Autonomous Vehicles

Autonomous Driving is set to redefine the mobility eco system as we know it today. The industry is at the cusp of a paradigm shift that will open avenues for new entrants and drive existing participants to rethink.

There will be numerous business opportunities from within the automotive industry and outside, but there will be two key common denominators to all of these opportunities: data and utilization. The core element to success in this market is embracing this phenomenon and aligning any offering in this industry to that one factor. Frost & Sullivan’s Autonomous Driving program area focuses on all new and shifting trends across this lucrative market such as:

- Market trends impacting uptake of autonomous vehicles in the future

- Technology trends driving innovation in the autonomous driving space

- Emergence of new technology and service providers that provide the disruptive change to the industry

- Competitive assessment of OEM and supplier strategies towards achieving autonomous capabilities.

- Market evaluation and forecasting of autonomous driving enablers and autonomous vehicles.

We work closely with the world’s largest OEMs, suppliers, service providers and technology firms to help them find the opportunities in this sea of change. Our holistic yet substantial research services enable us to stay at the forefront of change in this dynamic market, and enable our clients to achieve the same.

-

27 Oct 2022 | North America

Insights on North American OEMs’ ADAS and AD Sensor Strategies

Push to L2+ and L3 will Drive Competitive Intensity and the Uptake of Cameras and LiDARs

Autonomous driving and ADAS features are on the rise in the NA market. Market participants that offer vehicles with L1 and L2 capabilities dominate the current market. A few of these OEMs also have vehicles with L2+ capabilities. Vehicles with L2+ ADAS and L3 AD capabilities will dominate the future of the NA ADAS and AD markets. Because of the ple...

$4,950.00

Special Price $4,455.00 save 10 %

-

15 Sep 2022 | North America

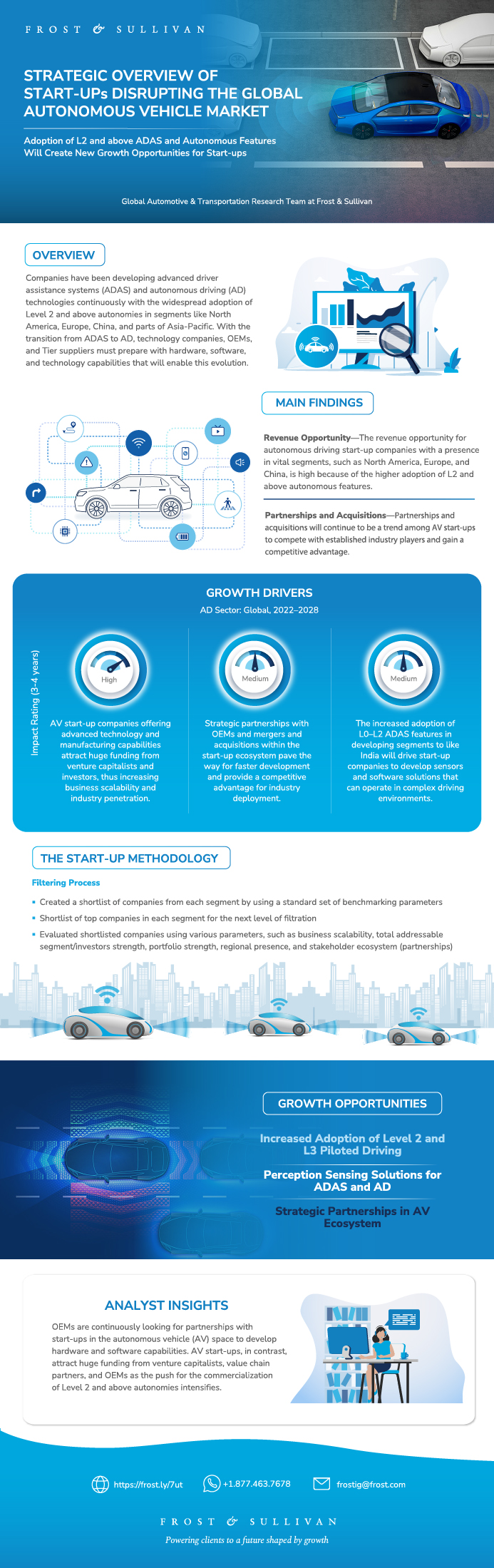

Strategic Overview of Start-ups Disrupting the Global Autonomous Vehicle Market

Adoption of L2 and above ADAS and Autonomous Features Will Create New Growth Opportunities for Start-ups

Companies have been developing advanced driver assistance systems (ADAS) and autonomous driving (AD) technologies continuously with the widespread adoption of Level 2 and above autonomies in markets like North America, Europe, China, and parts of Asia-Pacific. With the transition from ADAS to AD, technology companies, OEMs, and Tier suppliers must ...

$4,950.00

Special Price $4,207.50 save 15 %

-

24 Aug 2021 | North America

Global Autonomous Vehicles Regulatory Growth Opportunities

Progressive Regulatory Frameworks and Technology Developments Boost Future Growth Potential of Autonomous Vehicles

Partners in the autonomous driving value chain are on the brink of developing advanced driver-assistance systems (ADAS) and autonomous driving systems to enhance the safety and convenience requirements of the driver, passengers, and other vulnerable road users. Increasing automated safety requirements have necessitated the need for a robust regulat...

$4,950.00

Special Price $3,712.50 save 25 %

-

28 Jan 2019 | North America

Benchmarking Profile of Tesla's Autonomous Driving Strategy, 2018

Tesla’s In-house Technological Innovations will Continue to Upend the Conventional Automotive Industry

Once in a while, a new market participant will emerge in an industry and disrupt its technological and business landscape entirely. In the automobile industry, the entry of Tesla created this dramatic shift and began to transform the sector. Tesla’s fully self-reliant business model has disrupted conventional ways of doing business, as traditiona...

$3,000.00

Special Price $2,250.00 save 25 %

-

15 Mar 2018 | North America

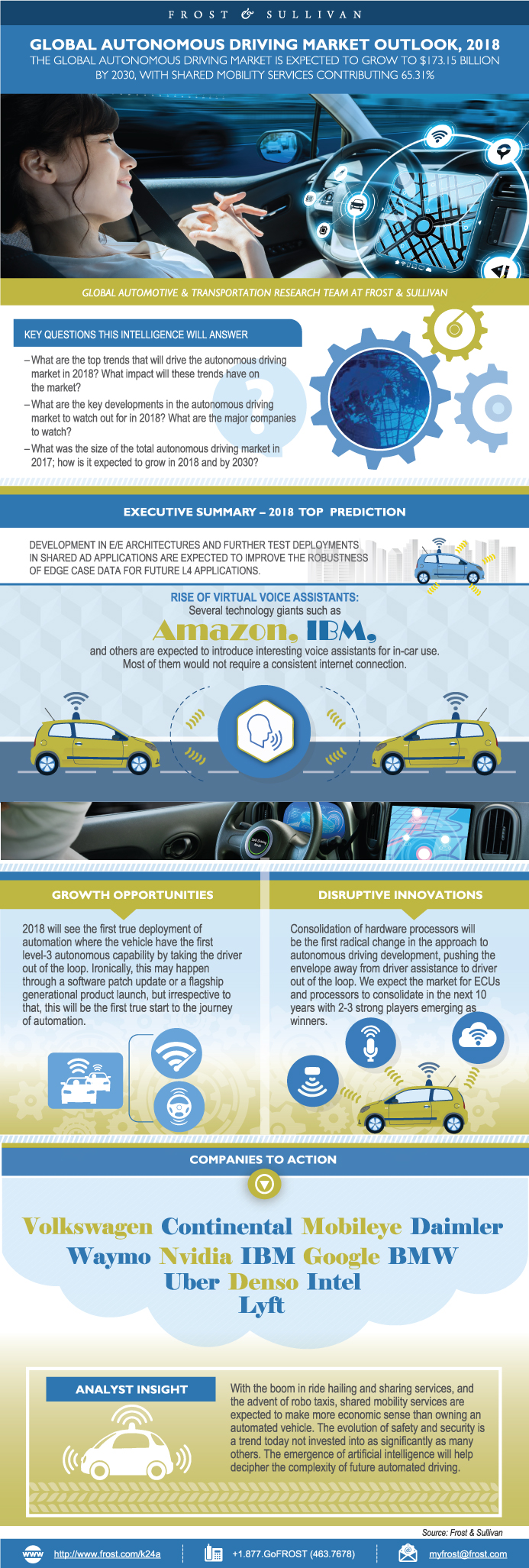

Global Autonomous Driving Market Outlook, 2018

The Global Autonomous Driving Market is Expected Grow up to $173.15 B by 2030, with Shared Mobility Services Contributing to 65.31%

2018 will see the first true deployment of automation where the vehicle will tell the driver with the first level 3 (L3) autonomous capability by taking the driver out of the loop to be introduced next year. Ironically, this may happen through a software patch update or a flagship generational product launch. Regardless of the medium through which ...

$4,950.00

Special Price $3,712.50 save 25 %

-

24 Apr 2017 | North America

North America and Europe Rear View Mirrors Market, 2017

Cockpit Digitization Will Have a Positive Impact on Take Rates for eMirrors in Future

Piloted driving is rapidly being offered by most OEMs for a particular stretch. All major OEMs have a definite plan to launch an automated vehicle by at least 2025, while trying to differentiate themselves by how the automation is delivered to the customer. Automakers face the inevitable shift from today's brand loyalty into more functional and l...

$4,950.00

Special Price $3,712.50 save 25 %

-

07 Nov 2016 | North America

Market Analysis of Premium European OEMs' ADAS and Automated Driving (AD) Strategies

Along with Level 3 and 4 Functions, Shared Mobility Portfolio to Play a Key Role in OEMs’ Future Business Models

While OEMs are racing towards achieving L4 and 5 automation features in their vehicles in developed markets such as NA and Europe, there will be major improvements in the ADAS sensors that will be used to achieve the desired features. Every OEM is working on a strategy that is different from others in terms of the level of automation desired. With ...

$4,950.00

Special Price $3,712.50 save 25 %

-

24 Mar 2016 | North America

Automotive Solution Business Models—Strategic Insights

Taxi eHailing, Public Transport and Shared Mobility Segments Display Potential as Commuter Focus Shifts from Value-for-Money to Value-for-Time Services

With autonomous vehicles soon to be a reality, it is necessary for OEMs, mobility providers, and anyone associated within the mobility value chain to look at different business models in order to be relevant to future times and be a profitable business. The study looks at the impact of autonomous vehicles on different segments within the automotive...

$4,950.00

Special Price $3,712.50 save 25 %

-

17 Mar 2016 | North America

Global Test Sites and Incentive Programs for Automated Cars, Forecast to 2022

Automated Vehicle Technologies Set for Take-Off, Early Wave Testers Include Ford Motor Company, Volvo AB and Big 3 German OEMs in Europe

Major automotive OEMs globally are now incorporating active safety and automated vehicle technologies in their future vehicle line-up to enhance safety and driver comfort. To gauge the suitability of each technology, continuous testing and validation is a must. Based on the supportive legislation, several regions across the globe have been identifi...

$4,950.00

Special Price $3,712.50 save 25 %

-

28 Aug 2015 | North America

LIDAR-based Strategies for Active Safety and Automated Driving from Major OEMs in Europe and North America

Seven of the Top-13 OEMs to Drive 8-fold Growth of LIDAR Revenue Potential by 2021

This study discusses LIDAR as a part of a sensor suite in Advanced Driver Assistance Systems (ADAS) in next-generation automated passenger vehicles. It analyses which type of LIDAR would best enable active safety and automated driving functions, especially as Original Equipment Manufacturers (OEMs) are now accepting LIDAR as integral for partial to...

$3,950.00

Special Price $2,962.50 save 25 %

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB