Disruptive Technologies with Innovative Business Models Driving Platform and Architecture Strategies for AVs, 2020

Disruptive Technologies with Innovative Business Models Driving Platform and Architecture Strategies for AVs, 2020

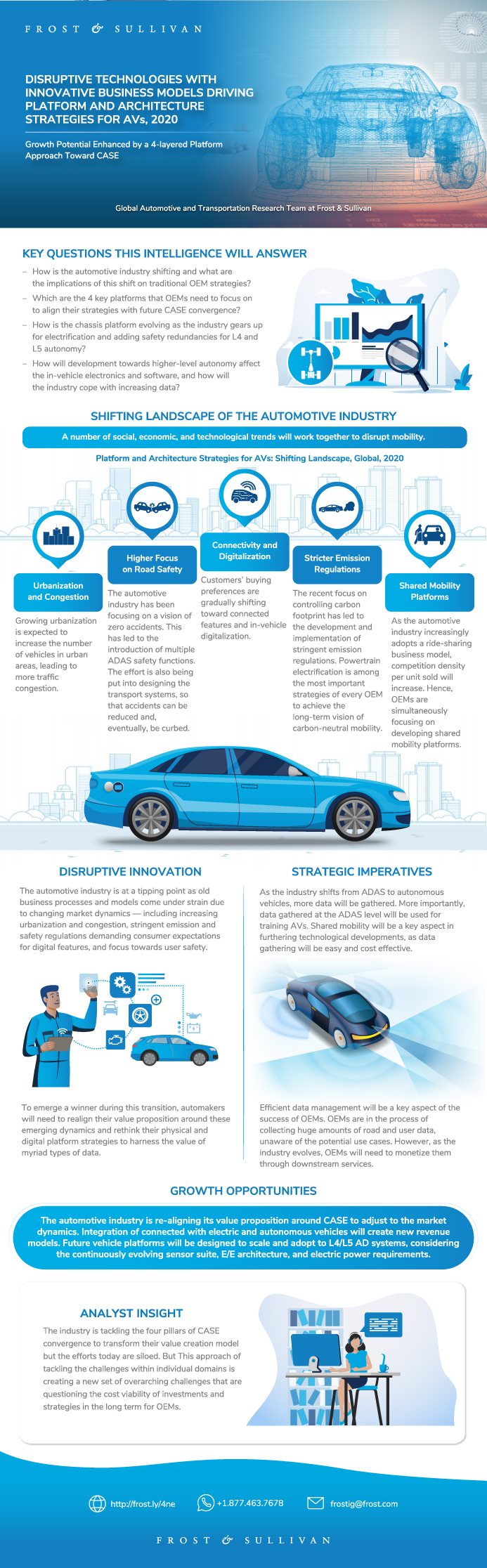

Growth Potential Enhanced by 4-layered Platform Approach Toward CASE

23-Sep-2020

Global

Description

The automotive industry is at a tipping point, with traditional business models being disrupted, changing the market dynamics?increasing urbanization and congestion, tighter emission and safety regulations, evolving consumer expectations for digital features, and focus on user safety. The ecosystem is evolving at a rapid pace, not only through the emergence of new business models, but also on the technological front.

Traditionally, most OEMs and Tier-I suppliers have been taking the siloed approach for developments in connected, autonomous, and electric vehicles. However, this approach of singular focus is not viable for the long term. OEMs will need strategies that explore the benefits of developing applications focused on the convergence of the 3 technology pillars. To cope with this transition, automakers will need to realign their value proposition around these emerging dynamics and rethink their physical and digital platform strategies to harness the value of myriad types of data.

Powertrain electrification is among the most important strategies of every OEM to achieve the long-term vision of carbon-neutral mobility. OEMs are also aiming to create a consolidated chassis platform, which will be modular enough to handle multiple segments of vehicles. These factors will force the OEMs to shift from well-established legacy chassis platforms to multi-energy platforms (MEPs) and modular and dedicated electric platforms. OEMs are also focused on strengthening their E/E architecture, which can handle humongous data sizes from continuously evolving sensor suite and processing software. The rise of data ingestion per vehicle has called in the significance of cloud computation as on-premise servers become incapable.

The study covers the key platforms that OEMs need to focus on, as they shift their strategy to data-centric revenue models from traditional vehicle-centric business models. As every OEM strategizes their individual path toward CASE convergence, the expected evolution of the platforms are explored, along with major industry partnerships.

Key Issues Addressed

- How is the automotive industry shifting, and what are the implications of that shift on traditional OEM strategies?

- Which are the 4 key platforms that OEMs need to focus on to align their strategy with future CASE convergence?

- How is the chassis platform evolving, as the industry gears up for electrification and adding redundancies for L4 and L5 autonomy?

- How will development toward higher-level autonomy affect the in-vehicle electronics and software, and how will the industry cope with increasing data?

- What are specific OEMs and developers strategizing for the 4 key platforms?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Platform Components

Chassis Platform

Electronic Platform

Software Platform

Cloud Platform

Partnership Strategies across Platforms

Key Conclusions

Research Scope

Key Questions this Study will Answer

Vehicle Segmentation

Standards for Autonomous Driving

Electric Vehicle (xEV) in Scope

Shifting Landscape of the Automotive Industry

Industry Optimizations Due to Shifting Landscape

Key Challenges for OEMs with Traditional Development

Platform-based Approach Toward CASE

Future Autonomous Vehicle Platforms

Modular and Skateboard Platforms

Key Platforms

OEMs’ Strategy—BEVs on Skateboard Platform

Evolution of E/E Architecture

Evolution of Sensor Hardware

Role of Sensor Data Fusion by Level of Automation

EV Power Components

OEM E/E Architecture Strategies

EV Battery and Motor Strategy

Key In-vehicle Software Enabling AD

Software-Hardware Decoupling

AI-based Software Vs. Conventional Software

Role of Machine Learning

Implementation of Machine Learning

Autonomous Driving Software Platforms

Data Storage and Computing for AVs

Edge Vs. Cloud Computing

Cloud-Edge Computation Models

Cloud Storage and Computation

OEM Cloud Strategy

CASE Convergence

Implications of CASE Convergence

Growth Opportunity—Investments and Partnerships from OEMs/TSPs

Strategic Imperatives for Success and Growth

Key Conclusions

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Abbreviations and Acronyms Used

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Popular Topics

Key Issues Addressed

- How is the automotive industry shifting, and what are the implications of that shift on traditional OEM strategies?

- Which are the 4 key platforms that OEMs need to focus on to align their strategy with future CASE convergence?

- How is the chassis platform evolving, as the industry gears up for electrification and adding redundancies for L4 and L5 autonomy?

- How will development toward higher-level autonomy affect the in-vehicle electronics and software, and how will the industry cope with increasing data?

- What are specific OEMs and developers strategizing for the 4 key platforms?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Ayan Biswas |

| Industries | Automotive |

| WIP Number | MF26-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9882-A6,9B13-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB