The Future of the United States

The Future of the United States

The Social and Technological Forces Reshaping the Country

26-Jan-2017

North America

$3,950.00

Special Price $2,962.50 save 25 %

Description

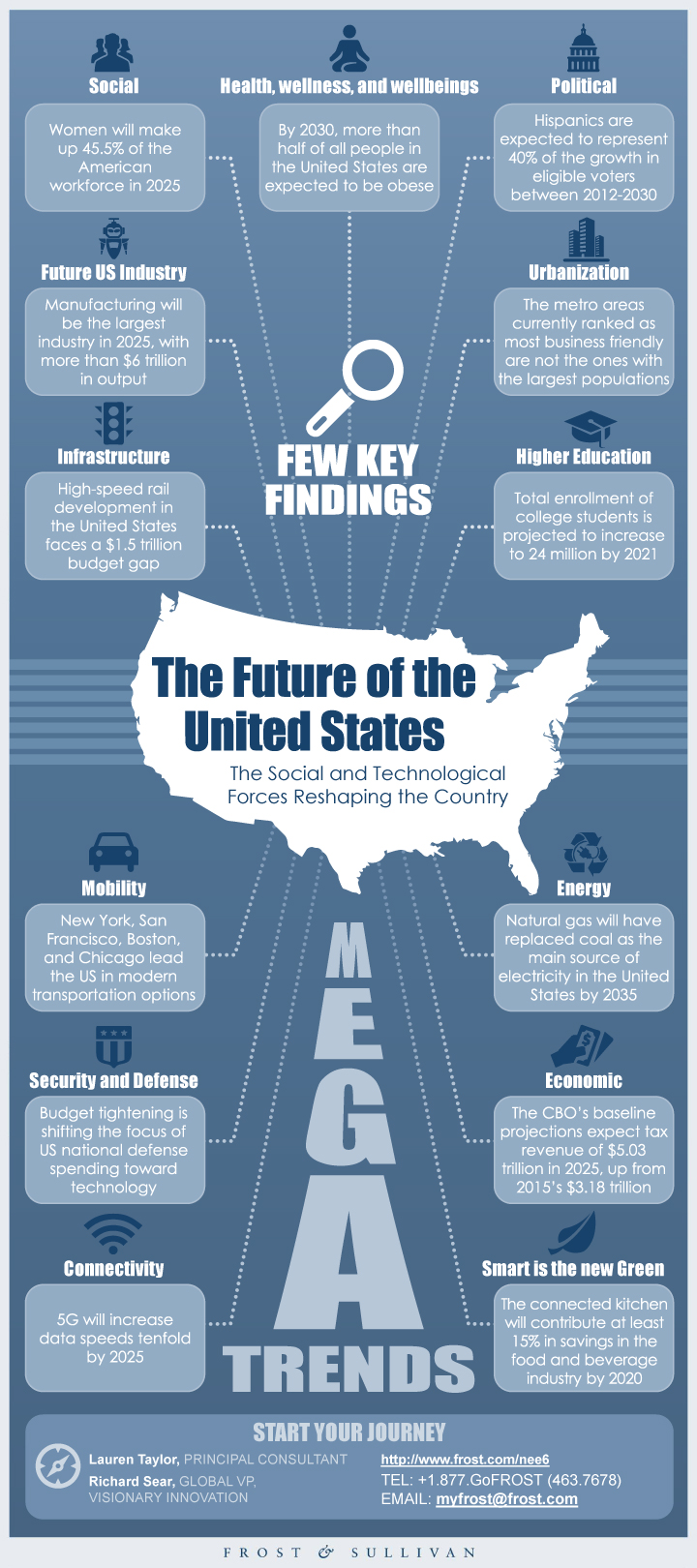

Frost & Sullivan's research service on The Future of the United States offers a comprehensive analysis of the Mega Trends that will impact American citizens and businesses through 2025. In this research, Frost & Sullivan's expert analysts highlight the imminent challenges and opportunities for growth stemming from the following trends:

Social, Higher education, Politics, Industry, Health, wellness and wellbeing, Urbanization, Infrastructure, Mobility, Energy, Security and defense, Economics, Connectivity, Smart is the new green

The study also offers strategic recommendations and predictions backed by relevant facts and statistics.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

In 2025, the United States Will be a Land of Quantification

A Network Culture Will Shape American Lives

Work in the United States Will be Smarter and More Human-centric

Collaboration Will Define Both Professional and Personal Lives

Competition in the United States Will be Reconfigured

Top US Disruptors through 2025

Macro-to-micro Analysis of Key Mega Trends

Macro-to-micro Analysis of Key Mega Trends (continued)

Research Methodology—From Macro-to-micro

Research Methodology—From Macro-to-micro (continued)

List of Definitions

List of Definitions (continued)

List of Acronyms and Abbreviations

List of Acronyms and Abbreviations (continued)

Social Trends—Key Findings

North America’s 2025 Population Will be Smaller Than Other Regions’

As Millennials Rise, so Will Their Influence

Millennials Display Common Characteristics

The US Racial Composition Will be More Diverse

The US Hispanic Culture is Evolving

The US Immigrant Population Will Grow

The She-conomy Will Strengthen

Aging Americans Will Form an Important Demographic

Aging Americans Will be Unlike Their Previous Counterparts

The Working-age Support Burden Will be Greater

Job Automation Threatens Parts of the Working Population

American Incomes Will Continue to Polarize

With Income Polarization Comes Drivers and Opportunities

“Macro-to-micro”—Strategic Recommendations and Predictions

Higher Education Trends—Key Findings

College Attendance Will Increase

Demand for College-educated Americans Will Continue to Grow

Higher Education Costs Will Continue to Rise

Student Debt Burden is Worsening

Does the US Government Profit from Student Loans?

Student Debt Has Negative, Lifelong Repercussions

Technology Evolves Learning Methods

Higher Education Reveals Widening Racial Gaps

Projected Increase in STEM-related Jobs

“Macro-to-micro”—Strategic Recommendations and Predictions

Political Trends—Key Findings

eGovernance and mGovernance Increase Efficiency

eGovernance and mGovernance Increase Efficiency (continued)

Population Density Drives Innovative Mobility Strategies in US Cities

The Effect of Social Media on Presidential Elections

The Balance of the US Supreme Court Hinges on 2016 and 2020

Key Business Issues Will be on the Court’s Docket

Persistent Polarization in Congress May Weaken Its Role

State and Local Government Influence is Increasing

The Hispanic Vote Will be More Important but Less Cohesive

“Macro-to-micro”—Strategic Recommendations and Predictions

Future US Industry Trends—Key Findings

Future US Industries to Experience Growth

Future US Industries Will Grow with Technology Adoption

Retail—Consumption and Technology Patterns Alter the Status Quo

Retail—Bricks-and-Clicks Retailing Influences Shoppers

Manufacturing—Key Industry Subsectors Grow Quickly

Manufacturing—Trends Drive Transformational Shifts

Construction—US Energy Drives Growth

Construction—Industry Shifts and Trends Drive Innovation

Finance—Competition from China Will Intensify

Finance—Industry Shifts Put the Customer First

Healthcare—Huge Forces Drive Industry Changes

Healthcare—Opportunities Arise in a New Landscape

Technology—Game Changers are Born in the United States

Technologies Will Continue Disrupting Industries

“Macro-to-micro”—Strategic Recommendations and Predictions

Health, Wellness, and Wellbeing Trends—Key Findings

Chronic Health Problems Weigh Down the US Healthcare System

Healthcare Becomes Decentralized

Technology is in Place for Home Healthcare Solutions

The “Quantified Self” Emerges from Future Healthcare Applications

The Workplace Promotes a Healthy Lifestyle

Prevention-focused Wellness Programs Could Offset Insurance Costs

The Dietary Supplement Market Grows

What’s the Buzz on Marijuana?

Widespread Marijuana Legalization Could Impact Big Pharma

“Macro-to-micro”—Strategic Recommendations and Predictions

Urbanization Trends—Key Findings

The City Will be 2025’s Most Connected Customer

Population Density Will Rise while Trends Expand

Two Mega Regions Will Dominate the East and West Coasts

Mega Regions are Not Necessarily the Fastest Growing

What Makes a Metro Area Business Friendly?

Urban Core Population Will Continue to Swell

Suburban Rings Will Continue to House Most Americans

Smart Will Become the Technological Norm

San Francisco Leads the Smart City Race

Growing GDP and Spend Are Turning Cities into Customers

Boston’s SCOPE Project Embodies the Connected City

“Macro-to-micro”—Strategic Recommendations and Predictions

Infrastructure Trends—Key Findings

Pipeline Infrastructure Investments Will Grow

Utility Infrastructure Investments Will Double

New Highways Indicate Pockets of Economic Development

Waterways, Locks, and Ports Require Immediate Funding

US New High-speed Rail (HSR) Development

New Freight Rail Development Offers Cheaper Transport

Hot Topic—Water in Fracking to Continue Making Headlines

“Macro-to-micro”—Strategic Recommendations and Predictions

Mobility Trends—Key Findings

Diverse Forces Are Shifting the Mobility Landscape

Population Density Drives Innovative Mobility Strategies in US Cities

Mobility Options Will Increase for Every Journey

Intercity Bus Mobility May Outpace High-speed Rail

The Suburban Commute Will be Smarter

Alternative Fuel Vehicles Will See Continued Growth

Intra-city Public Transit Will Have More Options

Conflicting Policies Limit Public Transit Adoption

Ride Sharing and eHailing Will Yield to Autonomous Taxis

Car Sharing Offers Alternatives to Ownership for Urban Residents

Emerging Micro-mobility Solutions Will Not Go Far in the United States

Federal Support for Non-motorized Transport Will Increase

“Macro-to-micro”—Strategic Recommendations and Predictions

Energy Trends—Key Findings

The US Energy Outlook is Highly Vulnerable to Disruptions

Electricity Generation Will be More Natural Gas Reliant

The US Will Continue Being a Dominant Participant in O&G Production

Natural Gas Production Depends on Favorable Regulation

The Era of Coal’s Dominance Will Come to an End

Strengthening Renewables Requires More Holistic Assessments

Nuclear Energy Will Post Less Growth in the United States

Energy Harvesting Holds Great Promise for Cheap Energy

Solving Energy Storage is Key to Growth in Renewables

Distributed Generation is Going Smart

Greenhouse Gas Emissions Likely to Grow

“Macro-to-micro”—Strategic Recommendations and Predictions

Security and Defense Trends—Key Findings

The Threats to Security and Safety are Changing

Cybersecurity Will Experience Widespread Demand

Cybersecurity Will Adapt to a Changing Landscape

Crime Rates Continue to Fall

Increasing Natural Disasters Require Preparation and Collaboration

Safe Cities Will Emerge

Safe Cities Rely on Advancing Technologies

National Defense Will Focus on Non-traditional Actors

National Defense Spending Will Focus on Technology

“Macro-to-micro”—Strategic Recommendations and Predictions

Economic Trends—Key Findings

Projections for US Global Economic Standing Are Mixed

Government, Consumers, Business, and Exports Comprise the Economy

The CBO Projects Deficit Spending through 2025

Social Programs Dominate Federal Government Spend

Education Holds the Bulk of State Government Spend

Consumer Pressures May Threaten the Country’s Economic Backbone

Consumer Sentiment is Rising; Expenditure is Growing

Business Spend Favors Predictability

Indicators Point to a Recovering but Precarious Economy

US Exports Show No Sign of Overtaking Imports

Two Key Economic Influencers are Interest Rates and Trade Deals

“Macro-to-micro”—Strategic Recommendations and Predictions

Connectivity Trends—Key Findings

The Internet of Things Will Become Pervasive

The Internet of Things is Creating Growth Opportunities

New Technologies Are Emerging in the IoT

The Race for 5G Will Create a New Standard for Connectivity

Efforts to Close the Digital Divide Will Increase in Importance

New Methods of Internet Access Will be Tested

Net Neutrality Ruling is Likely to be Revisited

Public Perceptions of Privacy are Mixed

Privacy Concerns with Big Data May Drive Self-regulation

“Macro-to-micro”—Strategic Recommendations and Predictions

Smart is the New Green—Key Findings

Smart is Connected

Smart is Embedded within Most Devices

Smart Converses

“Macro-to-micro”—Strategic Recommendations and Predictions

The Last Word—3 Big Predictions

Legal Disclaimer

Full List of Slide Titles

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Full List of Slide Titles (continued)

Popular Topics

Market Overview

Collaboration will define both personal and professional lives

Over the next 10 years, several social, technological, political and economic forces will reshape the business and lifestyle patterns of society in the United States. As Millennials age into management roles and government positions, they will wield significant influence on the American community. Consequently, organizations will re-prioritize competitive dimensions in order to adapt to changing customer dynamics.

Connectivity will penetrate industries and daily life through the Internet of Things. Cities will invest in smart technologies to forge new avenues for commerce and collaboration. This collaboration will lead to greater asset sharing, enhanced inter-business partnerships and strengthened employer-employee relationships. Subsequently, cybersecurity will emerge as a critical point of focus and technologies will become more proactive, adaptive and collaborative to protect against new risks. In spite of several challenges such as mounting student debts and aging infrastructure, the evolution of smart cities, advances in security technology and new jobs created by automation will revive the American dream.

| No Index | No |

|---|---|

| Podcast | No |

| Author | Lauren Taylor |

| WIP Number | NEE6-01-00-00-00 |

| Keyword 1 | Future of the United States |

| Keyword 2 | USA Economy |

| Keyword 3 | USA GDP Forecast |

| Is Prebook | No |

| GPS Codes | 9600-B1,9705-C1,9800-A6,9813-A6,9A3B,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB