Analysis of the US Breast Imaging Systems Market

Analysis of the US Breast Imaging Systems Market

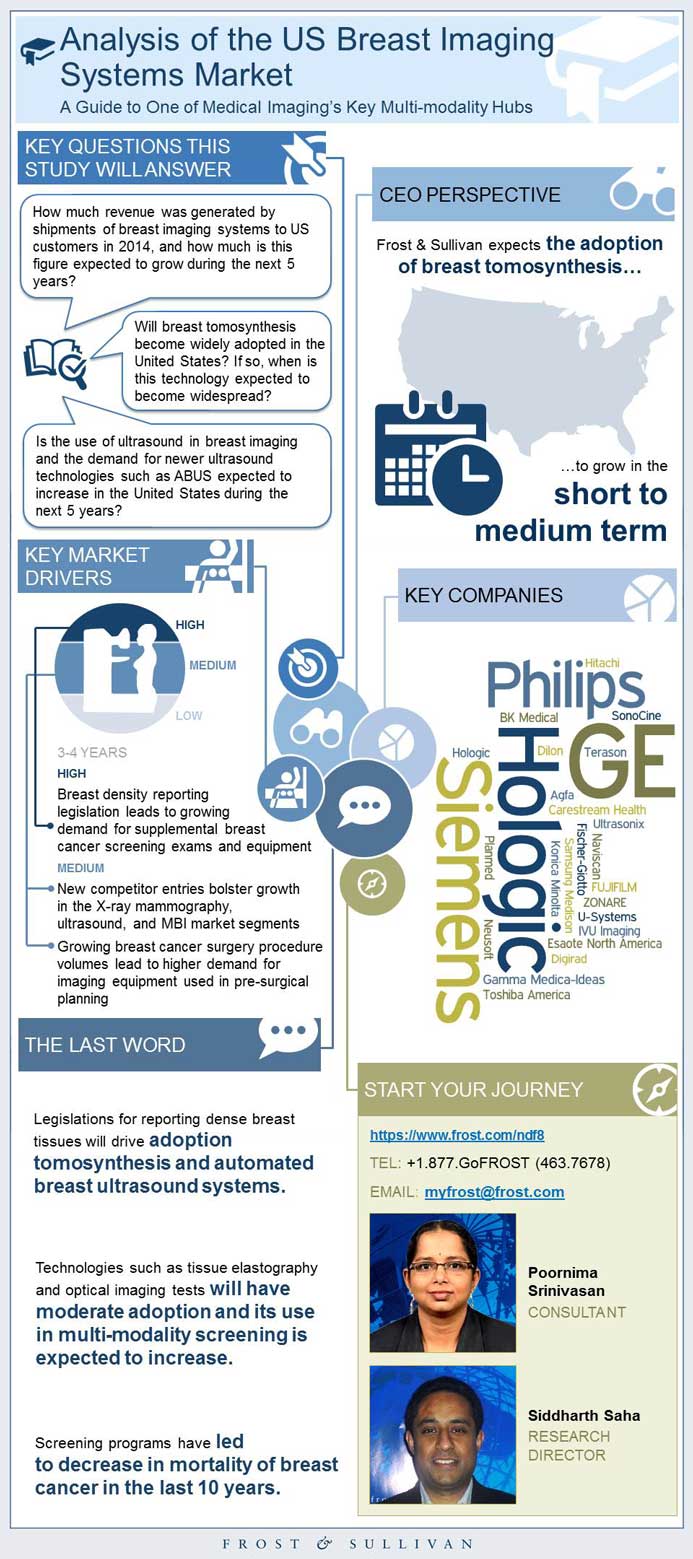

A Guide to One of Medical Imaging’s Key Multi-modality Hubs

RELEASE DATE

05-Nov-2015

05-Nov-2015

REGION

North America

North America

Research Code: NDF8-01-00-00-00

SKU: MX00011-NA-MR_17146

$4,950.00

Special Price $3,712.50 save 25 %

In stock

SKU

MX00011-NA-MR_17146

Description

This research service presents an analysis of the breast imaging systems market in the United States. It provides an in-depth analysis of the current trends, market size, revenue forecast, drivers and restraints, market penetration, and market attractiveness. Segments that are covered include X-ray mammography (with analog, digital radiography, computed radiography, and digital breast tomosynthesis), ultrasound (including automated breast ultrasound), breast MRI, and molecular breast imaging. Market participants were interviewed to obtain their perceptions of breast imaging systems and trends.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Total Breast Imaging Systems Market: Market Engineering Measurements, United States, 2014

- Breast Ultrasound Segment

- Breast MRI Segment

- Molecular Breast Imaging Segment

CEO”s Perspective

Key Companies to Watch

3 Big Predictions

Scope of Market Covered

Definitions of Metrics Evaluated

Market Segmentation

The Case for Breast Imaging

Breast Care in the United States

Breast Imaging Technology Trends

Breast Imaging Technology Trends Explained

Market Drivers

Market Restraints

Market Engineering Measurements by Segment

Unit Shipment Forecast by Segment

Percent Unit Shipment Forecast by Segment

Revenue Forecast

Percent Revenue Forecast by Segment

Market Penetration Analysis by Segment

Market Penetration Analysis Explained

Competitive Analysis—Market Share

Market Share Analysis

Competitive Environment

Top Competitors

Competitive Factors and Assessment

Segment Background

Segment Perspective—Global

Technology Background and Trends

Market Engineering Measurements

Unit Shipment Forecast

Unit Shipment Forecast by Technology

Percent Unit Shipment Forecast by Technology

Pricing Trends and Forecast by Technology

Revenue Forecast

Revenue Forecast by Technology

Competitive Analysis—Segment Share

Segment Share Analysis

Competitor Product List

Segment Background

Technology Background and Trends

Market Engineering Measurements

Unit Shipment Forecast

Pricing Trends and Forecast

Revenue Forecast

Competitive Analysis—Segment Share

Segment Share Analysis

Competitor Product List of ABUS

Segment Background

Technology Background and Trends

Market Engineering Measurements

Unit Shipment Forecast

Pricing Trends and Forecast

Revenue Forecast

Competitive Analysis—Segment Share

Market Share Analysis

Segment Background

Technology Background and Trends

Market Engineering Measurements

Unit Shipment Forecast

Pricing Trends and Forecast

Revenue Forecast

Competitive Analysis—Segment Share

Segment Share Analysis

Competitor Product List

3 Big Predictions

The Last Word – Discussion

Legal Disclaimer

Market Engineering Methodology

Market Competitors by Segment

Table of Abbreviations Used

- 1. The American College of Radiology’s Breast Imaging Reporting and Database System (BI-RADS), United States, 2014

- 2. Total Breast Imaging Systems Market: Key Market Drivers, United States, 2015–2019

- 3. Total Breast Imaging Systems Market: Key Market Restraint, United States, 2015–2019

- 4. Total Breast Imaging Systems Market: Market Engineering Measurements, United States, 2014

- 5. Total Breast Imaging Systems Market: Company Market Share Analysis of Top 4 Competitors, United States, 2014

- 6. Total Breast Imaging Systems Market: Top Competitor SWOT Analysis, United States, 2014

- 7. X-ray Mammography Imaging Systems Segment: Market Engineering Measurements, United States, 2014

- 8. X-ray Mammography Imaging Systems Segment**: Company Segment Share Analysis for Top 4 Participants, United States, 2014

- 9. X-ray Mammography Imaging Systems Segment: Competitor Product List, United States, 2014–2015

- 10. Breast Ultrasound Imaging Systems Segment: Market Engineering Measurements, United States, 2014

- 11. Breast Ultrasound Imaging Systems Segment: Company Segment Revenue of Top 5 Competitors, United States, 2014

- 12. Breast Ultrasound Imaging Systems Segment: Competitor Product List of ABUS, United States, 2014–2015

- 13. Breast MRI Systems Segment: Market Engineering Measurements, United States, 2014

- 14. Breast MRI Systems Segment: Company Segment Share Analysis of Top 5 Competitors, United States, 2014

- 15. Molecular Breast Imaging Systems Segment: Market Engineering Measurements, United States, 2014

- 16. Molecular Breast Imaging Systems Segment: Competitor Product List, United States, 2014–2015

- 17. Breast Imaging Systems Market: Market Participation of Competitors by Segment, United States, 2013–2014

- 1. Total Breast Imaging Systems Market: Market Engineering Measurements, United States, 2014

- 2. Market Engineering Measurements—X-ray Mammography Segment

- 3. Market Engineering Measurements—Breast Ultrasound Segment

- 4. Market Engineering Measurements—Breast MRI Segment

- 5. Market Engineering Measurements—Molecular Breast Imaging Segment

- 6. Total Breast Imaging Systems Market: Market Segmentation, United States, 2014

- 7. Total Breast Imaging Systems Market: Revenue Breakdown by Modality, United States, 2014 and 2019

- 8. Total Breast Imaging Systems Market: Key Technology Trends, United States, 2015–2019

- 9. Total Breast Imaging Systems Market: Breast Cancer Procedural Volumes, United States, 2006–2013

- 10. Total Breast Imaging Systems Market: Proportional Breast Cancer Surgery Procedure Volumes by Clinical Setting, United States, 2004–2013

- 11. Total Breast Imaging Systems Market: Breast Cancer Incidence and Mortality Rates in Females, United States, 1996–2013

- 12. Total Breast Imaging Systems Market: Breast Cancer Percent of New Cases by Age, United States, 2008–2012

- 13. Total Breast Imaging Systems Market: Number of MQSA-certified facilities and Accredited X-ray Mammography Units, United States, 2005–2014

- 14. Total Breast Imaging Systems Market: Breast Cancer Screening Rates in Women by Age, United States, 1990–2013

- 15. Total Breast Imaging Systems Market: Unit Shipment Forecast by Segment, United States, 2012–2019

- 16. Total Breast Imaging Systems Market: Percent Unit Shipment Forecast by Segment, United States, 2012–2019

- 17. Total Breast Imaging Systems Market: Revenue Forecast, United States, 2012–2019

- 18. Total Breast Imaging Systems Market: Percent Revenue Forecast by Segment, United States, 2012–2019

- 19. Total Breast Imaging Systems Market: Market Penetration Rates* by Segment, United States, 2014

- 20. Total Breast Imaging Systems Market: Percent Revenue Breakdown, United States, 2014

- 21. X-ray Mammography Imaging Systems Segment: Annual Procedure Volumes, United States, 2006–2014

- 22. X-ray Mammography Imaging Systems Segment: Penetration of Digital Mammography, United States, 2007–2014

- 23. X-ray Mammography Imaging Systems Segment: Percent Revenue by Geographic Region, Global, 2013–2014

- 24. X-ray Mammography Imaging Systems Segment: Unit Shipment Forecast by Technology, United States, 2012–2019

- 25. X-ray Mammography Imaging Systems Segment: Percent Unit Shipment Forecast by Technology, United States, 2012–2019

- 26. X-ray Mammography Imaging Systems Segment: Unit Price Forecast by Technology, United States, 2012–2019

- 27. X-ray Mammography Imaging Systems Segment: Revenue Forecast, United States, 2012–2019

- 28. X-ray Mammography Imaging Systems Segment: Revenue Forecast by Technology, United States, 2012–2019

- 29. X-ray Mammography Imaging Systems Segment**: Percent Revenue Breakdown, United States, 2014

- 30. X-ray Mammography Imaging Systems Segment: Percent Revenue Breakdown for DBT Technology, United States, 2014

- 31. Breast Ultrasound Imaging Systems Segment: Revenue Breakdown by Intended Use, United States, 2014

- 32. Breast Ultrasound Imaging Systems Segment: Unit Shipment Forecast, United States, 2012–2019

- 33. Breast Ultrasound Imaging Systems Segment: Unit Price* Forecast, United States, 2012–2019

- 34. Breast Ultrasound Imaging Systems Segment: Revenue Forecast, United States, 2012–2019

- 35. Breast Ultrasound Imaging Systems Segment: Percent Revenue Breakdown, United States, 2014

- 36. Breast MRI Systems Segment: Revenue Breakdown by Intended Use, United States, 2014

- 37. Breast MRI Systems Segment: Procedure Volumes, United States, 2002–2012

- 38. Breast MRI Systems Segment: Unit Shipment Forecast, United States, 2012–2019

- 39. Breast MRI Systems Segment: Unit Price* Forecast, United States, 2012–2019

- 40. Breast MRI Systems Segment: Revenue Forecast, United States, 2012–2019

- 41. Breast MRI Systems Segment: Percent Revenue Breakdown, United States, 2014

- 42. Molecular Breast Imaging Systems Segment: Installed Base Breakdown by Technology, United States, 2014

- 43. Molecular Breast Imaging Systems Segment: Unit Shipment Forecast, United States, 2012–2019

- 44. Molecular Breast Imaging Systems Segment: Unit Price* Forecast, United States, 2012–2019

- 45. Molecular Breast Imaging Systems Segment: Unit Price* by Technology, United States, 2014

- 46. Molecular Breast Imaging Systems Segment: Revenue Forecast, United States, 2012–2019

- 47. Molecular Breast Imaging Systems Segment: Percent Revenue Breakdown, United States, 2014

Popular Topics

This research service presents an analysis of the breast imaging systems market in the United States. It provides an in-depth analysis of the current trends, market size, revenue forecast, drivers and restraints, market penetration, and market attractiveness. Segments that are covered include X-ray mammography (with analog, digital radiography, computed radiography, and digital breast tomosynthesis), ultrasound (including automated breast ultrasound), breast MRI, and molecular breast imaging. Market participants were interviewed to obtain their perceptions of breast imaging systems and trends.

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Total Breast Imaging Systems Market: Market Engineering Measurements, United States, 2014~ ||| Breast Ultrasound Segment~ ||| Breast MRI Segment~ ||| Molecular Breast Imaging Segment~ || CEO”s Perspective~ || Key Companies to Watch~ || 3 Big Predictions~ | Market Overview~ || Scope of Market Covered~ || Definitions of Metrics Evaluated~ || Market Segmentation~ | Introduction to the US Breast Imaging Systems Market~ || The Case for Breast Imaging~ || Breast Care in the United States~ | Technology Trends—Total Breast Imaging Systems Market~ || Breast Imaging Technology Trends~ || Breast Imaging Technology Trends Explained~ | Drivers and Restraints—Total Breast Imaging Systems Market~ || Market Drivers~ ||| Breast Density Reporting Legislation Leads to Growing Demand for Supplemental Breast Cancer Screening Exams and Equipment~ ||| Breast Density Reporting Legislation Leads to Growing Demand for Supplemental Breast Cancer Screening Exams and Equipment~ ||| New Competitor Entries Bolster Growth in the X-ray Mammography, Ultrasound, and MBI Market Segments~ ||| New Competitor Entries Bolster Growth in the X-ray Mammography, Ultrasound, and MBI Market Segments~ ||| Growing Breast Cancer Surgery Procedure Volumes Lead to Higher Demand for Imaging Equipment Used in Pre-surgical Planning~ ||| Others~ || Market Restraints~ ||| Controversy and Conflicting Recommendations on Mammography Screening Compromise National Breast Cancer Screening Rates~ ||| False Positives in ABUS Raises Concern on Diagnostic Efficacy~ | Forecast and Trends—Total Breast Imaging Systems Market~ || Market Engineering Measurements by Segment~ || Unit Shipment Forecast by Segment~ || Percent Unit Shipment Forecast by Segment~ || Revenue Forecast~ || Percent Revenue Forecast by Segment~ | Demand Analysis—Total Breast Imaging Systems Market~ || Market Penetration Analysis by Segment~ || Market Penetration Analysis Explained~ | Market Share and Competitive Analysis— Total Breast Imaging Systems Market~ || Competitive Analysis—Market Share~ || Market Share Analysis~ || Competitive Environment~ || Top Competitors~ || Competitive Factors and Assessment~ | Analysis of the X-ray Mammography Segment~ || Segment Background~ || Segment Perspective—Global~ || Technology Background and Trends~ || Market Engineering Measurements~ || Unit Shipment Forecast~ || Unit Shipment Forecast by Technology~ || Percent Unit Shipment Forecast by Technology~ || Pricing Trends and Forecast by Technology~ || Revenue Forecast~ || Revenue Forecast by Technology~ || Competitive Analysis—Segment Share~ || Segment Share Analysis~ || Competitor Product List~ | Analysis of the Breast Ultrasound Segment~ || Segment Background~ || Technology Background and Trends~ || Market Engineering Measurements~ || Unit Shipment Forecast~ || Pricing Trends and Forecast~ || Revenue Forecast~ || Competitive Analysis—Segment Share~ || Segment Share Analysis~ || Competitor Product List of ABUS~ | Analysis of the Breast MRI Segment~ || Segment Background~ || Technology Background and Trends~ || Market Engineering Measurements~ || Unit Shipment Forecast~ || Pricing Trends and Forecast~ || Revenue Forecast~ || Competitive Analysis—Segment Share~ || Market Share Analysis~ | Analysis of the MBI Segment~ || Segment Background~ || Technology Background and Trends~ || Market Engineering Measurements~ || Unit Shipment Forecast~ || Pricing Trends and Forecast~ || Revenue Forecast~ || Competitive Analysis—Segment Share~ || Segment Share Analysis~ || Competitor Product List~ | The Last Word~ || 3 Big Predictions~ || The Last Word – Discussion~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Market Competitors by Segment~ || Table of Abbreviations Used~ |

| List of Charts and Figures | 1. The American College of Radiology’s Breast Imaging Reporting and Database System (BI-RADS), United States, 2014~ 2. Total Breast Imaging Systems Market: Key Market Drivers, United States, 2015–2019~ 3. Total Breast Imaging Systems Market: Key Market Restraint, United States, 2015–2019~ 4. Total Breast Imaging Systems Market: Market Engineering Measurements, United States, 2014~ 5. Total Breast Imaging Systems Market: Company Market Share Analysis of Top 4 Competitors, United States, 2014~ 6. Total Breast Imaging Systems Market: Top Competitor SWOT Analysis, United States, 2014~ 7. X-ray Mammography Imaging Systems Segment: Market Engineering Measurements, United States, 2014~ 8. X-ray Mammography Imaging Systems Segment**: Company Segment Share Analysis for Top 4 Participants, United States, 2014~ 9. X-ray Mammography Imaging Systems Segment: Competitor Product List, United States, 2014–2015~ 10. Breast Ultrasound Imaging Systems Segment: Market Engineering Measurements, United States, 2014~ 11. Breast Ultrasound Imaging Systems Segment: Company Segment Revenue of Top 5 Competitors, United States, 2014~ 12. Breast Ultrasound Imaging Systems Segment: Competitor Product List of ABUS, United States, 2014–2015~ 13. Breast MRI Systems Segment: Market Engineering Measurements, United States, 2014~ 14. Breast MRI Systems Segment: Company Segment Share Analysis of Top 5 Competitors, United States, 2014~ 15. Molecular Breast Imaging Systems Segment: Market Engineering Measurements, United States, 2014~ 16. Molecular Breast Imaging Systems Segment: Competitor Product List, United States, 2014–2015~ 17. Breast Imaging Systems Market: Market Participation of Competitors by Segment, United States, 2013–2014~| 1. Total Breast Imaging Systems Market: Market Engineering Measurements, United States, 2014~ 2. Market Engineering Measurements—X-ray Mammography Segment~ 3. Market Engineering Measurements—Breast Ultrasound Segment~ 4. Market Engineering Measurements—Breast MRI Segment~ 5. Market Engineering Measurements—Molecular Breast Imaging Segment~ 6. Total Breast Imaging Systems Market: Market Segmentation, United States, 2014~ 7. Total Breast Imaging Systems Market: Revenue Breakdown by Modality, United States, 2014 and 2019~ 8. Total Breast Imaging Systems Market: Key Technology Trends, United States, 2015–2019~ 9. Total Breast Imaging Systems Market: Breast Cancer Procedural Volumes, United States, 2006–2013~ 10. Total Breast Imaging Systems Market: Proportional Breast Cancer Surgery Procedure Volumes by Clinical Setting, United States, 2004–2013~ 11. Total Breast Imaging Systems Market: Breast Cancer Incidence and Mortality Rates in Females, United States, 1996–2013~ 12. Total Breast Imaging Systems Market: Breast Cancer Percent of New Cases by Age, United States, 2008–2012~ 13. Total Breast Imaging Systems Market: Number of MQSA-certified facilities and Accredited X-ray Mammography Units, United States, 2005–2014~ 14. Total Breast Imaging Systems Market: Breast Cancer Screening Rates in Women by Age, United States, 1990–2013~ 15. Total Breast Imaging Systems Market: Unit Shipment Forecast by Segment, United States, 2012–2019~ 16. Total Breast Imaging Systems Market: Percent Unit Shipment Forecast by Segment, United States, 2012–2019~ 17. Total Breast Imaging Systems Market: Revenue Forecast, United States, 2012–2019~ 18. Total Breast Imaging Systems Market: Percent Revenue Forecast by Segment, United States, 2012–2019~ 19. Total Breast Imaging Systems Market: Market Penetration Rates* by Segment, United States, 2014~ 20. Total Breast Imaging Systems Market: Percent Revenue Breakdown, United States, 2014~ 21. X-ray Mammography Imaging Systems Segment: Annual Procedure Volumes, United States, 2006–2014~ 22. X-ray Mammography Imaging Systems Segment: Penetration of Digital Mammography, United States, 2007–2014~ 23. X-ray Mammography Imaging Systems Segment: Percent Revenue by Geographic Region, Global, 2013–2014~ 24. X-ray Mammography Imaging Systems Segment: Unit Shipment Forecast by Technology, United States, 2012–2019~ 25. X-ray Mammography Imaging Systems Segment: Percent Unit Shipment Forecast by Technology, United States, 2012–2019~ 26. X-ray Mammography Imaging Systems Segment: Unit Price Forecast by Technology, United States, 2012–2019~ 27. X-ray Mammography Imaging Systems Segment: Revenue Forecast, United States, 2012–2019~ 28. X-ray Mammography Imaging Systems Segment: Revenue Forecast by Technology, United States, 2012–2019~ 29. X-ray Mammography Imaging Systems Segment**: Percent Revenue Breakdown, United States, 2014~ 30. X-ray Mammography Imaging Systems Segment: Percent Revenue Breakdown for DBT Technology, United States, 2014~ 31. Breast Ultrasound Imaging Systems Segment: Revenue Breakdown by Intended Use, United States, 2014~ 32. Breast Ultrasound Imaging Systems Segment: Unit Shipment Forecast, United States, 2012–2019~ 33. Breast Ultrasound Imaging Systems Segment: Unit Price* Forecast, United States, 2012–2019~ 34. Breast Ultrasound Imaging Systems Segment: Revenue Forecast, United States, 2012–2019~ 35. Breast Ultrasound Imaging Systems Segment: Percent Revenue Breakdown, United States, 2014~ 36. Breast MRI Systems Segment: Revenue Breakdown by Intended Use, United States, 2014~ 37. Breast MRI Systems Segment: Procedure Volumes, United States, 2002–2012~ 38. Breast MRI Systems Segment: Unit Shipment Forecast, United States, 2012–2019~ 39. Breast MRI Systems Segment: Unit Price* Forecast, United States, 2012–2019~ 40. Breast MRI Systems Segment: Revenue Forecast, United States, 2012–2019~ 41. Breast MRI Systems Segment: Percent Revenue Breakdown, United States, 2014~ 42. Molecular Breast Imaging Systems Segment: Installed Base Breakdown by Technology, United States, 2014~ 43. Molecular Breast Imaging Systems Segment: Unit Shipment Forecast, United States, 2012–2019~ 44. Molecular Breast Imaging Systems Segment: Unit Price* Forecast, United States, 2012–2019~ 45. Molecular Breast Imaging Systems Segment: Unit Price* by Technology, United States, 2014~ 46. Molecular Breast Imaging Systems Segment: Revenue Forecast, United States, 2012–2019~ 47. Molecular Breast Imaging Systems Segment: Percent Revenue Breakdown, United States, 2014~ |

| Author | Poornima Srinivasan |

| Industries | Healthcare |

| WIP Number | NDF8-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB