Digitization Powers the Indian Passenger Vehicle Industry, Outlook 2021

Digitization Powers the Indian Passenger Vehicle Industry, Outlook 2021

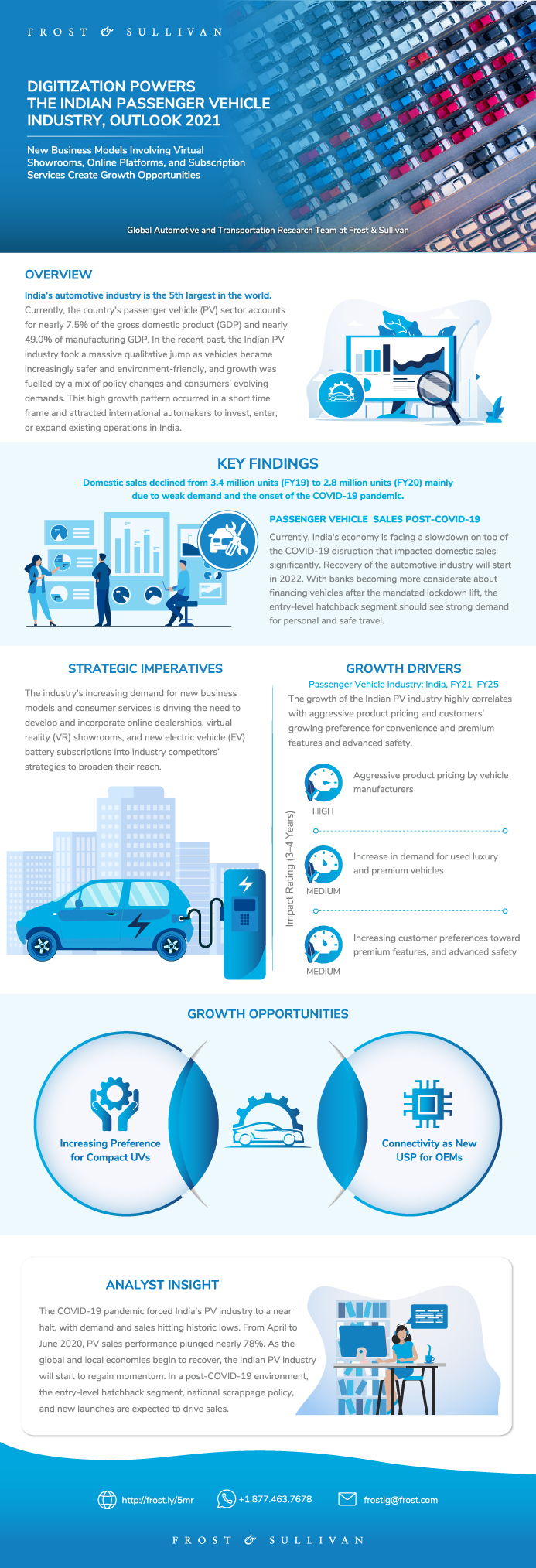

New Business Models Involving Virtual Showrooms, Online Platforms, and Subscription Services Create Growth Opportunities

31-Mar-2021

South Asia, Middle East & North Africa

$4,950.00

Special Price $3,712.50 save 25 %

Description

India’s automotive industry is one of the 5 largest in the world. Currently, the country’s passenger vehicle (PV) sector accounts for nearly 7.5% of gross domestic product (GDP) and nearly 49.0% of manufacturing GDP. In the recent past, the Indian PV industry took a massive qualitative jump as vehicles became increasingly safer and environment-friendly, growth fuelled by a mix of policy changes and consumers’ evolving demands. This high growth pattern occurred in a short time frame and attracted International automakers to invest in, enter, or expand existing operations in India. Meanwhile, domestic automakers raced toward perfecting a balance between price sensitivity and customers’ expectations for in-car features.

However, the COVID-19 pandemic forced India’s PV industry to a near halt, with demand and sales hitting historic lows. From April to June 2020, PV sales performance plunged nearly 78%. As the global and local economies begin to recover, the Indian PV industry will start to regain momentum. In a post-COVID-19 environment, the entry-level hatchback segment, national scrappage policy, and new launches are expected to drive sales. Emission and safety regulations will also influence purchase criteria in the near term.

In addition, the Indian electric vehicle (EV) market will see positive movement in 2021-2022. On the EV components side, cell-level manufacturing will commence, with technological collaborations and government support focusing on (lithium titanium oxide (LTO) battery chemistry.

In this Outlook, Frost & Sullivan highlights the Indian PV industry’s current state, critical challenges, key growth metrics, digitization trends, and impact caused by the COVID-19 pandemic on each segment (passenger care, utility vehicle, van) and sub-segment. The study analyses key technological trends, growth opportunities, the scope of electric PVs in India, and the key areas of focus for new entrants.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the Indian Passenger Vehicle (PV) Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Research Scope and Objectives

Indian PV Industry—Vehicle Segmentation Overview

Passenger Vehicle Classification, Definitions, and Key Models

Passenger Vehicle Classification, Definitions, and Key Models (continued)

Passenger Vehicle Classification, Definitions, and Key Models (continued)

Key Findings

Key Findings (continued)

Key Findings (continued)

Key Findings (continued)

Key Findings (continued)

Passenger Vehicle Industry Trends

Challenges Mobility Industry Faced Due to COVID-19

Key Technological Shifts During FY20–25

Key Future Outlook

Impact of COVID-19 on Passenger Vehicle Sales

Impact of COVID-19 on Passenger Vehicle Sales (continued)

Impact of COVID-19 on Passenger Vehicle Sales (continued)

FY20—Monthly Sales Trend

PV Segment Sales Trend

PV—Strategic Sales by Segment

PV Segment Trends

PV Segment Trends (continued)

Performance of PV Companies in FY20

PV Sales by State

Top-selling PV Models

OEM Offerings in India

OEM Offerings in India (continued)

Segment Analysis—Mini Segment

Segment Analysis—Compact Segment

Segment Analysis—Super Compact Segment

Segment Analysis—Mid-size Segment

Segment Analysis—Executive and Premium Segment

Segment Analysis—Compact UV Segment

Segment Analysis—UV2 Segment

Segment Analysis—Other UVs (UV3 TO UV5) Segment

Segment Analysis—Van Segment*

Maruti Suzuki India Limited (MSIL)

Maruti Suzuki India Limited (MSIL) (continued)

Maruti Suzuki India Limited (MSIL) (continued)

Hyundai Motors

Hyundai Motors (continued)

Hyundai Motors (continued)

Mahindra and Mahindra Motors (M&M)

Mahindra and Mahindra Motors (M&M) (continued)

Vehicle Segment-wise Analysis

Key Trends Impacting the Passenger Vehicle Industry

Trend 1—Race Toward Level 1 ADAS Solutions

Trend 2—Rise of Automatic Transmission (AT) in the Indian PV Industry

Trend 3—More Powertrain Options Attract More Sales

Trend 4—Connectivity Becomes USP for OEMs

Trend 4—Connectivity Becomes USP for OEMs (continued)

Trend 5—Declining Petrol and Diesel Price Gap Boosts Shift to Petrol/CNG Vehicles

Trend 6—UV Segment will Hold Diesel Demand AFLOAT for Medium Term

Trend 7—Digitization of Retail – Omnichannel Strategy of Indian OEMs

Trend 8—Impact of Covid-19 on Shared Mobility

Trend 9—No Slowdown in Pre-Owned Car Market

Trend 10—New Business Models – Subscription / Leasing

Trend 11—Wave of In-car Air Purifiers

HMI Trend

HMI Input—Current and Future Focus Areas

India’s HMI Technology Roadmap

HMI Features—OEM Adoption by 2025

Touch Screen Offerings by Top India OEMs

Automotive HMI—Current Penetration & Relevance for Indian Market

Global ADAS Technology Pyramid

India’s Advanced Drive Assistance System (ADAS) Timeline

Key Legislation—ADAS Roadmap

Global Supplier Sensor Suite Offerings

ADAS Functionalities—OEM Adoption by 2025

ADAS Technology R&D in India

ADAS Features—Global Popularity & Relevance for India

Evolution of HWW in the Automotive Industry

HWW Features—Benchmarking by Region (2025)

HWW Functionalities—Current Penetration & Relevance for India

Global Heatmap of 4G & 5G Network Coverage

Automotive 5G Use Cases

Top 5G Use Cases—Growth Potential in Auto Industry

Opportunities for 5G in Automotive Industry

Electric Vehicles in India

Key OEMs’ Product Portfolio and Launch Roadmap

Current Lithium-based Cell Manufacturing Plans

Public/Private Charging Infrastructure Standards and Implementation

Future Charging Stations

Future Charging Stations (continued)

Future Charging Stations (continued)

Growth Drivers for Passenger Vehicle Industry

Growth Drivers for Passenger Vehicle Industry (continued)

Growth Restraints for Passenger Vehicle Industry

Growth Restraints for Passenger Vehicle Industry (continued)

Factors Impacting the Passenger Vehicle Industry in India

Domestic Sales Forecast: Scenario Analysis

Export Forecast—Scenario Analysis

Production Forecast—Scenario Analysis

Passenger Vehicle Industry—Sales Forecast by Segment

Passenger Vehicle Industry—Sales Forecast by Segment (continued)

Growth Opportunity 1: Increasing Preference for Compact UVs, 2021

Growth Opportunity 1: Increasing Preference for Compact UVs, 2021 (continued)

Growth Opportunity 2: Connectivity as New USP for OEMs, 2021

Growth Opportunity 2: Connectivity as New USP for OEMs, 2021 (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Manish Bisht |

| Industries | Automotive |

| WIP Number | PB9A-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB