Global Airline and Tourism Growth Opportunities

Global Airline and Tourism Growth Opportunities

Transformative Mega Trends and Industry Convergence through Airline Partnerships Drive Tourism Growth

30-Jun-2022

Global

Market Research

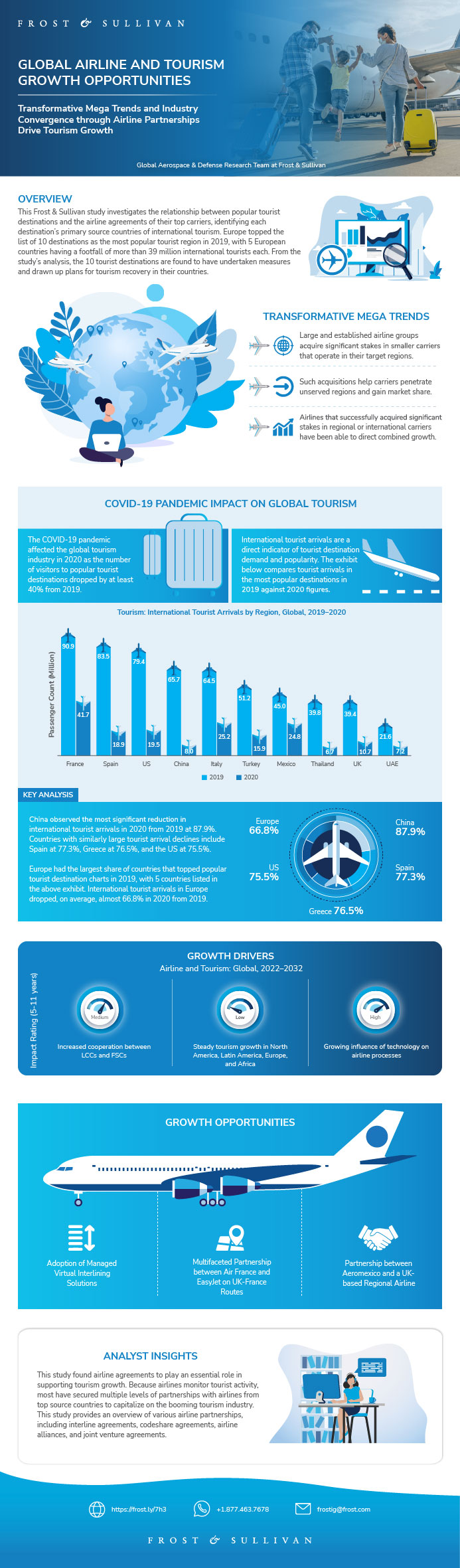

This Frost & Sullivan study investigates the relationship between popular tourist destinations and the airline agreements of their top carriers, identifying each destination’s primary source countries of international tourism. Europe topped the list of 10 destinations as the most popular tourist region in 2019, with 5 European countries having a footfall of more than 39 million international tourists each. From the study’s analysis, the 10 tourist destinations are found to have undertaken measures and drawn up plans for tourism recovery in their countries. Another key observation indicates that these destinations have a robust aviation network comprising a major full-service carrier (usually the country’s flag carrier) and at least one low-cost carrier connecting them with a nearby source country of tourism.

This study found airline agreements to play an essential role in supporting tourism growth. Because airlines monitor tourist activity, most have secured multiple levels of partnerships with airlines from top source countries to capitalize on the booming tourism industry. This study provides an overview of various airline partnerships, including interline agreements, codeshare agreements, airline alliances, and joint venture agreements.

Key Issues Addressed

- What was the pandemic impact on the tourism industry, and what steps have some countries taken for tourism recovery?

- Which destinations are the most popular for international tourists?

- What are the different airline agreements currently in existence?

- How are airlines using their agreements to position themselves in top tourist markets?

- Which regions have not fully capitalized on their top source countries of international tourism, and how can airlines utilize this growth opportunity?

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Strategic 3 Imperatives on the Airline and Tourism Industries

Growth Opportunities Fuel the Growth Pipeline Engine™

COVID-19 Pandemic Impact on Global Tourism

Initiatives and Efforts to Improve Tourism

Introduction and Interline Agreements

Codeshare Agreements

Airline Alliances

Joint Ventures

France

Spain

United States

China

Italy

Turkey

Mexico

Thailand

United Kingdom

United Arab Emirates

Growth Drivers

Growth Drivers Analysis

Growth Restraints

Growth Restraints Analysis

Growth Opportunity 1—Adoption of Managed Virtual Interlining Solutions

Growth Opportunity 1—Adoption of Managed Virtual Interlining Solutions (continued)

Growth Opportunity 2—Multifaceted Partnership between Air France and easyJet on UK-France Routes

Growth Opportunity 2—Multifaceted Partnership between Air France and easyJet on UK-France Routes (continued)

Growth Opportunity 3—Partnership between Aeromexico and a UK-based Regional Airline

Growth Opportunity 3—Partnership between Aeromexico and a UK-based Regional Airline (continued)

List of Exhibits

Legal Disclaimer

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

Key Issues Addressed

- What was the pandemic impact on the tourism industry, and what steps have some countries taken for tourism recovery

- Which destinations are the most popular for international tourists

- What are the different airline agreements currently in existence

- How are airlines using their agreements to position themselves in top tourist markets

- Which regions have not fully capitalized on their top source countries of international tourism, and how can airlines utilize this growth opportunity

| Deliverable Type | Market Research |

|---|---|

| Author | Vedhas Sabnis |

| Industries | Aerospace, Defence and Security |

| No Index | No |

| Is Prebook | No |

| Podcast | No |

| WIP Number | PD44-01-00-00-00 |