Growth Opportunities in the US In Vitro Diagnostics (IVD) Market, Forecast to 2021

Growth Opportunities in the US In Vitro Diagnostics (IVD) Market, Forecast to 2021

US IVD Market Witnesses Pricing Fluctuations Due to the PAMA Regulation

23-May-2017

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

The In Vitro Diagnostics (IVD) landscape in the United States is extremely dynamic, with a high level of merger and acquisition activity with many high-value deals still pending. Both clinical laboratories and manufacturers are increasingly vying for smaller specialized niche technology companies to increase their market share. Molecular point of care testing (POCT) and liquid biopsy continue to attract investment opportunities from private equity and venture capitalists. The new government in the United States aims to provide a retail-like experience for healthcare services. As a result, innovative and clinically vetted direct to consumer (DTC) diagnostic testing services are expected to thrive. Partnerships with non-healthcare (HC) companies are expected to empower core diagnostic companies with artificial intelligence (AI) and big data capabilities are on the rise. Given these market trends, it is important to understand the market dynamics to remain competitive and successful in the IVD market in the United States of America.

Research Scope:

The key objectives of this growth opportunity study are to track the changes in the IVD market landscape in the United States for 2016-2021. The study aims to identify growth segments and disruptive companies to invest into. Further, the study provides an in-depth revenue and market share analysis of over 8 segments within the IVD landscape: POCT, tissue diagnostics, self-monitoring blood glucose meter (SMBG), hemostasis, hematology, clinical chemistry, microbiology, immunochemistry, and molecular diagnostics. The study highlights industry challenges, growth drivers, restraints, competitive developments, mergers and acquisition, and investment opportunities. It also discusses the impact of Protecting Access to Medicare Act (PAMA), identifies transforming business models, and makes strategic recommendations to understand the dynamics of the US IVD market. The study also covers key trends and growth opportunities, game-changing companies, disruptive technologies and transforming business models, as well as strategic recommendations.

Key Questions this Study will Answer:

1. What are some of the current issues that concern the US IVD industry? How would these impact the different stakeholders in the healthcare landscape?

2. Which are the major segments of growth and why should you invest in them?

3. How to identify partners outside the conventional IVD realm?

4. How can big data support the growth of the IVD industry?

5. What are some of the newer products to watch in 2017 and beyond?

6. Which companies are categorized as early disruptors in this space? Who are the possible candidates to acquire, invest in, and help grow your business?

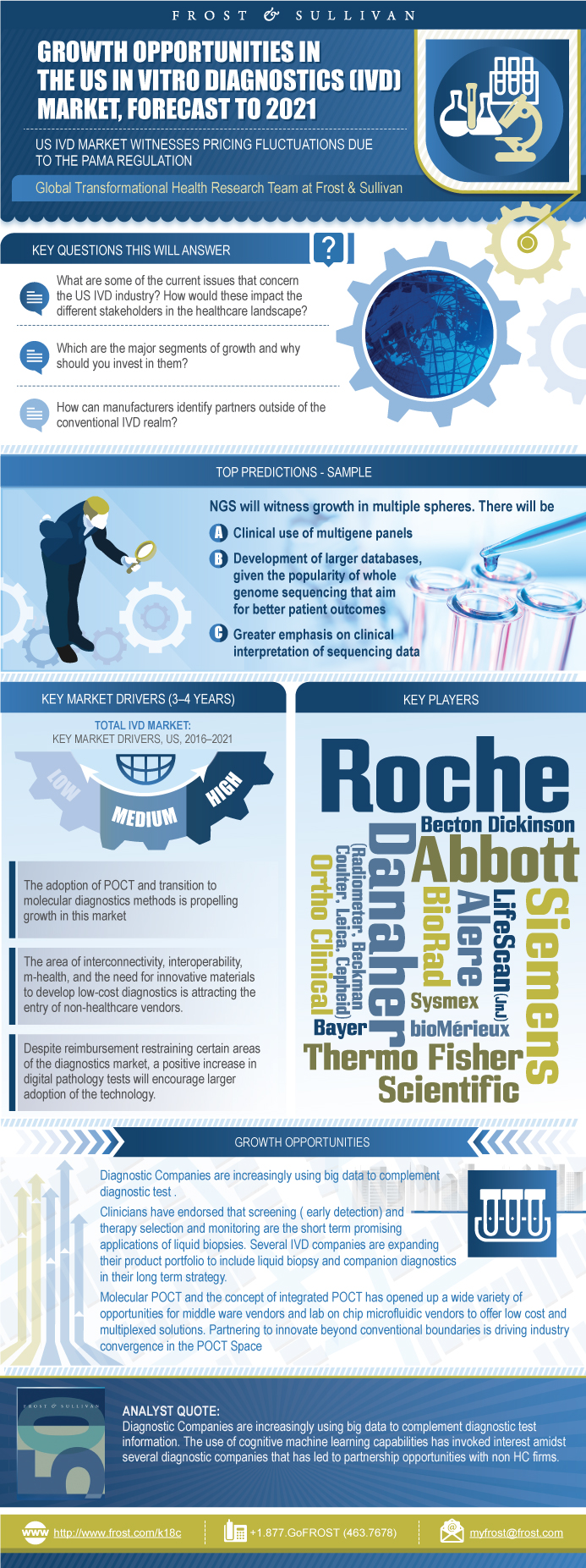

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Purpose of this Experiential Study

5 Step Process to Transformational Growth

Scope and Segmentation

Market Highlights

Strategic Imperatives for Suppliers and Laboratories

Big Growth Themes for US IVD Industry

Market Definition and Segments Covered

Market Drivers and Restraints

Reasons for Considering PAMA

Impact of the PAMA Regulations

Proposed Timeline for Implementation

Foreseeing the Effects of PAMA

CLFS Rate/Code Determination

Value Chain of IVD Industry

Key Disruptive IVD Concepts to Impact Healthcare by 2021

Snapshot of Growth Technologies in In-vitro Diagnostics Market

Transformation in the IVD Industry Ecosystem—2016

Growth Opportunities for Suppliers in Top 3 Segments

Macro to Micro Visioning

5 Major Growth Opportunities

Opportunity 1—Use of Big Data

Opportunity 2—Liquid Biopsy and CDx

Opportunity 3—Molecular POCT

Opportunity 4—Direct-to-Consumer Testing

Opportunity 5—PGx Testing

Top Predictions for the US IVD Market

Total IVD Market—Revenue Forecast

Revenue Forecast by Segment

Revenue Growth Rate by Segment

Percent Revenue Forecast by Segment

Overall US IVD Market Share

Overall US IVD Market Share Analysis

2016 IVD Market Participant Strategies

Competitor IVD Matrix

Segment Sales Analysis

Top 13 Companies—US IVD Market

Competitor Segment Ranking Matrix

Notable Activities

Venture Radar—Additional Investment Opportunities

Opportunities and Challenges—Hematology

Revenue Forecast—Hematology

Market Share Analysis—Hematology

Products to Watch in 2017

Opportunities and Challenges—Hemostasis

Revenue Forecast—Hemostasis

Market Share Analysis—Hemostasis

Products to Watch in 2017

Opportunities and Challenges—POCT

Revenue Forecast—POCT

Market Share Analysis—POCT

Products to Watch in 2017

Opportunities and Challenges—Molecular Diagnostics

Revenue Forecast—Molecular Diagnostics

Market Share Analysis—Molecular Diagnostics

Products to Watch in 2017

Opportunities and Challenges—Tissue Diagnostics

Revenue Forecast—Tissue Diagnostics

Market Share Analysis—Tissue Diagnostics

Products to Watch in 2017

Reimbursement Analysis for Key AP Codes

Opportunities and Challenges—SMBG

Revenue Forecast—SMBG

Market Share Analysis—SMBG

Product to Watch in 2017

Opportunities and Challenges—Clinical Microbiology

Revenue Forecast—Clinical Microbiology

Market Share Analysis—Clinical Microbiology

Products to Watch in 2017

Opportunities and Challenges—Immunochemistry

Revenue Forecast—Immunochemistry

Market Share Analysis—Immunochemistry

Competitor Customer Coverage

Key Conclusions and Future Outlook

Legal Disclaimer

Installed Base and Pricing Analysis—Hematology

Installed Base and Pricing Analysis—Hemostasis

Pricing Analysis—NGS

Pricing Analysis—Thermal Cyclers

Pricing Analysis—Microarrays

Pricing Analysis—Tissue Diagnostics

Installed Base and Pricing Analysis—Immunoassay Systems

Installed Base and Pricing Analysis—Chemistry Analyzers

Pricing Analysis—Automated Urine Analyzers

Key Abbreviations

List of Other Companies Includes

- 1. Total IVD Market: Key Market Drivers and Restraints, US, 2017–2021

- 2. Total IVD Market: Medicare Part B Lab Test Payments, US, 2016

- 3. Total IVD Market: Proposed Timeline for Execution, US, 2016–2021

- 4. Total IVD Market: Revised PAMA Payment Rates, US, 2016

- 5. Total IVD Market: Medicare Growth Opportunities for Suppliers, US, 2016

- 6. Total IVD Market: Liquid Biopsy Companies, US, 2016

- 7. Total IVD Market: Revenue Forecast by Segment, US, 2011–2021

- 8. Total IVD Market: Market Share Revenue, US, 2016

- 9. Total IVD Market: Market Participant Strategies, US, 2016

- 10. Total IVD Market: Competitor Matrix, US, 2016

- 11. Total IVD Market: Segment Share Analysis, US, 2016

- 12. Total IVD Market: Competitor Segment Ranking Matrix, US, 2016

- 13. Total IVD Market: M&A Assessment, US, 2014–2016

- 14. Total IVD Market: Hematology Market Share, US, 2016

- 15. Hematology Market: New Products to Watch, US, 2017

- 16. Total IVD Market: Hemostasis Market Share, US, 2016

- 17. Hemostasis Market: New Products to Watch, US, 2017

- 18. Total IVD Market: POCT Market Share Analysis, US, 2016

- 19. POCT Market: New Products to Watch, US, 2017

- 20. Total IVD Market: Molecular Diagnostics Market Share Analysis, US, 2016

- 21. Molecular Diagnostics Market: New Products to Watch, US, 2017

- 22. Total IVD Market: Tissue Diagnostics Market Share Analysis, US, 2016

- 23. Tissue Diagnostics Market: New Products to Watch, US, 2017

- 24. Tissue Diagnostics Market: CPT Code Analysis, US, 2016–2017

- 25. Total IVD Market: SMBG Market Share Analysis, US, 2016

- 26. SMBG Market: New Products to Watch, US, 2017

- 27. Total IVD Market: Clinical Microbiology Market Share Analysis, US, 2017

- 28. Clinical Microbiology Market: New Products to Watch, US, 2017

- 29. Total IVD Market: Immunochemistry Market Share Analysis, US, 2016

- 30. Immunochemistry Market: Comparative Analysis of Competitor Customer Coverage, US, 2016

- 31. Total IVD Market: Key Conclusions and Future Outlook, US, 2016

- 32. Total IVD Market: Hematology-Installed Base and Pricing Analysis, US, 2016

- 33. Total IVD Market: Hematology-Installed Base and Pricing Analysis, US, 2016

- 34. Total IVD Market: Hemostasis-Installed Base and Pricing Analysis, US, 2016

- 35. Total IVD Market: NGS-Capital Pricing Analysis, US,2016

- 36. Total IVD Market: Thermal Cyclers-Capital Pricing Analysis, US, 2016

- 37. Total IVD Market: Microarrays-Capital Pricing Analysis, US, 2016

- 38. Total IVD Market: Slide Stainers-Capital Pricing Analysis, US, 2016

- 39. Total IVD Market: Slides and Cassettes-Capital Pricing Analysis, US, 2016

- 40. Total IVD Market: Microtome-Capital Pricing Analysis, US, 2016

- 41. Total IVD Market: Tissue Diagnostics-Capital Pricing Analysis, US, 2016

- 42. Total IVD Market: Immunoassay Systems-Installed Base and Capital Pricing Analysis, US, 2016

- 43. Total IVD Market: Immunoassay Systems-Installed Base and Capital Pricing Analysis, US, 2016

- 44. Total IVD Market: Immunoassay Systems-Installed Base & Capital Pricing Analysis, US, 2016

- 45. Total IVD Market: Immunoassay Systems-Installed Base & Capital Pricing Analysis, US, 2016

- 46. Total IVD Market: Immunoassay Systems-Installed Base and Capital Pricing Analysis, US, 2016

- 47. Total IVD Market: Chemistry Analyzers-Installed Base and Capital Pricing Analysis, US, 2016

- 48. Total IVD Market: Urine Analyzers-Capital Pricing Analysis, US, 2016

- 1. Total IVD Market: Percent of Lab test and Medicare Payments, US, 2016

- 2. Total IVD Market: Key Areas of Growth, Global, 2025

- 3. Total IVD Market: Revenue Forecast, Global, 2016 and 2025

- 4. Total IVD Market: Revenue Forecast, US, 2011–2021

- 5. Total IVD Market: Revenue Growth Rate by Segment, US, 2012–2021

- 6. Total IVD Market: Percent Revenue Forecast by Segment, US, 2016–2021

- 7. Total IVD Market: Percent Revenue Breakdown, US, 2016

- 8. Total IVD Market: Market Share Analysis, US, 2016

- 9. Hematology Market: Revenue Forecast, US, 2011–2021

- 10. Hematology Market: Percent Revenue Breakdown, US, 2016

- 11. Hemostasis Market: Revenue Forecast, US, 2011–2021

- 12. Hemostasis Market: Market Share Analysis, US, 2016

- 13. POCT Market: Revenue Forecast, US, 2011–2021

- 14. POCT Market: Percent Revenue Breakdown, US, 2016

- 15. Molecular Diagnostics Market: Revenue Forecast, US, 2011–2021

- 16. Molecular Diagnostics Market: Percent Revenue Breakdown, US, 2016

- 17. Tissue Diagnostics Market: Revenue Forecast, US, 2011–2021

- 18. Tissue Diagnostics Market: Percent Revenue Breakdown, US, 2016

- 19. SMBG Market: Revenue Forecast, US, 2011–2021

- 20. SMBG Market: Percent Revenue Breakdown, US, 2016

- 21. Clinical Microbiology Market: Revenue Forecast, US, 2011–2021

- 22. Clinical Microbiology Market: Percent Revenue Breakdown, US, 2016

- 23. Immunochemistry Market: Revenue Forecast, US, 2011–2021

- 24. Immunochemistry Market: Percent Revenue Breakdown, US, 2016

- 25. Total IVD Market: Clinical Chemistry Brand Interest by Hospitals, US, Dec 2015-Dec 2016

- 26. Total IVD Market: Automated Urine Analyzers Brand Interest, US, Dec 2015-Dec 2016

- 27. Total IVD Market: Immunoassay Brand Interest by Hospitals, US, Dec 2015-Dec 2016

- 28. Total IVD Market: Hematology-Sales Channel % (OEM Vs Distributors), US, 2016

- 29. Total IVD Market: Hematology-Service Providers (OEM Vs 3rd Party), US, 2016

- 30. Total IVD Market: Hemostasis–Sales Channel % (OEM Vs Distributors), US, 2016

- 31. Total IVD Market: Hemostasis–Service Providers (OEM Vs 3rd Party), US, 2016

- 32. Total IVD Market: NGS-Sales Channel % (OEM Vs Distributors), US, 2016

- 33. Total IVD Market: NGS-Service Providers (OEM Vs 3rd Party), US, 2016

- 34. Total IVD Market: Thermal Cyclers-Sales Channel % (OEM Vs Distributors), US, 2016

- 35. Total IVD Market: Thermal Cyclers-Service Providers (OEM Vs 3rd Party), US, 2016

- 36. Total IVD Market: Microarrays-Sales Channel % (OEM Vs Distributors), US, 2016

- 37. Total IVD Market: Microarrays-Service Providers (OEM Vs 3rd Party), US, 2016

- 38. Total IVD Market: Sales Channel % (OEM Vs Distributors), US, 2016

- 39. Total IVD Market: Service Providers (OEM Vs 3rd Party), US, 2016

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Dashboard~ || Purpose of this Experiential Study~ || 5 Step Process to Transformational Growth~ || Scope and Segmentation~ || Market Highlights~ || Strategic Imperatives for Suppliers and Laboratories~ || Big Growth Themes for US IVD Industry~ | Growth Environment—Market Overview~ || Market Definition and Segments Covered~ || Market Drivers and Restraints~ || Reasons for Considering PAMA~ || Impact of the PAMA Regulations~ || Proposed Timeline for Implementation~ || Foreseeing the Effects of PAMA~ || CLFS Rate/Code Determination~ || Value Chain of IVD Industry~ || Key Disruptive IVD Concepts to Impact Healthcare by 2021~ || Snapshot of Growth Technologies in In-vitro Diagnostics Market~ | Vision and Strategy—Emerging Growth Opportunities~ || Transformation in the IVD Industry Ecosystem—2016~ || Growth Opportunities for Suppliers in Top 3 Segments~ || Macro to Micro Visioning~ || 5 Major Growth Opportunities~ || Opportunity 1—Use of Big Data~ || Opportunity 2—Liquid Biopsy and CDx~ || Opportunity 3—Molecular POCT~ || Opportunity 4—Direct-to-Consumer Testing~ || Opportunity 5—PGx Testing~ || Top Predictions for the US IVD Market~ | Total Market Forecasts~ || Total IVD Market—Revenue Forecast~ || Revenue Forecast by Segment~ || Revenue Growth Rate by Segment~ || Percent Revenue Forecast by Segment~ || Overall US IVD Market Share~ || Overall US IVD Market Share Analysis~ | Competitive Analysis~ || 2016 IVD Market Participant Strategies~ || Competitor IVD Matrix~ || Segment Sales Analysis~ || Top 13 Companies—US IVD Market~ || Competitor Segment Ranking Matrix~ || Notable Activities~ || Venture Radar—Additional Investment Opportunities~ | Hematology Segment Breakdown~ || Opportunities and Challenges—Hematology~ || Revenue Forecast—Hematology~ || Market Share Analysis—Hematology~ || Products to Watch in 2017~ | Hemostasis Segment Breakdown~ || Opportunities and Challenges—Hemostasis~ || Revenue Forecast—Hemostasis~ || Market Share Analysis—Hemostasis~ || Products to Watch in 2017~ | POCT Segment Breakdown~ || Opportunities and Challenges—POCT~ || Revenue Forecast—POCT~ || Market Share Analysis—POCT~ || Products to Watch in 2017~ | Molecular Diagnostics Segment Breakdown~ || Opportunities and Challenges—Molecular Diagnostics~ || Revenue Forecast—Molecular Diagnostics~ || Market Share Analysis—Molecular Diagnostics~ || Products to Watch in 2017~ | Tissue Diagnostics Segment Breakdown~ || Opportunities and Challenges—Tissue Diagnostics~ || Revenue Forecast—Tissue Diagnostics~ || Market Share Analysis—Tissue Diagnostics~ || Products to Watch in 2017~ || Reimbursement Analysis for Key AP Codes~ | SMBG Segment Breakdown~ || Opportunities and Challenges—SMBG~ || Revenue Forecast—SMBG~ || Market Share Analysis—SMBG~ || Product to Watch in 2017~ | Clinical Microbiology Segment Breakdown~ || Opportunities and Challenges—Clinical Microbiology~ || Revenue Forecast—Clinical Microbiology~ || Market Share Analysis—Clinical Microbiology~ || Products to Watch in 2017~ | Immunochemistry Segment Breakdown (Includes Revenues for Immunossay, Clinical Chemistry, and Urinalysis)~ || Opportunities and Challenges—Immunochemistry~ || Revenue Forecast—Immunochemistry~ || Market Share Analysis—Immunochemistry~ || Competitor Customer Coverage~ | Last Word~ || Key Conclusions and Future Outlook~ || Legal Disclaimer~ | Appendix (Capital Pricing and Installed Base)~ || Installed Base and Pricing Analysis—Hematology~ || Installed Base and Pricing Analysis—Hemostasis~ || Pricing Analysis—NGS~ || Pricing Analysis—Thermal Cyclers~ || Pricing Analysis—Microarrays~ || Pricing Analysis—Tissue Diagnostics~ || Installed Base and Pricing Analysis—Immunoassay Systems~ || Installed Base and Pricing Analysis—Chemistry Analyzers~ || Pricing Analysis—Automated Urine Analyzers~ || Key Abbreviations~ || List of Other Companies Includes~ |

| List of Charts and Figures | 1. Total IVD Market: Key Market Drivers and Restraints, US, 2017–2021~ 2. Total IVD Market: Medicare Part B Lab Test Payments, US, 2016~ 3. Total IVD Market: Proposed Timeline for Execution, US, 2016–2021~ 4. Total IVD Market: Revised PAMA Payment Rates, US, 2016~ 5. Total IVD Market: Medicare Growth Opportunities for Suppliers, US, 2016~ 6. Total IVD Market: Liquid Biopsy Companies, US, 2016~ 7. Total IVD Market: Revenue Forecast by Segment, US, 2011–2021~ 8. Total IVD Market: Market Share Revenue, US, 2016~ 9. Total IVD Market: Market Participant Strategies, US, 2016~ 10. Total IVD Market: Competitor Matrix, US, 2016~ 11. Total IVD Market: Segment Share Analysis, US, 2016~ 12. Total IVD Market: Competitor Segment Ranking Matrix, US, 2016~ 13. Total IVD Market: M&A Assessment, US, 2014–2016~ 14. Total IVD Market: Hematology Market Share, US, 2016~ 15. Hematology Market: New Products to Watch, US, 2017~ 16. Total IVD Market: Hemostasis Market Share, US, 2016~ 17. Hemostasis Market: New Products to Watch, US, 2017~ 18. Total IVD Market: POCT Market Share Analysis, US, 2016~ 19. POCT Market: New Products to Watch, US, 2017~ 20. Total IVD Market: Molecular Diagnostics Market Share Analysis, US, 2016~ 21. Molecular Diagnostics Market: New Products to Watch, US, 2017~ 22. Total IVD Market: Tissue Diagnostics Market Share Analysis, US, 2016~ 23. Tissue Diagnostics Market: New Products to Watch, US, 2017~ 24. Tissue Diagnostics Market: CPT Code Analysis, US, 2016–2017~ 25. Total IVD Market: SMBG Market Share Analysis, US, 2016~ 26. SMBG Market: New Products to Watch, US, 2017~ 27. Total IVD Market: Clinical Microbiology Market Share Analysis, US, 2017~ 28. Clinical Microbiology Market: New Products to Watch, US, 2017~ 29. Total IVD Market: Immunochemistry Market Share Analysis, US, 2016~ 30. Immunochemistry Market: Comparative Analysis of Competitor Customer Coverage, US, 2016~ 31. Total IVD Market: Key Conclusions and Future Outlook, US, 2016~ 32. Total IVD Market: Hematology-Installed Base and Pricing Analysis, US, 2016~ 33. Total IVD Market: Hematology-Installed Base and Pricing Analysis, US, 2016~ 34. Total IVD Market: Hemostasis-Installed Base and Pricing Analysis, US, 2016~ 35. Total IVD Market: NGS-Capital Pricing Analysis, US,2016~ 36. Total IVD Market: Thermal Cyclers-Capital Pricing Analysis, US, 2016~ 37. Total IVD Market: Microarrays-Capital Pricing Analysis, US, 2016~ 38. Total IVD Market: Slide Stainers-Capital Pricing Analysis, US, 2016~ 39. Total IVD Market: Slides and Cassettes-Capital Pricing Analysis, US, 2016~ 40. Total IVD Market: Microtome-Capital Pricing Analysis, US, 2016~ 41. Total IVD Market: Tissue Diagnostics-Capital Pricing Analysis, US, 2016~ 42. Total IVD Market: Immunoassay Systems-Installed Base and Capital Pricing Analysis, US, 2016~ 43. Total IVD Market: Immunoassay Systems-Installed Base and Capital Pricing Analysis, US, 2016~ 44. Total IVD Market: Immunoassay Systems-Installed Base & Capital Pricing Analysis, US, 2016~ 45. Total IVD Market: Immunoassay Systems-Installed Base & Capital Pricing Analysis, US, 2016~ 46. Total IVD Market: Immunoassay Systems-Installed Base and Capital Pricing Analysis, US, 2016~ 47. Total IVD Market: Chemistry Analyzers-Installed Base and Capital Pricing Analysis, US, 2016~ 48. Total IVD Market: Urine Analyzers-Capital Pricing Analysis, US, 2016~| 1. Total IVD Market: Percent of Lab test and Medicare Payments, US, 2016~ 2. Total IVD Market: Key Areas of Growth, Global, 2025~ 3. Total IVD Market: Revenue Forecast, Global, 2016 and 2025~ 4. Total IVD Market: Revenue Forecast, US, 2011–2021~ 5. Total IVD Market: Revenue Growth Rate by Segment, US, 2012–2021~ 6. Total IVD Market: Percent Revenue Forecast by Segment, US, 2016–2021~ 7. Total IVD Market: Percent Revenue Breakdown, US, 2016~ 8. Total IVD Market: Market Share Analysis, US, 2016~ 9. Hematology Market: Revenue Forecast, US, 2011–2021~ 10. Hematology Market: Percent Revenue Breakdown, US, 2016~ 11. Hemostasis Market: Revenue Forecast, US, 2011–2021~ 12. Hemostasis Market: Market Share Analysis, US, 2016~ 13. POCT Market: Revenue Forecast, US, 2011–2021~ 14. POCT Market: Percent Revenue Breakdown, US, 2016~ 15. Molecular Diagnostics Market: Revenue Forecast, US, 2011–2021~ 16. Molecular Diagnostics Market: Percent Revenue Breakdown, US, 2016~ 17. Tissue Diagnostics Market: Revenue Forecast, US, 2011–2021~ 18. Tissue Diagnostics Market: Percent Revenue Breakdown, US, 2016~ 19. SMBG Market: Revenue Forecast, US, 2011–2021~ 20. SMBG Market: Percent Revenue Breakdown, US, 2016~ 21. Clinical Microbiology Market: Revenue Forecast, US, 2011–2021~ 22. Clinical Microbiology Market: Percent Revenue Breakdown, US, 2016~ 23. Immunochemistry Market: Revenue Forecast, US, 2011–2021~ 24. Immunochemistry Market: Percent Revenue Breakdown, US, 2016~ 25. Total IVD Market: Clinical Chemistry Brand Interest by Hospitals, US, Dec 2015-Dec 2016~ 26. Total IVD Market: Automated Urine Analyzers Brand Interest, US, Dec 2015-Dec 2016~ 27. Total IVD Market: Immunoassay Brand Interest by Hospitals, US, Dec 2015-Dec 2016~ 28. Total IVD Market: Hematology-Sales Channel % (OEM Vs Distributors), US, 2016~ 29. Total IVD Market: Hematology-Service Providers (OEM Vs 3rd Party), US, 2016~ 30. Total IVD Market: Hemostasis–Sales Channel % (OEM Vs Distributors), US, 2016~ 31. Total IVD Market: Hemostasis–Service Providers (OEM Vs 3rd Party), US, 2016~ 32. Total IVD Market: NGS-Sales Channel % (OEM Vs Distributors), US, 2016~ 33. Total IVD Market: NGS-Service Providers (OEM Vs 3rd Party), US, 2016~ 34. Total IVD Market: Thermal Cyclers-Sales Channel % (OEM Vs Distributors), US, 2016~ 35. Total IVD Market: Thermal Cyclers-Service Providers (OEM Vs 3rd Party), US, 2016~ 36. Total IVD Market: Microarrays-Sales Channel % (OEM Vs Distributors), US, 2016~ 37. Total IVD Market: Microarrays-Service Providers (OEM Vs 3rd Party), US, 2016~ 38. Total IVD Market: Sales Channel % (OEM Vs Distributors), US, 2016~ 39. Total IVD Market: Service Providers (OEM Vs 3rd Party), US, 2016~ |

| Lightbox Content | World Cancer Day 2019|Get 15% discount for all Healthcare studies |https://store.frost.com/contacts/?utm_source=PD&utm_medium=lightbox&utm_campaign=HEALTHCARE_CANCER2019 |

| Author | Divyaa Ravishankar |

| WIP Number | K18C-01-00-00-00 |

| Keyword 1 | In Vitro Diagnostics |

| Keyword 2 | IVD |

| Keyword 3 | IVD in USA |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB