Global Autonomous Driving Industry Outlook, 2020

Global Autonomous Driving Industry Outlook, 2020

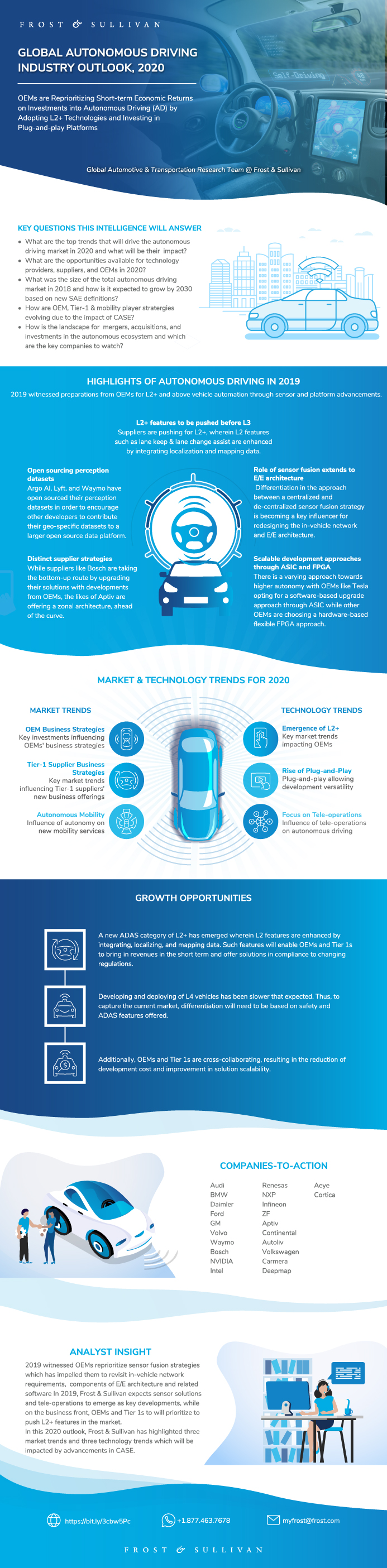

OEMs are Reprioritizing Short-term Economic Returns on Investments into Autonomous Driving (AD) by Adopting L2+ Technologies and Investing in Plug-and-play Platforms

30-Apr-2020

North America

Description

The autonomous industry, although developing at a decent pace, has realized that the transition from traditional vehicles to autonomous vehicles is still a long time away. OEMs and Tier-1 suppliers have been pouring in investments to develop technologies for deployments of highly automated vehicles. However, despite overcoming the technological barriers, these companies are still facing challenges from regulations and public acceptance. Accidents and fatalities caused by autonomous vehicles, making the headlines in 2018, have further added to the challenges. Owing to such circumstances, the industry is geared up for taking a gradual approach to developing autonomous driving technologies. Focus is on developing scalable L2+ features, where L2 features are enhanced by integrating localization and mapping data, while enabling a plug-and-play framework for scaling up developments with new-generation solutions. This ensures short-term revenue generation, allowing OEMs and suppliers to highlight returns and justify their investments.

In 2019, the autonomous industry witnessed OEMs’ preparation for L2+ and above automation through the adoption of a layered platform, coupled with developments in sensor fusion, which has impelled OEMs to re-visit in-vehicle network requirements. In 2020, Frost & Sullivan expects perception start-ups to seek new partnerships with platform developers and technology companies as the industry gears up for L4 deployments.

Research Highlights

In this 2020 outlook, Frost & Sullivan has highlighted 3 key market and business trends which have been impacted due to the changing dynamics of the autonomous ecosystem. The outlook also highlights 3 key technology trends that Frost & Sullivan believes will see fast advancements with a focus on highly automated vehicle commercialization.

- Market trends include changing OEM and supplier strategies, and the business developments of new mobility and mobility services. Frost & Sullivan believes collaborations, business diversifications, service-based business strategies will change the traditional business models while driving new revenue sources.

- In terms of technology, focus is expected to be on developing and adopting scalable hardware and software which will allow OEMs to offer over-the-air (OTA) upgrades in the future. Trends include emergence of L2+, rise of the plug-and-play framework, and focus on tele-operations.

This report highlights these trends and explains the impact along with use cases.

Key Issues Addressed

- What are the new business strategies followed by OEMs, Tier-1 suppliers, and technology providers in 2020?

- How is the global autonomous market expected to grow by 2030 based on new SAE definitions?

- Which are the key start-ups expected to announce new innovations in 2020?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Highlights of Autonomous Driving in 2019

Top 5 Predictions for Autonomous Driving in 2020

Forecast by Levels of Autonomous Driving

Key Trends by Level of Autonomy

Market & Technology Trends for 2020

Key Conclusions—Market Trends

Key Conclusions—Technology Trends

OEM Business Strategies—Comparative Analysis

Key Conclusions

Global Economy in 2019—Top Trends

Global Economic Outlook 2020—Top Predictions

Global Economic Outlook 2020—Top Predictions (continued)

2020 World GDP Growth Snapshot

Advanced Economies—Key Predictions for 2020

Emerging Economies—Key Predictions for 2020

2020 Growth Opportunities—Top 3 Opportunities by Region

2020 Regional Trends—GDP Growth, Risks, and Policy

Research Scope

Vehicle Segmentation

SAE Definitions

Overview of Market Trends—Impacting Automotive Value Chain

1. OEM Business Strategies—Comparative Analysis

1. OEM Business Strategies—Comparative Analysis (continued)

1. OEM Business Strategies: Case Study—VW–Ford Partnership

1. OEM Business Strategies: Case Study—Daimler and Bosch

1. OEM Business Strategies—Key Conclusions

Overview of Market Trends—Impacting Automotive Value Chain

2. Tier-1 Supplier Business Strategies—Comparative Analysis

2. Tier-1 Supplier Business Strategies Case Study—Continental Mobility

2. Tier-1 Supplier Business Strategies—Conclusion

Overview of Market Trends—Impacting Automotive Value Chain

3. Autonomous Mobility

3. Autonomous Mobility—Ecosystem

3. Autonomous Mobility: Case Study—Cruise Origin

Overview of Technology Trends

1. Emergence of L2+

1. Emergence of L2+: Case Study—ZF L2+ portfolio

Overview of Technology Trends

2. Rise of Plug-and-Play

2. Rise of Plug-and-Play: Case Study—NVIDIA

Overview of Technology Trends

3. Focus on Tele-operations in Autonomous Driving

3. Focus on Tele-operations: Case Study—Ottopia

Forecast by Levels of Autonomous Driving

Forecast of Highly Automated Vehicles by OEM Categories

Frost & Sullivan's Key Criteria to Shortlist Companies

Capabilities of Shortlisted Start-ups—Perception Sensors

Capabilities of Shortlisted Start-ups—AD-enabling Software

Growth Opportunity—Investments and Partnerships from OEMs/TSPs

Strategic Imperatives for Success and Growth

Key Conclusions

Legal Disclaimer

Abbreviations and Acronyms Used

Market Engineering Methodology

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Research Highlights

In this 2020 outlook, Frost & Sullivan has highlighted 3 key market and business trends which have been impacted due to the changing dynamics of the autonomous ecosystem. The outlook also highlights 3 key technology trends that Frost & Sullivan believes will see fast advancements with a focus on highly automated vehicle commercialization.

- Market trends include changing OEM and supplier strategies, and the business developments of new mobility and mobility services. Frost & Sullivan believes collaborations, business diversifications, service-based business strategies will change the traditional business models while driving new revenue sources.

- In terms of technology, focus is expected to be on developing and adopting scalable hardware and software which will allow OEMs to offer over-the-air (OTA) upgrades in the future. Trends include emergence of L2+, rise of the plug-and-play framework, and focus on tele-operations.

This report highlights these trends and explains the impact along with use cases.

Key Issues Addressed

- What are the new business strategies followed by OEMs, Tier-1 suppliers, and technology providers in 2020?

- How is the global autonomous market expected to grow by 2030 based on new SAE definitions?

- Which are the key start-ups expected to announce new innovations in 2020?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Varun Krishna Murthy |

| Industries | Automotive |

| WIP Number | MF42-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9673-A6,9800-A6,9807-A6,9813-A6,9B13-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB