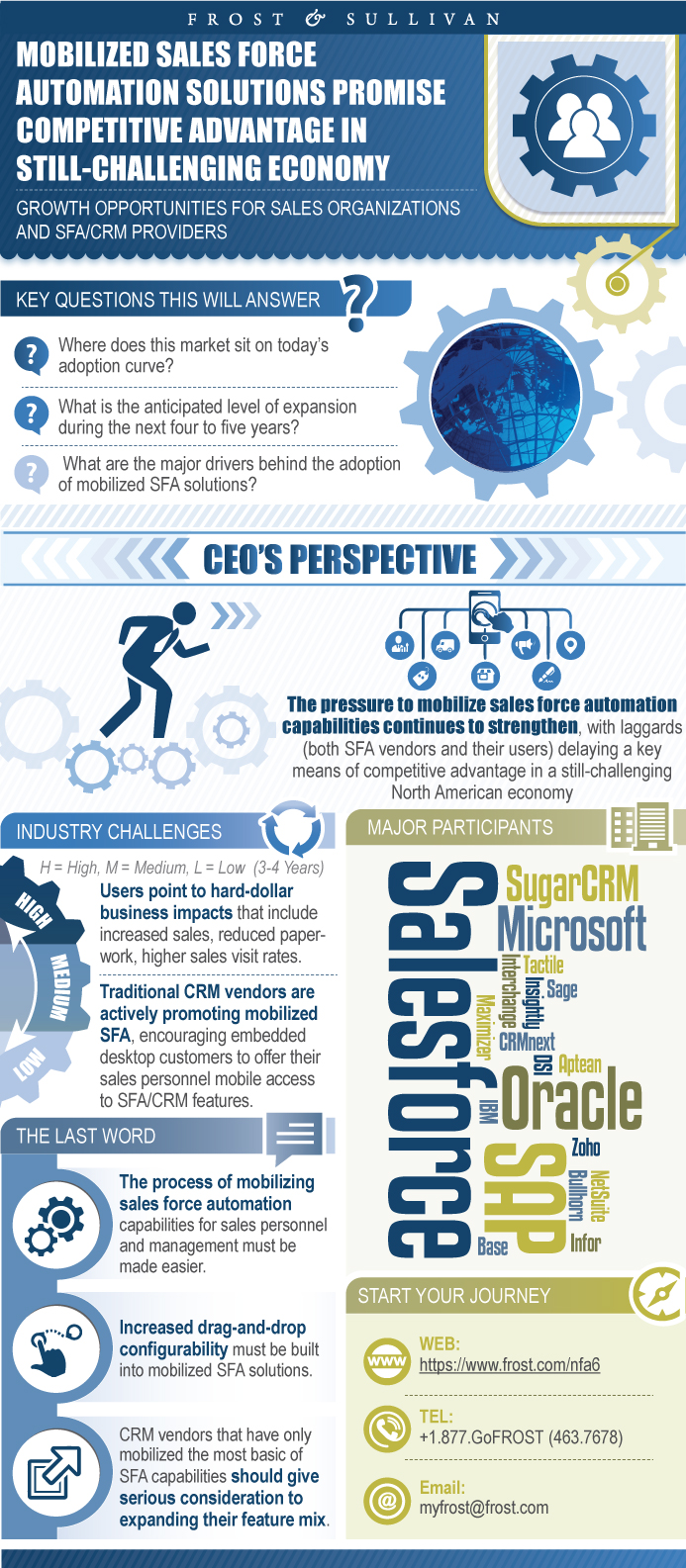

Mobilized Sales Force Automation Solutions Promise Competitive Advantage in Still-Challenging Economy

Mobilized Sales Force Automation Solutions Promise Competitive Advantage in Still-Challenging Economy

Growth Opportunities for Sales Organizations and SFA/CRM Providers

RELEASE DATE

19-Aug-2016

19-Aug-2016

REGION

North America

North America

Deliverable Type

Market Research

Market Research

Research Code: NFA6-01-00-00-00

SKU: TE03628-NA-MR_18909

$4,950.00

In stock

SKU

TE03628-NA-MR_18909

Now that sales representatives and their managers are able to have mobile access to their sales force automation (SFA) solutions, everyday selling processes and activities can be automated, accelerated and optimized. This study examines how this market is progressing as mobile-centric app developers, traditional CRM vendors, and other large business suite software providers promote mobilization to both new and current customers. Key trends, solution features and adoption dynamics are discussed. An analysis of the competitive landscape (including participant profiles), revenue/user/channel forecasts, and growth recommendations are included.

Key Findings

Key Findings (continued)

Market Engineering Measurements

Market Engineering Measurements (continued)

CEO’s Perspective

Market Definitions

Market Definitions (continued)

Key Questions this Study will Answer

Original Solution Developers

Distribution Channels

Distribution Channels Discussion

Key Trends

Key Trends (continued)

Key Trends (continued)

Market Drivers

Market Restraints

Forecast Assumptions

User and Revenue Forecast

User and Revenue Forecast Discussion

Pricing Trends and Forecast

Pricing Trends and Forecast Discussion

Percent Revenue Forecast by Distribution Channel

Percent Revenue Forecast Discussion by Distribution Channel

Demand Analysis

Demand Analysis (continued)

Demand Analysis (continued)

Demand Analysis (continued)

Demand Analysis (continued)

Demand Analysis Discussion

Market Share for Mobilized SFA Solutions

Competitive Environment

Top Competitors

Top Competitors (continued)

Top Competitors (continued)

Top Competitors (continued)

Top Competitors (continued)

Top Competitors (continued)

Competitive Factors and Assessment

The Last Word—Predictions

The Last Word—Recommendations

Legal Disclaimer

Market Engineering Methodology

Market Engineering Measurements

Market Engineering Measurements (continued)

Additional Sources of Information on the North American Mobile Sales Force Automation Market

Aptean Profile

AT&T Profile

Data Systems International, Inc. (DSI) Profile

Infor Profile

Interchange Solutions Profile

Maximizer Profile

NetSuite Profile

Salesforce Profile

SAP Profile

SugarCRM Profile

Tactile Profile

Verizon Profile

Learn More—Next Steps

List of Exhibits

List of Exhibits (continued)

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

Now that sales representatives and their managers are able to have mobile access to their sales force automation (SFA) solutions, everyday selling processes and activities can be automated, accelerated and optimized. This study examines how this market is progressing as mobile-centric app developers, traditional CRM vendors, and other large business suite software providers promote mobilization to both new and current customers. Key trends, solution features and adoption dynamics are discussed. An analysis of the competitive landscape (including participant profiles), revenue/user/channel forecasts, and growth recommendations are included.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Jeanine Sterling |

| Industries | Telecom |

| WIP Number | NFA6-01-00-00-00 |

| Is Prebook | No |