Insight on North American OEM ADAS Sensor Strategies

Insight on North American OEM ADAS Sensor Strategies

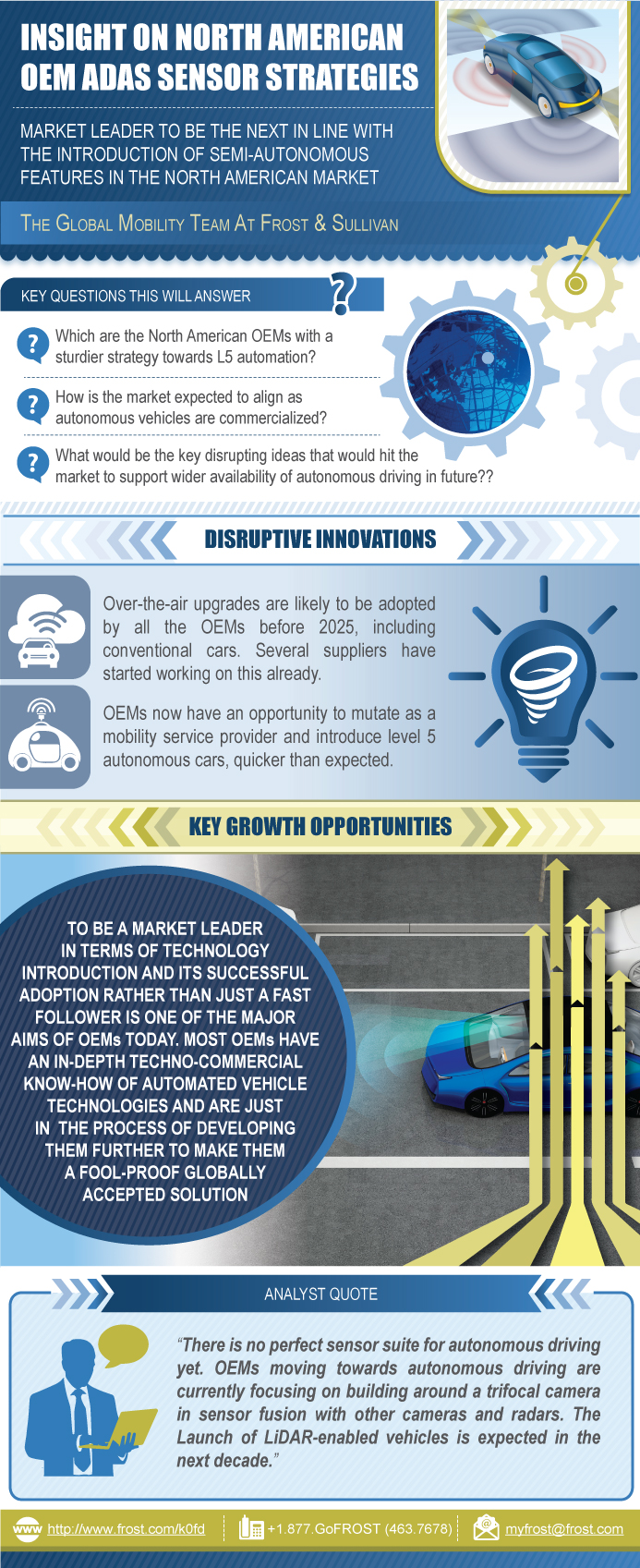

Market Leader to be the Next in Line with the Introduction of Semi-autonomous Features in the North American Market

RELEASE DATE

30-Sep-2016

30-Sep-2016

REGION

Global

Global

Research Code: K0FD-01-00-00-00

SKU: AU01377-GL-MR_19071

$4,950.00

Special Price $3,712.50 save 25 %

In stock

SKU

AU01377-GL-MR_19071

Description

While OEMs are racing toward achieving level 4 and 5 automation features in their vehicles in North America, there will be major changes and improvements in the ADAS sensors that will be used to achieve the desired features. With this in mind, some OEMs are also looking forward to transforming themselves as mobility service providers rather than remain a conventional OEM. Several key disruptions are expected in the autonomous driving space within the next 5 years.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

NA OEM Approach for Step-wise Introduction of Autonomous Driving

Overview of Active Safety and Autonomous Driving Feature Availability

Automotive Sensors—Performance and Qualitative Benefits

Research Scope

Vehicle Segmentation

Ford Motor Co.—Autonomous Driving Vision

Sensor Suite—Current Generation Versus Future Expectation

Ford Group—Functional Roadmap

Ford—Functional Timeline: Toward Level 5 Automation

Model-wise ADAS Capabilities—Major Models

Ford—Penetration Rates of Key ADAS Sensors

Ford Motor Co.—Sensor Suite Strategy: Production Vehicle

FCA Strategy

Sensor Suite—Current Generation Versus Future Expectation

FCA—Functional Roadmap

FCA—Functional Timeline

Model-wise ADAS Capability—Current

FCA-Penetration Rates of Key ADAS Sensors

FCA—Sensor Suite Strategy: Production Vehicle

GM—Autonomous Driving Strategy

GM—Functional Timeline: Toward Level 5 Automation

Sensor Suite—Current Generation Versus Future Expectation

GM—Functional Roadmap

Model-wise ADAS Capability—Current

GM—Penetration Rates of Key ADAS Sensors

GM—Sensor Suit Strategy: Production vehicle

Tesla Motors—Autonomous Driving Capabilities

Over-the-Air Updates—Standout Point of Technology

Tesla—Autopilot

Sensor Suite—Current Generation Versus Future Expectation

Vital Conclusions and Takeaways

Legal Disclaimer

Market Engineering Methodology

- 1. Autonomous Driving Market: Overview of Feature Availability, North America, 2015

- 2. Autonomous Driving Market: Comparative Analysis of ADAS Sensor Suite, North America, 2015–2022

- 3. Automotive Sensors Market: Ford Group’s Current Versus Future Production Vehicle Sensor Suite, North America, 2016 and 2022

- 4. Automotive Sensors Market: Ford Group’s Current Versus Future Scenario, North America, 2015–2022

- 5. Automotive Sensors Market: Ford Group—Market Penetration, North America, 2015 and 2022

- 6. Automotive Sensors Market: Ford Group—Major Suppliers, US, 2015–2022

- 7. Automotive Sensors Market: FCA’s Sensor Suite—Current Versus Future, North America, 2015 and 2022

- 8. Automotive Sensors Market: FCA—Current Versus Future Scenario, North America, 2015 and 2022

- 9. Automotive Sensors Market: FCA Group—Market Penetration, North America, 2015 and 2022

- 10. Automotive Sensors Market: Ford Group—Major Suppliers, North America, 2015–2022

- 11. Autonomous Driving Market: GM’s AD Strategy, North America, 2015–2022

- 12. Automotive Sensors Market: GM’s Sensor Suite—Current Versus Future, North America, 2015 and 2022

- 13. Automotive Sensors Market: GM—Current Versus Future Scenario, North America, 2015–2022

- 14. Automotive Sensors Market: General Motors—Market Penetration, North America, 2015 and 2022

- 15. Automotive Sensors Market: General Motors—Major Suppliers, US, 2015–2022

- 16. Automotive Sensors Market: Tesla Motors—Autopilot, North America, 2015

- 17. Automotive Sensors Market: Tesla Motors—Autopilot, North America, 2015

- 18. Automotive Sensors Market: Tesla Motors’ Sensor Suite—Current Versus Future,

- 19. North America, 2015 and 2022

- 1. Automated Driving Market: Ford Motor Co.—Autonomous Driving Vision, North America, 2016

- 2. Automotive Sensors Market: Ford Group’s Functional Roadmap Sensor Suite, North America, 2015–2035

- 3. Autonomous Driving Market: Ford Motor Co.—Functional Timeline, North America, 2015–2022

- 4. Automotive Sensors Market: FCA’s Functional Roadmap With Respect to Sensor Suite, North America, 2015–2035

- 5. Autonomous Driving Market: Ford Motor Co.—Functional Timeline, North America, 2015, 2020, and Beyond 2025

- 6. Autonomous Driving Market: GM—Functional Timeline, North America, 2015–2022

- 7. Automotive Sensors Market: GM—Functional Roadmap with Respect to Sensor Suite, North America, 2015 and beyond 2035

- 8. Automotive Sensors Market: Tesla Motors—OTA Updates, North America, 2015

Popular Topics

While OEMs are racing toward achieving level 4 and 5 automation features in their vehicles in North America, there will be major changes and improvements in the ADAS sensors that will be used to achieve the desired features. With this in mind, some OEMs are also looking forward to transforming themselves as mobility service providers rather than remain a conventional OEM. Several key disruptions are expected in the autonomous driving space within the next 5 years.

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || NA OEM Approach for Step-wise Introduction of Autonomous Driving~ || Overview of Active Safety and Autonomous Driving Feature Availability~ || Automotive Sensors—Performance and Qualitative Benefits~ | Research Scope and Segmentation~ || Research Scope~ || Vehicle Segmentation~ | Ford Motor Group—Ford and Lincoln~ || Ford Motor Co.—Autonomous Driving Vision~ || Sensor Suite—Current Generation Versus Future Expectation~ || Ford Group—Functional Roadmap~ || Ford—Functional Timeline: Toward Level 5 Automation~ || Model-wise ADAS Capabilities—Major Models~ || Ford—Penetration Rates of Key ADAS Sensors~ || Ford Motor Co.—Sensor Suite Strategy: Production Vehicle~ | Fiat Chrysler Automobiles—Fiat, Chrysler, Jeep, Dodge, RAM~ || FCA Strategy~ || Sensor Suite—Current Generation Versus Future Expectation~ || FCA—Functional Roadmap~ || FCA—Functional Timeline~ || Model-wise ADAS Capability—Current~ || FCA-Penetration Rates of Key ADAS Sensors~ || FCA—Sensor Suite Strategy: Production Vehicle~ | General Motors—Buick, Chrysler, Chevrolet, GMC~ || GM—Autonomous Driving Strategy~ || GM—Functional Timeline: Toward Level 5 Automation~ || Sensor Suite—Current Generation Versus Future Expectation~ || GM—Functional Roadmap~ || Model-wise ADAS Capability—Current~ || GM—Penetration Rates of Key ADAS Sensors~ || GM—Sensor Suit Strategy: Production vehicle~ | Tesla Motors, Inc.~ || Tesla Motors—Autonomous Driving Capabilities~ || Over-the-Air Updates—Standout Point of Technology~ || Tesla—Autopilot~ || Sensor Suite—Current Generation Versus Future Expectation~ | Vital Conclusions and Outlook for the Future~ || Vital Conclusions and Takeaways~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Autonomous Driving Market: Overview of Feature Availability, North America, 2015~ 2. Autonomous Driving Market: Comparative Analysis of ADAS Sensor Suite, North America, 2015–2022~ 3. Automotive Sensors Market: Ford Group’s Current Versus Future Production Vehicle Sensor Suite, North America, 2016 and 2022~ 4. Automotive Sensors Market: Ford Group’s Current Versus Future Scenario, North America, 2015–2022~ 5. Automotive Sensors Market: Ford Group—Market Penetration, North America, 2015 and 2022~ 6. Automotive Sensors Market: Ford Group—Major Suppliers, US, 2015–2022~ 7. Automotive Sensors Market: FCA’s Sensor Suite—Current Versus Future, North America, 2015 and 2022~ 8. Automotive Sensors Market: FCA—Current Versus Future Scenario, North America, 2015 and 2022~ 9. Automotive Sensors Market: FCA Group—Market Penetration, North America, 2015 and 2022~ 10. Automotive Sensors Market: Ford Group—Major Suppliers, North America, 2015–2022~ 11. Autonomous Driving Market: GM’s AD Strategy, North America, 2015–2022~ 12. Automotive Sensors Market: GM’s Sensor Suite—Current Versus Future, North America, 2015 and 2022~ 13. Automotive Sensors Market: GM—Current Versus Future Scenario, North America, 2015–2022~ 14. Automotive Sensors Market: General Motors—Market Penetration, North America, 2015 and 2022~ 15. Automotive Sensors Market: General Motors—Major Suppliers, US, 2015–2022~ 16. Automotive Sensors Market: Tesla Motors—Autopilot, North America, 2015~ 17. Automotive Sensors Market: Tesla Motors—Autopilot, North America, 2015~ 18. Automotive Sensors Market: Tesla Motors’ Sensor Suite—Current Versus Future, ~ 19. North America, 2015 and 2022~| 1. Automated Driving Market: Ford Motor Co.—Autonomous Driving Vision, North America, 2016~ 2. Automotive Sensors Market: Ford Group’s Functional Roadmap Sensor Suite, North America, 2015–2035~ 3. Autonomous Driving Market: Ford Motor Co.—Functional Timeline, North America, 2015–2022~ 4. Automotive Sensors Market: FCA’s Functional Roadmap With Respect to Sensor Suite, North America, 2015–2035~ 5. Autonomous Driving Market: Ford Motor Co.—Functional Timeline, North America, 2015, 2020, and Beyond 2025~ 6. Autonomous Driving Market: GM—Functional Timeline, North America, 2015–2022~ 7. Automotive Sensors Market: GM—Functional Roadmap with Respect to Sensor Suite, North America, 2015 and beyond 2035~ 8. Automotive Sensors Market: Tesla Motors—OTA Updates, North America, 2015~ |

| Author | Anirudh Venkitaraman |

| Industries | Automotive |

| WIP Number | K0FD-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB