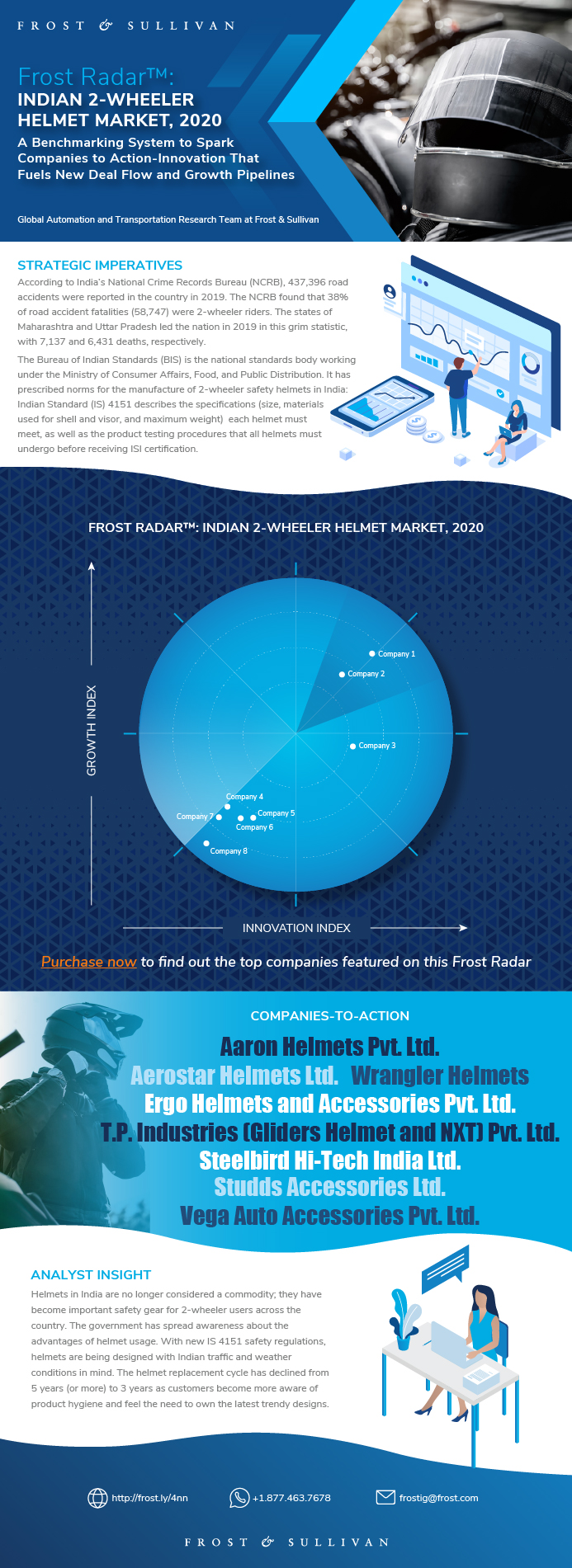

Frost Radar™: Indian 2-Wheeler Helmet Market, 2020

Frost Radar™: Indian 2-Wheeler Helmet Market, 2020

A Benchmarking System to Spark Companies to Action-Innovation That Fuels New Deal Flow and Growth Pipelines

30-Sep-2020

South Asia, Middle East & North Africa

Description

India is the largest market for 2-wheelers (e.g., scooterettes, mopeds, and motorcycles), with more than 190 million in operation at the end of 2019. It also is home to one of the world’s largest and most competitive 2-wheeler helmet manufacturing industries, with a current capacity of 35 million helmets per year.

Helmet sales increased at a healthy compound annual growth rate (CAGR) of 10% from financial year (FY) 2012 to FY 2017. Market revenue for FY 2018 was estimated at $184 million, with 20.04 million helmets sold; only 0.3% were imported brands. India also is a prominent helmet exporter to countries in Africa and South Asia.

The helmet industry is by nature dependent on the performance of the 2-wheeler industry, which Frost & Sullivan expects to increase at a CAGR of 7.40% from FY 2019 to FY 2024. Lockdowns put in place to battle the COVID-19 pandemic in 2020, however, have affected the automotive market as a whole: Frost & Sullivan anticipates a drop in growth through FY 2021.

Full-face helmets are the top choice for commuters because they provide complete protection in various weather conditions. Open-face helmets follow; they are popular among female riders and are the go-to choice in states where pillion rider helmet use is mandatory. Helmet shell design, color, and graphic options are key considerations in a purchase decision today.

The Frost Radar™ reveals the market positioning of companies in an industry using their Growth and Innovation scores as highlighted in the Frost Radar™ methodology. The document presents competitive profiles on each of the companies in the Frost Radar™ based on their strengths, opportunities, and a small discussion on their positioning. Frost & Sullivan analyzes hundreds of companies in the industry and benchmarks them across 10 criteria on the Frost Radar™, where the leading companies in the industry are then positioned. Industry leaders on both the Growth and Innovation indices are recognized as best practice recipients.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Strategic Imperative

Strategic Imperative (continued)

Growth Environment

Growth Environment (continued)

Frost Radar™: Indian 2-Wheeler Helmet Market

Frost Radar™: Competitive Environment

Frost Radar™: Competitive Environment (continued)

Aaron Helmets Pvt. Ltd.

Aerostar Helmets Ltd.

Ergo Helmets and Accessories Pvt. Ltd.

Steelbird Hi-Tech India Ltd.

Studds Accessories Ltd.

T.P. Industries (Gliders Helmet and NXT) Pvt. Ltd.

Vega Auto Accessories Pvt. Ltd.

Wrangler Helmets

Strategic Insights

Significance of Being on the Frost Radar™

Frost Radar™ Empowers the CEO’s Growth Team

Frost Radar™ Empowers Investors

Frost Radar™ Empowers Customers

Frost Radar™ Empowers the Board of Directors

Frost Radar™: Benchmarking Future Growth Potential

Frost Radar™: Benchmarking Future Growth Potential

Frost Radar™: Benchmarking Future Growth Potential

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Nachiket Devasthaley |

| Industries | Automotive |

| WIP Number | PB32-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB