APAC Automation and Control Systems Market in the Upstream Oil and Gas Industry, Forecast to 2023

APAC Automation and Control Systems Market in the Upstream Oil and Gas Industry, Forecast to 2023

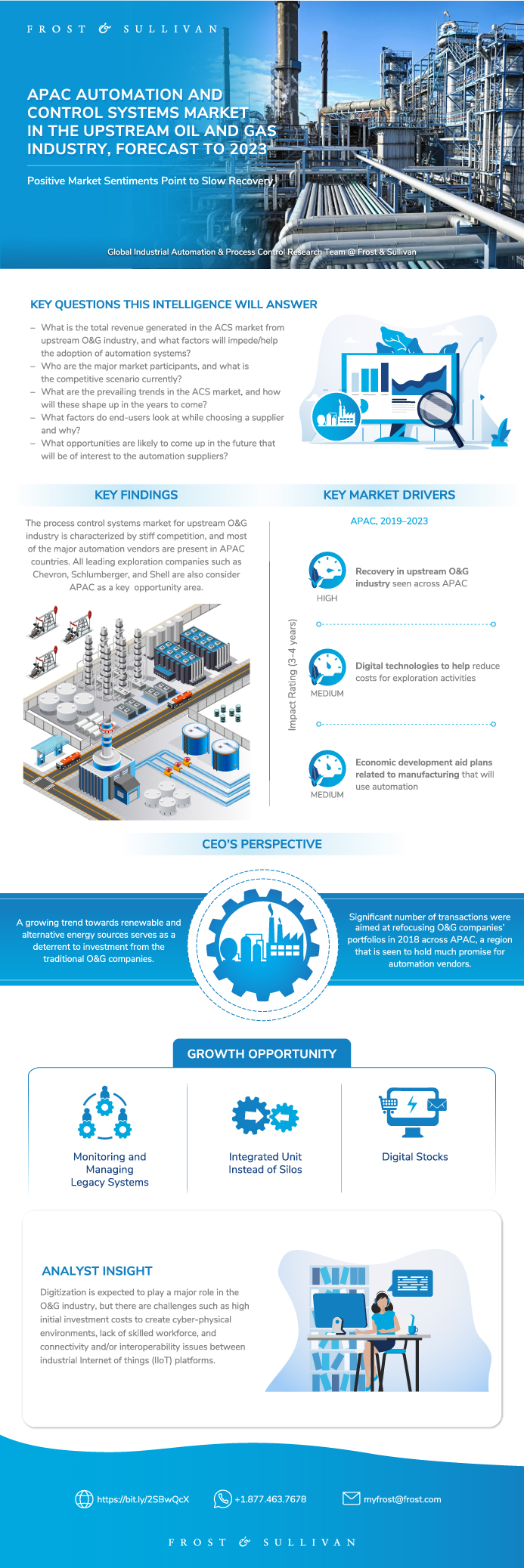

Positive Market Sentiments Point to Slow Recovery

14-Feb-2020

Asia Pacific

Market Research

This research service discusses revenues generated by various automation and control system (ACS) companies in Asia-Pacific that supply to organizations involved in upstream oil and gas activities. The companies included in this study are all major ACS vendors or service providers.

Key Issues Addressed

- What is the total revenue generated in the ACS market from upstream O&G industry, and what factors will impede/help the adoption of automation systems?

- Who are the major market participants, and what is the competitive scenario currently?

- What are the prevailing trends in the ACS market, and how will these shape up in the years to come?

- What factors do end users look at while choosing a supplier and why?

- What opportunities are likely to come up in the future that will be of interest to the automation suppliers?

Author: Krishnan Ramanathan

Research Scope

The objective of this study is to identify the major end users, distribution channel for each product segment, and the major suppliers of ACS in APAC. The study also discusses the revenue contribution of major vendors in the market. Historical data from 2015 to 2017 are examined and included. Considering the prevailing political, legal, and economic situation and other trends, the study also forecasts revenue and growth rates till 2023 and discusses major factors affecting the industry. Drivers, restraints, and initiatives and support from public and private organizations are also provided. It is seen that national oil companies across APAC are facing problems due to their maturing assets and growing domestic energy demand, which points toward more collaboration/need for partners with technical and financial capabilities to help maximize recovery. It is also seen that by 2020, companies across Australia will be investing in building sizeable utility storage, solar, other renewable sources. As many environmental agencies and governments are focusing on replacing conventional sources with green energy, there is a lack of transparency or clarity at different levels, especially in Southeast Asia. While benefits of using cleaner sources are well understood, it is not clear if energy generated from such sources will meet the requirements over the long term. Revenue split among major vendors has been discussed for the total market while analyzing their strengths, weaknesses, opportunities, and threats in the market.

Product Scope

The product segment includes the following categories:

- Programmable Logic Controllers (PLC)

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control System (DCS)

- Human Machine Interface (HMI)

- Safety Systems (SS)

Key Findings

Market Engineering Measurements

Market Engineering Measurements (continued)

CEO’s Perspective

Overview of APAC

Research Scope

Market Segmentation

Product Definitions

Product Definitions (continued)

Key Questions this Study will Answer

Percent Revenue Breakdown by Automation Component

Percent Revenue Breakdown by Product

Market Distribution Channels

Key Trends in O&G Industry

Opportunity Areas for ACS Suppliers

Profiles of Select Channel Partners (EPCs and SIs) Across APAC

Supply Chain Stakeholders

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Restraints Explained (continued)

Market Engineering Measurements

Market Engineering Measurements (continued)

Forecast Assumptions

Revenue Forecast

Revenue Forecast Discussion

Revenue Forecast by Product

Revenue Forecast Discussion by Product

PESTLE Analysis

Market Share

Competitive Environment

Automation Vendors’ Presence Across Products

Best Practices from the Market Leader

Key Success Factors for Market Leader—Yokogawa

Key Success Factors for Yokogawa

Key Success Factors for Yokogawa (continued)

CEO’s 360 Degree Perspective

TIES Project—Major Growth Opportunities

Growth Opportunity 1—Monitoring and Managing Legacy Systems

Growth Opportunity 2—Integrated Unit Instead of Silos

Growth Opportunity 3—Digital Stocks

Strategic Imperatives for Success and Growth

Market Engineering Measurements

Revenue Forecast

Distribution Channel

Percent Revenue Breakdown by Automation Component

Market Share

Market Engineering Measurements

Revenue Forecast

Distribution Channel

Percent Revenue Breakdown by Automation Component

Market Share

Market Engineering Measurements

Revenue Forecast

Distribution Channel

Percent Revenue Breakdown by Automation Component

Market Share

Market Engineering Measurements

Revenue Forecast

Distribution Channel

Percent Revenue Breakdown by Automation Component

Market Share

Market Engineering Measurements

Revenue Forecast

Distribution Channels

Percent Revenue Breakdown by Automation Component

Market Share

The Last Word—Three Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Market Participants

Learn More—Next Steps

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

Research Scope

The objective of this study is to identify the major end users, distribution channel for each product segment, and the major suppliers of ACS in APAC. The study also discusses the revenue contribution of major vendors in the market. Historical data from 2015 to 2017 are examined and included. Considering the prevailing political, legal, and economic situation and other trends, the study also forecasts revenue and growth rates till 2023 and discusses major factors affecting the industry. Drivers, restraints, and initiatives and support from public and private organizations are also provided. It is seen that national oil companies across APAC are facing problems due to their maturing assets and growing domestic energy demand, which points toward more collaboration/need for partners with technical and financial capabilities to help maximize recovery. It is also seen that by 2020, companies across Australia will be investing in building sizeable utility storage, solar, other renewable sources. As many environmental agencies and governments are focusing on replacing conventional sources with green energy, there is a lack of transparency or clarity at different levels, especially in Southeast Asia. While benefits of using cleaner sources are well understood, it is not clear if energy generated from such sources will meet the requirements over the long term. Revenue split among major vendors has been discussed for the total market while analyzing their strengths, weaknesses, opportunities, and threats in the market.

Product Scope

The product segment includes the following categories:

- Programmable Logic Controllers (PLC)

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control System (DCS)

- Human Machine Interface (HMI)

- Safety Systems (SS)

Key Issues Addressed

- What is the total revenue generated in the ACS market from upstream O&G industry, and what factors will impede/help the adoption of automation systems?

- Who are the major market participants, and what is the competitive scenario currently?

- What are the prevailing trends in the ACS market, and how will these shape up in the years to come?

- What factors do end users look at while choosing a supplier and why?

- What opportunities are likely to come up in the future that will be of interest to the automation suppliers?

Author: Krishnan Ramanathan

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Krishnan Ramanathan |

| Industries | Industrial Automation |

| WIP Number | PA36-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9672-A9,9593,9420 |