Start-ups Disrupting the Global Automotive and Mobility Industry, 2016–2017

Start-ups Disrupting the Global Automotive and Mobility Industry, 2016–2017

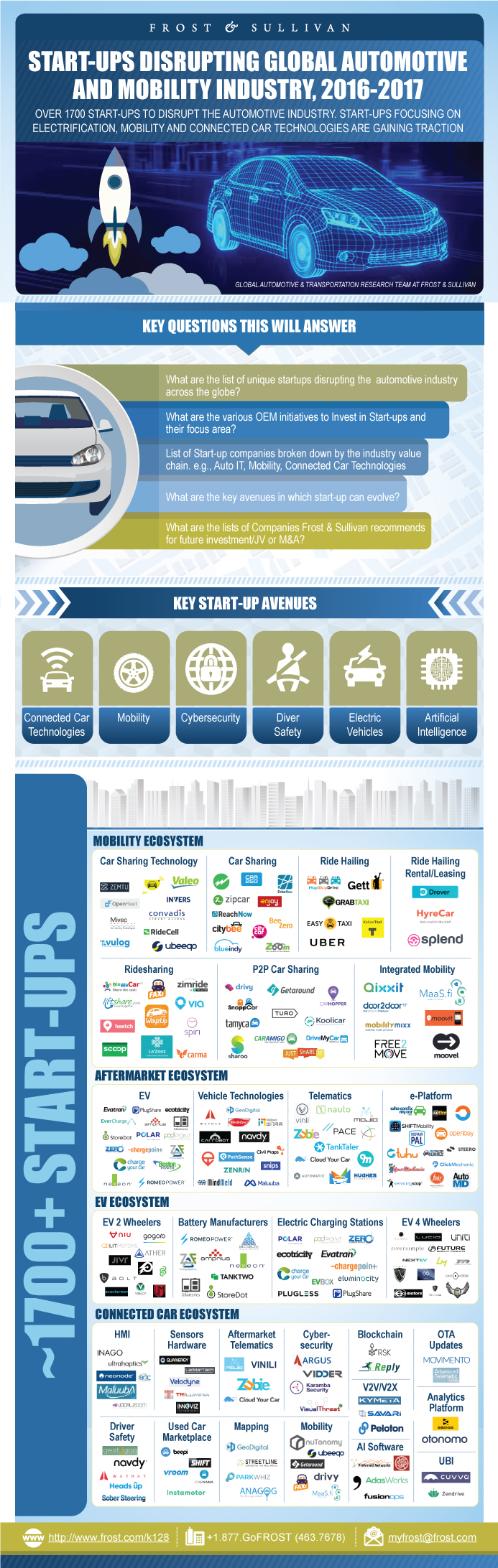

Over 1,700 Start-ups Focused on Electrification, Mobility, and Connected Car Technologies are Gaining Traction

06-Apr-2017

Global

Market Research

The study identifies and analyzes various start-ups in the automotive space across various verticals - ranging from connected car technologies to aftermarket solution providers. Start-ups are identified based on their solutions and their globe reach. Frost & Sullivan has examined the evolution of the shortlisted start-ups and their offerings to customers. In-depth profiles have been created for those companies expected to disrupt the market. Most of the start-ups in North America come from Silicon Valley, California. Automotive start-ups have been beefing up their presence in the Detroit area to attract engineering talent from traditional automakers and directly engage with OEMs in their facilities.

Key Findings

Why Start-ups? Reasons for Investing

Top-level Snapshot of Funding across Technology

Snapshot of Major Automakers’ Investment and M&A Activity (2011–2016)

Implications—Over ~1,700 Start-ups are Disrupting the Automotive Industry Supply Chain

Segmentation of Start-ups

List of Start-ups in the AI Ecosystem

List of Start-ups in the Mobility Ecosystem

List of Start-ups in the EV Ecosystem

List of Start-ups in the Aftermarket Ecosystem

List of Start-ups in the Connected Car Ecosystem

Start-up Ecosystem in Israel

Start-up Ecosystem in India

Start-up Ecosystem in Africa

Automotive Start-up Hotspot by Region

Key Domain Focus for Future Start-ups

Key Criteria—List of Companies

Shortlisted Start-ups—Summary

Shortlisted Start-ups—Summary (continued)

Research Scope and Objectives

Key Questions this Study will Answer

Research Methodology

Start-up Avenues

OEM Start-up Initiatives

OEM Start-up Initiatives (continued)

OEM Start-up Initiatives (continued)

Start-up Avenues—Connected Car Technologies

Start-up Avenues—Auto IT

Start-up Avenues—Mobility

List of Start-up Companies for Comparison

List of Start-up Companies for Comparison (continued)

List of Start-up Companies for Comparison (continued)

Key Selection Criteria

Key Criteria—List of Companies

Final List of Selected Companies—Company Score Card

Final List of Selected Companies—Company Score Card (continued)

Shortlisted Start-ups—By Region

Innoviz

AdasWorks

Gestigon (Recently Acquired by Valeo)

Maluuba (Recently Acquired by Microsoft)

WAYRAY

Rightware (Recently Acquired by Thundersoft)

Zendrive

Lynx

SHIFTMobility

FusionOps

VocalZoom—Microphone Technology

Karamba Security

Kymeta Corporation

Movimento (Recently Acquired by Delphi)

MaaS Global’s Solutions in the Whim App—Links the Entire Industry Value Chain

ITS and Mobility Integration Platform—Helsinki MAAs Concept

Ubeeqo

Oxbotica

Bolt Mobility

Faxi

nuTonomy

Civil Maps

GeoDigital

Lit Motors

Smove

Future Mobility Corp

Cloud Your Car

5 Major Growth Opportunities in the Automotive and Mobility Industry

Key Conclusions and Findings

The Last Word—3 Big Predictions

Legal Disclaimer

Investment Priority

Conclusion

Conclusion (continued)

Conclusion (continued)

Conclusion (continued)

List of Other Dynamic Start-ups

List of Other Dynamic Start-ups (continued)

List of P2P Car Sharing and Mobility Integrator Start-ups

List of On-demand Bus Transit Start-ups

List of on e-Hailing Start-ups—Europe

List of on e-Hailing Start-ups—North America/LATAM/Asia-Pacific

List of e-Hailing Start-ups—Europe/North America/LATAM/Asia-Pacific

Case Study—Recent Investments in/Acquisitions of Start-ups: Auto IT

ATS Advanced Telematics

Movimento

Vroom

Instamotor

Carvana

SHIFTMobility

Beepi

Karamba Security

VisualThreat

Argus

RSK Labs

Enigma

Case Study—Recent Investments in/Acquisitions of Start-ups: Mobility

nuTonomy

Faxi

Drivy

Getaround

ParkWhiz

Anagog

Streetline

Atieva

Lit Motors

Smove

Future Mobility Corp

Elio Motors

NextEV

Bolt Mobility

Case Study—Recent Investments in/Acquisitions of Start-ups

Case Study—Recent Investments in/Acquisitions of Start-ups (continued)

Maluuba

Neonode

FusionOps

Gestigon

iNAGO

Lynx

Ultrahaptics

Zendrive

Cuvva

Navdy

WAYRAY

HUDWAY

Quanergy

Veloydne

TriLumina

Leddar Tech

Innoviz

Rightware

Sober Steering—Sensor Diagnostics

GeoDigital

Civil Maps

Vinli

Cloud Your Car

Mojio

Zubie

Preferred Networks

Comma.ai

AdasWorks

CloudMade

Zendrive

Vidder

Market Engineering Methodology

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Ramnath Eswaravadivoo |

| Industries | Automotive |

| WIP Number | K128-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9A70-A6,9AF6-A6,9AF7-A6,9B07-C1 |