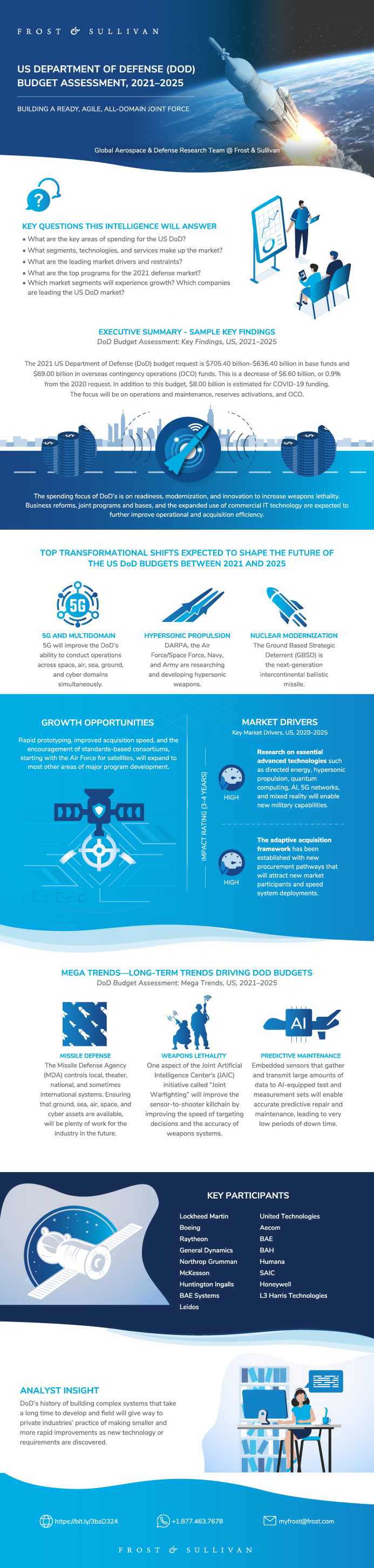

US Department of Defense (DoD) Budget Assessment, 2021–2025

US Department of Defense (DoD) Budget Assessment, 2021–2025

Building a Ready, Agile, All-domain Joint Force

20-Apr-2020

North America

Description

The fiscal year 2021 Department of Defense (DoD) budget request outlined in this research is the fourth budget under the Trump administration. The DoD request for 2021 maintains a high level of spending, but may encounter opposition from both sides of the political aisle. This research details the Defense Departments and Agency programs requests that offer the best opportunities for companies trying to enter the US defense market. The research includes market drivers and restraints that shed light on some budget numbers and the importance of participating as a primary or subcontractor on a variety of defense projects and programs. The research assists in understanding the government’s focus and the services it is likely to require in the future.

Research Highlights

This research service focuses on the US DoD spending requests for research, development, test & evaluation (RDT&E), procurement, and operations and maintenance (O&M) categories. The analyst has segmented the budget request by military department and 20 technology areas, such as aircraft, ships, ground vehicles and command and control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR).

The research also provides information on contract activity for 2019. The contract activity encompasses Army, Navy/Marine Corps, Air Force, and Joint Services contracts awarded, and lists the analyst’s estimate of the top 10 US DoD contractors based on available government data. The base year for DoD budgets is 2019, and the market forecast is estimated from 2020 to 2025.

Research, new purchases, and services for computers, healthcare, and base operations support are included. Classified budget requests are included, but cannot be broken out into technology areas. Budget requests include base, overseas contingency operations (OCO), and emergency categories.

Products and services that are inherent in new-build tactical ground vehicles, ships, and aircraft platforms are included if distinctly specified by program or modification. Program funding and contract values do not always align year-to-year due to administrative costs, multi-year contracts, and technology use across segments. Program and contract segmentation, large multi-year contract assessment, and funding forecasts for 2020 and beyond are made at the analyst’s discretion.

The purpose of this study is to discuss the 2021 DoD budget request. While the market is mature, there are signs that steady growth and new concepts are ahead, and this study will outline and provide commentary regarding those signs.

Key Features

- To understand the current state of DoD contract activities

- To understand military operational trends driving the DoD market

- To understand the commercial technology trends impacting DoD users

- Outline some future objectives for DoD spending

Key Issues Addressed

- What are some leading DoD programs?

- Which are some of the DoD contractors in the market?

- Where are the growth opportunities in the DoD market?

- What do the current DoD market and technology landscape look like?

- What activities will be emphasized as the DoD market continues to advance?

Author: Brad Curran

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Executive Summary—Key Predictions

Executive Summary—What DoD Customers Want

Executive Summary—Top Transformational Shifts Expected to Shape the Future of US DoD Budgets Between 2021 and 2025

Executive Summary—Market Overview

Executive Summary—Market Engineering Measurements

Executive Summary—Top Trends for the US DoD Market

Market Scope and Definitions

Defense Technology Segmentation

Market Segmentation

Market Segmentation (continued)

Market Segmentation (continued)

Market Segmentation (continued)

Key Questions this Study will Answer

2021 Budget by Department Segments

Market Drivers

Drivers Explained

Market Restraints

Restraints Explained

Market Engineering Measurements

Forecast Assumptions

DoD Top Line Budget Request for 2021

Forecast Discussion

Mega Trends—Long-term Trends Driving DoD Budgets

Market Share

Market Share Analysis

Competitive Environment

Top 10 DoD Contractors

Top Competitors

Competitive Structure of the US DoD Market

Growth Opportunity—US DoD 2020 Budget Assessment

Growth Opportunity—Spare Parts

Growth Opportunity—Digitization Technologies

Growth Opportunity—COVID-19 Response

Major Growth Opportunities

Strategic Imperatives for US DoD Product Providers

2021 Budget by Department

2021 Budget by Appropriation

Total RDT&E, Procurement, and O&M Program Funding by Technology Area

2021 RDT&E Budget by Department

Top 10 RDT&E Programs

2021 O&M Budget by Department

Top 10 O&M Programs

2021 Procurement Budget by Department

Top 10 Procurement Programs

2021 Air Force/Space Force Budget by Appropriation

Top 10 Air Force/Space Force Programs

2021 Army Budget by Appropriation

Top 10 Army Programs

2020 Joint Program Budget by Appropriation

Top 10 Joint Programs

2020 Navy/Marine Corps Budget by Appropriation

Top 10 Navy/Marine Corps Programs

Representative Unfunded Priorities List Requests

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Aerospace, Defense, and Security (ADS) Research Areas/Capabilities

Visit Our Website for More Information

List of Exhibits

List of Exhibits (continued)

Popular Topics

Research Highlights

This research service focuses on the US DoD spending requests for research, development, test & evaluation (RDT&E), procurement, and operations and maintenance (O&M) categories. The analyst has segmented the budget request by military department and 20 technology areas, such as aircraft, ships, ground vehicles and command and control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR).

The research also provides information on contract activity for 2019. The contract activity encompasses Army, Navy/Marine Corps, Air Force, and Joint Services contracts awarded, and lists the analyst’s estimate of the top 10 US DoD contractors based on available government data. The base year for DoD budgets is 2019, and the market forecast is estimated from 2020 to 2025.

Research, new purchases, and services for computers, healthcare, and base operations support are included. Classified budget requests are included, but cannot be broken out into technology areas. Budget requests include base, overseas contingency operations (OCO), and emergency categories.

Products and services that are inherent in new-build tactical ground vehicles, ships, and aircraft platforms are included if distinctly specified by program or modification. Program funding and contract values do not always align year-to-year due to administrative costs, multi-year contracts, and technology use across segments. Program and contract segmentation, large multi-year contract assessment, and funding forecasts for 2020 and beyond are made at the analyst’s discretion.

The purpose of this study is to discuss the 2021 DoD budget request. While the market is mature, there are signs that steady growth and new concepts are ahead, and this study will outline and provide commentary regarding those signs.

Key Features

- To understand the current state of DoD contract activities

- To understand military operational trends driving the DoD market

- To understand the commercial technology trends impacting DoD users

- Outline some future objectives for DoD spending

Key Issues Addressed

- What are some leading DoD programs?

- Which are some of the DoD contractors in the market?

- Where are the growth opportunities in the DoD market?

- What do the current DoD market and technology landscape look like?

- What activities will be emphasized as the DoD market continues to advance?

Author: Brad Curran

| No Index | No |

|---|---|

| Podcast | No |

| Author | Brad Curran |

| Industries | Aerospace, Defence and Security |

| WIP Number | K4AB-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9000-A1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB