Global Residential Battery Energy Storage Market, Forecast to 2022

Global Residential Battery Energy Storage Market, Forecast to 2022

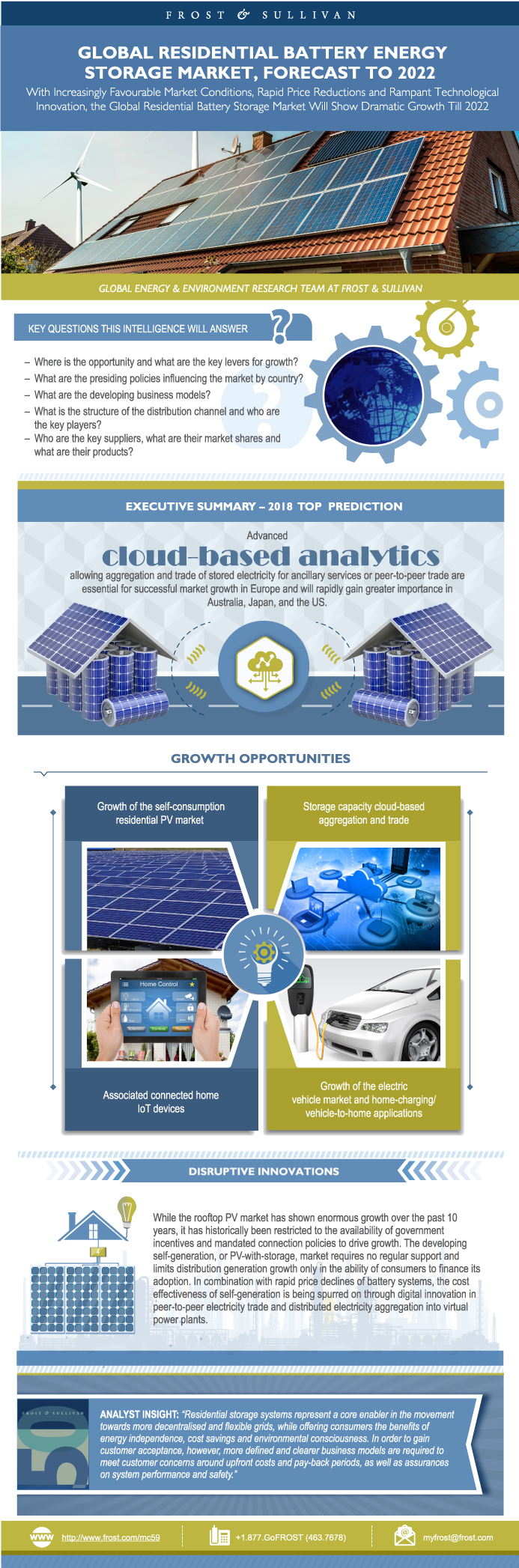

With Increasingly Favourable Market Conditions, Rapid Price Reductions and Rampant Technological Innovation, the Global Residential Battery Storage Market Will Show Dramatic Growth Till 2022

28-Mar-2018

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

The residential battery storage market is expected to show enormous growth over the period of 2016 to 2022, from a market of USD744 million in 2016 to USD3.6 billion by 2022. The market is being spurred on by feed-in tariff and net metering revisions in historic residential PV hotspots, subsidies and tax incentives, rapid price reductions in lithium-ion battery prices, and rising electricity tariffs. This is resulting in a shift from policy driven markets for solar power grid trade to self-consumption driven markets. Increasing the business case for such systems, at a time where system prices are still beyond customer acceptance levels for broad based adoption, is an increase in digital integration into these systems. This is allowing for value added functionalities such as electricity aggregation and trade from residential battery cloud based communities, or virtual power plants (VPPS), to the grid under balancing markets for ancillary services. Furthermore, the availability of residential storage increases the attractiveness for customers to enter the demand response market through similar aggregators, further increasing the value stack. Such functionalities allows for the opening up of income streams to customers as well as allowing suppliers to offer system financing support, such as reduced or zero down payment loan, lease or power purchase agreement (PPA) models. Significant reductions in upfront costs to customers through such models, combined with the provision of income streams, cost savings achieved through self-consumption, additional cost saving benefits when combined with electric vehicles, and the benefits of a reliable, green energy supply to customers is expected to drive this market forward, even before system price reductions have reached levels seen as acceptable for broad based adoption. Germany and Japan currently represent the largest markets for residential storage by a significant margin, but considering the above drivers, the market is expected to diversify significantly, with the US and Australia representing the two largest break-out markets and other European markets of Italy and the UK to show significant growth.

Key Issues Addressed

- Where is the opportunity and what are the key levers for growth?

- What are the presiding policies influencing the market by country?

- What are the developing business models?

- What is the structure of the distribution channel and who are the key players?

- Who are the key suppliers, what are their market shares and what are their products?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Takeaways by Country

Key Takeaways by Country (continued)

Market Engineering Measurements

CEO’s 360 Degree Perspective

Trends by Country

Market Share of Battery Storage System Suppliers

Market Share of Battery Storage System Suppliers (continued)

Market Definitions

Market Definitions (continued)

Market Definitions (continued)

Market Engineering Measurements

Global Market Forecast

Revenue Forecast by Country

Unit Forecast by Country

Capacity Additions by Country

Annual Market Forecasts

Annual Market Forecasts (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Market Restraints Explained (continued)

Supporting Policies

Supporting Policies (continued)

Supporting Policies (continued)

Supporting Policies (continued)

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Annual Market Forecasts

Annual Market Forecasts (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Market Restraints Explained (continued)

Supporting Policies

Supporting Policies (continued)

Supporting Policies (continued)

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Annual Market Forecast

Annual Market Forecast (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Market Restraints Explained (continued)

Supporting Policies

Supporting Policies (continued)

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Annual Market Forecasts

Annual Market Forecasts (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Market Restraints Explained (continued)

Supporting Policies

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Competitor Analysis of the Residential Battery Storage Market (continued)

Annual Market Forecasts

Annual Market Forecasts (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Supporting Policies

Supporting Policies (continued)

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

Annual Market Forecasts

Annual Market Forecasts (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Market Restraints Explained (continued)

Supporting Policies

Supporting Policies (continued)

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

Annual Market Forecasts

Annual Market Forecasts (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Market Restraints Explained (continued)

Supporting Policies

Supporting Policies (continued)

Supporting Policies (continued)

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

Annual Market Forecasts

Annual Market Forecasts (continued)

Market Drivers and Restraints

Market Drivers

Market Drivers Explained

Market Drivers Explained (continued)

Market Restraints

Market Restraints Explained

Market Restraints Explained (continued)

Supporting Policies

Supporting Policies (continued)

Distribution Structure

Distribution Structure (continued)

Distribution Structure (continued)

Competitor Analysis of the Residential Battery Storage Market

The Last Word—3 Big Predictions

Legal Disclaimer

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

The Frost & Sullivan Story

Value Proposition—Future of Your Company & Career

Global Perspective

Industry Convergence

360º Research Perspective

Implementation Excellence

Our Blue Ocean Strategy

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Ross Bruton |

| Industries | Energy |

| WIP Number | MC59-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9210,9211,9597,9599,9852,9AFE-A4,9AFF-A4,9B00-A4 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB