Energy

The energy and environment industry is undergoing rapid transformation from a static and conventional system to the fluid and dynamic Internet of Energy. Renewables are a significant portion of the world’s energy production, with rapid growth of the last decade spurring advanced solutions in grid technologies and energy storage. Nevertheless, fossil fuels continue to dominate much of the world’s power portfolio, from the adherents and detractors of fracking for oil and gas, to the continued high volume of coal used in key global regions. Services to the industry are rapidly evolving to leverage the influx of information from the Industrial Internet, creating new solutions and business models such as advanced predictive maintenance, optimized generation and storage, innovative energy efficiency solutions and X-as-a-Service. And all of this is driven by the push and pull of increasing demand for cleaner air and water alongside the need for more power and energy.

Frost & Sullivan works closely with the world’s largest OEMs, utilities, service providers and IT firms to help them find the opportunities in this sea of change. Our experts and consultants constantly engage with markets from oil and gas to electricity, grids to homes and buildings, and the critical needs for power, water, and environmental solutions across all sectors of the global economy.

-

17 Apr 2024 | South Asia, Middle East & North Africa

MENA Power and Energy Outlook and Growth Opportunities, 2024

Revenue from High Fossil Fuel Prices Drives Investment in Power Infrastructure

This Frost & Sullivan study assesses the power and energy industry in the Middle East and North Africa (MENA). It broadly classifies MENA countries into 3 groups. The first group comprises most of the Gulf states, which have high levels of investment relative to their population size because the governments can fund power investment from oil and ga...

$4,950.00 -

20 Apr 2023 | South Asia, Middle East & North Africa

Power and Energy in the Middle East Outlook, 2023

The EU Export Opportunity to Drive Power Investments

Russia’s war on Ukraine has unlocked unprecedented growth opportunities for the Middle East as Europe steers away from Russia for energy supply. The European Union’s commitment to end its reliance on Russian energy by 2027 and its focus on renewables and hydrogen offer ME countries a strong business case for energy investments, given that the r...

$4,950.00

Special Price $4,455.00 save 10 %

-

08 Jul 2022 | South Asia, Middle East & North Africa

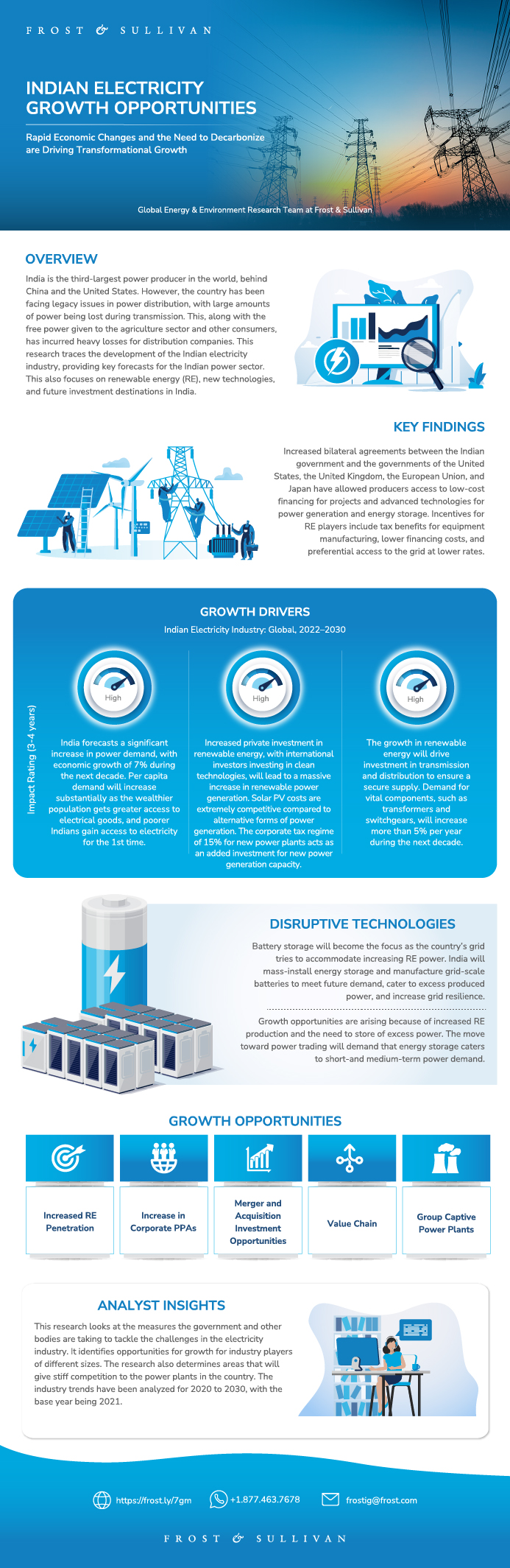

Indian Electricity Growth Opportunities

Rapid Economic Changes and the Need to Decarbonize are Driving Transformational Growth

The study traces the development of the Indian electricity market, providing key forecasts for the Indian power sector. The study focuses on renewable energy (RE), new technologies, and future investment destinations in India. India is the third-largest power producer in the world, behind China and the United States. However, the country has be...

$2,450.00

Special Price $2,082.50 save 15 %

-

11 Apr 2022 | South Asia, Middle East & North Africa

Middle East Power & Energy Outlook, 2022

Strong Growth in Electricity Demand and Supply Security Drive the Industry While Decarbonization and Expanding Markets Propel Power Investments

Globally, the Middle East (ME) is one of the regions most vulnerable to climate change. Nearly every ME country has been subjected to some of the lowest precipitation levels historically, and hotter climatic conditions will lead to a surge in demand for electricity to power regional cooling requirements. In fact, cooling already accounts for 70% of...

$4,950.00

Special Price $3,712.50 save 25 %

-

07 Jan 2022 | South Asia, Middle East & North Africa

Gulf Cooperation Council (GCC) Stationary Lead-acid Battery (LAB) Growth Opportunities

Renewable Energy, Telecoms and Data Centers Key Drivers of Growth

Evolving economic scenarios, innovation, and diversification of energy resources are playing a key role in the development of stationary battery storage technologies globally and also within the Gulf Cooperation Council (GCC). Economic and energy diversification away from oil and gas is a key trend in the GCC that is impacting the adoption and futu...

$2,450.00

Special Price $1,837.50 save 25 %

-

08 Apr 2021 | South Asia, Middle East & North Africa

Transformative Mega Trends in the Indian Solar Inverters Market

Future Growth Potential Enhanced by Rooftop Inverter Opportunities and C&I Segment Contribution

India is a signatory to the Paris climate change agreement, which requires at least 40% of its energy to be from renewable sources by 2030. By 2022, India targets 175GW from renewable sources, out of which it plans to achieve 100GW from solar sources with rooftop solar contributing about 40GW. The Ministry of Renewable Energy has launched a number...

$2,450.00

Special Price $1,837.50 save 25 %

-

05 Apr 2021 | South Asia, Middle East & North Africa

Distributed Energy Rejuvenating the Power Sector in the GCC through Innovation and Efficiency, 2021

Growth will be Spurred by the Region's Drive to Diversify the Energy Mix and Embrace Clean Energy Sources

Globally, the electricity supply industry is undergoing a major transition with the phasing out of conventional power generation technologies, which are being replaced by renewable energies like solar energy and wind energy. In addition to utility-scale power generation, customers are now considering self-generation through distributed renewable so...

$4,950.00

Special Price $3,712.50 save 25 %

-

17 Aug 2020 | South Asia, Middle East & North Africa

Solar PV Dominating Investment Opportunities in Renewable Sector Across the Middle East, 2020–2025

Opportunities Abound for Renewable Companies with Possible RE Capacity Addition of More Than 57.0 GW on the Radar

Sustainable development is the theme gaining unparalleled levels of attention and importance across the globe. The Middle East hosts top oil exporters in the world along with some of the top carbon emitters. The onus to reduce greenhouse gases (GHG) has fallen on the region and, therefore, the countries in the region have ambitious targets to promo...

$4,950.00

Special Price $3,712.50 save 25 %

-

13 Feb 2020 | South Asia, Middle East & North Africa

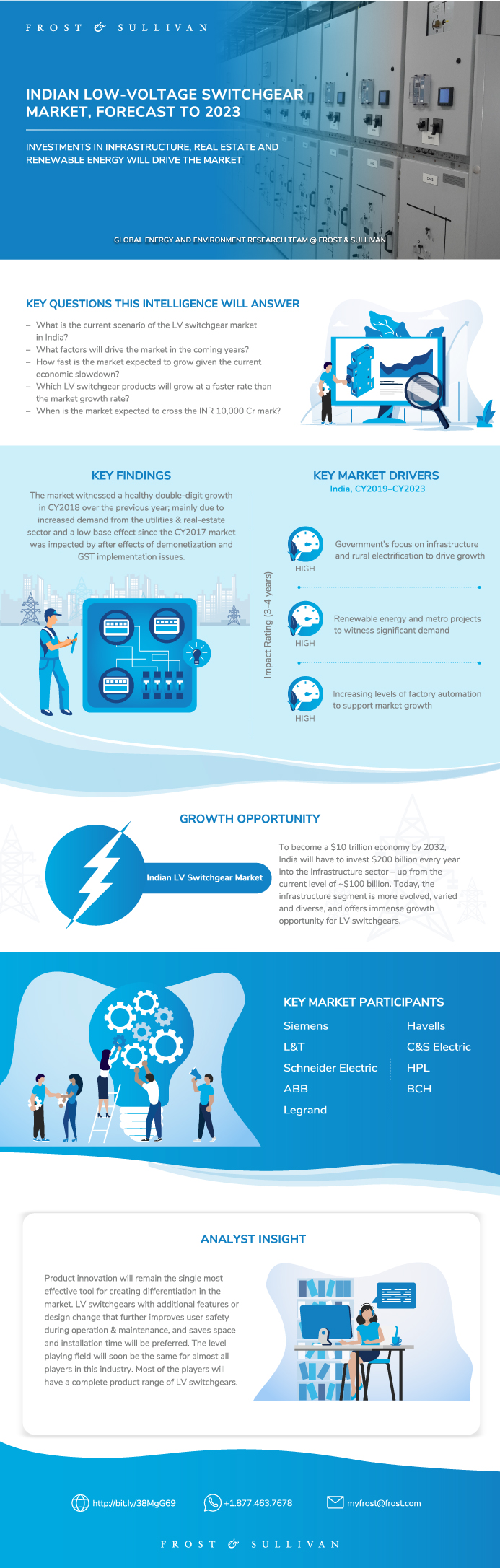

Indian Low-voltage Switchgear Market, Forecast to 2023

Investment into Infrastructure, Real Estate and Renewable Energy to Drive the Market

This research service examines the India Low-voltage (LV) switchgear market, using the calendar year 2018 as a base year, and insights from manufacturers, channel partners, and end users to identify drivers and restraints for the market until 2023. At the overall level, the market is segmented by product, region, end users and competition. The stud...

$4,950.00

Special Price $3,712.50 save 25 %

-

28 Dec 2017 | South Asia, Middle East & North Africa

Indian Low Voltage (LV) Switchgear Market, Forecast to 2021

Growth is Expected to be Fuelled by Investments in the Infrastructure and Renewable Energy Sectors

This research service analyzes the Indian LV switchgear market for the calendar year 2016 and uses insights from manufacturers, channel partners, and end users to identify drivers and restraints for the market for the next 5 years. The study further looks at product-wise segments of the market and their individual performance. Further, it describes...

$4,950.00

Special Price $3,712.50 save 25 %

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB