future Prospects of European High-speed Rail

Single Transport Area

Airport Infrastructure Development in Europe

Growing Green

Highlights

The Future European Security Scenario

European Security Industry

Prospects of a Secure European Cyberspace

Highlights

Main Trends in Urbanisation—Development of

Mega Cities in Europe

Mega Cities and Economic Impact

Mega Regions in Europe

Mega Corridors in Europe

Snapshot of Urban Opportunities, Europe, 2025

Road to Smart Cities

Types of Smart City Projects in Europe

Future Smart Cities of Europe

Investment and Funding of Smart Cities in Europe

Funding Mechanism Case Study

Alternative Finance Models for Smart City Projects in Europe

Mega Trend 12— Innovating to Zero

Siemens to be Climate-neutral by 2030

New Business Models’ 3-D Matrix

Key Variables of a Business Model

Business Models

Comparative Analysis of B2B and B2C Business Models

Europe Leads with Sharing Economy Models

Sharing Economy Ecosystem

B2B Sharing Economy is the Next Frontier

Key Global B2B Sharing Economy Growth Areas, Global, 2016

Highlights

Most Preferred Sustainable Personal Transport Options in Europe

Traditional Carsharing Services Market in Europe—Country-wise Analysis

European Market—Country-wise Analysis of P2P Carsharing Members

Convergence in Carsharing, Europe, 2011

Key Findings and Future Outlook of the Carsharing Market in Europe, 2020

European Ridesharing Market

Ridesharing Segments in Europe

Impact of Ridesharing, Global, 2014

Case Study—BlaBlaCar Experiencing Strong Growth in Europe, 2014

Case Study—Flinc, World’s First Social Mobility Network

Highlights

Europe Energy Outlook—Future Energy Mix

Future Role of Coal in Energy Generation

Future Gas Production in Europe

Europe’s Renewable Energy Prospects

Europe Power Landscape—Capacity and Generation

Shift in Europe’s Power Generation—Fossil-fired to Renewables

Future Power Investments in Europe

North–South Corridor—Europe’s Energy Corridor

Future Trends in European Healthcare

Impact of Influx of Refugees on the European Health System

Upsurge of Healthcare Expenditure in Europe

Obesity Crisis in Europe

Escalation of Digital Healthcare in Europe

The Global Game Changer, Europe,2025

Europe Could be a Single Market for Businesses

Fintech Revolution in Europe

Job Polarisation will Grow Stronger in Europe

Europe could be an Attractive Destination for Bitcoin Entrepreneurs

Future Clash of Data Policies—United States versus Europe

The Power of Crowd to Shape the European Economy

Dominance of Women in Corporate Leadership

Europe will Increasingly Focus on Renewable Energy

Europe will Enter the Cognitive Era in 2020

European Manufacturing will Move East

TTIP

European Aerospace Market—Snapshot

SESAR—Modernising the European Sky

European Military Spending—Falling Short

Scope—Meaning and Definition of Internet Economy

- 1. Top 5 Countries by FDI Project, Europe, 2013 and 2014

- 2. Top Online Retailers, Europe, 2013 and 2014

- 3. Urbanisation Rate, Europe, 2025

- 4. Job Threat Mapping Due to Automation, UK, 2015–2035

- 5. Share of Cash Transactions in Retail, Europe, 2012, 2016, and 2020

- 6. Top 3 Peer-to-Peer Lending Market Participants, Global, 2014

- 7. Drivers to close

- 8. the labour gap by 2030 to attain at least a 2-3% GDP growth rate (2015-2030)

- 9. How can German overcome the diminishing working age crisis

- 10. Emerging Future Industries and their Required Skills, Global, 2025

- 11. Share of Industry Output for Export, Europe, 2014

- 12. Balance of UK Trade between EU and Non-EU Countries, Europe, 2014 (€ Million) TTIP Status in 2015

- 13. Share of Manufacturing in the GDP, Europe, 2014-2020

- 14. Future of Manufacturing: Research and Innovation—Horizon 2020 Funding Structure, Europe, 2015

- 15. Automotive Industry, Czech Republic, 2015

- 16. Top Online Retailers, Europe, 2013 and 2014

- 17. Major Airport Developments, Europe, 2015

- 18. Status of Cyber Security, Europe, 2015

- 19. Urbanisation Rate, Europe, 2025

- 20. Future Outlook of the Carsharing Market in Europe, 2020

- 21. Ridesharing: Overview of Blablacar, Europe, 2014

- 22. Ridesharing: Overview of Flinc, Europe, 2014 Europe in 2025

- 1. 5G Technology Roadmap, EU, 2015–2020

- 2. Economic Contribution of the Internet Industry, Europe, 2015 and 2025

- 3. Non-cash Transactions, Europe, 2012–2020

- 4. Payments Industry Revenue, Europe, 2010–2020

- 5. Share of Non-cash Transactions, Europe, 2010–2020

- 6. Total Population*, Europe, 2015–2025

- 7. Population CAGR by Region, Global, 2015–2025

- 8. Population by Age Group, Europe, 2015, 2020, and 2025

- 9. Nominal GDP, Europe, 2014–2025

- 10. Projected Share of GDP in Global GDP:

- 11. China, EU, US, 2014–2025

- 12. FDI Inflows, Europe, 2012–2014

- 13. FDI Inflows by Region, Global, 2012–2014

- 14. FDI Projects, Europe, 2012–2014

- 15. Factors Driving European Manufacturers to the East, Europe, 2015

- 16. Economic Growth, Eastern Europe,2015–2020

- 17. Labour Skill and Cost, Eastern Europe, 2015

- 18. Online B2C e-commerce Sales, Europe, 2025

- 19. Online B2C e-commerce Top Markets, Europe, 2025

- 20. Factors Driving European Manufacturers to the East, Europe, 2015

- 21. Infrastructure Investment

- 22. by Sector, Europe,2014–2030

- 23. Mega Cities, Europe, 2025

- 24. Mega Regions, Europe, 2025

- 25. Mega Corridors, Europe, 2025

- 26. Smart Cities, Europe, 2025

- 27. Car sharing Market: Overview of Car sharing Members, Europe, 2014–2020

- 28. Country-wise Analysis of P2P Car sharing Members, Europe, 2014–2020

- 29. Total Final Energy Consumption, Europe,2013, 2020, and 2015

- 30. Key Energy Consumers, Europe, 2025

- 31. Total Installed Capacity by Technology, Europe, 2012 and 2020

- 32. Renewable Energy Generation Target by Countries, Europe, 2013–2020

- 33. Healthcare Expenditure as a Per cent of the GDP, Top 16 Countries of Europe 2014–2025

- 34. Healthcare Expenditure by Segment as a Per cent of the Total Healthcare Expenditure, Europe, 2025 e-health Action Plan, EU, 2012–2020

- 35. e-health Action Plan, EU, 2012–2020

- 36. Average Number of Connected Devices Used per Person in Select Countries: Netherlands, UK, Canada, US, Germany, 2014

- 37. Comparison between the Median Monthly Cost of Internet Services to the Percentage of the Population who are Regular Internet Users, Top 10 EU Countries, 2014

- 38. Economic Contribution of the Internet Industry, Europe, 2015 and 2025

- 39. Big Data Application Market: Revenue Forecast, Europe, 2014–2025

- 40. People with Access to High-speed Internet (>30 Mbps) (%), EU, 2014 and 2020

- 41. Industry Initiatives towards Digitisation ,Europe, 2015

- 42. AI-readiness Mapping, Global, 2016

- 43. Manufacturing GDP Growth versus Future FDI, Select Economies, 2005–2015

- 44. Innovation Index, Select Economies, 2015

- 45. Non-cash Transactions, Europe, 2012–2020

- 46. Payments Industry Revenue, Europe, 2010–2020

- 47. Share of Non-cash Transactions, Europe, 2010–2020

- 48. % of Bank Customers Using Mobile Devices for Banking, Europe, 2014 and 2020

- 49. % Mobile Users Accessing Mobile Banking, Europe, 2014–2020

- 50. Alternative Finance Market Size and Growth Rate, Europe, 2012–2014

- 51. Value of Investment in Financial Technology in Fintech, Select European Regions, 2014

- 52. Real Growth In Insurance Premiums, Europe, 2014

- 53. Peer-to-Peer Lending Market Size, Global, 2014-2025

- 54. Total Population*, Europe, 2015–2025

- 55. Population CAGR by Region, Global, 2015–2025

- 56. Population by Age Group, Europe, 2015, 2020, and 2025

- 57. Job Polarisation due to Technology Revolutions, EU, 1983–2030

- 58. Labour Force Breakdown Projections for Women by Age and Region, Global, 2015 and 2025*

- 59. Women Labour Force, Europe, 2015 and 2025

- 60. Labour Force, Europe, 2025

- 61. Working Age Population, Europe, 2025

- 62. Average Growth Rate of Male and Female Part-time Workers, Europe*, 2009–2014

- 63. % of Women as Decision Makers by Industry, Global, 2014

- 64. Women Labour Force, Global, 2015–2025

- 65. Fertility Rate, Europe, 2015

- 66. Age Distribution of Billionaires, Europe, 2020

- 67. Labour Supply Forecast, Europe, 2015–2030

- 68. Educational Composition of Tertiary Students by Field of Study, Top 8 Economies*, Global, 2012

- 69. Nominal GDP, Europe, 2014–2025

- 70. Projected Share of GDP in Global GDP: China, EU, US, 2014–2025

- 71. Nominal GDP, Top 6 European Countries, 2025

- 72. Nominal GDP, UK and Germany, 2015–2030

- 73. Sectorial Composition of GDP, Europe, 2025

- 74. Employment Share of Services, Industry, and Agriculture,Europe, 2025

- 75. Geographical Expansion, Europe, 2000–2020

- 76. Forecast Impact of Brexit on UK GDP by 2030

- 77. Benefits of a Circular Economy, Europe, 2030

- 78. FDI Inflows, Europe, 2012–2014

- 79. FDI Inflows by Region, Global, 2012–2014

- 80. FDI Projects, Europe, 2012–2014

- 81. Top 5 Countries by FDI Project, Europe, 2013 and 2014

- 82. Chinese FDI Transactions, EU-28 Economies, 2007–2014

- 83. Top Sectors Involved in Chinese FDI, Europe, 2014

- 84. Top Recipients of Chinese FDI, Europe, 2014

- 85. Intra- and Inter-regional Merchandise Trade, Europe, 2014

- 86. Top 5 Trading Partners of the EU, 2014

- 87. Significance of Manufacturing for the Economy, EU, 2016–2020

- 88. Manufacturing in Eastern Europe-Key Trends and Macroeconomic Analysis, Europe, 2020

- 89. Economic Growth, EU and CEE & Baltics, 2010–2020

- 90. Real GDP Growth, Poland, (% Change YoY), 2011–2020

- 91. Manufacturing Value Added: By Industries, Poland, 2015

- 92. Automotive Industry, Czech Republic, 2015

- 93. Greenhouse Gas Emission, Europe, 1990–2025

- 94. Greenhouse Gas Emission by

- 95. Manufacturing Industry, Europe, 1990–2020

- 96. Online B2C e-commerce Sales, Europe, 2025

- 97. Online B2C e-commerce Top Markets, Europe, 2025

- 98. e-commerce Activity of Enterprises in Key Economies, Global, 2020

- 99. Estimates of B2B e-commerce, Global, 2020

- 100. B2B e-commerce, EU, 2012 and 2020

- 101. B2B e-commerce by Industry, EU, 2012

- 102. Enterprises selling and buying online or having a Website or home page, UK, 2012

- 103. Enterprises selling and buying online or having a Website or home page, EU-27, 2012

- 104. Per Cent Businesses Using Social Media, UK, 2012

- 105. Per Cent Businesses Using Social Media by Industry Sector, UK, 2012

- 106. B2B Direct Model Framework, Global, 2014

- 107. Siemens’ Click2Procure Process, Global, 2014

- 108. Exostar Consortium, Global, 2010

- 109. GHX Model, Global, 2014

- 110. Case Study of eBay Motors’ Marketplace Model, Global, 2014

- 111. Facts on Online Retail in the United Kingdom, 2015–2017

- 112. Click and Collect—Driving More Revenue per Click

- 113. Parcel Delivery Numbers, Europe, 2012–2025

- 114. Top Product Categories by Parcel Deliveries, Europe, 2025

- 115. Private funds available for

- 116. European infrastructure from 2014to 2023 Infrastructure investment need up to 2030 in Europe

- 117. Infrastructure Investment Sector, Europe,2014–2030

- 118. High-speed Railway Network, EU, 2020

- 119. Security Funding, Europe, 2015–2020

- 120. Investment in Security, Europe, 2016

- 121. Mega Cities, Europe, 2025

- 122. Mega Cities will have GDPs comparable to developed countries, 2025

- 123. Mega Regions, Europe, 2025

- 124. Mega Corridors, Europe, 2025

- 125. Urban Opportunities, Europe, 2025

- 126. Smart Cities, Europe, 2025

- 127. Popular Funding Mechanisms Adopted for Smart City Projects* across

- Europe, 2014–2020

- 128. Smart City Market: Funding Mechanism Overview, Amsterdam, 2013

- 129. Siemens’ Aim of CO2 Neutrality,

- 130. Global, 2014–2025

- 131. Comparative Analysis of B2B and B2C, Global, 2014

- 132. Europe Leads with Sharing Economy Models

- 133. Sharing Economy Ecosystem

- 134. Key B2B Sharing Economy Costs, Global, 2016

- 135. Key Global B2B Sharing Economy Growth Areas, Global, 2016

- 136. Car sharing Market: Overview of Car sharing Members, Europe, 2014–2020

- 137. Country-wise Analysis of P2P Carsharing Members, Europe, 2014–2020

- 138. Carsharing Market: Convergence in Carsharing, Europe, 2011

- 139. Ridesharing Member Growth, Europe, 2014–2025

- 140. Ridesharing Revenue Estimates, Europe 2014–2025

- 141. Market for Ridesharing: Estimates—Ridesharing Segments, Europe, 2014–

- 2025

- 142. Ridesharing: Impact, Global, 2014

- 143. Total Final Energy Consumption, Europe, 2013, 2020, and 2015

- 144. Key Energy Consumers, Europe, 2025

- 145. Coal Generation Capacity

- 146. Forecasts, Europe, 2012, 2020, and 2030

- 147. Gas-fired Capacity

- 148. Forecasts, Europe, 2012, 2020, and 2030

- 149. Total Installed Capacity by Technology, Europe, 2012 and 2020

- 150. Renewable Energy Generation Target by Countries, Europe, 2013–2020

- 151. Annual Power Generation Forecast: Installed Capacity Forecast, EU, 2010–

- 2030

- 152. Annual Power Generation Forecast: Electricity Generation Forecast, EU,

- 2010–2030

- 153. Annual Power Generation Forecasts: Electricity Generation CAGRs by

- Technology, EU, 2010–2030

- 154. Expected Plant Investment, Europe, 2015–2030

- 155. Average Annual Investments in Transmission and Distribution, 2015–2030

- 156. North-South Corridor, Europe, 2020

- 157. Numbers of Migrants, Europe, 2015

- 158. Healthcare Expenditure as a Per cent of the GDP, Top 16 Countries of

- Europe 2014–2025

- 159. Healthcare Expenditure by Segment as a Per cent of the Total Healthcare

- Expenditure, Europe, 2025

- 160. Healthcare Expenditure by Segment as a Per cent of the Healthcare

- Expenditure, Europe, 2025

- 161. e-health Action Plan, EU, 2012–2020

- 162. Impact of Digital Healthcare (m-health), Europe, 2020 Aerospace Revenue

- By Segment and Region, Global, 2014 and 2025

- 163. Aerospace Industry, Key Participants, Europe SESAR—Modernising the

- European Sky

- 164. Defence Expenditure as a Percent of the GDP, Europe, 2014–2015

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive summary~ || Top 10 Facts on the Future of Europe~ || Key Findings~ || Europe’s Internet Economy~ || Europe’s Digital Single Market~ ||| Current Issues~ ||| Proposed Solutions/Strategies~ || Europe’s 5G Rollout~ ||| 5G Technology Roadmap, EU, 2015–2020~ ||| EU 5G Vision~ ||| 4G versus 5G~ ||| 5G Targets~ || AI Evolution~ || Human Brain versus Machines—Comparison of Learning~ || Europe will Move Closer to a Cashless Society by 2020~ || Europe’s Demographic Crisis—Declining Population Growth~ || Europe’s Demographic Future—Ageing Society~ || Future of Europe’s Economy—Global Prospective~ || Renaissance of Foreign Investment in Europe~ || Europe’s Manufacturing Dynamics—Shift towards the East~ || Europe’s Online Retail Landscape~ ||| Dominant Participants~ |||| Amazon~ |||| Otto Group~ |||| Tesco~ |||| Staples~ |||| Others~ || Building New Europe—Need for Infrastructure Investment~ || Europe’s Mega Cities~ || Europe’s Mega Regions~ || Europe’s Mega Corridors, 2025~ || Future Smart Cities of Europe,2025 ~ ||| Oslo~ ||| Amsterdam~ ||| London~ ||| Paris~ ||| Others~ || Traditional Carsharing Services Market in Europe—Country-wise Analysis~ || European Market—Country-wise Analysis of Peer-to-Peer (P2P) Carsharing Members~ || European Energy Outlook—Future Energy Mix~ || Europe’s Renewable Energy Prospects~ || Upsurge of Healthcare Expenditure in Europe~ || Escalation of Digital Healthcare in Europe~ | Research methodology~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ || Definitions Used in the Study~ | Mega Trend 1—Digital Single Market~ || Highlights~ || Europe’s Digital Single Market~ || Europe’s Transformational Agenda for the Digital Age~ ||| Key Sectors~ |||| Energy~ |||| SME’s~ |||| Manufacturing~ |||| Healthcare~ |||| Others~ || Acceptance of Europe’s Digital Single Market in the Business Environment~ || Europe’s 5G Rollout- Roadmap and vision~ || Galileo—The European Navigation Satellite System~ || Mini Satellites—All Set to Transform Space Exploration~ ||| About Mini Satellites~ || EU Data Protection Regulations~ || Impact of the New EU Data Protection Law on Businesses~ || Connected Devices Drive in Europe—A Comparative Analysis~ || Connected Devices Drive in Europe—A Regional Analysis~ || Europe’s Internet Economy~ || Big Data in Europe~ || Big Data—Big Opportunities in Europe~ || Satellite Broadband in Europe~ || Aim for Widespread High-speed Broadband Connectivity~ || Digitising Industry Initiatives across Europe—An Overview~ || European Mobile Economy—Key Growth Areas~ || Open Internet—Net Neutrality~ | Mega Trend 2— Cognitive Era~ || Artificial Intelligence(AI)~ ||| Defining AI~ ||| Types of AI Systems~ || AI Evolution~ || Human Brain versus Machines~ ||| Comparison of Learning~ ||| Structure, Capacity, and Access~ || Human Brain, Computers, and Supercomputers—Computing Powers~ ||| Human brain~ ||| Intel Core2~ ||| Tianhe 2~ || Dissecting AI~ ||| Machine Learning~ ||| Hardware—High-speed Computing and Memory Storage~ || AI and Automation—Job Threat Mapping~ || AI-readiness of Industries~ || Future AI Hubs will Prioritise Innovation over Labour Costs~ | Mega Trend 3— Future of Fintech~ || Future of Banking—Highlights~ || Europe will be Moving Closer to a Cashless Society by 2020~ || Mobile Banking in Europe~ || Europe’s Online Alternative Finance Market~ || Fintech Renaissance in Europe~ || Digital Insurance in Europe~ || Banking without Banks—Peer-to-Peer Lending in Europe~ || Digitisation of Banking Services in Europe~ || Introduction to Blockchain~ || The M2M Ledger~ || Expected Evolution of the Distributed Ledger~ || Beyond Bitcoin—New Applications~ || Blockchain Application by Industries~ | Mega Trend 4— Social Trends~ || Highlights~ || Europe’s Demographic Crisis—Declining Population Growth~ || Europe’s Demographic Future—Ageing Society~ || Job Polarisation—AI is Disrupting the Middle Class~ || Technological Revolution versus Job Trends~ || Trends Driving Women’s Empowerment~ || 100 Million More Women in the Global Labour Force by 2025 ~ || Economic Potential of European Women~ || Economic Potential of African Women~ || Roll Reversal in Europe~ || Women Leaders Dominate Europe’s Services Industries~ || The Good, the Bad, and the Ugly~ || Today’s Refugee Crisis Could be an Opportunity for Tomorrow’s Ageing Europe~ || Millennial Leaders—Today’s Youth are Tomorrow's Leaders~ || Young Billionaires—The Game Changers~ || Diminishing Workforce in Germany~ || Skills Demand Must be Met through Domestic Educational Attainment~ || Case Study—Flipped Classroom (Khan Academy)~ || Future Workforce Learning will Adapt to Many Perspectives~ | Mega Trend 5— Economic Trends and Future of Trade~ || Future Economic Trends—Highlights~ || Future of Europe’s Economy—Global Prospective~ || Superpower of Europe—The United Kingdom or Germany?~ || Europe’s GDP—Sectorial Composition~ || EU Enlargement—Make Way for More~ || EU Referendum—The Brexit Scenario~ || EU Restructuring—Britain's Exit~ || Future of the Euro~ || Circular Economy—Building a New Europe~ || Europe Coalition—Dynamics of the Russia-China Alliance~ || Renaissance of Foreign Investment in Europe~ || Chinese Investments in Europe—Growing Partnership~ || Europe—The Largest Trading Power in the World~ || Transatlantic Trade and Investment Partnership~ | Mega Trend 6— Europe’s 4th Industrial Revolution~ || Top Transformational Shifts Shaping the Industrial Revolution in Europe~ || Future of Manufacturing in Europe—Made in Europe~ || Research and Innovation—Horizon 2020 Funding Structure~ || Manufacturing Dynamics of Europe—Shift towards the East~ || Poland—Next Growth Engine for European Manufacturing~ || Czech Republic—Future Hub of Automotive Production~ || European Manufacturing to Go Green~ | Mega Trend 7— Bricks and Clicks~ || Future Retail Trends—Highlights~ || Europe’s Online Retail Landscape~ || Online Activity of Enterprises in Key Economies~ || Online Activity of Enterprises in Key Economies—The United Kingdom~ || Businesses Buy, More than Sell, Online~ || Enterprise Use of Social Media~ || Types of B2B Relationships~ || Types of B2B Business Models~ || Single Firm-independent Model~ || Private Network—Case Study: Wal-Mart Retail Link~ || Industry Consortium—~ || Public Marketplaces—Industry-specific Case Study~ || Online Retail in Europe—Dominant Participants~ || United Kingdom—The Largest e-Commerce Nation in Europe~ || Online Retail Innovation—New Last-mile Innovations~ || Click and Collect—Driving More Revenue per Click~ || Online Retail Boosts the European Parcel Delivery Market~ | Mega Trend 8— Future of Infrastructure~ || Highlights~ || Building New Europe—Need for Infrastructure Investment~ || High-speed Europe—Future Prospects of European High-speed Rail~ || Single Transport Area~ || Airport Infrastructure Development in Europe~ || Growing Green~ | Mega Trend 9— Future of Europe’s Security~ || Highlights~ || The Future European Security Scenario~ || European Security Industry~ || Prospects of a Secure European Cyberspace~ | Mega Trend 10— Urbanisation Trends~ || Highlights~ || Main Trends in Urbanisation—Development of ~ || Mega Cities in Europe~ || Mega Cities and Economic Impact~ || Mega Regions in Europe~ || Mega Corridors in Europe~ || Snapshot of Urban Opportunities, Europe, 2025~ | Mega Trend 11— Future of Smart Cities~ || Road to Smart Cities~ || Types of Smart City Projects in Europe~ || Future Smart Cities of Europe~ || Investment and Funding of Smart Cities in Europe~ || Funding Mechanism Case Study~ || Alternative Finance Models for Smart City Projects in Europe~ || Mega Trend 12— Innovating to Zero~ || Siemens to be Climate-neutral by 2030~ | Mega Trend 13— New Business Model~ || New Business Models’ 3-D Matrix~ || Key Variables of a Business Model~ || Business Models~ || Comparative Analysis of B2B and B2C Business Models~ || Europe Leads with Sharing Economy Models~ || Sharing Economy Ecosystem~ || B2B Sharing Economy is the Next Frontier~ || Key Global B2B Sharing Economy Growth Areas, Global, 2016~ | Mega Trend 14— Future of Mobility~ || Highlights~ || Most Preferred Sustainable Personal Transport Options in Europe~ || Traditional Carsharing Services Market in Europe—Country-wise Analysis~ || European Market—Country-wise Analysis of P2P Carsharing Members~ || Convergence in Carsharing, Europe, 2011~ || Key Findings and Future Outlook of the Carsharing Market in Europe, 2020~ || European Ridesharing Market~ || Ridesharing Segments in Europe~ || Impact of Ridesharing, Global, 2014~ || Case Study—BlaBlaCar Experiencing Strong Growth in Europe, 2014~ || Case Study—Flinc, World’s First Social Mobility Network~ | Mega Trend 15— Future of Energy~ || Highlights~ || Europe Energy Outlook—Future Energy Mix~ || Future Role of Coal in Energy Generation~ || Future Gas Production in Europe~ || Europe’s Renewable Energy Prospects~ || Europe Power Landscape—Capacity and Generation~ || Shift in Europe’s Power Generation—Fossil-fired to Renewables~ || Future Power Investments in Europe~ || North–South Corridor—Europe’s Energy Corridor~ | Mega Trend 16— Future of Healthcare~ || Future Trends in European Healthcare~ || Impact of Influx of Refugees on the European Health System~ || Upsurge of Healthcare Expenditure in Europe~ || Obesity Crisis in Europe~ || Escalation of Digital Healthcare in Europe~ | Future of Europe (In Summary)~ || The Global Game Changer, Europe,2025~ || Europe Could be a Single Market for Businesses~ || Fintech Revolution in Europe~ || Job Polarisation will Grow Stronger in Europe~ || Europe could be an Attractive Destination for Bitcoin Entrepreneurs~ || Future Clash of Data Policies—United States versus Europe~ || The Power of Crowd to Shape the European Economy~ || Dominance of Women in Corporate Leadership~ || Europe will Increasingly Focus on Renewable Energy~ || Europe will Enter the Cognitive Era in 2020~ || European Manufacturing will Move East~ || TTIP~ | Appendix~ || European Aerospace Market—Snapshot~ || SESAR—Modernising the European Sky~ || European Military Spending—Falling Short~ || Scope—Meaning and Definition of Internet Economy~ | The Frost & Sullivan Story-The Journey to Visionary Innovation~ |

| List of Charts and Figures | 1. Top 5 Countries by FDI Project, Europe, 2013 and 2014~ 2. Top Online Retailers, Europe, 2013 and 2014~ 3. Urbanisation Rate, Europe, 2025~ 4. Job Threat Mapping Due to Automation, UK, 2015–2035~ 5. Share of Cash Transactions in Retail, Europe, 2012, 2016, and 2020~ 6. Top 3 Peer-to-Peer Lending Market Participants, Global, 2014~ 7. Drivers to close~ 8. the labour gap by 2030 to attain at least a 2-3% GDP growth rate (2015-2030)~ 9. How can German overcome the diminishing working age crisis~ 10. Emerging Future Industries and their Required Skills, Global, 2025~ 11. Share of Industry Output for Export, Europe, 2014~ 12. Balance of UK Trade between EU and Non-EU Countries, Europe, 2014 (€ Million) TTIP Status in 2015~ 13. Share of Manufacturing in the GDP, Europe, 2014-2020~ 14. Future of Manufacturing: Research and Innovation—Horizon 2020 Funding Structure, Europe, 2015~ 15. Automotive Industry, Czech Republic, 2015~ 16. Top Online Retailers, Europe, 2013 and 2014~ 17. Major Airport Developments, Europe, 2015~ 18. Status of Cyber Security, Europe, 2015~ 19. Urbanisation Rate, Europe, 2025~ 20. Future Outlook of the Carsharing Market in Europe, 2020~ 21. Ridesharing: Overview of Blablacar, Europe, 2014~ 22. Ridesharing: Overview of Flinc, Europe, 2014 Europe in 2025~| 1. 5G Technology Roadmap, EU, 2015–2020~ 2. Economic Contribution of the Internet Industry, Europe, 2015 and 2025~ 3. Non-cash Transactions, Europe, 2012–2020~ 4. Payments Industry Revenue, Europe, 2010–2020~ 5. Share of Non-cash Transactions, Europe, 2010–2020~ 6. Total Population*, Europe, 2015–2025~ 7. Population CAGR by Region, Global, 2015–2025~ 8. Population by Age Group, Europe, 2015, 2020, and 2025~ 9. Nominal GDP, Europe, 2014–2025~ 10. Projected Share of GDP in Global GDP:~ 11. China, EU, US, 2014–2025~ 12. FDI Inflows, Europe, 2012–2014~ 13. FDI Inflows by Region, Global, 2012–2014~ 14. FDI Projects, Europe, 2012–2014~ 15. Factors Driving European Manufacturers to the East, Europe, 2015~ 16. Economic Growth, Eastern Europe,2015–2020~ 17. Labour Skill and Cost, Eastern Europe, 2015~ 18. Online B2C e-commerce Sales, Europe, 2025~ 19. Online B2C e-commerce Top Markets, Europe, 2025~ 20. Factors Driving European Manufacturers to the East, Europe, 2015~ 21. Infrastructure Investment~ 22. by Sector, Europe,2014–2030~ 23. Mega Cities, Europe, 2025~ 24. Mega Regions, Europe, 2025~ 25. Mega Corridors, Europe, 2025~ 26. Smart Cities, Europe, 2025~ 27. Car sharing Market: Overview of Car sharing Members, Europe, 2014–2020~ 28. Country-wise Analysis of P2P Car sharing Members, Europe, 2014–2020~ 29. Total Final Energy Consumption, Europe,2013, 2020, and 2015~ 30. Key Energy Consumers, Europe, 2025~ 31. Total Installed Capacity by Technology, Europe, 2012 and 2020~ 32. Renewable Energy Generation Target by Countries, Europe, 2013–2020~ 33. Healthcare Expenditure as a Per cent of the GDP, Top 16 Countries of Europe 2014–2025~ 34. Healthcare Expenditure by Segment as a Per cent of the Total Healthcare Expenditure, Europe, 2025 e-health Action Plan, EU, 2012–2020~ 35. e-health Action Plan, EU, 2012–2020~ 36. Average Number of Connected Devices Used per Person in Select Countries: Netherlands, UK, Canada, US, Germany, 2014~ 37. Comparison between the Median Monthly Cost of Internet Services to the Percentage of the Population who are Regular Internet Users, Top 10 EU Countries, 2014~ 38. Economic Contribution of the Internet Industry, Europe, 2015 and 2025~ 39. Big Data Application Market: Revenue Forecast, Europe, 2014–2025~ 40. People with Access to High-speed Internet (>30 Mbps) (%), EU, 2014 and 2020~ 41. Industry Initiatives towards Digitisation ,Europe, 2015~ 42. AI-readiness Mapping, Global, 2016~ 43. Manufacturing GDP Growth versus Future FDI, Select Economies, 2005–2015~ 44. Innovation Index, Select Economies, 2015~ 45. Non-cash Transactions, Europe, 2012–2020~ 46. Payments Industry Revenue, Europe, 2010–2020~ 47. Share of Non-cash Transactions, Europe, 2010–2020~ 48. % of Bank Customers Using Mobile Devices for Banking, Europe, 2014 and 2020~ 49. % Mobile Users Accessing Mobile Banking, Europe, 2014–2020~ 50. Alternative Finance Market Size and Growth Rate, Europe, 2012–2014~ 51. Value of Investment in Financial Technology in Fintech, Select European Regions, 2014~ 52. Real Growth In Insurance Premiums, Europe, 2014~ 53. Peer-to-Peer Lending Market Size, Global, 2014-2025~ 54. Total Population*, Europe, 2015–2025~ 55. Population CAGR by Region, Global, 2015–2025~ 56. Population by Age Group, Europe, 2015, 2020, and 2025~ 57. Job Polarisation due to Technology Revolutions, EU, 1983–2030~ 58. Labour Force Breakdown Projections for Women by Age and Region, Global, 2015 and 2025*~ 59. Women Labour Force, Europe, 2015 and 2025~ 60. Labour Force, Europe, 2025~ 61. Working Age Population, Europe, 2025~ 62. Average Growth Rate of Male and Female Part-time Workers, Europe*, 2009–2014~ 63. % of Women as Decision Makers by Industry, Global, 2014~ 64. Women Labour Force, Global, 2015–2025~ 65. Fertility Rate, Europe, 2015~ 66. Age Distribution of Billionaires, Europe, 2020~ 67. Labour Supply Forecast, Europe, 2015–2030~ 68. Educational Composition of Tertiary Students by Field of Study, Top 8 Economies*, Global, 2012~ 69. Nominal GDP, Europe, 2014–2025~ 70. Projected Share of GDP in Global GDP: China, EU, US, 2014–2025~ 71. Nominal GDP, Top 6 European Countries, 2025~ 72. Nominal GDP, UK and Germany, 2015–2030~ 73. Sectorial Composition of GDP, Europe, 2025~ 74. Employment Share of Services, Industry, and Agriculture,Europe, 2025~ 75. Geographical Expansion, Europe, 2000–2020~ 76. Forecast Impact of Brexit on UK GDP by 2030~ 77. Benefits of a Circular Economy, Europe, 2030~ 78. FDI Inflows, Europe, 2012–2014~ 79. FDI Inflows by Region, Global, 2012–2014~ 80. FDI Projects, Europe, 2012–2014~ 81. Top 5 Countries by FDI Project, Europe, 2013 and 2014~ 82. Chinese FDI Transactions, EU-28 Economies, 2007–2014~ 83. Top Sectors Involved in Chinese FDI, Europe, 2014~ 84. Top Recipients of Chinese FDI, Europe, 2014~ 85. Intra- and Inter-regional Merchandise Trade, Europe, 2014~ 86. Top 5 Trading Partners of the EU, 2014~ 87. Significance of Manufacturing for the Economy, EU, 2016–2020~ 88. Manufacturing in Eastern Europe-Key Trends and Macroeconomic Analysis, Europe, 2020~ 89. Economic Growth, EU and CEE & Baltics, 2010–2020~ 90. Real GDP Growth, Poland, (% Change YoY), 2011–2020~ 91. Manufacturing Value Added: By Industries, Poland, 2015~ 92. Automotive Industry, Czech Republic, 2015~ 93. Greenhouse Gas Emission, Europe, 1990–2025~ 94. Greenhouse Gas Emission by~ 95. Manufacturing Industry, Europe, 1990–2020~ 96. Online B2C e-commerce Sales, Europe, 2025~ 97. Online B2C e-commerce Top Markets, Europe, 2025~ 98. e-commerce Activity of Enterprises in Key Economies, Global, 2020~ 99. Estimates of B2B e-commerce, Global, 2020~ 100. B2B e-commerce, EU, 2012 and 2020~ 101. B2B e-commerce by Industry, EU, 2012~ 102. Enterprises selling and buying online or having a Website or home page, UK, 2012~ 103. Enterprises selling and buying online or having a Website or home page, EU-27, 2012~ 104. Per Cent Businesses Using Social Media, UK, 2012~ 105. Per Cent Businesses Using Social Media by Industry Sector, UK, 2012~ 106. B2B Direct Model Framework, Global, 2014~ 107. Siemens’ Click2Procure Process, Global, 2014~ 108. Exostar Consortium, Global, 2010~ 109. GHX Model, Global, 2014~ 110. Case Study of eBay Motors’ Marketplace Model, Global, 2014~ 111. Facts on Online Retail in the United Kingdom, 2015–2017~ 112. Click and Collect—Driving More Revenue per Click~ 113. Parcel Delivery Numbers, Europe, 2012–2025~ 114. Top Product Categories by Parcel Deliveries, Europe, 2025~ 115. Private funds available for~ 116. European infrastructure from 2014to 2023 Infrastructure investment need up to 2030 in Europe~ 117. Infrastructure Investment Sector, Europe,2014–2030~ 118. High-speed Railway Network, EU, 2020~ 119. Security Funding, Europe, 2015–2020~ 120. Investment in Security, Europe, 2016~ 121. Mega Cities, Europe, 2025~ 122. Mega Cities will have GDPs comparable to developed countries, 2025~ 123. Mega Regions, Europe, 2025~ 124. Mega Corridors, Europe, 2025~ 125. Urban Opportunities, Europe, 2025~ 126. Smart Cities, Europe, 2025~ 127. Popular Funding Mechanisms Adopted for Smart City Projects* across ~ Europe, 2014–2020~ 128. Smart City Market: Funding Mechanism Overview, Amsterdam, 2013~ 129. Siemens’ Aim of CO2 Neutrality,~ 130. Global, 2014–2025~ 131. Comparative Analysis of B2B and B2C, Global, 2014~ 132. Europe Leads with Sharing Economy Models~ 133. Sharing Economy Ecosystem~ 134. Key B2B Sharing Economy Costs, Global, 2016~ 135. Key Global B2B Sharing Economy Growth Areas, Global, 2016~ 136. Car sharing Market: Overview of Car sharing Members, Europe, 2014–2020~ 137. Country-wise Analysis of P2P Carsharing Members, Europe, 2014–2020~ 138. Carsharing Market: Convergence in Carsharing, Europe, 2011~ 139. Ridesharing Member Growth, Europe, 2014–2025~ 140. Ridesharing Revenue Estimates, Europe 2014–2025~ 141. Market for Ridesharing: Estimates—Ridesharing Segments, Europe, 2014– ~ 2025~ 142. Ridesharing: Impact, Global, 2014~ 143. Total Final Energy Consumption, Europe, 2013, 2020, and 2015~ 144. Key Energy Consumers, Europe, 2025~ 145. Coal Generation Capacity~ 146. Forecasts, Europe, 2012, 2020, and 2030~ 147. Gas-fired Capacity~ 148. Forecasts, Europe, 2012, 2020, and 2030~ 149. Total Installed Capacity by Technology, Europe, 2012 and 2020~ 150. Renewable Energy Generation Target by Countries, Europe, 2013–2020~ 151. Annual Power Generation Forecast: Installed Capacity Forecast, EU, 2010–~ 2030~ 152. Annual Power Generation Forecast: Electricity Generation Forecast, EU, ~ 2010–2030~ 153. Annual Power Generation Forecasts: Electricity Generation CAGRs by ~ Technology, EU, 2010–2030~ 154. Expected Plant Investment, Europe, 2015–2030~ 155. Average Annual Investments in Transmission and Distribution, 2015–2030~ 156. North-South Corridor, Europe, 2020~ 157. Numbers of Migrants, Europe, 2015~ 158. Healthcare Expenditure as a Per cent of the GDP, Top 16 Countries of ~ Europe 2014–2025~ 159. Healthcare Expenditure by Segment as a Per cent of the Total Healthcare ~ Expenditure, Europe, 2025~ 160. Healthcare Expenditure by Segment as a Per cent of the Healthcare ~ Expenditure, Europe, 2025~ 161. e-health Action Plan, EU, 2012–2020~ 162. Impact of Digital Healthcare (m-health), Europe, 2020 Aerospace Revenue ~ By Segment and Region, Global, 2014 and 2025~ 163. Aerospace Industry, Key Participants, Europe SESAR—Modernising the ~ European Sky~ 164. Defence Expenditure as a Percent of the GDP, Europe, 2014–2015~ |

| Author | Malabika Mandal |

| Industries | Aerospace, Defence and Security |

| WIP Number | MB83-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB