Analysis of the North American Hosted IP Telephony and UCC Services Market

Analysis of the North American Hosted IP Telephony and UCC Services Market

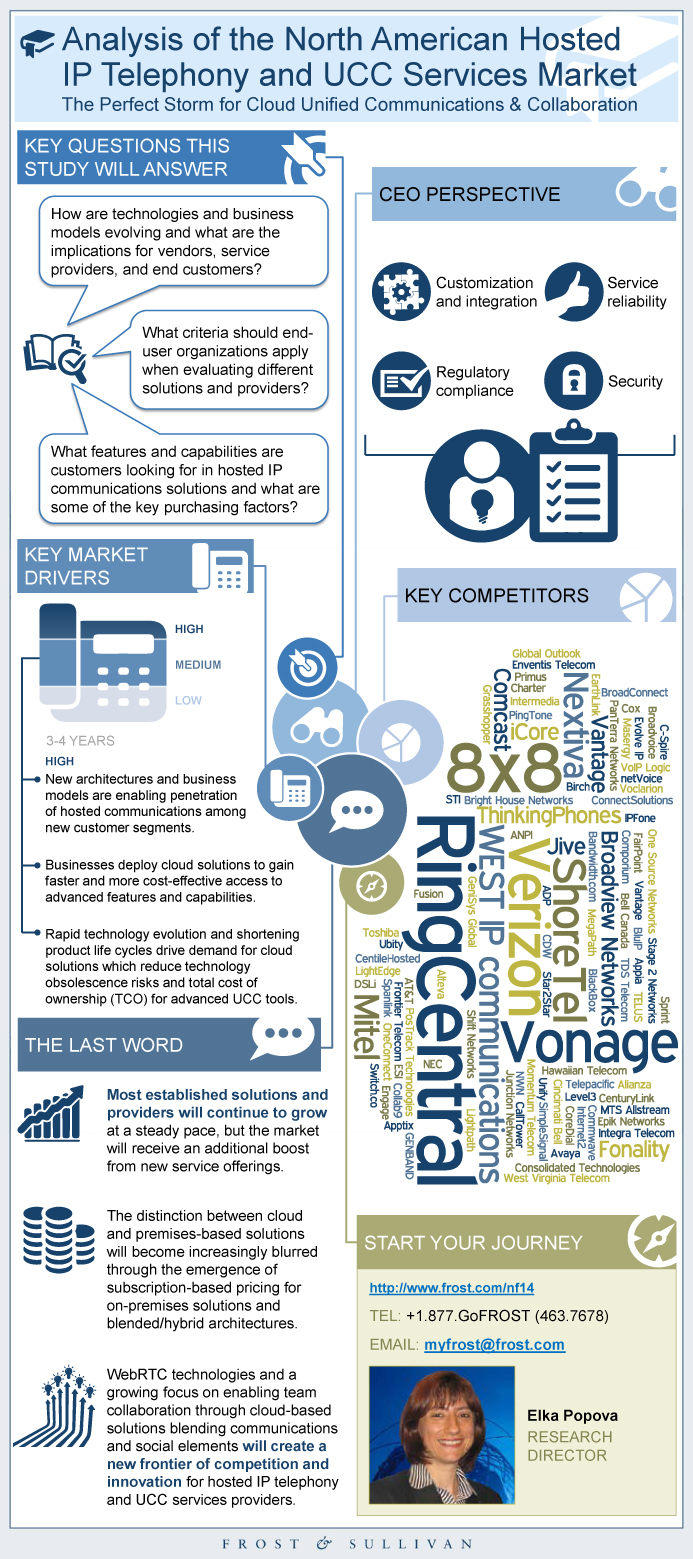

The Perfect Storm for Cloud Unified Communications & Collaboration

13-Jul-2015

North America

Market Research

The North American hosted IP telephony and UCC services market is undergoing major changes as it moves from early-adopter to mass-adoption stage. Increasing customer awareness of cloud communications is driving adoption, yet is also leading to greater scrutiny of service quality and reliability. Heightened customer requirements along with the proliferation of cloud solutions with little differentiation is compelling providers to seek mergers and acquisitions to gain efficiencies, economies of scale, and better compete in the marketplace. In spite of intensifying competition, however, the still-untapped North American cloud communications market continues to present considerable growth opportunities for both existing and new market participants. This study provides market participants with an in-depth analysis of market trends and challenges to help them develop more sustainable growth strategies.

Key Findings

Market Engineering Measurements

- Market Overview

- Competitor Overview

- Total Addressable Market

- Industry Advancement

CEO’s Perspective

Market Definitions and Methodology Overview and Scope

Market Distribution Channels

Channel SWOT

Market Readiness

Hosted IP Telephony and UCC Services Ecosystem

Segmentation by Country

Segmentation by Customer Size

- Total Hosted IP Telephony and UCC Services Market: Porter’s Five Forces, North America, 2014

Segmentation by Type of Access

Total Hosted IP Telephony and UCC Services Market: Key Market Drivers, North America, 2015–2021

Primary Drivers for IT Investments

Major Challenges for IT

Attitudes About the Use of Cloud Computing/Hosted Communications

Satisfaction with Cloud Computing Use, by Company Size

Satisfaction with Cloud Computing Use, by Vertical

Total Hosted IP Telephony and UCC Services Market: Key Market Restraints, North America, 2015–2021

Attitudes About Cloud Computing by Non-users

Installed Users and Revenue Forecast

Pricing Trends and Forecast

Typical Hosted IPT/UC Offerings

Percent Installed Users Forecast by Country

Demand Analysis

Communications Deployment in the Cloud

Current Deployment of IT in the Cloud, by Company Size

Current Deployment of IT in the Cloud, by Vertical

Demand Analysis Discussion

Key Cloud Phone System Features

Demand for Features and Applications by Vertical Industry

Other Key Market Trends

Finding the Best Fit

Competitive Analysis—Market Share

Competitive Environment

Top Competitors

Competitive Factors and Assessment

Criteria When Selecting a Cloud Provider

Criteria When Selecting a Cloud Provider, by Company Size

Criteria When Selecting a Cloud Provider, by Vertical

Criteria for Selecting the Right Hosted Solution and Service Provider

Impact of Communications Industry Mega Trends on the Hosted IP Telephony and UCC Services Market

Mega Trend Impact on the Hosted IP Telephony and UCC Services Market

Predictions

Recommendations to Service Providers

Recommendations to End Customers

Market Engineering Methodology

Market Engineering Measurements

Additional Sources of Information on Hosted IP Telephony and UCC Services

List of Other Service Providers

Partial List of Companies Interviewed

Table of Acronyms Used

List of Exhibits

- 1. UCC Applications

- 2. Total Hosted IP Telephony and UCC Services Market: Distribution Channel Analysis, North America, 2014

- 3. Total Hosted IP Telephony and UCC Services Market: Channel SWOT Analysis, North America, 2014

- 4. The Perfect Storm for Cloud UCC

- 5. Total Hosted IP Telephony and UCC Services Market: Porter’s Five Forces, North America, 2014

- 6. Total Hosted IP Telephony and UCC Services Market: Key Market Drivers, North America, 2015–2021

- 7. Total Hosted IP Telephony and UCC Services Market: Key Market Restraints, North America, 2015–2021

- 8. Typical Hosted IPT/UC Offerings

- 9. Demand Analysis: Key Cloud Phone System Features

- 10. Demand Analysis: Demand for Features and Applications by Vertical Industry

- 11. Total Hosted IP Telephony and UCC Services Market: Competitive Structure, North America, 2014

- 12. Total Hosted IP Telephony and UCC Services Market: SWOT Analysis, North America, 2014

- 13. Total Hosted IP Telephony and UCC Services Market: Competitor Success Factors, North America, 2014

- 14. Criteria for Selecting the Right Hosted Solution and Service Provider

- 15. Total Hosted IP Telephony and UCC Services Market: Mega Trend Impact, North America, 2015–2021

- 16. Market Engineering Methodology

- 17. Total Hosted IP Telephony and UCC Services Market: Market Engineering Measurements, North America, 2014

- 1. Total Hosted IP Telephony and UCC Services Market: Market Engineering Measurements, North America, 2014

- 2. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users by Country, North America, 2014

- 3. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users by Customer Size, North America, 2014

- 4. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users by Type of Access, North America, 2014

- 5. Primary Drivers for IT Investment—Percent of Somewhat/Very Important Responses, North America, 2014

- 6. Ratings of Major Challenges for IT—Percent of Agree/Strongly Agree Responses, North America, 2014

- 7. Attitudes toward Use of Cloud Computing/Hosted Communications—Percent of Agree/Strongly Agree Responses, North America, 2014

- 8. Satisfaction with Cloud Computing Use–by Company Size, North America, 2014

- 9. Satisfaction with Cloud Computing Use–by Vertical, North America, 2014

- 10. Attitudes Toward Cloud Computing by Non-users—Percent of Agree/Strongly Agree Responses, North America, 2014

- 11. Total Hosted IP Telephony and UCC Services Market: Installed Users and Revenue Forecast, North America, 2013–2021

- 12. Total Hosted IP Telephony and UCC Services Market: Average Revenue per User per Month (Without Access), North America, 2013–2021

- 13. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users Forecast by Country, North America, 2014 and 2021

- 14. Total Hosted IP Telephony and UCC Services Market: Penetration Analysis, North America, 2013–2021

- 15. IT Deployment in the Cloud, North America, 2014

- 16. Current Deployment of IT in the Cloud–by Company Size, North America, 2014

- 17. Current Deployment of IT in the Cloud–by Vertical, North America, 2014

- 18. Total Hosted IP Telephony and UCC Services Market: Percent Revenue Breakdown (Without Access), North America, 2014

- 19. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users Breakdown, North America, 2014

- 20. Criteria When Selecting a Cloud Provider—Percent of Important/Very Important, North America, 2014Criteria When Selecting a Cloud Provider—Percent of Important/Very Important, North America, 2014

- 21. Criteria When Selecting a Cloud Provider—Percent of Important/Very Important, North America, 2014

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Market Engineering Measurements~ ||| Market Overview~ ||| Competitor Overview~ ||| Total Addressable Market~ ||| Industry Advancement~ || CEO’s Perspective~ | Market Overview~ || Market Definitions and Methodology Overview and Scope~ || Market Distribution Channels~ || Channel SWOT ~ || Market Readiness~ || Hosted IP Telephony and UCC Services Ecosystem~ ||| Total Hosted IP Telephony and UCC Services Market: Porter’s Five Forces, North America, 2014~ || Segmentation by Country~ || Segmentation by Customer Size~ || Segmentation by Type of Access~ | Drivers and Restraints—Total Hosted IP Telephony and UCC Services Market~ || Total Hosted IP Telephony and UCC Services Market: Key Market Drivers, North America, 2015–2021~ ||| Rapid technology evolution and shortening product life cycles drive demand for cloud solutions which reduce technology obsolescence risks and total cost of ownership (TCO) for advanced UCC tools.~ ||| Growing complexity of communications infrastructure compels SMBs to outsource their communications solutions in order to gain access to superior technology expertise and improve disaster avoidance capabilities.~ ||| Businesses deploy cloud solutions to gain faster and more cost-effective access to advanced features and capabilities and thus improve worker productivity, business agility and customer support.~ ||| Larger distributed organizations choose flexible delivery models in order to consolidate and more economically scale their communications infrastructure and more effectively support mobile and remote workers.~ ||| New architectures and business models are enabling penetration of hosted communications among new customer segments.~ || Primary Drivers for IT Investments~ || Major Challenges for IT~ || Attitudes About the Use of Cloud Computing/Hosted Communications~ || Satisfaction with Cloud Computing Use, by Company Size~ || Satisfaction with Cloud Computing Use, by Vertical~ || Total Hosted IP Telephony and UCC Services Market: Key Market Restraints, North America, 2015–2021~ ||| Businesses with unamortized and still-functional premises-based solutions and no perceived need for new functionality see few economic benefits in an infrastructure upgrade, including a switch to hosted/ cloud communications services.~ ||| New business models in the premises-based UCC space including subscription (OPEX)-based pricing and fully managed solutions entice certain customers to retain or upgrade their existing premises-based investments.~ ||| Security, control, reliability as well as customization and integration concerns often tip the scales in favour of premises based communications deployments.~ ||| Hosted communications market fragmentation with no clear leaders and little provider and service differentiation cause some uncertainty and hesitation among potential customers.~ ||| Consumer services—POTS and VoIP—restrain adoption of business-grade IP telephony services at the very low customer end where price and simplicity trump demand for advanced functionality and customer support.~ || Attitudes About Cloud Computing by Non-users~ | Forecasts and Trends—Total Hosted IP Telephony and UCC Services Market~ || Installed Users and Revenue Forecast~ || Pricing Trends and Forecast~ || Typical Hosted IPT/UC Offerings~ || Percent Installed Users Forecast by Country~ | Demand Analysis—Total Hosted IP Telephony and UCC Services Market~ || Demand Analysis~ || Communications Deployment in the Cloud~ || Current Deployment of IT in the Cloud, by Company Size~ || Current Deployment of IT in the Cloud, by Vertical~ || Demand Analysis Discussion~ ||| Market Penetration~ ||| Demand by Business Size~ ||| Demand by Type of Access~ ||| Demand by Vertical~ ||| Demand by Type of Application~ || Key Cloud Phone System Features~ || Demand for Features and Applications by Vertical Industry~ || Other Key Market Trends~ ||| Equipment Rental~ ||| Desktop Phone Trends~ ||| Hybrid Architectures~ || Finding the Best Fit~ ||| Small Businesses and Small Sites~ ||| Distributed Enterprises/Virtual Organizations~ ||| OPEX-driven Budgets~ | Market Share and Competitive Analysis—Total Hosted IP Telephony and UCC Services Market~ || Competitive Analysis—Market Share~ ||| Total Hosted IP Telephony and UCC Services Market: Percent Revenue Breakdown (Without Access), North America, 2014~ |||| RingCentral~ |||| 8x8~ |||| Vonage (VBS+Telesphere)~ |||| Verizon~ |||| Others~ ||| Total Hosted IP Telephony and UCC Services Market: Pe~ |||| RingCentral~ |||| 8x8~ |||| Verizon~ |||| Vonage (VBS+Telesphere)~ |||| Others~ || Competitive Environment~ || Top Competitors~ ||| 8x8~ ||| Alcatel-Lucent Enterprise~ ||| Alianza~ ||| Alteva (formerly WVT)~ ||| Others~ || Competitive Factors and Assessment~ || Criteria When Selecting a Cloud Provider~ || Criteria When Selecting a Cloud Provider, by Company Size~ || Criteria When Selecting a Cloud Provider, by Vertical~ || Criteria for Selecting the Right Hosted Solution and Service Provider~ | Mega Trends and Industry Convergence Implications~ || Impact of Communications Industry Mega Trends on the Hosted IP Telephony and UCC Services Market~ || Mega Trend Impact on the Hosted IP Telephony and UCC Services Market~ | The Last Word~ || Predictions~ || Recommendations to Service Providers~ || Recommendations to End Customers~ | Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Market Engineering Measurements~ || Additional Sources of Information on Hosted IP Telephony and UCC Services~ || List of Other Service Providers~ || Partial List of Companies Interviewed~ || Table of Acronyms Used~ || List of Exhibits~ |

| List of Charts and Figures | 1. UCC Applications~ 2. Total Hosted IP Telephony and UCC Services Market: Distribution Channel Analysis, North America, 2014~ 3. Total Hosted IP Telephony and UCC Services Market: Channel SWOT Analysis, North America, 2014~ 4. The Perfect Storm for Cloud UCC~ 5. Total Hosted IP Telephony and UCC Services Market: Porter’s Five Forces, North America, 2014~ 6. Total Hosted IP Telephony and UCC Services Market: Key Market Drivers, North America, 2015–2021~ 7. Total Hosted IP Telephony and UCC Services Market: Key Market Restraints, North America, 2015–2021~ 8. Typical Hosted IPT/UC Offerings~ 9. Demand Analysis: Key Cloud Phone System Features~ 10. Demand Analysis: Demand for Features and Applications by Vertical Industry~ 11. Total Hosted IP Telephony and UCC Services Market: Competitive Structure, North America, 2014~ 12. Total Hosted IP Telephony and UCC Services Market: SWOT Analysis, North America, 2014~ 13. Total Hosted IP Telephony and UCC Services Market: Competitor Success Factors, North America, 2014~ 14. Criteria for Selecting the Right Hosted Solution and Service Provider~ 15. Total Hosted IP Telephony and UCC Services Market: Mega Trend Impact, North America, 2015–2021~ 16. Market Engineering Methodology~ 17. Total Hosted IP Telephony and UCC Services Market: Market Engineering Measurements, North America, 2014~| 1. Total Hosted IP Telephony and UCC Services Market: Market Engineering Measurements, North America, 2014~ 2. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users by Country, North America, 2014~ 3. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users by Customer Size, North America, 2014~ 4. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users by Type of Access, North America, 2014~ 5. Primary Drivers for IT Investment—Percent of Somewhat/Very Important Responses, North America, 2014~ 6. Ratings of Major Challenges for IT—Percent of Agree/Strongly Agree Responses, North America, 2014~ 7. Attitudes toward Use of Cloud Computing/Hosted Communications—Percent of Agree/Strongly Agree Responses, North America, 2014~ 8. Satisfaction with Cloud Computing Use–by Company Size, North America, 2014~ 9. Satisfaction with Cloud Computing Use–by Vertical, North America, 2014~ 10. Attitudes Toward Cloud Computing by Non-users—Percent of Agree/Strongly Agree Responses, North America, 2014~ 11. Total Hosted IP Telephony and UCC Services Market: Installed Users and Revenue Forecast, North America, 2013–2021~ 12. Total Hosted IP Telephony and UCC Services Market: Average Revenue per User per Month (Without Access), North America, 2013–2021~ 13. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users Forecast by Country, North America, 2014 and 2021~ 14. Total Hosted IP Telephony and UCC Services Market: Penetration Analysis, North America, 2013–2021~ 15. IT Deployment in the Cloud, North America, 2014~ 16. Current Deployment of IT in the Cloud–by Company Size, North America, 2014~ 17. Current Deployment of IT in the Cloud–by Vertical, North America, 2014~ 18. Total Hosted IP Telephony and UCC Services Market: Percent Revenue Breakdown (Without Access), North America, 2014~ 19. Total Hosted IP Telephony and UCC Services Market: Percent Installed Users Breakdown, North America, 2014~ 20. Criteria When Selecting a Cloud Provider—Percent of Important/Very Important, North America, 2014Criteria When Selecting a Cloud Provider—Percent of Important/Very Important, North America, 2014~ 21. Criteria When Selecting a Cloud Provider—Percent of Important/Very Important, North America, 2014~ |

| Author | Elka Popova |

| Industries | Telecom |

| WIP Number | NF14-01-00-00-00 |

| Is Prebook | No |