Frost Radar™: European UCaaS Market 2022

Frost Radar™: European UCaaS Market 2022

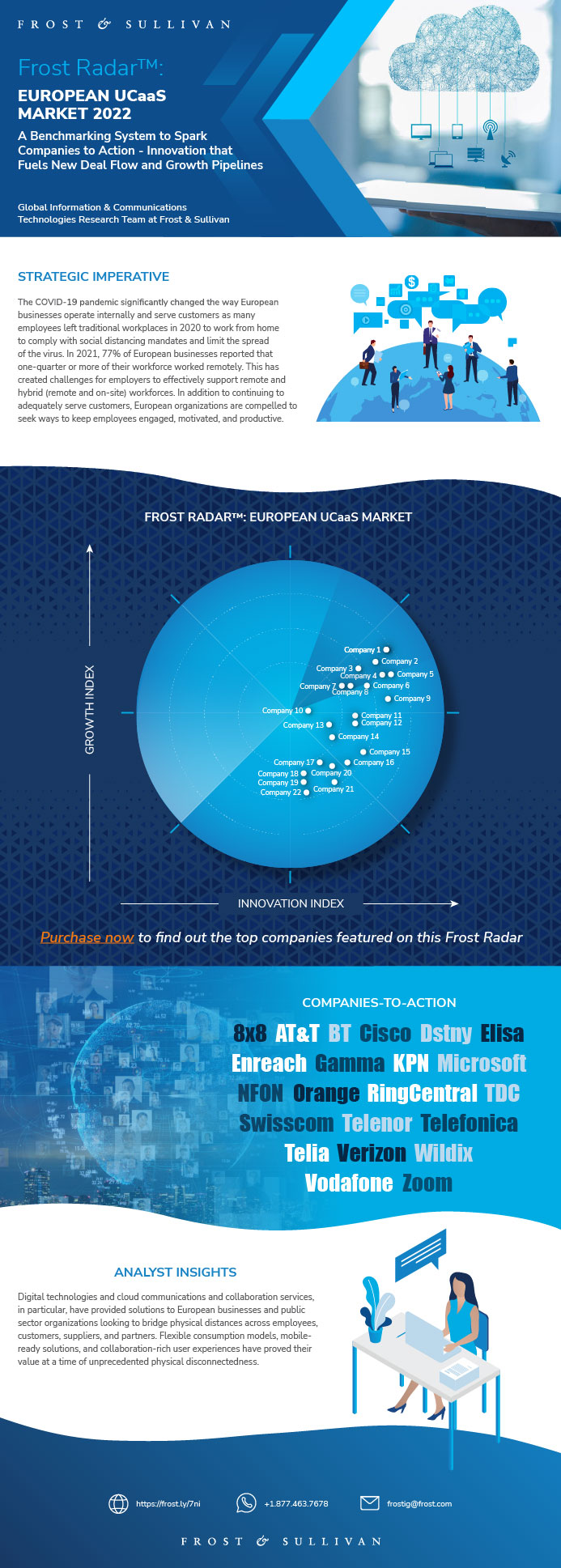

A Benchmarking System to Spark Companies to Action - Innovation that Fuels New Deal Flow and Growth Pipelines

21-Sep-2022

Europe

Description

Digital technologies and cloud communications and collaboration services, in particular, have provided solutions to European businesses and public sector organizations looking to bridge physical distances across employees, customers, suppliers, and partners. Flexible consumption models, mobile-ready solutions, and collaboration-rich user experiences have proved their value at a time of unprecedented physical disconnectedness.

To grow revenue above historical levels, European UCaaS market participants must create a robust growth pipeline incorporating strategic imperatives in the post-pandemic world to empower a globally connected organization, a demographically diverse workforce, and digital-native customers.

Differentiated programmable solutions, creative packaging and pricing, unique value propositions, and excellent customer support will determine market winners. It also is imperative for communications technology developers and service providers to focus on feature differentiation and platform reliability, security, scalability, and extensibility in the next 5 to 10 years.

Software-based, mobile-ready, pre-packaged, yet API-rich cloud communications solutions will gain traction among small and medium-size businesses (SMBs) as well as larger enterprises and multinational corporations (MNCs). To scale and accelerate growth, market participants need to leverage a robust core feature set and standardized packaging and pricing across customer segments and multiple countries, while creating differentiated customer value through integrations with important processes in customer organizations.

Programmability, embedded unified communications (i.e., voice, video and messaging features integrated with IoT devices), as well as workflow collaboration (integrated with business and vertical software), and composable, persona-based experiences will determine provider success in the next 10 years.

The Frost Radar™ reveals the market positioning of companies in an industry using their Growth and Innovation scores as highlighted in the Frost Radar™ methodology. The document presents competitive profiles on each of the companies in the Frost Radar™ based on their strengths, opportunities, and a small discussion on their positioning. Frost & Sullivan analyzes hundreds of companies in an industry and benchmarks them across 10 criteria on the Frost Radar™, where the leading companies in the industry are then positioned.

Author: Robert Arnold

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

The Strategic Imperative

The Strategic Imperative (continued)

The Strategic Imperative (continued)

Growth Environment

Growth Environment (continued)

Frost Radar™: European UCaaS Market

Frost Radar™: Competitive Environment

Frost Radar™: Competitive Environment (continued)

Frost Radar™: Competitive Environment (continued)

8x8

AT&T

BT

Cisco

Dstny

Elisa

Enreach

Gamma

KPN

Microsoft

NFON

Orange

RingCentral

Swisscom

TDC

Telefonica

Telenor

Telia

Verizon

Vodafone

Wildix

Zoom

Strategic Insights

Significance of Being on the Frost Radar™

Frost Radar™ Empowers the CEO’s Growth Team

Frost Radar™ Empowers Investors

Frost Radar™ Empowers Customers

Frost Radar™ Empowers the Board of Directors

Frost Radar™: Benchmarking Future Growth Potential

Frost Radar™: Benchmarking Future Growth Potential

Legal Disclaimer

Popular Topics

| Author | Rob Arnold |

|---|---|

| Industries | Telecom |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | ucaas market |

| Keyword 2 | ucaas market share |

| Keyword 3 | ucaas market trends |

| Podcast | No |

| Predecessor | K66E-01-00-00-00 |

| WIP Number | K7FB-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB