US and EU Biotech Industry VC Investment Growth Opportunities

US and EU Biotech Industry VC Investment Growth Opportunities

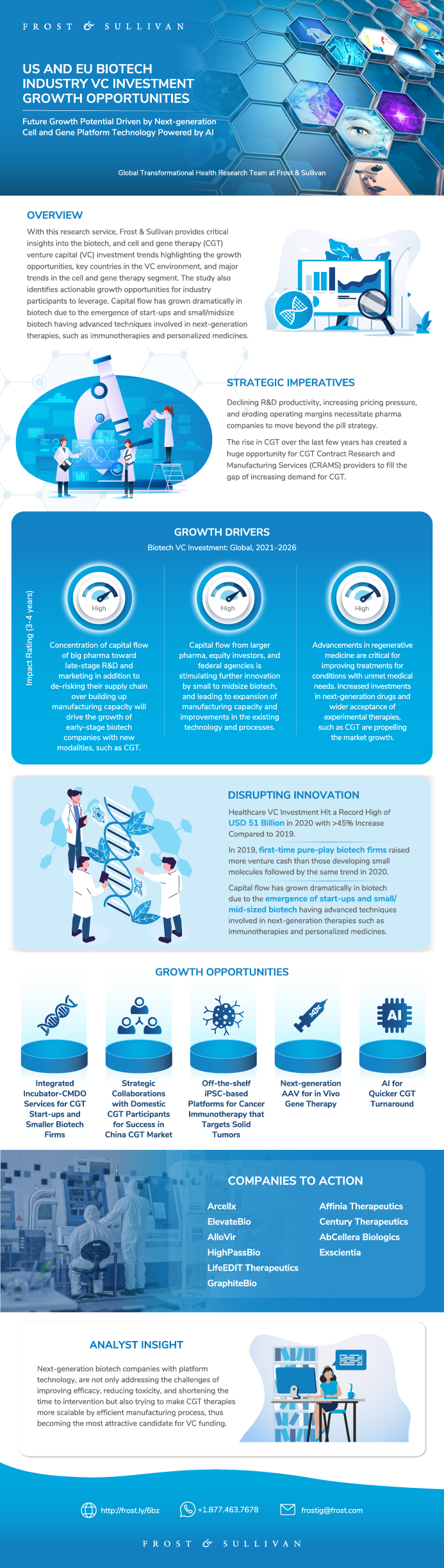

Future Growth Potential Driven by Next-generation Cell and Gene Platform Technology Powered by AI

24-Aug-2021

North America

Description

With this research service, Frost & Sullivan provides critical insights into the biotech, and cell and gene therapy (CGT) venture capital (VC) investment trends highlighting the growth opportunities, key countries in the VC environment, and major trends in cell and gene therapy segment. The study also identifies actionable growth opportunities for industry participants to leverage. Capital flow has grown dramatically in biotech due to emergence of start-ups and small/midsize biotech having advanced techniques involved in next-generation therapies, such as immunotherapies and personalized medicines. In the biopharma sector, companies with platform technology for targeting multiple indications in early clinical and preclinical stages, such as Roviant Sciences, Curevac, and Sana Biotechnology saw the highest investments in 2020.

This report reviews the significant drivers that will propel the VC investment in biotech and specifically CGT. It highlights the dynamics of the Chinese investors in the biotech VC landscape.

Other discussions on the biotech VC investment trend include:

• The healthcare sector VC landscape in the US and EU from 2018 to 2020.

• Key trends in biopharma VC investment.

• Analysis of global biotech VC deals by modality from 2016 to H1 2021.

• Analysis of global biotech VC deals by therapeutic segment from 2016 to H1 2021.

• Analysis of global biotech VC deals by stage of clinical development from 2016 to H1 2021.

• A snapshot of the VC investment trend in the CGT segment.

• The key companies to watch in the CGT space.

• Key growth opportunities paving the way for future VC investment in the biotech industry.

Author: Surbhi Gupta

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on Biotech VC Investment

Growth Opportunities Fuel the Growth Pipeline Engine™

Growth Environment

Growth Drivers for Biotech VC Investment

Growth Restraints for Biotech VC Investment

Healthcare VC Investment Trend in the US and EU

Biopharma VC Investment Trend

Biotech VC Deals Analysis by Modality

Biotech VC Deals Analysis by Stages of Clinical Development

Biotech VC Deals Analysis by Therapeutic Segment

Cell and Gene Therapy VC Investment Trend

AI-enabled Drug Discovery Global Investment Trend

AI-enabled Drug Discovery VC Deals Analysis by Funding Stage

Arcellx, US

Arcellx’s Cell Therapy Pipeline

ElevateBio, US

ElevateBio Portfolio Companies Snapshot—AlloVir

ElevateBio Portfolio Companies Snapshot—HighPassBio

ElevateBio Portfolio Companies Snapshot—LifeEDIT Therapeutics

GraphiteBio, US

Graphite Bio’s Gene Therapy Pipeline

Affinia Therapeutics, US

Affinia Therapeutics’ Gene Therapy Pipeline

Century Therapeutics, US

Century Therapeutics’ Cell Therapy Pipeline

AbCellera Biologics, Canada

Exscientia, United Kingdom

Growth Opportunity 1—Integrated Incubator-CMDO Services for CGT Start-ups and Smaller Biotech Firms

Growth Opportunity 1—Integrated Incubator-CMDO Services for CGT Start-ups and Smaller Biotech Firms (continued)

Traditional CDMO Collaborations to Strengthen CGT Services

Growth Opportunity 2—Strategic Collaborations with Domestic CGT Participants for Success in China CGT Market

Growth Opportunity 2—Strategic Collaborations with Domestic CGT Participants for Success in China CGT Market (continued)

China—Healthcare VC Investment Trend

Growth Opportunity 3—Off-the-shelf iPSC-based Platforms for Cancer Immunotherapy that Targets Solid Tumors

Growth Opportunity 3—Off-the-shelf iPSC-based Platforms for Cancer Immunotherapy that Targets Solid Tumors (continued)

Growth Opportunity 4—Next-generation AAV for in Vivo Gene Therapy

Growth Opportunity 4—Next-generation AAV for in Vivo Gene Therapy (continued)

Growth Opportunity 5—AI for Quicker CGT Turnaround

Growth Opportunity 5—AI for Quicker CGT Turnaround (continued)

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Surbhi Gupta |

| Industries | Healthcare |

| WIP Number | MG49-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9600-B1,9571-B1,99C1-B1,9568-B1,9611-B1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB