Analysis of the North American UCaaS Market, Forecast to 2028

Analysis of the North American UCaaS Market, Forecast to 2028

What Does it Take to Capitalize on the Robust Growth Trajectory?

22-Jul-2022

North America

$4,950.00

Special Price $4,207.50 save 15 %

Description

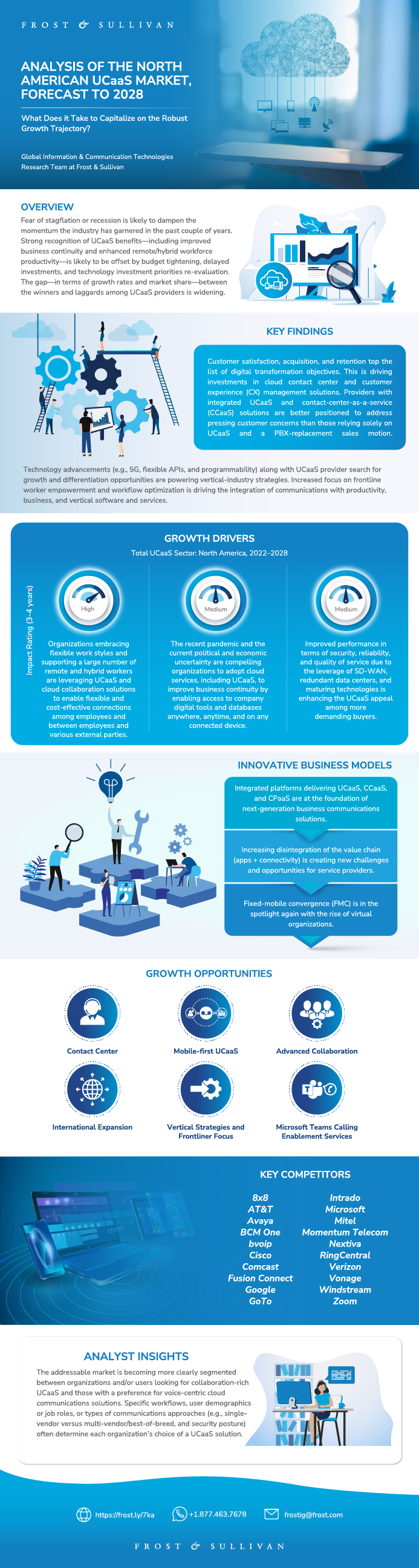

Fear of stagflation or recession is likely to dampen the momentum the industry has garnered in the past couple of years. Strong recognition of UCaaS benefits—including improved business continuity and enhanced remote/hybrid workforce productivity—is likely to be offset by budget tightening, delayed investments, and technology investment priorities re-evaluation.

The gap—in terms of growth rates and market share—between the winners and laggards among UCaaS providers is widening. This is compelling market participants to urgently seek greater differentiation and identify new growth opportunities. Providers with broader solutions portfolios (e.g., broadband, mobile services, SD WAN, and managed security) and those offering freemium and/or mobile-ready cloud collaboration services are likely to see pull-through on UCaaS sales.

The addressable market is becoming more clearly segmented between organizations and/or users looking for collaboration-rich UCaaS and those with a preference for voice-centric cloud communications solutions. Specific workflows, user demographics or job roles, or types of communications approaches (e.g., single-vendor versus multi-vendor/best-of-breed, and security posture) often determine each organization’s choice of a UCaaS solution.

This market analysis provides valuable insights on UCaaS market growth drivers and restraints, competitive factors and growth opportunities. It can be leveraged by market participants to develop sustainable growth strategies.

Author: Elka Popova

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the North American UCaaS Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Scope of Analysis

Scope and Market Definitions

Scope and Market Definitions (continued)

Scope and Market Definitions (continued)

Scope and Market Definitions (continued)

Scope and Market Definitions (continued)

Scope and Market Definitions (continued)

Key Findings

Key Growth Metrics

Distribution Channels

Growth Drivers

Growth Driver Analysis

Growth Driver Analysis (continued)

Growth Restraints

Growth Restraint Analysis

Organization Likely to Decrease Share of Workforce Using PBX, PSTN and Both by 2025

Forecast Assumptions

Organizations’ Cloud Migration Plans

Enterprise Telephony/Business Call-control Environment Trends

Revenue and Installed Seats/Users Forecast

Net New Seats/Users Forecast

UCaaS Penetration of the Addressable Market

Installed Seats/Users Forecast by Country

Unit and Revenue Forecast Analysis

Market Analysis by Country

Market Analysis by Industry Vertical

Market Analysis by Industry Vertical (continued)

Percent Installed Seats/Users by Customer Size, 2021

Desktop and Mobile Access to UCaaS Functionality, 2021

Percent Installed Users by Type of Access, 2021

Pricing Trends and Forecast Analysis

Pricing Trends and Forecast, Total UCaaS Market

Monthly Average Cloud PBX/UCAAS Price Trends

Preferred Cloud PBX/UCaaS Packaging

Preferred Way to Purchase Calling Plans for Cloud PBX/UCaaS

Competitive Environment

Important PBX Features in Cloud PBX Solution/Provider Selection

Important Capabilities in Cloud Communications Provider Selection

Importance of a Fully Integrated UCaaS Solution

Importance of Purchasing Tangential Capabilities from the Same Provider

Installed Seats/Users Share by Service Provider Brand

Revenue Market Share by Service Provider Brand

UCaaS Platform Vendor Market Share by Installed Seats/Users

Selected Competitor Analysis

Selected Competitor Analysis (continued)

Selected Competitor Analysis (continued)

Competitive Trends

Competitive Trends (continued)

Important Aspects in Cloud PBX/UCaaS Provider Selection

Intent to Switch Cloud PBX/UCaaS Provider Upon Current Contract Expiration

Top 3 Reasons for Replacing Cloud PBX/UCaaS Provider

Growth Opportunity 1—Contact Center

Growth Opportunity 1—Contact Center (continued)

Growth Opportunity 2—Mobile-first UCaaS

Growth Opportunity 2—Mobile-first UCaaS (continued)

Growth Opportunity 3—Advanced Collaboration

Growth Opportunity 3—Advanced Collaboration (continued)

Growth Opportunity 4—International Expansion

Growth Opportunity 4—International Expansion (continued)

Growth Opportunity 5—Vertical Strategies and Frontliner Focus

Growth Opportunity 5—Vertical Strategies and Frontliner Focus (continued)

Growth Opportunity 6—Microsoft Teams Calling Enablement Services

Growth Opportunity 6—Microsoft Teams Calling Enablement Services (continued)

Survey Study Objectives

Evolution of the Cloud Communications Market Survey: Research Methodology

IT/Telecom Decision Maker Investment Priorities Survey: Research Methodology

Providers Included in “Other”

Platforms Included in “Other”

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| Author | Elka Popova |

|---|---|

| Industries | Telecom |

| No Index | No |

| Is Prebook | No |

| Podcast | No |

| WIP Number | K745-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB