Growth Opportunities for Global Subscription Video on Demand (SVOD) Services

Growth Opportunities for Global Subscription Video on Demand (SVOD) Services

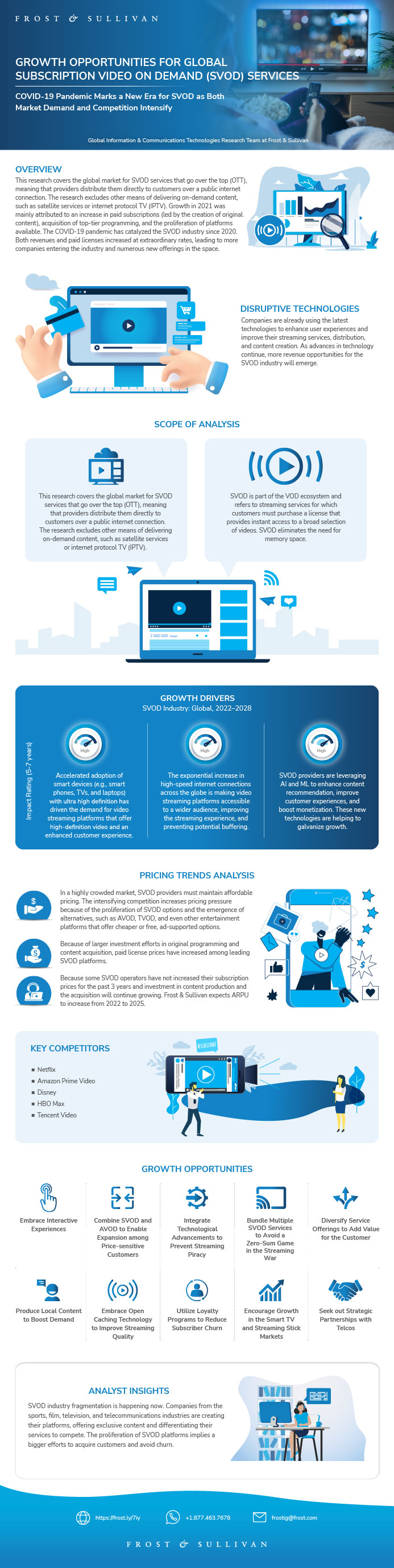

COVID-19 Pandemic Marks a New Era for SVOD as Both Market Demand and Competition Intensify

01-Aug-2022

Latin America

Market Research

Description

This study covers the global market for SVOD services that go over the top (OTT), meaning that providers distribute them directly to customers over a public internet connection. The study excludes other means of delivering on-demand content, such as satellite services or internet protocol TV (IPTV).

The booming SVOD market presents immense growth potential. In 2021, the global SVOD market earned revenues of $87.30 billion, an increase of 24.5% over 2020.

Growth in 2021 was mainly attributed to an increase in paid subscriptions (led by the creation of original content), acquisition of top-tier programming, and the proliferation of platforms available.

The COVID-19 pandemic has catalyzed the SVOD market since 2020. Both revenues and paid licenses increased at extraordinary rates, leading to more companies entering the market and numerous new offerings in the space.

While SVOD companies covered in the study can offer advertising-based video on demand (AVOD) or transactional video on demand (TVOD) services as part of their portfolio, pure AVOD or TVOD participants are excluded from the research.

This research does not provide individual regional forecasts for SVOD services, but Frost & Sullivan does provide 2020 versus 2021 revenue market splits by region, including North America; Europe, the Middle East and Africa (EMEA); Asia-Pacific (APAC); and Latin America. The study period is 2019–2028.

Primary and secondary information, in conjunction with internal information databases, underpin the market analysis, observations, and conclusions.

Research Highlights

Even though COVID-19 no longer has the same effect as it did initially, the SVOD market has plenty of room to expand. Three main factors will drive market growth, in terms of revenues and paid licenses:

- Younger generations prefer VOD services rather than pay TV because they are cheaper and offer the flexibility to watch content at any place and time.

- More people will have access to ever faster internet connections and smart devices in upcoming years, boosting the total addressable market for SVOD services.

- Penetration of SVOD services into regions such as Latin America or Africa remains limited but will continue developing.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on the Global Subscription Video on Demand (SVOD) Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Scope of Analysis

SVOD Market as Part of the VOD Ecosystem*

SVOD as Part of the OTT Market*

Key Competitors

Growth Metrics

Growth Drivers

Growth Restraints

Forecast Assumptions

Revenue and Installed Licenses Forecast

Net New Licenses Forecast

Percent Revenue by Region

Revenue and Installed Licenses Forecast Analysis

Revenue and Installed Licenses Forecast Analysis (continued)

Revenue Analysis by Region

Pricing Trends Analysis

Competitive Environment

Revenue Share

Installed Paid Licenses Share

Revenue Share and Installed Paid Licenses Analysis

Revenue Share and Installed Paid Licenses Analysis (continued)

Growth Opportunities

Growth Opportunity 1: Embrace Interactive Experiences

Growth Opportunity 1: Embrace Interactive Experiences (continued)

Growth Opportunity 2: Combine SVOD and AVOD to Enable Expansion among Price-sensitive Customers

Growth Opportunity 2: Combine SVOD and AVOD to Enable Expansion among Price-sensitive Customers (continued)

Growth Opportunity 3: Integrate Technological Advancements to Prevent Streaming Piracy

Growth Opportunity 3: Integrate Technological Advancements to Prevent Streaming Piracy (continued)

Growth Opportunity 4: Bundle Multiple SVOD Services to Avoid a Zero-Sum Game in the Streaming War

Growth Opportunity 4: Bundle Multiple SVOD Services to Avoid a Zero-sum Game in the Streaming War (continued)

Growth Opportunity 5: Diversify Service Offerings to Add Value for the Customer

Growth Opportunity 5: Diversify Service Offerings to Add Value for the Customer (continued)

Growth Opportunity 6: Produce Local Content to Boost Demand

Growth Opportunity 6: Produce Local Content to Boost Demand (continued)

Growth Opportunity 7: Embrace Open Caching Technology to Improve Streaming Quality

Growth Opportunity 7: Embrace Open Caching Technology to Improve Streaming Quality (continued)

Growth Opportunity 8: Utilize Loyalty Programs to Reduce Subscriber Churn

Growth Opportunity 8: Utilize Loyalty Programs to Reduce Subscriber Churn (continued)

Growth Opportunity 9: Encourage Growth in the Smart TV and Streaming Stick Markets

Growth Opportunity 9: Encourage Growth in the Smart TV and Streaming Stick Markets (continued)

Growth Opportunity 10: Seek out Strategic Partnerships with Telcos

Growth Opportunity 10: Seek out Strategic Partnerships with Telcos (continued)

Providers included in “Others” in the SVOD Revenue and Installed Paid Licenses Share Section

Your Next Steps

Why Frost, Why Now?

List of Exhibits

Legal Disclaimer

Popular Topics

Research Highlights

Even though COVID-19 no longer has the same effect as it did initially, the SVOD market has plenty of room to expand. Three main factors will drive market growth, in terms of revenues and paid licenses:

- Younger generations prefer VOD services rather than pay TV because they are cheaper and offer the flexibility to watch content at any place and time.

- More people will have access to ever faster internet connections and smart devices in upcoming years, boosting the total addressable market for SVOD services.

- Penetration of SVOD services into regions such as Latin America or Africa remains limited but will continue developing.

| Deliverable Type | Market Research |

|---|---|

| Author | Lara Forlino |

| Industries | Entertainment and Media |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | Video on Demand Market |

| Keyword 2 | SVOD |

| Keyword 3 | Subscription Video on Demand |

| Podcast | No |

| WIP Number | K7A0-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB