Frost Radar™: US Healthcare Cybersecurity Market, 2020

Frost Radar™: US Healthcare Cybersecurity Market, 2020

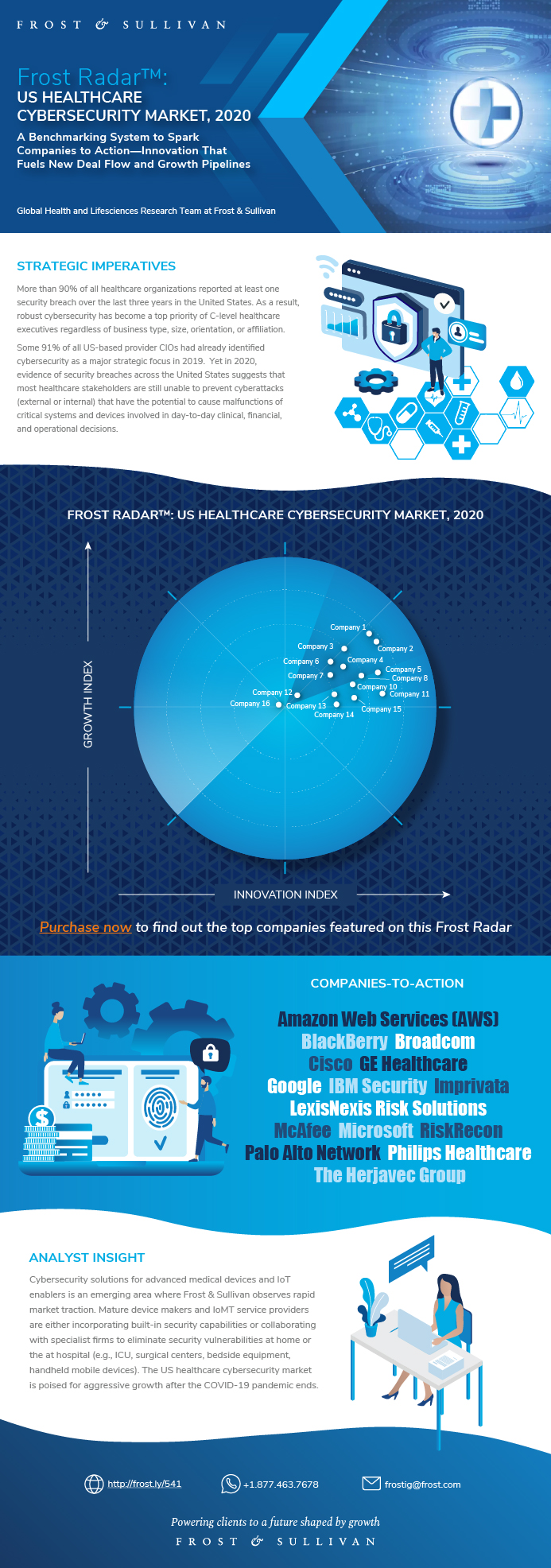

A Benchmarking System to Spark Companies to Action—Innovation That Fuels New Deal Flow and Growth Pipelines

23-Dec-2020

North America

Description

The US healthcare cybersecurity market is poised for aggressive growth after the COVID-19 pandemic ends. The impending challenges related to the top 5 cyber threats (phishing attacks, credential harvesting, ransomware, social engineering attacks, and information theft or loss) will drive a higher spend on progressive cybersecurity solutions across infrastructure, applications, networks, cloud, and the Internet of Things (IoT).

More than 90% of all healthcare organizations reported at least one security breach over the last 3 years in the United States. As a result, robust cybersecurity has become a top priority of C-level healthcare executives regardless of business type, size, orientation, or affiliation.

Some 91% of all US-based provider CIOs had already identified cybersecurity as a major strategic focus in 2019. Yet in 2020, evidence of security breaches across the United States suggests that most healthcare stakeholders are still unable to prevent cyberattacks (external or internal) that have the potential to cause malfunctions of critical systems and devices involved in day-to-day clinical, financial, and operational decisions. Further, 61% of US-based healthcare businesses acknowledged that they lack effective mechanisms to ensure cybersecurity at an organizational level. During the COVID-19 pandemic, the matter worsened as hackers started to target virtual care platforms, clinical trial database, remote patient monitoring devices, diagnostic systems, and ICU ventilators that historically were relatively more vulnerable to security threats that involve phishers, cybercriminals, and negligent/malicious insiders. Such attacks have a direct impact on patient safety and the integrity of the healthcare businesses responsible for it.

Poor cybersecurity is bad for business as well. Most hospitals spend, on average, 64% more on general advertising in the year after a data breach. Cyberattacks on revenue cycle management platforms disrupt claims management processes and reduce the cumulative quality rating or STAR ranking, which ultimately result in reduced reimbursement and a lower patient footprint: a double whammy for providers.

The Frost Radar™ reveals the market positioning of companies in an industry using their Growth and Innovation scores as highlighted in the Frost Radar™ methodology. The document presents competitive profiles on each of the companies in the Frost Radar™ based on their strengths, opportunities, and a small discussion on their positioning. Frost & Sullivan analyzes hundreds of companies in an industry and benchmarks them across 10 criteria on the Frost Radar™, where the leading companies in the industry are then positioned.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Strategic Imperative

Growth Environment

Growth Environment (continued)

Frost Radar™: US Healthcare Cybersecurity Market, 2020

Frost Radar™: Competitive Environment

Amazon Web Services (AWS)

BlackBerry

Broadcom

Cisco

GE Healthcare

IBM Security

Imprivata

LexisNexis Risk Solutions

McAfee

Microsoft

Palo Alto Network

Philips Healthcare

RiskRecon

The Herjavec Group

Strategic Insights

Significance of Being on the Frost Radar™

Frost Radar™ Empowers the CEO’s Growth Team

Frost Radar™ Empowers Investors

Frost Radar™ Empowers Customers

Frost Radar™ Empowers the Board of Directors

Frost Radar™: Benchmarking Future Growth Potential

Frost Radar™: Benchmarking Future Growth Potential

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Koustav Chatterjee |

| Industries | Healthcare |

| WIP Number | K589-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9564-B1,9600-B1,9612-B1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB