Strategic Analysis of the South African Automotive Filters Aftermarket

Strategic Analysis of the South African Automotive Filters Aftermarket

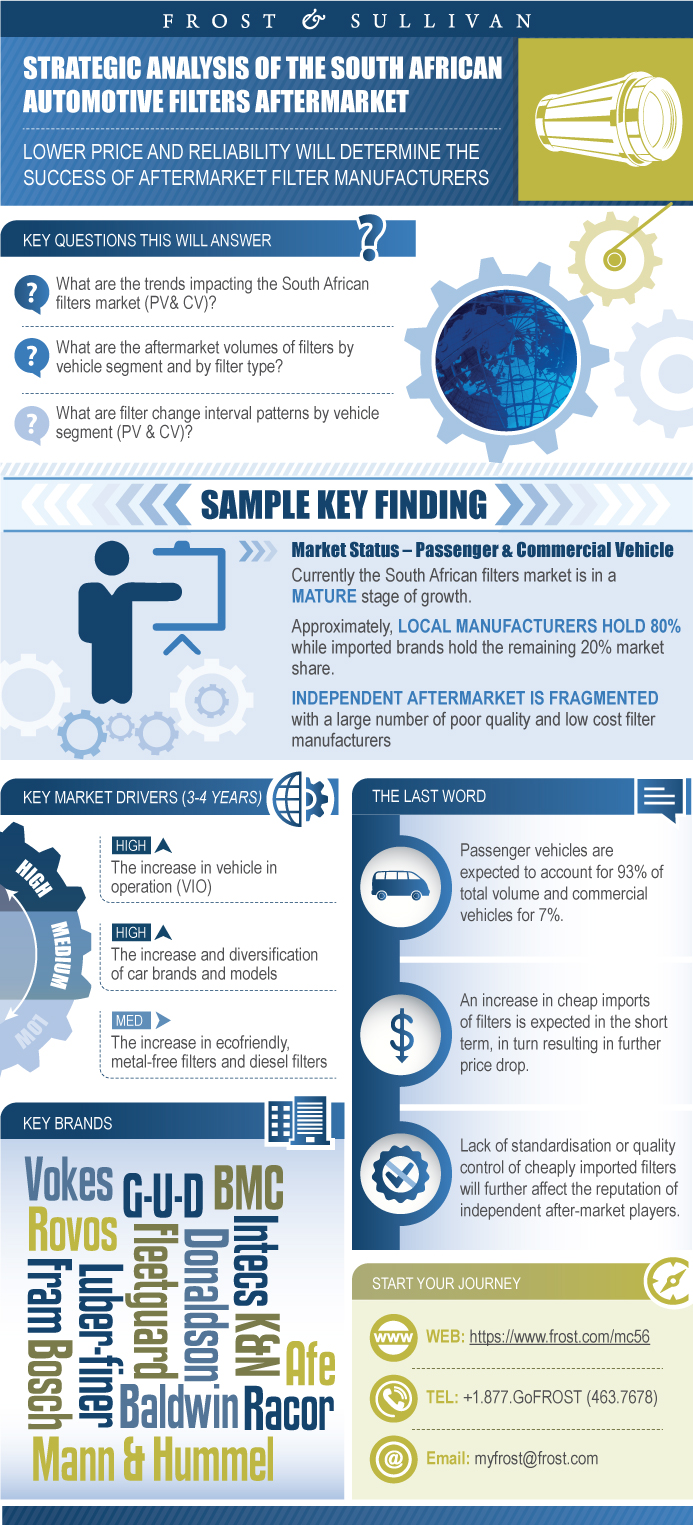

Lower Price and Reliability will Determine the Success of Aftermarket Filter Manufacturers

RELEASE DATE

02-Sep-2016

02-Sep-2016

REGION

Global

Global

Deliverable Type

Market Research

Market Research

Research Code: MC56-01-00-00-00

SKU: AU01352-GL-MR_18950

$4,950.00

In stock

SKU

AU01352-GL-MR_18950

This report covers the passenger and commercial vehicles, replacement filters aftermarket in terms of volume and value across South Africa. It provides the qualitative and quantitative aspects, such as market trends and market metrics. Increase in vehicles in operation (VIO) and improved maintenance practice awareness, will help the aftermarket grow during the forecast period. The report covers segments such as air filter, fuel filter, oil filter and cabin air filter. Unit shipments will experience a strong marginal growth, considering the fact that the market is in the growth stage and the competition is increasing.

Key Findings

- Market Status PV & CV

- Volumes

- Pricing

- Change Intervals

- Cheap Imports on the Rise

Market Engineering Measurements

- Passenger Vehicles

- Commercial Vehicles

Key Conclusions and Future Outlook

- Market Status

- Volumes

- Pricing

Research Scope

Research Aims and Objectives

Research Background

Research Methodology

Product Segmentation

Definitions

Key Market Trends

South Africa Market VIO

Vehicles in Operation by Brand Analysis & Age

Demand Analysis

Drivers & Challenges

Filter Change Intervals

Market Engineering Measurements

Overview of Replacement Filters Aftermarket—Estimate

PV Filter Demand by Type

CV Filter Demand by Type

Distribution Analysis—Passenger & Commercial Vehicles

Filters Aftermarket Pricing Analysis

Conclusion

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Passenger Vehicle Filters—Distribution Analysis

Commercial Vehicle Filters—Distribution Analysis

Abbreviations

- 1. Automotive Filters Aftermarket: Current and Future Outlook, Europe, 2015–2020

- 2. Automotive Filters Aftermarket: Unit Shipment Forecast, South Africa, 2015–2022

- 3. Automotive Filters Aftermarket: Research Methodology, South Africa, 2015

- 4. Automotive Filters Aftermarket: Market Engineering Measurements, South Africa, 2015

- 1. Automotive Filters Aftermarket: Market Engineering Measurements, South Africa, 2015

- 2. Automotive Filters Aftermarket: Research Background, South Africa, 2015

- 3. Automotive Filters Aftermarket: Product Segmentation, South Africa, 2015

- 4. Automotive Filters Aftermarket: Definitions, South Africa, 2015

- 5. Automotive Filters Aftermarket: Key Market Trends, South Africa, 2015

- 6. Automotive Filters Aftermarket: Vehicle in Operation by Vehicle Segment, South Africa, 2015–2022

- 7. Automotive Filters Aftermarket: VIO by Brand & Age, South Africa, 2015

- 8. Automotive Filters Aftermarket: Demand Analysis, South Africa, 2015

- 9. Automotive Filters Aftermarket: Drivers & Challenges, South Africa, 2015

- 10. Automotive Filters Aftermarket: Filter Change Intervals, South Africa, 2015

- 11. Automotive Filters Aftermarket: Unit Shipment Forecast by Vehicle Segment, South Africa, 2015–2022

- 12. Automotive Filters Aftermarket: Unit Shipment Forecast by Vehicle Segment and Filter Type, South Africa, 2015 and 2022

- 13. Total PV Filters Aftermarket: Unit Shipment Forecast by Filter Type, South Africa, 2015–2022

- 14. Total CV Filters Aftermarket: Unit Shipment Forecast by Filter Type, South Africa, 2015–2022

- 15. Automotive Filters Aftermarket: Market Structure, South Africa, 2015

- 16. Automotive Filters Aftermarket: Pricing Analysis, South Africa, 2015

- 17. Automotive Filters Aftermarket: Conclusion, South Africa, 2015

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

This report covers the passenger and commercial vehicles, replacement filters aftermarket in terms of volume and value across South Africa. It provides the qualitative and quantitative aspects, such as market trends and market metrics. Increase in vehicles in operation (VIO) and improved maintenance practice awareness, will help the aftermarket grow during the forecast period. The report covers segments such as air filter, fuel filter, oil filter and cabin air filter. Unit shipments will experience a strong marginal growth, considering the fact that the market is in the growth stage and the competition is increasing.

Key Questions This Study Will Answer

• What are the trends impacting the South African filters market (PV& CV)?

• What are the aftermarket volumes of filters by vehicle segment and by filter type?

• What are filter change interval patterns by vehicle segment (PV & CV)?

• What is the impact of imported filter brands on the South African market?

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ ||| Market Status PV & CV~ ||| Volumes~ ||| Pricing~ ||| Change Intervals~ ||| Cheap Imports on the Rise~ || Market Engineering Measurements~ ||| Passenger Vehicles~ ||| Commercial Vehicles~ || Key Conclusions and Future Outlook~ ||| Market Status~ ||| Volumes~ ||| Pricing~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ | Definitions and Segmentation~ || Product Segmentation~ ||| Vehicle Segment~ |||| Passenger Vehicles~ |||| Commercial Vehicles~ ||| Component~ |||| Automotive Filters~ ||| Filter Type~ |||| Oil Filters~ |||| Air Filters~ |||| Fuel Filters~ |||| Cabin Filters~ || Definitions~ ||| Air Filter~ ||| Fuel Filter~ ||| Oil Filter~ ||| Cabin Air Filters~ | South African Aftermarket Market Overview/Trends—Passenger Vehicles & Commercial Vehicles~ || Key Market Trends~ || South Africa Market VIO~ || Vehicles in Operation by Brand Analysis & Age~ || Demand Analysis~ ||| Vehicle in Operation~ ||| New Vehicle Sales~ ||| Average Annual Mileage~ ||| Average Vehicle Age~ || Drivers & Challenges~ ||| Drivers~ |||| The increase in vehicle in operation (VIO) drives the on-going demand for filter replacement~ |||| The increase and diversification of car brands and models in South Africa are likely to drive an increasing number of SKU of filters~ |||| The increase in ecofriendly, metal-free filters and diesel filters, is likely to drive the demand for new filters~ |||| Owing to shorter recommended change intervals there is an increase in penetration fitment rates~ ||| Challenges~ |||| Prices, for the aftermarket are expected to decline over the forecast period, due to the increase in cheap imports~ |||| Lack of standardization and quality control will dampen growth~ |||| Consumers are under the pressure of high car premiums and are price sensitive; hence, they usually prefer cheaper, longer lasting filters~ |||| OEMS are increasingly promoting the use of original filters even after warranty~ || Filter Change Intervals~ | Filters Market Breakdown by Segment & Type~ || Market Engineering Measurements~ || Overview of Replacement Filters Aftermarket—Estimate~ || PV Filter Demand by Type~ || CV Filter Demand by Type~ | Market Distribution Structure & Pricing~ || Distribution Analysis—Passenger & Commercial Vehicles~ || Filters Aftermarket Pricing Analysis~ | Conclusions~ || Conclusion~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Passenger Vehicle Filters—Distribution Analysis~ || Commercial Vehicle Filters—Distribution Analysis~ || Abbreviations~ |

| List of Charts and Figures | 1. Automotive Filters Aftermarket: Current and Future Outlook, Europe, 2015–2020~ 2. Automotive Filters Aftermarket: Unit Shipment Forecast, South Africa, 2015–2022~ 3. Automotive Filters Aftermarket: Research Methodology, South Africa, 2015~ 4. Automotive Filters Aftermarket: Market Engineering Measurements, South Africa, 2015~| 1. Automotive Filters Aftermarket: Market Engineering Measurements, South Africa, 2015~ 2. Automotive Filters Aftermarket: Research Background, South Africa, 2015~ 3. Automotive Filters Aftermarket: Product Segmentation, South Africa, 2015~ 4. Automotive Filters Aftermarket: Definitions, South Africa, 2015~ 5. Automotive Filters Aftermarket: Key Market Trends, South Africa, 2015~ 6. Automotive Filters Aftermarket: Vehicle in Operation by Vehicle Segment, South Africa, 2015–2022~ 7. Automotive Filters Aftermarket: VIO by Brand & Age, South Africa, 2015~ 8. Automotive Filters Aftermarket: Demand Analysis, South Africa, 2015~ 9. Automotive Filters Aftermarket: Drivers & Challenges, South Africa, 2015~ 10. Automotive Filters Aftermarket: Filter Change Intervals, South Africa, 2015~ 11. Automotive Filters Aftermarket: Unit Shipment Forecast by Vehicle Segment, South Africa, 2015–2022~ 12. Automotive Filters Aftermarket: Unit Shipment Forecast by Vehicle Segment and Filter Type, South Africa, 2015 and 2022~ 13. Total PV Filters Aftermarket: Unit Shipment Forecast by Filter Type, South Africa, 2015–2022~ 14. Total CV Filters Aftermarket: Unit Shipment Forecast by Filter Type, South Africa, 2015–2022~ 15. Automotive Filters Aftermarket: Market Structure, South Africa, 2015~ 16. Automotive Filters Aftermarket: Pricing Analysis, South Africa, 2015~ 17. Automotive Filters Aftermarket: Conclusion, South Africa, 2015~ |

| Author | Sundar Shankarnarayanan |

| Industries | Automotive |

| WIP Number | MC56-01-00-00-00 |

| Keyword 1 | Automotive Filters After |

| Keyword 2 | South African Automotive Filters After |

| Keyword 3 | South African Filters |

| Is Prebook | No |