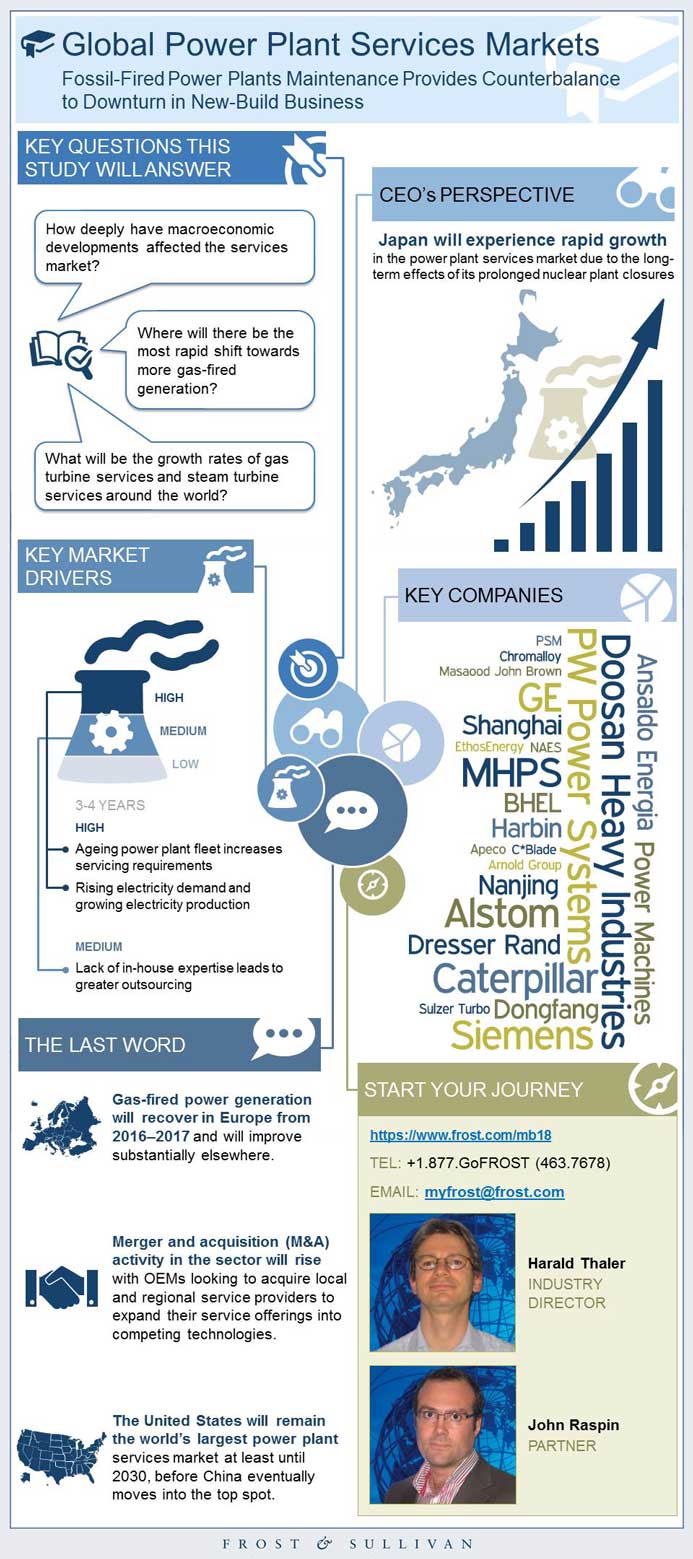

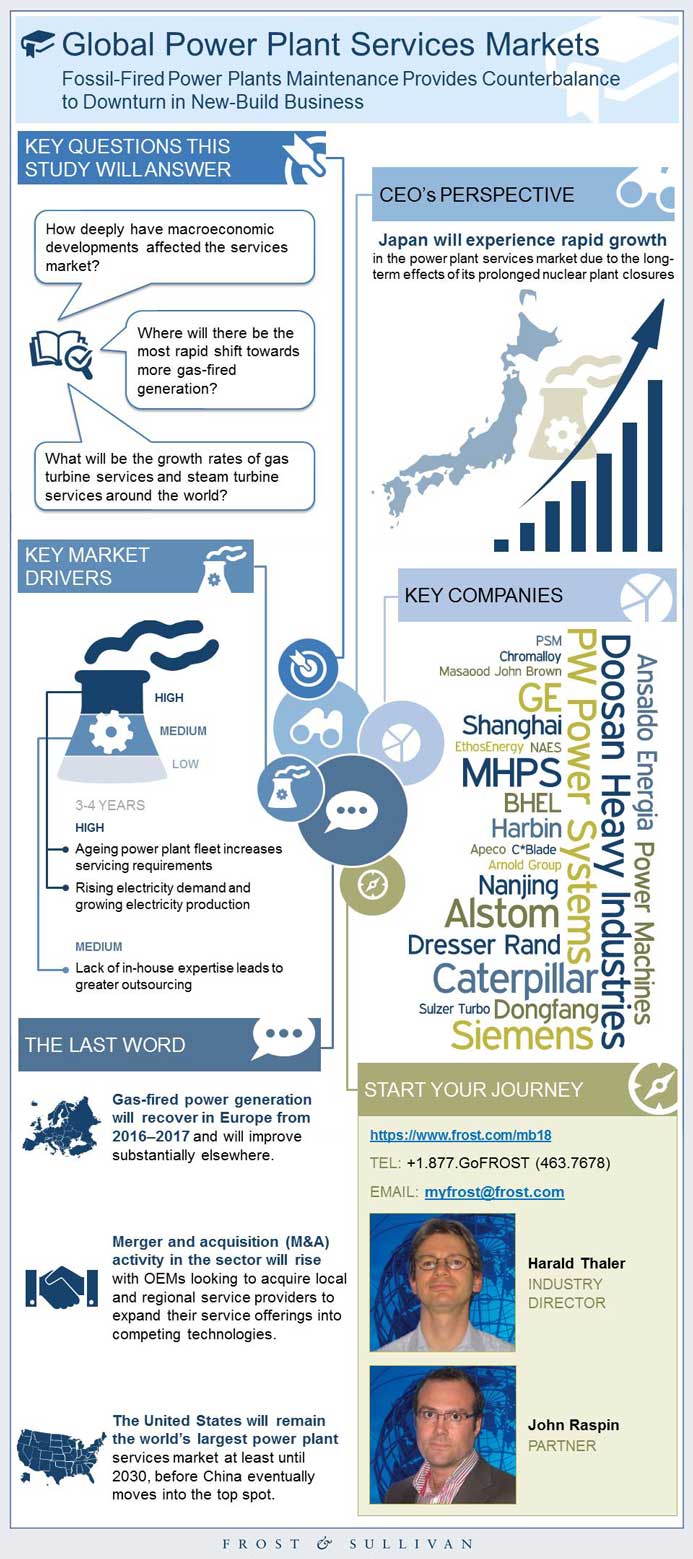

Global Power Plant Services Markets

Global Power Plant Services Markets

Fossil-Fired Power Plants Maintenance Provides Counterbalance to Downturn in New-Build Business

21-Aug-2015

Global

Description

Aging power plants generate high revenues for the power plant servicing market

The power plant services market is growing rapidly as new generating capacities are being added to plants to cope with the rising demand for electricity. The US is the biggest market in this segment and is expected to retain this position until 2030 due to the presence of numerous old and maintenance-intensive power plants in the country. In the meantime, the markets of China, India and the Association of Southeast Asian Nations (ASEAN) are expanding rapidly, fuelled by escalating energy needs. This demand has spurred a massive expansion drive in the Asia-Pacific power sector, especially in China, which is investing heavily in gas-fired power plants. As these power plants require frequent maintenance, there will be substantial opportunities in the power plant services market in the coming years. Furthermore, with the growth of independent power producers (IPPS), the Chinese power industry has become extremely competitive which will, in turn, drive the power plant services market.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

CEO’s Perspective

Three Big Predictions

Definitions

Specific Exclusions

Segmentation

Global Prospects

Market Engineering Measurements

Revenue Forecast

Percent Revenue Forecast by Region

Revenue Forecast by Region

Market Growth Correlation with Electricity Consumption

Percent Revenue Forecast by Equipment

Revenue Forecast by Equipment

Percent Revenue Forecast by Region for Steam Turbine Services

CAGR for Steam Turbine Services by Region

Revenue Forecast by Region for Steam Turbine Services

Percent Revenue Forecast by Region for Gas Turbine Services

CAGR for Gas Turbine Services by Region

Revenue Forecast by Region for Gas Turbine Services

Percent Revenue Forecast by Region for Boiler and HRSG Services

CAGR for Boiler and HRSG Services by Region

Revenue Forecast by Region for Boiler and HRSG Services

Revenue Forecast by Plant Type

Percent Revenue Forecast by End-user Type

Gas Turbine Services Technology Curve

Competitive Structure

Key Competitors by Region

Market Drivers

Market Restraints

Forecasts and Trends

Market Drivers

Market Restraints

Forecasts and Trends

Market Drivers

Market Restraints

Forecasts and Trends

Market Drivers

Market Restraints

Forecasts and Trends

Market Drivers

Market Restraints

Forecasts and trends

Market Drivers

Market Restraints

Forecasts and Trends

Market Drivers

Market Restraints

Forecasts and Trends

Three Big Predictions

Legal Disclaimer

Market Engineering Methodology

- 1. Power Plant Services Market: Market Engineering Measurements, Global, 2014

- 2. Power Plant Services Market: Revenue Forecast by Region, Global, 2011–2021

- 3. Power Plant Services Market: Revenue Forecast by Equipment, Global, 2011–2021

- 4. Power Plant Services Market: Revenue Forecast by Region for Steam Turbine Services, Global, 2011–2021

- 5. Power Plant Services Market: Revenue Forecast by Region for Gas Turbine Services, Global, 2011–2021

- 6. Power Plant Services Market: Revenue Forecast by Region for Boiler and HRSG Services, Global, 2011–2021

- 7. Power Plant Services Market: Key Market Drivers, Western Europe, 2015–2021

- 8. Power Plant Services Market: Key Market Restraints, Western Europe, 2015–2021

- 9. Power Plant Services Market: Market Engineering Measurements, Western Europe, 2014

- 10. Power Plant Services Market: Revenue Forecast by Equipment, Western Europe, 2011–2021

- 11. Power Plant Services Market: Key Market Drivers, Central & Eastern Europe, 2015–2021

- 12. Power Plant Services Market: Key Market Restraints, Central & Eastern Europe, 2015–2021

- 13. Power Plant Services Market: Market Engineering Measurements, Central & Eastern Europe, 2014

- 14. Power Plant Services Market: Revenue Forecast by Equipment, Central & Eastern Europe, 2011–2021

- 15. Power Plant Services Market: Key Market Drivers, Russia, 2015–2021

- 16. Power Plant Services Market: Key Market Restraints, Russia, 2015–2021

- 17. Power Plant Services Market: Market Engineering Measurements, Russia, 2014

- 18. Power Plant Services Market: Revenue Forecast by Equipment, Russia, 2011–2021

- 19. Power Plant Services Market: Key Market Drivers, Middle East, 2015–2021

- 20. Power Plant Services Market: Key Market Restraints, Middle East, 2015–2021

- 21. Power Plant Services Market: Market Engineering Measurements, Middle East, 2014

- 22. Power Plant Services Market: Revenue Forecast by Equipment, Middle East, 2011–2021

- 23. Power Plant Services Market: Key Market Drivers, Africa, 2015–2021

- 24. Power Plant Services Market: Key Market Restraints, Africa, 2015–2021

- 25. Power Plant Services Market: Market Engineering Measurements, Africa, 2014

- 26. Power Plant Services Market: Revenue Forecast by Equipment, Africa, 2011–2021

- 27. Power Plant Services Market: Key Market Drivers, North America, 2015–2021

- 28. Power Plant Services Market: Key Market Restraints, North America, 2015–2021

- 29. Power Plant Services Market: Market Engineering Measurements, North America, 2014

- 30. Power Plant Services Market: Revenue Forecast by Equipment, North America, 2011–2021

- 31. Power Plant Services Market: Key Market Drivers, Latin America, 2015–2021

- 32. Power Plant Services Market: Key Market Restraints, Latin America, 2015–2021

- 33. Power Plant Services Market: Market Engineering Measurements, Latin America, 2014

- 34. Power Plant Services Market: Revenue Forecast by Equipment, Latin America, 2011–2021

- 35. Power Plant Services Market: Key Market Drivers, China, 2015–2021

- 36. Power Plant Services Market: Key Market Restraints, China, 2015–2021

- 37. Power Plant Services Market: Market Engineering Measurements, China, 2014

- 38. Power Plant Services Market: Revenue Forecast by Equipment, China, 2011–2021

- 39. Power Plant Services Market: Key Market Drivers, India, 2015–2021

- 40. Power Plant Services Market: Key Market Restraints, India, 2015–2021

- 41. Power Plant Services Market: Market Engineering Measurements, India, 2014

- 42. Power Plant Services Market: Revenue Forecast by Equipment, India, 2011–2021

- 43. Power Plant Services Market: Key Market Drivers, ASEAN, 2015–2021

- 44. Power Plant Services Market: Key Market Restraints, ASEAN, 2015–2021

- 45. Power Plant Services Market: Market Engineering Measurements, ASEAN, 2014

- 46. Power Plant Services Market: Revenue Forecast by Equipment, ASEAN, 2011–2021

- 47. Power Plant Services Market: Key Market Drivers, ANZ, 2015–2021

- 48. Power Plant Services Market: Key Market Restraints, ANZ, 2015–2021

- 49. Power Plant Services Market: Market Engineering Measurements, ANZ, 2014

- 50. Power Plant Services Market: Revenue Forecast by Equipment, ANZ, 2011–2021

- 51. Power Plant Services Market: Key Market Drivers, Japan, 2015–2021

- 52. Power Plant Services Market: Key Market Restraints, Japan, 2015–2021

- 53. Power Plant Services Market: Market Engineering Measurements, Japan, 2014

- 54. Power Plant Services Market: Revenue Forecast by Equipment, Japan, 2011–2021

- 1. Power Plant Services Market: Market Engineering Measurements, Global, 2014

- 2. Power Plant Services Market: Market Segmentation, Global, 2014

- 3. Power Plant Services Market: Revenue Forecast, Global, 2011–2021

- 4. Power Plant Services Market: Percent Revenue Forecast by Region, Global, 2014 and 2021

- 5. Power Plant Services Market: Correlation Between Electricity Demand and Power Plant Services, Global, 2014–2021

- 6. Power Plant Services Market: Percent Revenue Forecast by Equipment, Global, 2011–2021

- 7. Power Plant Services Market: Percent Revenue Forecast by Region for Steam Turbine Services, Global, 2014 and 2021

- 8. Power Plant Services Market: CAGR for Steam Turbine Services by Region, Global, 2014–2021

- 9. Power Plant Services Market: Percent Revenue Forecast by Region for Gas Turbine Services, Global, 2014 and 2021

- 10. Power Plant Services Market: CAGR for Gas Turbine Services by Region, Global, 2014–2021

- 11. Power Plant Services Market: Percent Revenue Forecast by Region for Boiler and HRSG Services, Global, 2014 and 2021

- 12. Power Plant Services Market: CAGR for Boiler and HRSG Services by Region, Global, 2014–2021

- 13. Power Plant Services Market: Revenue Forecast by Plant Type, Global, 2014 and 2021

- 14. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Global, 2014 and 2021

- 15. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Global, 2014 and 2021

- 16. Power Plant Services Market: Potential for Non-OEM Service Providers Along Gas Turbine Technology Curve, Global, 2014

- 17. Power Plant Services Market: Competitive Structure, Global, 2014

- 18. Power Plant Services Market: Revenue Forecast, Western Europe, 2011–2021

- 19. Power Plant Services Market: Percent Revenue Forecast by Equipment, Western Europe, 2011–2021

- 20. Power Plant Services Market: Revenue Forecast by Plant Type, Western Europe, 2014–2021

- 21. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Western Europe, 2014–2021

- 22. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Western Europe, 2014 and 2021

- 23. Power Plant Services Market: Revenue Forecast, Central & Eastern Europe, 2011–2021

- 24. Power Plant Services Market: Percent Revenue Forecast by Equipment, Central & Eastern Europe, 2011–2021

- 25. Power Plant Services Market: Revenue Forecast by Plant Type, Central & Eastern Europe, 2014–2021

- 26. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Central & Eastern Europe, 2014–2021

- 27. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Central & Eastern Europe, 2014 and 2021

- 28. Power Plant Services Market: Revenue Forecast, Russia, 2011–2021

- 29. Power Plant Services Market: Percent Revenue Forecast by Equipment, Russia, 2011–2021

- 30. Power Plant Services Market: Revenue Forecast by Plant Type, Russia, 2014–2021

- 31. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Russia, 2014–2021

- 32. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Russia, 2014 and 2021

- 33. Power Plant Services Market: Revenue Forecast, Middle East, 2011–2021

- 34. Power Plant Services Market: Percent Revenue Forecast by Equipment, Middle East, 2011–2021

- 35. Power Plant Services Market: Revenue Forecast by Plant Type, Middle East, 2014–2021

- 36. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Middle East, 2014–2021

- 37. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Middle East, 2014 and 2021

- 38. Power Plant Services Market: Revenue Forecast, Africa, 2011–2021

- 39. Power Plant Services Market: Percent Revenue Forecast by Equipment, Africa, 2011–2021

- 40. Power Plant Services Market: Revenue Forecast by Plant Type, Africa, 2014–2021

- 41. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Africa, 2014–2021

- 42. Power Plant Services Market: Percent Revenue Forecast by End-User Type, Africa, 2014 and 2021

- 43. Power Plant Services Market: Revenue Forecast, North America, 2011–2021

- 44. Power Plant Services Market: Percent Revenue Forecast by Equipment, North America, 2011–2021

- 45. Power Plant Services Market: Revenue Forecast by Plant Type, North America, 2014–2021

- 46. Power Plant Services Market: Percent Revenue Forecast by Plant Type, North America, 2014–2021

- 47. Power Plant Services Market: Percent Revenue Forecast by End-user Type, North America, 2014 and 2021

- 48. Power Plant Services Market: Revenue Forecast, Latin America, 2011–2021

- 49. Power Plant Services Market: Percent Revenue Forecast by Equipment, Latin America, 2011–2021

- 50. Power Plant Services Market: Revenue Forecast by Plant Type, Latin America, 2014–2021

- 51. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Latin America, 2014–2021

- 52. Power Plant Services Market: Percent Revenue Forecast by End-User Type, Latin America, 2014 and 2021

- 53. Power Plant Services Market: Revenue Forecast, China, 2011–2021 Power Plant Services Market: Percent Revenue Forecast by Equipment, China, 2011–2021

- 54. Power Plant Services Market: Revenue Forecast by Plant Type, China, 2014–2021

- 55. Power Plant Services Market: Percent Revenue Forecast by Plant Type, China, 2014–2021

- 56. Power Plant Services Market: Percent Revenue Forecast by End-User Type, China, 2014 and 2021

- 57. Power Plant Services Market: Revenue Forecast, India, 2011–2021 Power Plant Services Market: Percent Revenue Forecast by Equipment, India, 2011–2021

- 58. Power Plant Services Market: Revenue Forecast by Plant Type, India, 2014–2021

- 59. Power Plant Services Market: Percent Revenue Forecast by Plant Type, India, 2014–2021

- 60. Power Plant Services Market: Percent Revenue Forecast by End-user Type, India, 2014 and 2021

- 61. Power Plant Services Market: Revenue Forecast, ASEAN, 2011–2021

- 62. Power Plant Services Market: Percent Revenue Forecast by Equipment, ASEAN, 2011–2021

- 63. Power Plant Services Market: Revenue Forecast by Plant Type, ASEAN, 2014–2021

- 64. Power Plant Services Market: Percent Revenue Forecast by Plant Type, ASEAN, 2014–2021

- 65. Power Plant Services Market: Percent Revenue Forecast by End-user Type, ASEAN, 2014 and 2021

- 66. Power Plant Services Market: Revenue Forecast, ANZ, 2011–2021

- 67. Power Plant Services Market: Percent Revenue Forecast by Equipment, ANZ, 2011–2021

- 68. Power Plant Services Market: Revenue Forecast by Plant Type, ANZ, 2014–2021

- 69. Power Plant Services Market: Percent Revenue Forecast by Plant Type, ANZ, 2014–2021

- 70. Power Plant Services Market: Percent Revenue Forecast by End-User Type, ANZ, 2014 and 2021

- 71. Power Plant Services Market: Revenue Forecast, Japan, 2011–2021

- 72. Power Plant Services Market: Percent Revenue Forecast by Equipment, Japan, 2011–2021

- 73. Power Plant Services Market: Revenue Forecast by Plant Type, Japan, 2014–2021

- 74. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Japan, 2014–2021

- 75. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Japan, 2014 and 2021

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Market Engineering Measurements~ || CEO’s Perspective~ || Three Big Predictions~ | Global Market Overview~ || Definitions~ || Specific Exclusions~ || Segmentation~ || Global Prospects~ | Forecasts and Trends—Power Plant Services Market~ || Market Engineering Measurements~ || Revenue Forecast~ || Percent Revenue Forecast by Region~ || Revenue Forecast by Region~ || Market Growth Correlation with Electricity Consumption~ || Percent Revenue Forecast by Equipment~ || Revenue Forecast by Equipment~ || Percent Revenue Forecast by Region for Steam Turbine Services~ || CAGR for Steam Turbine Services by Region~ || Revenue Forecast by Region for Steam Turbine Services~ || Percent Revenue Forecast by Region for Gas Turbine Services~ || CAGR for Gas Turbine Services by Region~ || Revenue Forecast by Region for Gas Turbine Services~ || Percent Revenue Forecast by Region for Boiler and HRSG Services~ || CAGR for Boiler and HRSG Services by Region~ || Revenue Forecast by Region for Boiler and HRSG Services~ || Revenue Forecast by Plant Type~ || Percent Revenue Forecast by End-user Type~ || Gas Turbine Services Technology Curve~ || Competitive Structure~ || Key Competitors by Region~ | Western Europe Analysis—External Challenges: Drivers and Restraints~ || Market Drivers~ ||| Ageing European power plant fleet~ ||| Greater focus on energy efficiency and cost reduction~ ||| Increasing trend towards LTSAs for new build power plants~ ||| Lack of in-house capabilities~ || Market Restraints~ ||| Ongoing economic weakness limits fired hours~ ||| Increasing focus on renewable energy~ ||| Limited investment in new fossil-fired plants~ ||| Reluctance to outsource operations~ || Forecasts and Trends~ ||| Market Engineering Measurements~ ||| Revenue Forecast~ ||| Percent Revenue Forecast by Equipment~ ||| Revenue Forecast by Equipment~ ||| Revenue Forecast by Plant Type~ ||| Percent Revenue Forecast by End-user Type~ | Central & Eastern Europe Analysis—External Challenges: Drivers and Restraints~ || Market Drivers~ ||| Ageing power plant fleet~ ||| Growing penetration of gas-fired generation~ ||| Increasing electricity demand~ ||| Greater liberalisation and privatisation of electricity industry~ || Market Restraints~ ||| Economic weakness reduces fired hours~ ||| Expansion of nuclear and hydro generating plants~ ||| Expansion of nuclear and hydro generating plants~ ||| Strong tradition of in-house servicing~ || Forecasts and Trends~ | Russia Analysis—External Challenges: Drivers and Restraints~ || Market Drivers~ ||| Ageing Russian power plant fleet due to historical underinvestment~ ||| Liberalisation of the Russian electricity market~ ||| Growing importance of energy efficiency~ ||| Growth in outsourcing of power plant maintenance and services~ || Market Restraints~ ||| Economic downturn driven by lower oil prices and Western sanctions~ ||| Reluctance to outsource power plant services~ ||| Promotion of non-fossil sources such as nuclear~ ||| Administrative barriers affect investor confidence~ || Forecasts and Trends~ | Middle East Analysis—External Challenges: Drivers and Restraints~ || Market Drivers~ ||| Continued strong growth in electricity demand~ ||| Continued strong growth in electricity demand~ ||| Continued investments in oil and gas industries despite lower oil prices~ ||| Power industry privatisation~ || Market Restraints~ ||| Lower oil and gas prices affect government income and reduce economic growth~ ||| Ongoing political upheaval~ ||| Bureaucracy affects pace of power reform and investment programmes~ ||| Development of non-fossil power generation sources~ || Forecasts and Trends~ | Africa Analysis—External Challenges: Drivers and Restraints~ || Market Drivers~ ||| Rapidly rising electricity demand~ ||| Shortage of power generation capacity prompts investments in new capacity~ ||| Vast natural gas reserves~ ||| Greater private participation in the power sector~ || Market Restraints~ ||| Lower oil prices affect investments in the oil and gas industry~ ||| Weak infrastructure~ ||| Political unrest and weak governments~ ||| Bureaucracy and corruption~ || Forecasts and trends~ | North America Analysis—External Challenges: Drivers and Restraints~ || Market Drivers~ ||| Ageing North American power plant fleet~ ||| Rapid growth in gas plants~ ||| Lack of in-house expertise~ ||| IPP and industrial preference for outsourcing~ || Market Restraints~ ||| Growth in renewable energy plants curtails expansion of fossil-based power services~ ||| Weak electricity demand growth~ ||| Resource constraints such as skilled labour and ageing workforce~ || Forecasts and Trends~ | Latin America Analysis—External Challenges: Drivers and Restraints~ || Market Drivers~ ||| Rising electricity demand~ ||| Expansion of gas-fired power~ ||| Increasing private sector participation~ ||| Oil and gas sector recovery~ || Market Restraints~ ||| Strong expansion of renewable energy~ ||| Low oil prices~ ||| Bureaucracy and corruption~ ||| Slow progress of liberalisation~ || Forecasts and Trends~ | China Analysis—External Challenges: Drivers and Restraints~ | India Analysis—External Challenges: Drivers and Restraints~ | Association of Southeast Asian Nations (ASEAN) Analysis—External Challenges: Drivers and Restraints~ | Australia & New Zealand (ANZ) Analysis—External Challenges: Drivers and Restraints~ | Japan Analysis—External Challenges: Drivers and Restraints~ | The Last Word~ || Three Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Power Plant Services Market: Market Engineering Measurements, Global, 2014~ 2. Power Plant Services Market: Revenue Forecast by Region, Global, 2011–2021~ 3. Power Plant Services Market: Revenue Forecast by Equipment, Global, 2011–2021~ 4. Power Plant Services Market: Revenue Forecast by Region for Steam Turbine Services, Global, 2011–2021~ 5. Power Plant Services Market: Revenue Forecast by Region for Gas Turbine Services, Global, 2011–2021~ 6. Power Plant Services Market: Revenue Forecast by Region for Boiler and HRSG Services, Global, 2011–2021~ 7. Power Plant Services Market: Key Market Drivers, Western Europe, 2015–2021~ 8. Power Plant Services Market: Key Market Restraints, Western Europe, 2015–2021~ 9. Power Plant Services Market: Market Engineering Measurements, Western Europe, 2014~ 10. Power Plant Services Market: Revenue Forecast by Equipment, Western Europe, 2011–2021~ 11. Power Plant Services Market: Key Market Drivers, Central & Eastern Europe, 2015–2021~ 12. Power Plant Services Market: Key Market Restraints, Central & Eastern Europe, 2015–2021~ 13. Power Plant Services Market: Market Engineering Measurements, Central & Eastern Europe, 2014~ 14. Power Plant Services Market: Revenue Forecast by Equipment, Central & Eastern Europe, 2011–2021~ 15. Power Plant Services Market: Key Market Drivers, Russia, 2015–2021~ 16. Power Plant Services Market: Key Market Restraints, Russia, 2015–2021~ 17. Power Plant Services Market: Market Engineering Measurements, Russia, 2014~ 18. Power Plant Services Market: Revenue Forecast by Equipment, Russia, 2011–2021~ 19. Power Plant Services Market: Key Market Drivers, Middle East, 2015–2021~ 20. Power Plant Services Market: Key Market Restraints, Middle East, 2015–2021~ 21. Power Plant Services Market: Market Engineering Measurements, Middle East, 2014~ 22. Power Plant Services Market: Revenue Forecast by Equipment, Middle East, 2011–2021~ 23. Power Plant Services Market: Key Market Drivers, Africa, 2015–2021~ 24. Power Plant Services Market: Key Market Restraints, Africa, 2015–2021~ 25. Power Plant Services Market: Market Engineering Measurements, Africa, 2014~ 26. Power Plant Services Market: Revenue Forecast by Equipment, Africa, 2011–2021~ 27. Power Plant Services Market: Key Market Drivers, North America, 2015–2021~ 28. Power Plant Services Market: Key Market Restraints, North America, 2015–2021~ 29. Power Plant Services Market: Market Engineering Measurements, North America, 2014~ 30. Power Plant Services Market: Revenue Forecast by Equipment, North America, 2011–2021~ 31. Power Plant Services Market: Key Market Drivers, Latin America, 2015–2021~ 32. Power Plant Services Market: Key Market Restraints, Latin America, 2015–2021~ 33. Power Plant Services Market: Market Engineering Measurements, Latin America, 2014~ 34. Power Plant Services Market: Revenue Forecast by Equipment, Latin America, 2011–2021~ 35. Power Plant Services Market: Key Market Drivers, China, 2015–2021~ 36. Power Plant Services Market: Key Market Restraints, China, 2015–2021~ 37. Power Plant Services Market: Market Engineering Measurements, China, 2014~ 38. Power Plant Services Market: Revenue Forecast by Equipment, China, 2011–2021~ 39. Power Plant Services Market: Key Market Drivers, India, 2015–2021~ 40. Power Plant Services Market: Key Market Restraints, India, 2015–2021~ 41. Power Plant Services Market: Market Engineering Measurements, India, 2014~ 42. Power Plant Services Market: Revenue Forecast by Equipment, India, 2011–2021~ 43. Power Plant Services Market: Key Market Drivers, ASEAN, 2015–2021~ 44. Power Plant Services Market: Key Market Restraints, ASEAN, 2015–2021~ 45. Power Plant Services Market: Market Engineering Measurements, ASEAN, 2014~ 46. Power Plant Services Market: Revenue Forecast by Equipment, ASEAN, 2011–2021~ 47. Power Plant Services Market: Key Market Drivers, ANZ, 2015–2021~ 48. Power Plant Services Market: Key Market Restraints, ANZ, 2015–2021~ 49. Power Plant Services Market: Market Engineering Measurements, ANZ, 2014~ 50. Power Plant Services Market: Revenue Forecast by Equipment, ANZ, 2011–2021~ 51. Power Plant Services Market: Key Market Drivers, Japan, 2015–2021~ 52. Power Plant Services Market: Key Market Restraints, Japan, 2015–2021~ 53. Power Plant Services Market: Market Engineering Measurements, Japan, 2014~ 54. Power Plant Services Market: Revenue Forecast by Equipment, Japan, 2011–2021~| 1. Power Plant Services Market: Market Engineering Measurements, Global, 2014~ 2. Power Plant Services Market: Market Segmentation, Global, 2014~ 3. Power Plant Services Market: Revenue Forecast, Global, 2011–2021~ 4. Power Plant Services Market: Percent Revenue Forecast by Region, Global, 2014 and 2021~ 5. Power Plant Services Market: Correlation Between Electricity Demand and Power Plant Services, Global, 2014–2021~ 6. Power Plant Services Market: Percent Revenue Forecast by Equipment, Global, 2011–2021~ 7. Power Plant Services Market: Percent Revenue Forecast by Region for Steam Turbine Services, Global, 2014 and 2021~ 8. Power Plant Services Market: CAGR for Steam Turbine Services by Region, Global, 2014–2021~ 9. Power Plant Services Market: Percent Revenue Forecast by Region for Gas Turbine Services, Global, 2014 and 2021~ 10. Power Plant Services Market: CAGR for Gas Turbine Services by Region, Global, 2014–2021~ 11. Power Plant Services Market: Percent Revenue Forecast by Region for Boiler and HRSG Services, Global, 2014 and 2021~ 12. Power Plant Services Market: CAGR for Boiler and HRSG Services by Region, Global, 2014–2021~ 13. Power Plant Services Market: Revenue Forecast by Plant Type, Global, 2014 and 2021~ 14. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Global, 2014 and 2021~ 15. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Global, 2014 and 2021~ 16. Power Plant Services Market: Potential for Non-OEM Service Providers Along Gas Turbine Technology Curve, Global, 2014~ 17. Power Plant Services Market: Competitive Structure, Global, 2014~ 18. Power Plant Services Market: Revenue Forecast, Western Europe, 2011–2021~ 19. Power Plant Services Market: Percent Revenue Forecast by Equipment, Western Europe, 2011–2021~ 20. Power Plant Services Market: Revenue Forecast by Plant Type, Western Europe, 2014–2021~ 21. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Western Europe, 2014–2021~ 22. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Western Europe, 2014 and 2021~ 23. Power Plant Services Market: Revenue Forecast, Central & Eastern Europe, 2011–2021~ 24. Power Plant Services Market: Percent Revenue Forecast by Equipment, Central & Eastern Europe, 2011–2021~ 25. Power Plant Services Market: Revenue Forecast by Plant Type, Central & Eastern Europe, 2014–2021~ 26. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Central & Eastern Europe, 2014–2021~ 27. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Central & Eastern Europe, 2014 and 2021~ 28. Power Plant Services Market: Revenue Forecast, Russia, 2011–2021~ 29. Power Plant Services Market: Percent Revenue Forecast by Equipment, Russia, 2011–2021~ 30. Power Plant Services Market: Revenue Forecast by Plant Type, Russia, 2014–2021~ 31. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Russia, 2014–2021~ 32. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Russia, 2014 and 2021~ 33. Power Plant Services Market: Revenue Forecast, Middle East, 2011–2021~ 34. Power Plant Services Market: Percent Revenue Forecast by Equipment, Middle East, 2011–2021~ 35. Power Plant Services Market: Revenue Forecast by Plant Type, Middle East, 2014–2021~ 36. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Middle East, 2014–2021~ 37. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Middle East, 2014 and 2021~ 38. Power Plant Services Market: Revenue Forecast, Africa, 2011–2021~ 39. Power Plant Services Market: Percent Revenue Forecast by Equipment, Africa, 2011–2021~ 40. Power Plant Services Market: Revenue Forecast by Plant Type, Africa, 2014–2021~ 41. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Africa, 2014–2021~ 42. Power Plant Services Market: Percent Revenue Forecast by End-User Type, Africa, 2014 and 2021~ 43. Power Plant Services Market: Revenue Forecast, North America, 2011–2021~ 44. Power Plant Services Market: Percent Revenue Forecast by Equipment, North America, 2011–2021~ 45. Power Plant Services Market: Revenue Forecast by Plant Type, North America, 2014–2021~ 46. Power Plant Services Market: Percent Revenue Forecast by Plant Type, North America, 2014–2021~ 47. Power Plant Services Market: Percent Revenue Forecast by End-user Type, North America, 2014 and 2021~ 48. Power Plant Services Market: Revenue Forecast, Latin America, 2011–2021~ 49. Power Plant Services Market: Percent Revenue Forecast by Equipment, Latin America, 2011–2021~ 50. Power Plant Services Market: Revenue Forecast by Plant Type, Latin America, 2014–2021~ 51. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Latin America, 2014–2021~ 52. Power Plant Services Market: Percent Revenue Forecast by End-User Type, Latin America, 2014 and 2021~ 53. Power Plant Services Market: Revenue Forecast, China, 2011–2021 Power Plant Services Market: Percent Revenue Forecast by Equipment, China, 2011–2021~ 54. Power Plant Services Market: Revenue Forecast by Plant Type, China, 2014–2021~ 55. Power Plant Services Market: Percent Revenue Forecast by Plant Type, China, 2014–2021~ 56. Power Plant Services Market: Percent Revenue Forecast by End-User Type, China, 2014 and 2021~ 57. Power Plant Services Market: Revenue Forecast, India, 2011–2021 Power Plant Services Market: Percent Revenue Forecast by Equipment, India, 2011–2021~ 58. Power Plant Services Market: Revenue Forecast by Plant Type, India, 2014–2021~ 59. Power Plant Services Market: Percent Revenue Forecast by Plant Type, India, 2014–2021~ 60. Power Plant Services Market: Percent Revenue Forecast by End-user Type, India, 2014 and 2021~ 61. Power Plant Services Market: Revenue Forecast, ASEAN, 2011–2021~ 62. Power Plant Services Market: Percent Revenue Forecast by Equipment, ASEAN, 2011–2021~ 63. Power Plant Services Market: Revenue Forecast by Plant Type, ASEAN, 2014–2021~ 64. Power Plant Services Market: Percent Revenue Forecast by Plant Type, ASEAN, 2014–2021~ 65. Power Plant Services Market: Percent Revenue Forecast by End-user Type, ASEAN, 2014 and 2021~ 66. Power Plant Services Market: Revenue Forecast, ANZ, 2011–2021~ 67. Power Plant Services Market: Percent Revenue Forecast by Equipment, ANZ, 2011–2021~ 68. Power Plant Services Market: Revenue Forecast by Plant Type, ANZ, 2014–2021~ 69. Power Plant Services Market: Percent Revenue Forecast by Plant Type, ANZ, 2014–2021~ 70. Power Plant Services Market: Percent Revenue Forecast by End-User Type, ANZ, 2014 and 2021~ 71. Power Plant Services Market: Revenue Forecast, Japan, 2011–2021~ 72. Power Plant Services Market: Percent Revenue Forecast by Equipment, Japan, 2011–2021~ 73. Power Plant Services Market: Revenue Forecast by Plant Type, Japan, 2014–2021~ 74. Power Plant Services Market: Percent Revenue Forecast by Plant Type, Japan, 2014–2021~ 75. Power Plant Services Market: Percent Revenue Forecast by End-user Type, Japan, 2014 and 2021~ |

| Author | Harald Thaler |

| Industries | Energy |

| WIP Number | MB18-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB