Fintech

The global experience with COVID-19 gave financial services companies a unique opportunity to refocus and rebuild the trust of their customers, ultimately leading to their loyalty. Banking is now embedded in the customers’ lifestyle; and as part of banks' continued digital transformation, they can serve their customers through multiple channels and technologies. The use of technology to automate processes removes internal obstacles and creates a seamless customer experience. Key to this automation is advances like AI, data analytics, and systems that can react quickly to the market.

The acceleration of work-from-home culture and convergence of technology with financial services (Fintech) aligns with Frost & Sullivan's own breadth and depth of expertise. Frost & Sullivan tracks the digital transformation of financial services companies and fintech disruptors. The Fintech industry is extensive. It is comprised of multiple subsectors; each of which have trends specific to them, and to each global region. Having a 360-degree view of emerging technologies, the global financial services industry, and regional expertise creates a unique perspective that is valuable to our research and advisory for clients.

The Fintech subsectors we cover include:

• Verticals: Digital Banking, Insurtech, Wealthtech

• Enablers: Cloud, Data and Analytics, Blockchain, Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT)

• Services: Lending Platforms, Regtech, Paytech

-

19 Dec 2019 | Asia Pacific

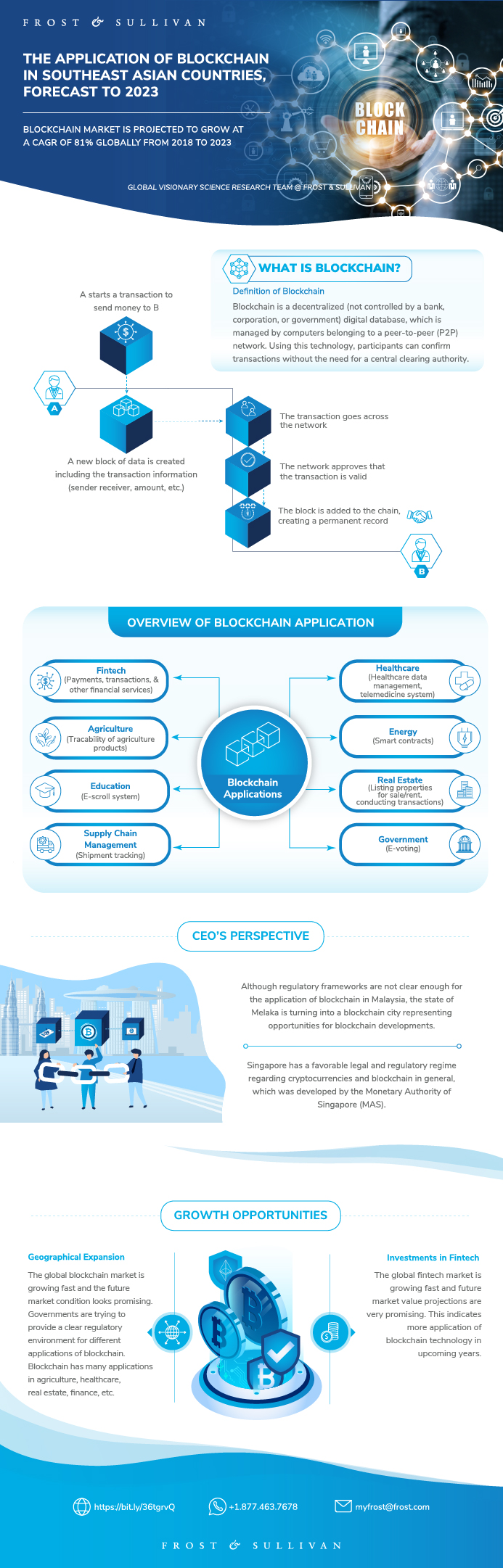

The Application of Blockchain in Southeast Asian Countries, Forecast to 2023

Blockchain Market is Projected to Grow at a CAGR of 81% Globally from 2018 to 2023

Blockchain, which is a decentralized digital database, supports participants when they confirm their transactions without the need for a central authority to approve/accept the transaction. Although this technology has been recognized mainly by digital currencies such as Bitcoin and other cryptocurrencies, it has several other applications in diffe...

$3,000.00

Special Price $2,250.00 save 25 %

-

18 Dec 2019 | Asia Pacific

The Malaysian FinTech Landscape, 2019

The Malaysian Banking Industry is on the Brink of Technological Disruption

This study covers the reaction of traditional banks and other financial service companies, the Malaysian regulators and supporting organisations to the new-generation trend of FinTech and explores FinTech start-ups active in the Malaysian market. A regulator holds the key to growing markets; this is true of FinTech in Malaysia. We have captured ke...

$1,500.00

Special Price $1,125.00 save 25 %

-

28 Aug 2019 | Asia Pacific

The Malaysian InsurTech Landscape, 2019

Insurtech Players Spur Growth in the Malaysian Insurance Industry

This study covers the reaction of traditional insurance companies, the Malaysian government and supporting organisations to the new-generation trend of InsurTech and explores InsurTech start-ups active in the Malaysian market. The Malaysian insurance industry has been showing good growth since its inception as Bank Negara Malaysia (BNM; the centra...

$1,500.00

Special Price $1,125.00 save 25 %

-

07 Jun 2019 | Global

Smart Home Insurance—Role of Emerging Technologies, 2019

New Business Models and Enhanced Customer Engagement Critical for Insurers to Retain Relevance and Competitiveness

Consumers' interest in connected devices has been one of the significant drivers of innovation in the sector. Over the years, as the cost of sensors declined, the number of IoT-enabled devices has increased steadily and they have become more affordable and viable. However, consumers continue to be wary about data privacy and sharing. The applicati...

$1,500.00

Special Price $1,125.00 save 25 %

-

29 Dec 2017 | Global

FinTech Watchlist Company Profile—SoFi

Peer-to-Peer Lenders are Redefining the Student and Personal Loan Market and Challenging the Century Old Established Banks

The study covers one of the leading online lenders in the United States. SoFi that started offering student loan refinancing has moved much beyond and rolled out a series of products to cater to the full stack of the market. In the study, Frost & Sullivan has presented the evolution of SoFi tracking back to May 2012, when it launched is the first p...

$1,500.00

Special Price $1,125.00 save 25 %

-

26 Dec 2017 | Global

FinTech Watchlist Company Profile – ZhongAn

Online Insurance Company ZhongAn Creating New Markets and Disrupting Existing Markets in the Chinese P&C Insurance Industry

The study covers the leading online insurance provider ZhongAn in China. ZhongAn has launched many new products mostly partnering with the industry participants. It started by offering Merchant Performance Insurance, Zhonglebao in November 2013. Since then it has ventured in many different market segments covering e-Commerce, Electronic Products, ...

$1,500.00

Special Price $1,125.00 save 25 %

-

11 Dec 2017 | Global

Fintech Watchlist Company Profile—Betterment

To Avoid Being Disrupted, Legacy Wealth Management Companies Should Embrace Robo-advisory to Address New Areas Of Growth

The study covers one of the leading Robo-advisor in the United States. Betterment, that started offering online wealth management advice to the masses, has moved much beyond and rolled out a series of products to cater to the full stack of the market. In the study, Frost & Sullivan has presented the evolution of Betterment tracking back from its st...

$1,500.00

Special Price $1,125.00 save 25 %

-

10 Nov 2017 | Europe

The Global Paytech Market, 2017: Driving Transaction Transformation

The Application of Enabling Technologies will Underpin the Delivery of Disruptive Payment Services to Customers

Fintech companies are disrupting the traditional banking and financial services ecosystem by leveraging innovative technologies in order to provide value-added services. Paytech appears as the most exciting subsector of the Fintech industry. Indeed, most technology innovations are used to perform payment transactions in a disruptive way: faster, an...

$1,500.00

Special Price $1,125.00 save 25 %

-

12 Oct 2017 | North America

An End User Perspective on Navigating Digital Transformation in Finance, Banking, and Insurance, Global, 2017

Gain a Competitive Advantage Using Insights from IT Buyers

The overall research objective is to measure the current use and future decision making behavior toward information technology (IT) in Finance, Banking, and Insurance, specifically: Enterprise Mobility Management, eCommerce/mCommerce, Unified Communications & Collaboration (UCC), Infrastructure and Data Centers, Big Data and Analytics’ Omnichanne...

$3,000.00

Special Price $2,250.00 save 25 %

-

21 Jul 2017 | Global

Disruption in Global Financial Services, 2017—Machine Learning is Imperative

Realigning Customer Engagement with Predictive Analytics and Customization

Technology is disrupting the financial services industry. Also termed fintech, tech-enabled products and services in the industry are further enhanced by advanced technologies such as cloud, IoT, analytics, artificial intelligence (AI), and machine language (ML). This research service explores the impact of ML on the financial services industry. Th...

$3,000.00

Special Price $2,250.00 save 25 %

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB