Analysis of the North America Managed & Professional Security Services Market, Forecast to 2021

Analysis of the North America Managed & Professional Security Services Market, Forecast to 2021

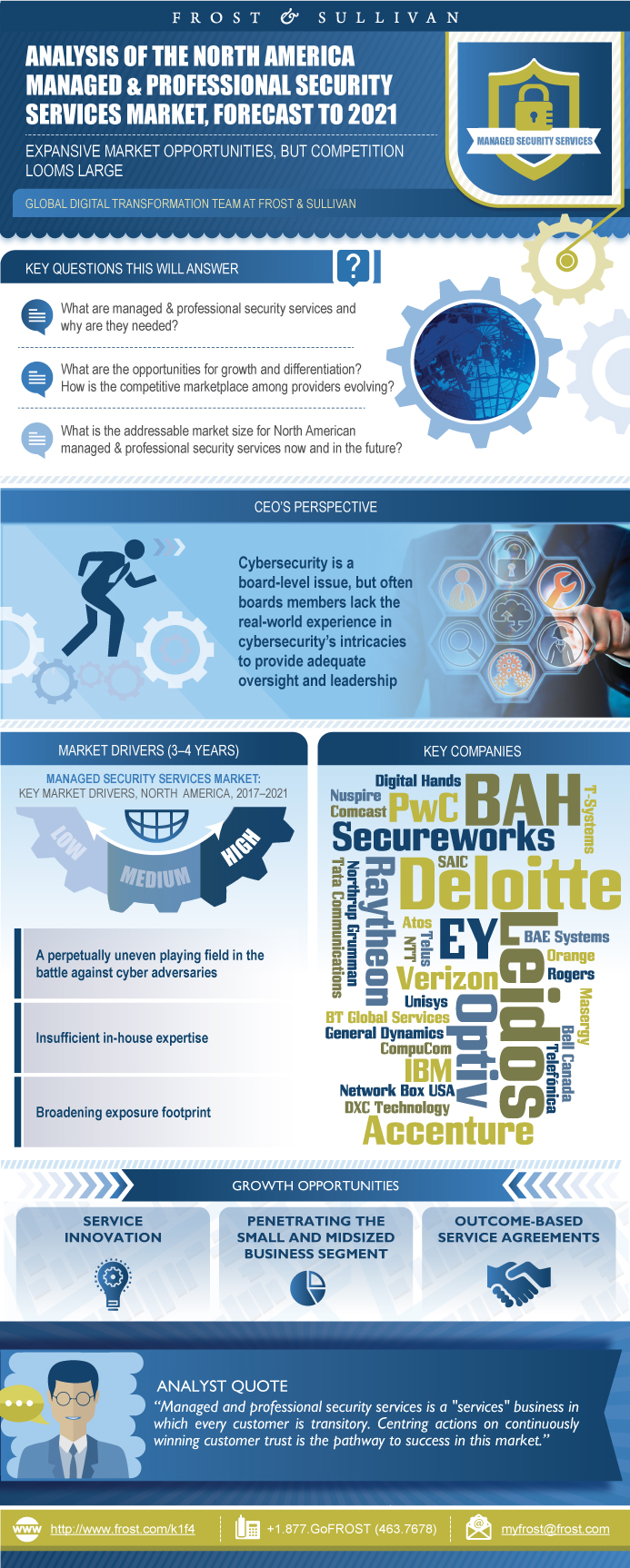

Expansive Market Opportunities, But Competition Looms Large

30-Jan-2018

North America

Market Research

The North American managed and professional security services market totaled $7.2 billion in 2016 and is projected to increase at double-digit rates annually almost throughout the entire forecast period.

The increasing volume, diversity, and sophistication of cyber threats aimed at a broadening exposure footprint, and the mounting severity of direct and indirect implications attributed to inadequate or outdated security practices, plus challenges of in-house staffing and adaptation are durable contributors to market demand.

The competitive landscape is highly diverse with providers from a myriad of backgrounds. The largest competitors, as measured by revenues, are firms with a deep history in serving the government and consulting firms. Their revenues are concentrated in professional security services. Next, with a mix of managed and professional security services, the fewer in number but sizable individually pure-play security service providers constitute the next tier. Much greater in number, communication service providers (telcos), security product vendors, local and regional IT services firms, cloud management providers, and managed Security-as-as-Service (SECaaS) providers round out the competitive landscape.

Competition among providers will intensify, compelling providers to ratchet upward their investments in technological innovation, sales & marketing, and strategic acquisitions. Simultaneously, pricing pressure will intensify as will client expectations for tangible demonstrations of security services’ essentialness and business return.

The managed and professional security services market is a high growth, dynamic market. The number and variety of competitors continue to increase. Consequently, the competitive playing field is intensifying.

Although numerous durable factors driving market demand are present, there are also other factors that will dampen demand. For example, self-service, automation, containerization, and standardization, hallmarks of cloud services, will reduce market opportunities as organizations, justifiably or not, gain a stronger sense of prowess in cyber risk management with their cloud deployments. In turn, this segment of demand for managed and professional security services will not reach the level of security services demand in non-cloud environments.

Profitability for service providers will also become more difficult to maintain as honing "means to serve" is an ever-present expenditure. Innovating through use of advanced technologies, building and re-building intellectual property, and marketing and sales investments must continue to remain a relevant provider. Also, like their clients, managed and professional security service providers confront the same challenging and expensive staffing issues (e.g., wage increases, periodic training, and retention).

Finally, security services clients expect tangible results and outcomes that demonstrate they are receiving a favorable return on their expenditures on managed and professional security services. As with any fixed-term service arrangement, each service provider is at risk of not having its contract renewed, being replaced by another provider, or not considered for additional service engagements. Earning customer trust and appreciation must be a top priority in order to thrive as a managed and professional security service provider.

In Analysis of the North America Managed & Professional Security Services Market, Forecast 2021 - Expansive Market Opportunities, But Competition Looms Large, Frost & Sullivan delves into the drivers and restraints of the managed and professional security services market, estimates its current size and forecasts its growth, and adds color to the competitive landscape.

Executive Summary

Market Engineering Measurements

Executive Summary—CEO’s Perspective

Introduction to the Research

Market Overview—Security Services Description

Market Overview—Service Lines in Managed Security Services (MSS)

Market Overview—Service Lines in Managed Security Services (MSS) (continued)

Market Overview—Service Lines in Professional Security Services (PSS)

Market Overview—InfoSec’s Views on Security Services: Why Partner?

Market Overview—InfoSec’s Views on Security Services: Proclivity to Partner with a MSS Provider

Market Overview—InfoSec’s Views on Security Services: Spending Outlook

Market Overview—InfoSec’s Views on Security Services: Spending Outlook (continued)

Market Overview—Distribution Channels

Total Managed & Professional Security Services Market—Market & Technology Trends

Market Drivers and Restraints

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Restraints Explained

Restraints Explained (continued)

Restraints Explained (continued)

Restraints Explained (continued)

Forecast Assumptions

Total Managed & Professional Security Services Market—Revenue Forecast

Total Managed & Professional Security Services Market—Revenue Forecast (continued)

Total Managed Security Services Market—Revenue Forecast

Total Professional Security Services Market—Revenue Forecast

Revenue Forecast Discussion

General Discussion on Market Segmentation

Clear Demarcation Between Provider Types

Service Lines—A Period of Shifting Focus

Service Lines—A Period of Shifting Focus (continued)

Industry Verticals—Broadening Base

Customer Size—Large Dominates, but Small will Grow

Total Managed & Professional Security Services Market—Market Share

Competitive Environment—Managed & Professional Security Services Market

Total Managed Security Services Market—Market Share

Competitive Environment—Managed Security Services Market

Total Professional Security Services Market—Market Share

Competitive Environment—Professional Security Services Market

Competitive Environment Discussion

Strategic Imperatives for Success and Growth

The Last Word—Predictions

The Last Word—Recommendations

Legal Disclaimer

Alert Logic

Alert Logic (continued)

AT&T

AT&T (continued)

Booz Allen Hamilton

Booz Allen Hamilton (continued)

CenturyLink

CenturyLink (continued)

Cisco

Cisco (continued)

eSentire

eSentire (continued)

IBM

IBM (continued)

KPMG

KPMG (continued)

Kudelski Security

Kudelski Security (continued)

Leidos

Leidos (continued)

NTT

NTT (continued)

Optiv

Optiv (continued)

PwC

PwC (continued)

Rackspace

Rackspace (continued)

Raytheon

Raytheon (continued)

RSA

RSA (continued)

Secureworks

Secureworks (continued)

Symantec

Symantec (continued)

Trustwave

Trustwave (continued)

Verizon

Verizon (continued)

Windstream

Market Engineering Methodology

Market Engineering Measurements

List of Providers Interviewed and/or Revenue Estimated

Additional Providers Included in “Others”

Additional Sources of Information on Study Topic Area

Learn More—Next Steps

List of Exhibits

List of Exhibits (continued)

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Michael Suby |

| Industries | Information Technology |

| WIP Number | K1F4-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9519,9659,9705-C1 |