Global Digital Broadcast and Cinematography Cameras Market

Global Digital Broadcast and Cinematography Cameras Market

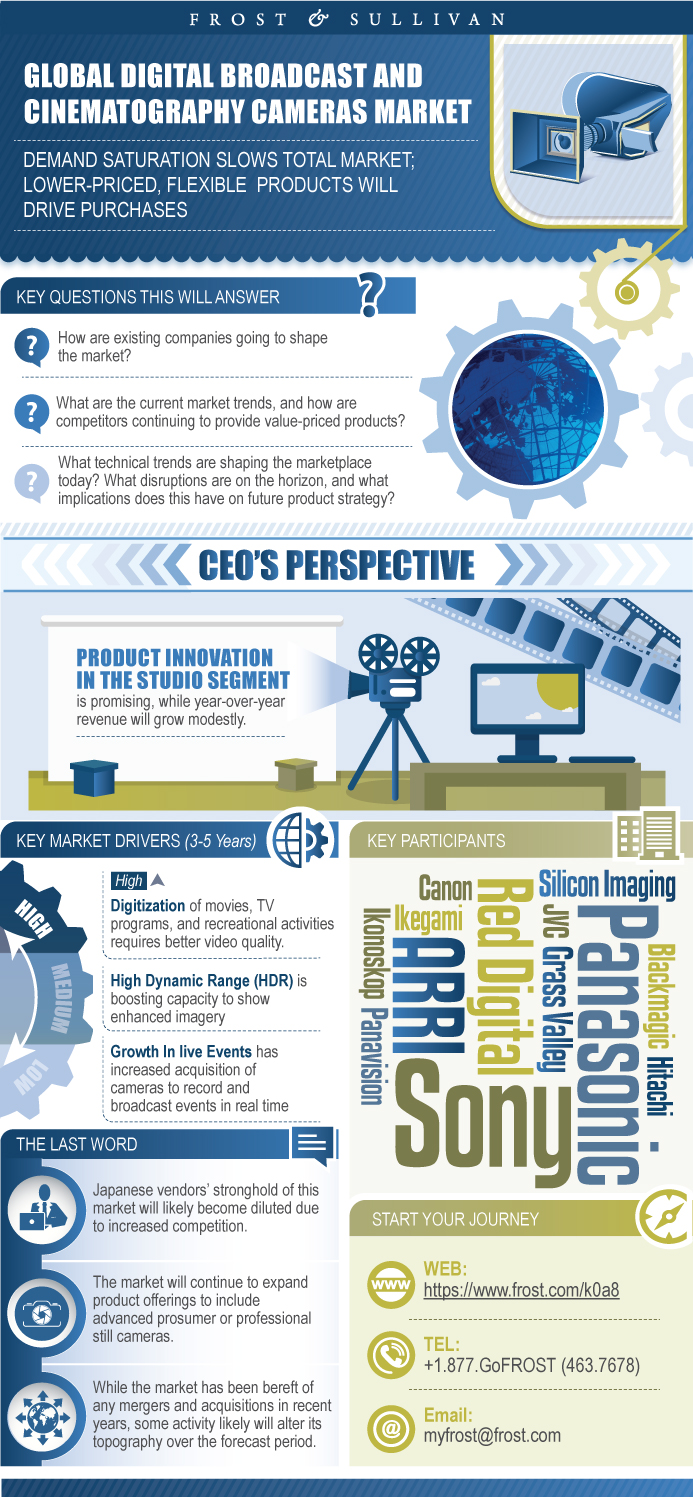

Demand Saturation Slows Total Market; Lower-Priced, Flexible Products will Drive Purchases

10-Aug-2016

North America

Description

This research service examines the global digital broadcast and cinematography cameras market. Detailed market trend analyses, including market drivers, market restraints, technology trends, and segment analysis, are provided. Revenue forecasts are projected through 2020. The global market has been segmented into North America and Latin America; Asia-Pacific; and Europe, the Middle East, and Africa, with further breakdowns as needed to discuss country- or region-specific issues. The competitive landscape examines major participants, their market shares, and specific strengths and weaknesses, both in the total market and by segment (studio, cinematography, electronic news gathering, and electronic field production). The base year is 2015.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary

Executive Summary (continued)

Executive Summary (continued)

Executive Summary—Market Engineering Measurements

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—CEO’s Perspective

Frost & Sullivan Digital Media Value Chain Coverage

Market Overview—Definitions

Market Overview—Definitions (continued)

Market Overview—Definitions (continued)

Global Digital Camera Industry Segmentation

Market Overview—Regions Covered

Revenue Share by Product Type

Unit Shipment Share by Product Type

Market Overview—Key Questions this Study will Answer

Regional Market Life Cycle Analysis

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Restraints Explained (continued)

Impact of New Trends on the Digital Broadcast and Cinematography Cameras Market

Action Cameras

360 Video

Slow Motion

Market Engineering Measurements

Market Engineering Measurements (continued)

Forecast Assumptions

Unit Shipment and Revenue Forecast

Unit Shipment and Revenue Forecast Discussion

Price Forecast by Product

Revenue Share Forecast by Region

Revenue Forecast by Region

Revenue Forecast by Region Discussion

Competitive Analysis—Market Share

Competitive Analysis—Market Share Discussion

Market Leader—Sony

Market Challengers and Contenders

Other Market Participants—Highlights

Competitive Environment

Key Industry Participants

Product List

Competitive Landscape

Competitive Factors and Assessment

Studio Cameras Segment—Market Engineering Measurements

Studio Cameras Segment—Unit Shipment and Revenue Forecast

Studio Cameras Segment—Unit Shipment and Revenue Forecast Discussion

Studio Cameras Segment—Unit Shipment and Revenue Forecast Discussion (continued)

Studio Cameras Segment—Competitive Landscape

Studio Cameras Segment—Market Share

Studio Cameras Segment—Competitive Environment

Cinematography Cameras Segment—Market Engineering Measurements

Cinematography Cameras Segment—Unit Shipment and Revenue Forecast

Cinematography Cameras Segment—Unit Shipment and Revenue Forecast Discussion

Competitive Landscape

Cinematography Cameras Segment—Market Share

Cinematography Cameras Segment—Competitive Environment

ENG Cameras Segment—Market Engineering Measurements

ENG Cameras Segment—Unit Shipment and Revenue Forecast

ENG Cameras Segment—Unit Shipment and Revenue Forecast Discussion

ENG Cameras Segment—Unit Shipment and Revenue Forecast Discussion (continued)

Competitive Landscape

ENG Cameras Segment—Market Share

ENG Cameras Segment—Competitive Environment

EFP Cameras Segment—Market Engineering Measurements

EFP Cameras Segment—Unit Shipment and Revenue Forecast

EFP Cameras Segment—Unit Shipment and Revenue Forecast Discussion

Competitive Landscape

EFP Cameras Segment—Market Share

EFP Cameras Segment—Competitive Environment

Hot Company Watchlist

Hot Company Watchlist—Red Digital, Company Heat Index, 2016

Red Digital

Hot Company Watchlist—ARRI, Company Heat Index, 2016

ARRI

The Last Word—Predictions

Legal Disclaimer

Market Engineering Methodology

Partial List of Companies Interviewed

Data Gathering

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Elvia Valdes |

| Industries | Entertainment and Media |

| WIP Number | K0A8-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB