Global Combat Vehicles Market Analysis, Forecast to 2026

Global Combat Vehicles Market Analysis, Forecast to 2026

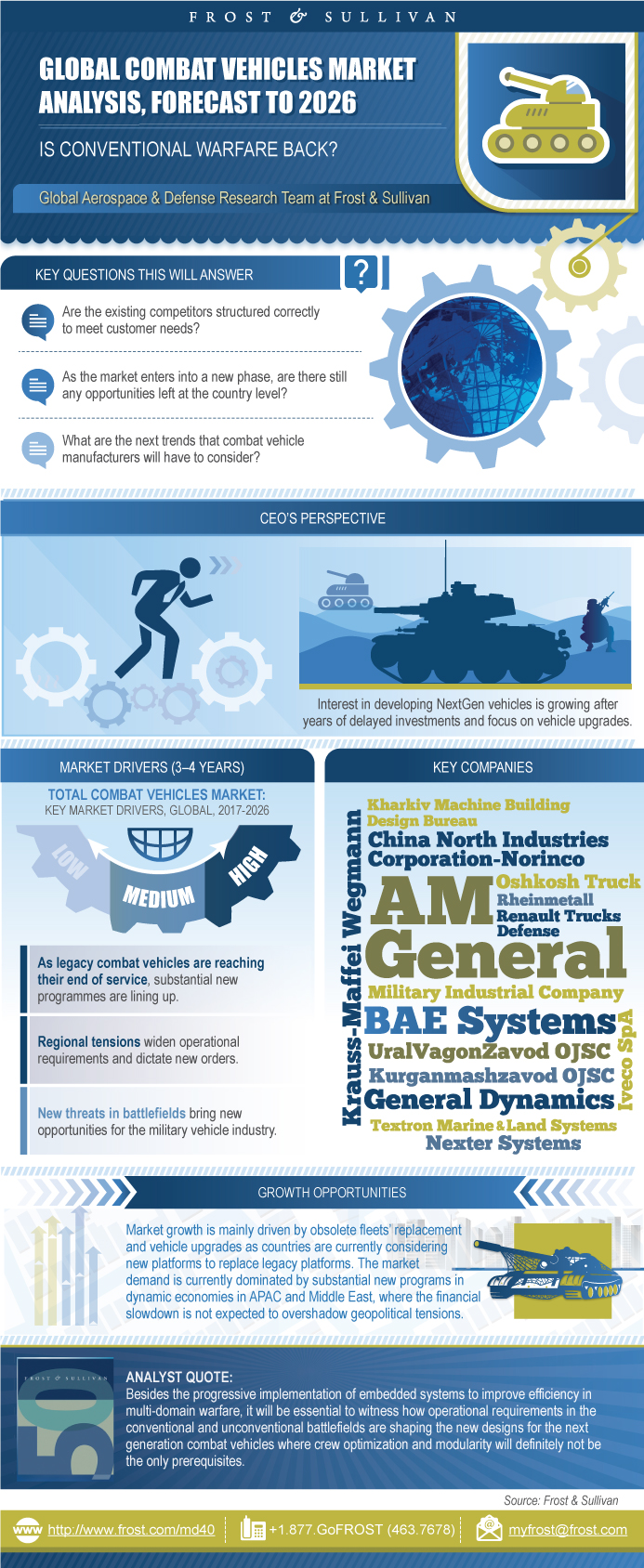

Is Conventional Warfare back?

29-Aug-2017

Europe

Market Research

The combat vehicles market will undergo significant transformations after years of market stagnation and preference over modernisation programmes. As platforms are reaching the end of their lifespan, substantial renewal opportunities are in line and a slow growth is projected. Market revenues are estimated to grow by almost by $5 billion during 2017–2026 and at a compound annual growth rate of 2.2%.

Frost & Sullivan new market analysis of combat vehicles studies the future market trends and evolution for the next 10 years and across the following segments:

• Main battle tanks

• Infantry fighting vehicles

• Armoured personnel carriers

• Protected patrol vehicles

• Amphibious assault vehicles

• Reconnaissance vehicles

• Armoured recovery vehicles

• Armoured engineering vehicles

An in-depth analysis of operational requirements, budget priorities, and disruptive technologies impacting procurement and modernisation programmes is provided across 7 regions (Africa, Asia-Pacific, Central Asia, Europe, Middle East, North America, South America), including country insights and upcoming fleet renewal opportunities.

Key Question this Study will Answer

• What are the macro level drivers and restraints?

• How are changing operational concepts impacting armour vehicle designs?

• What are the current budget pressure and spending priorities?

• What is the market growth rate?

• What is the market size by contracted, planned, and forecasted programmes?

• Is there any change of business patterns in traditional distribution channels?

• Who are the top 10 producers?

• How will the competitive environment be impacted by market trends?

• What are the technology trends and challenges regarding vetronics and open systems architecture?

In addition, an analytical overview of leading manufacturers (BAE Systems, General Dynamics, Oshkosh Truck Corporation, Textron Land and Marine Systems, KNDS, Rheinmetall, Iveco, UVZ, Patria, Renault Trucks Defence & Security, etc.) and market position by product segments are also provided, based on 2016 installed fleet.

The market size is expressed in programme revenues and units. Units comprise current and projected installed vehicle fleet of conventional military forces (Army, Naval Infantry, and Special Forces).

Market Revenues Cover Contracted, Planned, and Forecasted Programmes

• Contracted: On-going programmes already signed before the base year.

• Planned: Programmes officially announced by Ministries of Defence and expected to be signed during the short term (1 to 3 years). This

includes pending tenders and requests for proposals (RFPs).

• Forecasted: Programmes expected in the near term (more than 5 years) based on the analysis of current fleet age, operational

requirements, and geopolitical constraints.

Key Findings

Market Engineering Measurements

Market Engineering Measurements (continued)

CEO’s Perspective

Market Scope

Market Definitions

Market Definitions (continued)

Key Questions this Study will Answer

Market Segmentation

Market Distribution Channels

Combat Vehicle Market—Macro Level Analysis

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Restraints Explained (continued)

Market Engineering Measurements

Market Engineering Measurements (continued)

Forecast Assumptions

Unit Shipment and Revenue Forecast

Unit Shipment and Revenue Forecast Discussion

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

Fleet Renewal Analysis

Projected Revenue by Vehicle Types

Projected Revenue by Vehicle Types Discussion

Per Cent Revenue Forecast by Region

Revenue Forecast by Region

Revenue Forecast Discussion by Region

Combat Vehicles Market Analysis—Competitive Forces

Market Share

Annual Revenue Evolution

Annual Revenues Evolution (continued)

Market Share Analysis

Top Competitors Profiles

Top Competitors Profiles (continued)

Top Competitors Profiles (continued)

Top Competitors Profiles (continued)

Top Competitors Profiles (continued)

Competitive Map—Key JVs And Partnerships to Watch

Growth Opportunity 1—Changing Concepts: Manned Unmanned Teaming (MUM-T)

Growth Opportunity 2—Recycling Legacy Vehicle to become UGVs

Growth Opportunity 3—New Design: The New Light Tank

Strategic Imperatives for Success and Growth

Market Engineering Measurements

Main Battle Tanks

Main Battle Tanks Discussion

Main Battle Tanks Outlook

Main Battle Tanks Outlook (continued)

Market Engineering Measurements

Armoured Infantry Fighting Vehicles

Armoured Infantry Fighting Vehicles Discussion

Armoured Infantry Fighting Vehicles Outlook

Armoured Infantry Fighting Vehicles Outlook (continued)

Market Engineering Measurements

Amphibious Assault Vehicles

Amphibious Assault Vehicles Discussion

Amphibious Assault Vehicles Outlook

Amphibious Assault Vehicles Outlook (continued)

Market Engineering Measurements

Armoured Personnel Carriers

Armoured Personnel Carriers Discussion

Armoured Personnel Carriers Outlook

Armoured Personnel Carriers Outlook (continued)

Market Engineering Measurements

Reconnaissance Vehicles

Reconnaissance Vehicles Discussion

Reconnaissance Vehicles Outlook

Reconnaissance Vehicles Outlook (continued)

Market Engineering Measurements

Protected Patrol Vehicles

Protected Patrol Vehicles Discussion

Protected Patrol Vehicles Outlook

Protected Patrol Vehicles Outlook (continued)

Market Engineering Measurements

Armoured Engineering and Recovery Vehicles

Armoured Engineering and Recovery Vehicles Discussion

Armoured Engineering and Recovery Vehicles Outlook

Armoured Engineering and Recovery Vehicles Outlook (continued)

Vetronics and Open Architecture—Challenges Roadmap

Standardised Open Architecture—Retrofit and Line Fit Challenges

Vetronics Open Architecture and Level of Systems Prioritisation

Integrating Combat Vehicles in Multi-domains Warfare

Disruptive Technologies to Counter New Threats

Combat Vehicles World Threats Map

UGVs Maturity—From 3D Operations to Dismounted Soldier Wingman

Revenue Forecast by Region—Map

Africa Key Findings

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

Asia-Pacific Key Findings

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

Central Asia Key Findings

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

Europe Key Findings

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

Middle East Key Findings

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

North America Key Findings

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

South America Key Findings

Revenue Forecast by Programme Type

Revenue Forecast by Programme Type Discussion

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Acronyms

List of Acronyms (continued)

List of Other Companies

List of Other Companies (continued)

List of Other Companies (continued)

Learn More—Next Steps

Image Source

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Alix Leboulanger |

| Industries | Aerospace, Defence and Security |

| WIP Number | MD40-01-00-00-00 |

| Is Prebook | No |