Strategic Analysis of the Off-Highway Vehicle (OHV) and OHV Telematics Market in China

Strategic Analysis of the Off-Highway Vehicle (OHV) and OHV Telematics Market in China

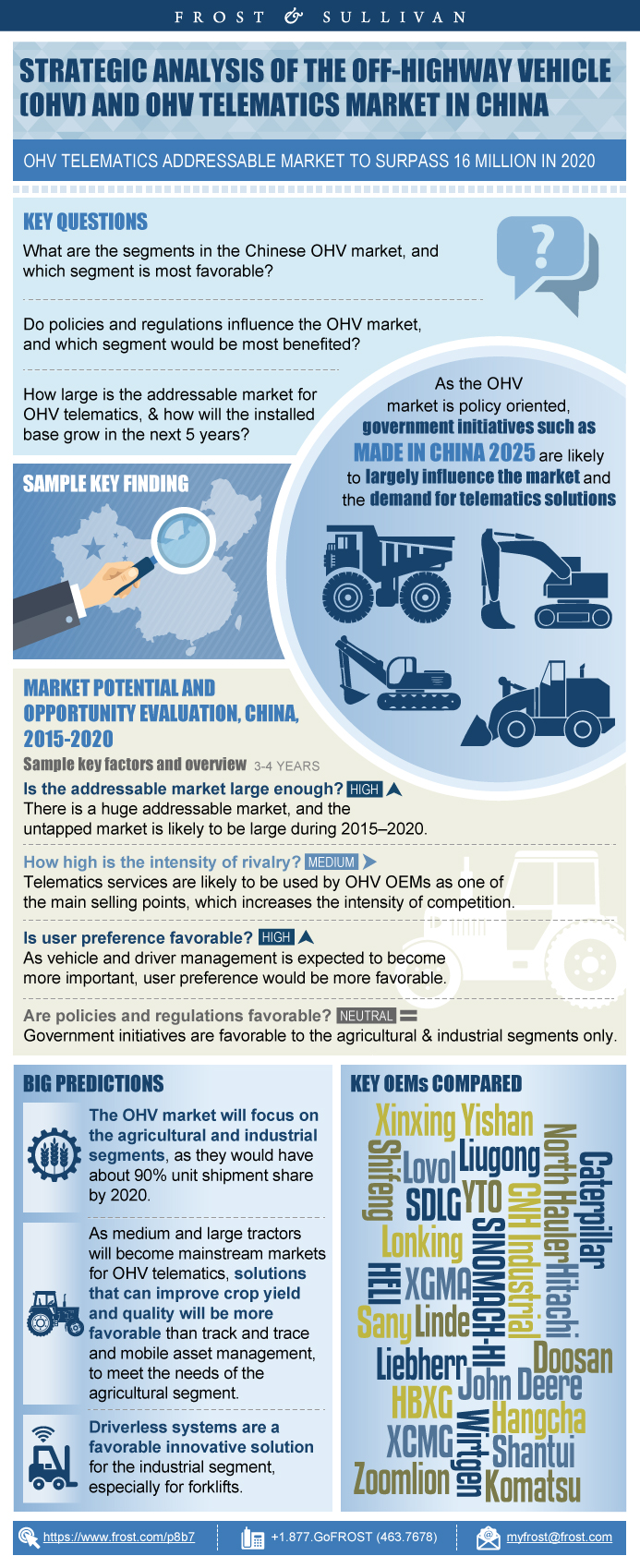

OHV Telematics Addressable Market to Surpass 16 Million in 2020

RELEASE DATE

26-Jul-2016

26-Jul-2016

REGION

Asia Pacific

Asia Pacific

Deliverable Type

Market Research

Market Research

Research Code: P8B7-01-00-00-00

SKU: AU01328-AP-MR_18823

$4,950.00

In stock

SKU

AU01328-AP-MR_18823

This research service offers a strategic analysis of the nascent market for the off-highway vehicles (OHV) and OHV telematics market in China. It provides an overview of market trends, growth prospects, and key sectors for growth. It also contains case studies of key market participants. It includes a market structure and outlook, market potential and opportunity analysis for the OHV market, and case studies of OHV telematics solutions. The base year is 2015, with forecasts for the 2016–2020 period.

Key Findings

Research Scope

Research Aims and Objectives

Research Background

Research Methodology

- Secondary Research

- Primary Research

Key OEMs and TSPs Compared in this Study

OHV Market—End-user Segments and Definitions

OHV Telematics Market—Segments and Definitions

Country-level Demographic Highlights

Province-level Demographic Highlights

Country-level Economic Highlights

Province-level Economic Highlights

Key End-user Segment Highlights

Key Policies and Regulations

Roadmap of Made in China 2025

Key Advantages of the Belt and Road Initiative

Roadmap of Emission Standard for Diesel-powered OHVs

Key Market Segments and Products

Unit Shipment and Outlook

Unit Shipment and Outlook for Medium and Large Tractors

Unit Shipment and Outlook for Wheel Loaders

Unit Shipment and Outlook for Excavators

Unit Shipment and Outlook for Truck Cranes

Unit Shipment and Outlook for Rollers

Unit Shipment and Outlook for Forklifts

Unit Shipment and Outlook for Off-highway Trucks

Unit Shipment and Outlook for Pavement Planers

Unit Shipment and Outlook for Bulldozers

Key OHV OEMs—Product Features

Sany—Successful Global Expansion

XCMG—Successful in Exports

Wirtgen GmbH—Successful in Entering the Chinese Market

Key Developments and Outlook

Addressable Market and Outlook

Addressable Market by Segment

Market Penetration

Service Demand Trend

Value Chain

Competitive Structure

Potential Emerging Market

Market Potential and Opportunity Evaluation

Opportunity Strategy Evaluation (OSE) Grid

XCMG’s IoT Smartphone

Shantui’s Remote-control Dozer

Kubota Smart Agri System

3 Big Predictions

Legal Disclaimer

Abbreviations and Acronyms Used

Market Engineering Methodology

- 1. Total OHV and OHV Telematics Market: Key Takeaways, China, 2015

- 2. Total OHV and OHV Telematics Market: OHV Unit Shipment and OHV Telematics Installed Base, China, 2010–2020

- 3. Total OHV and OHV Telematics Market: Key Questions This Study Will Answer, China, 2015

- 4. Economic Growth Rate, Global Key Countries, 2015–2020

- 5. Total OHV and OHV Telematics Market: Key Policies and Regulations, China, 2015

- 6. Total OHV and OHV Telematics Market: Made in China 2025, China, 2015–2025

- 7. Total OHV and OHV Telematics Market: Belt and Road Initiative, China, 2015

- 8. OHV Market: Product Features, China, 2015

- 9. OHV Telematics Market: Key Development, China, 2003–2020

- 10. OHV Telematics Market: Service Demand Trend, China, 2015

- 11. OHV Telematics Market: Value Chain, China, 2015

- 12. OHV Telematics Market: Potential Emerging Market, China, 2015

- 13. OHV Telematics Market: Market Potential and Opportunity Evaluation, China, 2015–2020

- 1. Population Structure, China, 2015 and 2020

- 2. Population by Age Structure, China, 2015 and 2020

- 3. Urbanization Rate by Region, China, 2010 and 2015

- 4. Nominal GDP per Capita by Region, China, 2010 and 2015

- 5. Food Production, China, 2011–2015

- 6. Real Estate Development Investment, China, 2011–2015

- 7. Purchasing Managers’ Index (PMI), China, Jun. 2013 to Dec. 2015

- 8. Coal Mining Investment, China, 2011–2015

- 9. OHV Market: Number of Parc by Segment, China, 2015 and 2020

- 10. OHV Market: Number of Parc in the Agricultural Segment by Product, China, 2015

- 11. OHV Market: Number of Parc in the Construction Segment by Product, China, 2015

- 12. OHV Market: Number of Parc in the Industrial Segment by Product, China 2015

- 13. OHV Market: Number of Parc in the Mining Segment by Product, China, 2015

- 14. OHV Market: Unit Shipment Forecast, China, 2010–2020

- 15. OHV Market: Percent Unit Shipment by Product, China, 2015

- 16. OHV Market: Percent Unit Shipment by Product, China, 2020

- 17. OHV Market: Unit Shipment Forecast for Medium and Large Tractors, China, 2010–2020

- 18. OHV Market: Unit Shipment Forecast for Wheel Loaders, China, 2010–2020

- 19. OHV Market: Unit Shipment Forecast for Excavators, China, 2010–2020

- 20. OHV Market: Unit Shipment Forecast for Truck Cranes, China, 2010–2020

- 21. OHV Market: Unit Shipment Forecast for Rollers, China, 2010–2020

- 22. OHV Market: Unit Shipment Forecast for Forklifts, China, 2010–2020

- 23. OHV Market: Unit Shipment Forecast for Off-highway Trucks, China, 2010–2020

- 24. OHV Market: Unit Shipment Forecast for Pavement Planers, China, 2010–2020

- 25. OHV Market: Unit Shipment Forecast for Bulldozers, China, 2010–2020

- 26. OHV Telematics Market: Unit Shipment Forecast, China, 2010–2020

- 27. OHV Telematics Market: Addressable Market by End-user Segment, China, 2015

- 28. OHV Telematics Market: Addressable Market by End-user Segment, China, 2020

- 29. OHV Telematics Market: Addressable Market in the Agricultural Segment, China, 2015–2020

- 30. OHV Telematics Market: Addressable Market in the Construction Segment, China, 2015–2020

- 31. OHV Telematics Market: Addressable Market in the Industrial Segment, China, 2015–2020

- 32. OHV Telematics Market: Addressable Market in the Mining Segment, China, 2015–2020

- 33. OHV Telematics Market: Installed Base, China, 2010–2020

- 34. OHV Telematics Market: Addressable Market Penetration, China, 2015

- 35. OHV Telematics Market: Addressable Market Penetration, China, 2020

- 36. OHV Telematics Market: Market Share of OHV TSPs, China, 2015

- 37. OHV Telematics Market: Opportunity Strategy Evaluation, China, 2015

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

This research service offers a strategic analysis of the nascent market for the off-highway vehicles (OHV) and OHV telematics market in China. It provides an overview of market trends, growth prospects, and key sectors for growth. It also contains case studies of key market participants. It includes a market structure and outlook, market potential and opportunity analysis for the OHV market, and case studies of OHV telematics solutions. The base year is 2015, with forecasts for the 2016–2020 period.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ ||| Secondary Research~ ||| Primary Research~ || Key OEMs and TSPs Compared in this Study~ | Definitions and Segmentation~ || OHV Market—End-user Segments and Definitions~ ||| Agriculture~ ||| Construction~ ||| Industrial~ ||| Mining~ || OHV Telematics Market—Segments and Definitions~ ||| Advanced Management~ ||| Driver Management~ ||| Vehicle Management~ ||| Base-level Management~ | Market Overview~ || Country-level Demographic Highlights~ || Province-level Demographic Highlights~ || Country-level Economic Highlights~ || Province-level Economic Highlights~ || Key End-user Segment Highlights~ || Key Policies and Regulations~ ||| Made in China 2025: China’s Version of Industry 4.0~ ||| Belt and Road Initiative~ ||| Production Overcapacity Cut and Pollution Curb~ ||| Emission Standard~ ||| Urban Agglomeration and Economic Zone~ ||| Housing Purchase Restrictions~ ||| Agricultural Subsidies~ ||| Formulation of Industry Standards~ || Roadmap of Made in China 2025~ || Key Advantages of the Belt and Road Initiative~ || Roadmap of Emission Standard for Diesel-powered OHVs~ | OHV Market Structure and Outlook~ || Key Market Segments and Products~ || Unit Shipment and Outlook~ || Unit Shipment and Outlook for Medium and Large Tractors~ || Unit Shipment and Outlook for Wheel Loaders~ || Unit Shipment and Outlook for Excavators~ || Unit Shipment and Outlook for Truck Cranes~ || Unit Shipment and Outlook for Rollers~ || Unit Shipment and Outlook for Forklifts~ || Unit Shipment and Outlook for Off-highway Trucks~ || Unit Shipment and Outlook for Pavement Planers~ || Unit Shipment and Outlook for Bulldozers~ || Key OHV OEMs—Product Features~ | Case Studies of Key OHV OEMs~ || Sany—Successful Global Expansion~ || XCMG—Successful in Exports~ || Wirtgen GmbH—Successful in Entering the Chinese Market~ | OHV Telematics Market Structure and Outlook~ || Key Developments and Outlook~ || Addressable Market and Outlook~ || Addressable Market by Segment~ || Market Penetration~ || Service Demand Trend ~ || Value Chain ~ || Competitive Structure ~ || Potential Emerging Market~ | Market Potential and Opportunity Analysis for OHV Telematics~ || Market Potential and Opportunity Evaluation~ || Opportunity Strategy Evaluation (OSE) Grid~ | Case Studies of OHV Telematics Solutions~ || XCMG’s IoT Smartphone~ || Shantui’s Remote-control Dozer~ || Kubota Smart Agri System~ | Conclusions and Future Outlook~ || 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Abbreviations and Acronyms Used~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Total OHV and OHV Telematics Market: Key Takeaways, China, 2015~ 2. Total OHV and OHV Telematics Market: OHV Unit Shipment and OHV Telematics Installed Base, China, 2010–2020~ 3. Total OHV and OHV Telematics Market: Key Questions This Study Will Answer, China, 2015~ 4. Economic Growth Rate, Global Key Countries, 2015–2020~ 5. Total OHV and OHV Telematics Market: Key Policies and Regulations, China, 2015~ 6. Total OHV and OHV Telematics Market: Made in China 2025, China, 2015–2025~ 7. Total OHV and OHV Telematics Market: Belt and Road Initiative, China, 2015~ 8. OHV Market: Product Features, China, 2015~ 9. OHV Telematics Market: Key Development, China, 2003–2020~ 10. OHV Telematics Market: Service Demand Trend, China, 2015~ 11. OHV Telematics Market: Value Chain, China, 2015~ 12. OHV Telematics Market: Potential Emerging Market, China, 2015~ 13. OHV Telematics Market: Market Potential and Opportunity Evaluation, China, 2015–2020~| 1. Population Structure, China, 2015 and 2020~ 2. Population by Age Structure, China, 2015 and 2020~ 3. Urbanization Rate by Region, China, 2010 and 2015~ 4. Nominal GDP per Capita by Region, China, 2010 and 2015~ 5. Food Production, China, 2011–2015~ 6. Real Estate Development Investment, China, 2011–2015~ 7. Purchasing Managers’ Index (PMI), China, Jun. 2013 to Dec. 2015~ 8. Coal Mining Investment, China, 2011–2015~ 9. OHV Market: Number of Parc by Segment, China, 2015 and 2020~ 10. OHV Market: Number of Parc in the Agricultural Segment by Product, China, 2015~ 11. OHV Market: Number of Parc in the Construction Segment by Product, China, 2015~ 12. OHV Market: Number of Parc in the Industrial Segment by Product, China 2015~ 13. OHV Market: Number of Parc in the Mining Segment by Product, China, 2015~ 14. OHV Market: Unit Shipment Forecast, China, 2010–2020~ 15. OHV Market: Percent Unit Shipment by Product, China, 2015~ 16. OHV Market: Percent Unit Shipment by Product, China, 2020~ 17. OHV Market: Unit Shipment Forecast for Medium and Large Tractors, China, 2010–2020~ 18. OHV Market: Unit Shipment Forecast for Wheel Loaders, China, 2010–2020~ 19. OHV Market: Unit Shipment Forecast for Excavators, China, 2010–2020~ 20. OHV Market: Unit Shipment Forecast for Truck Cranes, China, 2010–2020~ 21. OHV Market: Unit Shipment Forecast for Rollers, China, 2010–2020~ 22. OHV Market: Unit Shipment Forecast for Forklifts, China, 2010–2020~ 23. OHV Market: Unit Shipment Forecast for Off-highway Trucks, China, 2010–2020~ 24. OHV Market: Unit Shipment Forecast for Pavement Planers, China, 2010–2020~ 25. OHV Market: Unit Shipment Forecast for Bulldozers, China, 2010–2020~ 26. OHV Telematics Market: Unit Shipment Forecast, China, 2010–2020~ 27. OHV Telematics Market: Addressable Market by End-user Segment, China, 2015~ 28. OHV Telematics Market: Addressable Market by End-user Segment, China, 2020~ 29. OHV Telematics Market: Addressable Market in the Agricultural Segment, China, 2015–2020~ 30. OHV Telematics Market: Addressable Market in the Construction Segment, China, 2015–2020~ 31. OHV Telematics Market: Addressable Market in the Industrial Segment, China, 2015–2020~ 32. OHV Telematics Market: Addressable Market in the Mining Segment, China, 2015–2020~ 33. OHV Telematics Market: Installed Base, China, 2010–2020~ 34. OHV Telematics Market: Addressable Market Penetration, China, 2015~ 35. OHV Telematics Market: Addressable Market Penetration, China, 2020~ 36. OHV Telematics Market: Market Share of OHV TSPs, China, 2015~ 37. OHV Telematics Market: Opportunity Strategy Evaluation, China, 2015~ |

| Author | Will Wong |

| Industries | Automotive |

| WIP Number | P8B7-01-00-00-00 |

| Is Prebook | No |