Competitive Intensity Propelling the Global Autonomous Driving Industry Market, Outlook 2021

Competitive Intensity Propelling the Global Autonomous Driving Industry Market, Outlook 2021

Future Growth Potential Enhanced by Growth Opportunities in L2 And L3 Piloted Driving Features

30-Apr-2021

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

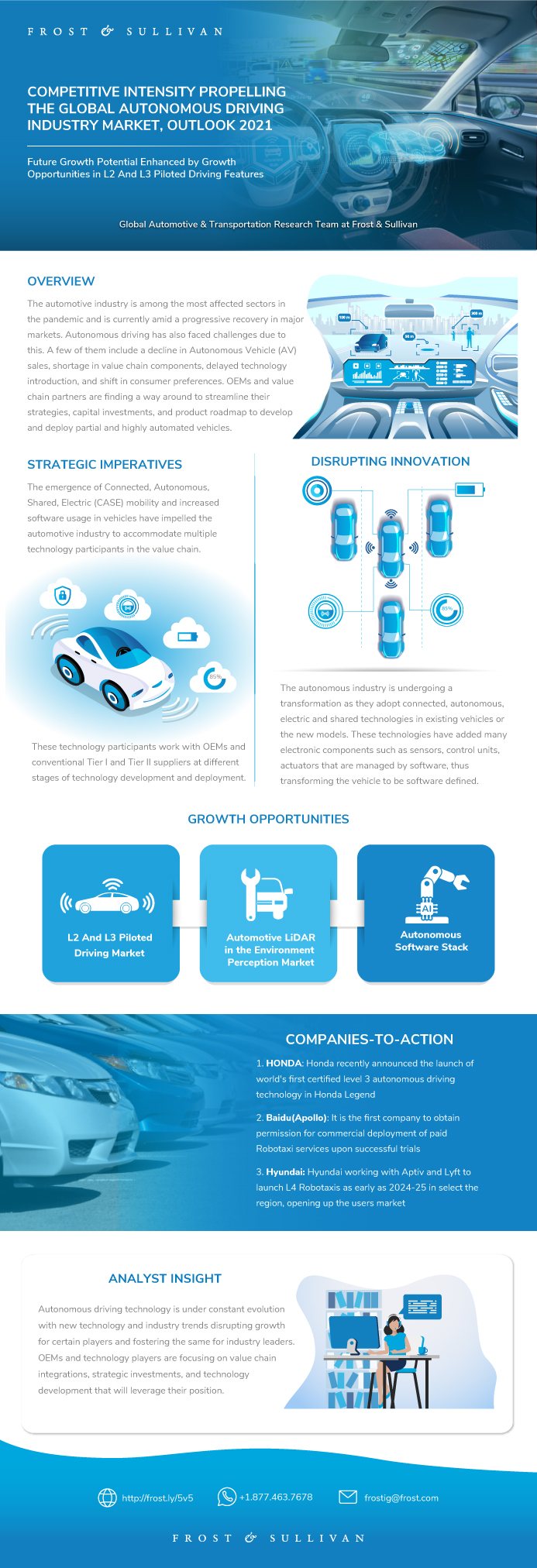

The automotive industry is among the most affected sectors in the pandemic and is currently amid progressive recovery in major markets. Autonomous driving has also faced challenges due to this. A few of them include a decline in Autonomous Vehicle (AV) sales, shortage in value chain components, delayed technology introduction, and shift in consumer preferences. OEMs and value chain partners are finding a way around to streamline their strategies, capital investments, and product roadmap to develop and deploy partial and highly automated vehicles.

In 2021, many major OEMs will focus on the deployment of Level 2 and Level 2+ partial automation driving systems in mass-market vehicles and Level 3 conditional automation in a few premium models. Global regulations favoring testing and deployment will determine the adoption timeline for consumer markets. China will lead the usership model of Level 4 robotaxis by operation of paid services for public use within predefined geographies. Autonomous shuttles will also be commercially deployed within controlled environments.

In this 2021 outlook, Frost & Sullivan has highlighted 3 key market and business trends that have been affected by the changing dynamics of the autonomous ecosystem. The outlook also highlights 3 key technology trends that Frost & Sullivan expects will see fast advancements, with focus on highly automated vehicle commercialization.

• Market trends include reprioritization of OEM strategies, insurance business models for piloted driving, evolution of technology participants, and the emergence of Tier 0.5 suppliers.

• In terms of technology, the focus is expected to be on developing in-house capabilities for scalable hardware and software that will allow OEMs to offer Over the Air (OTA) upgrades for future developments. Trends include in-cabin monitoring systems, System on Chip (SoC), and Frequency Modulated Continuous Wave (FMCW) technology in LiDARs.

This research service highlights these trends and explains their impact along with use cases.

Key Issues Addressed

- What are the new business strategies adopted by OEMs and technology providers in 2021?

- How is the global autonomous market expected to grow by 2025 based on new SAE definitions?

- Which are the key companies expected to announce new innovations in 2021?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Highlights 2020—Autonomous Driving

Challenges Faced by the Global Autonomous Driving Industry Due to COVID-19

The 2020 Global Autonomous Driving—Actuals Versus Forecast

Global Autonomous Vehicle Forecast, 2020–2025

Overview of Market and Technology Trends for 2021

Top Predictions for 2021—Autonomous Driving

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

Impact of the Top-Three Strategic Imperatives on Autonomous Driving Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Vehicle Segmentation

SAE Definitions

COVID-19 Impact on World GDP Growth

Global Growth Scenario Analysis—Assumptions

World GDP Growth Under Differing Scenarios

COVID-19 Impact on Key Regions

Global Light Vehicle Sales, 2008 to 2021

Market Assumptions—Global Autonomous Driving Market

Technology Assumptions—Global Autonomous Driving Market

Global Autonomous Vehicle Forecast, 2020–2025

L2,L2+ Global Sales Units 2020–2025

Overview of ADAS/Autonomous Driving Regulations, Global

Regulations Overview for ADAS/AD Implementation in Global Markets

Overall AD Roadmap

Market Trends—Autonomous Driving, 2021

Insurance Business Models for Piloted Driving

Insurance Premium Costs for Piloted Driving

Reprioritization of OEM Strategies

Value Chain Integration of OEMs for Reprioritization

Evolution of Technology Participants

Technology Companies Developing AD Integration Capabilities

Emergence of Tier 0.5

Collaboration for Co-Development of Advanced Technologies

Technology Trends—Autonomous Driving, 2021

In-Housing Autonomous Driving Software Stack

OEM Strategies in Software Stack Development

In-Cabin Monitoring System

Product Launch Roadmap—In-Cabin Monitoring System

System on Chip for AD

SOC Tailored to Address Layers of Autonomous Driving

Frequency Modulated Continuous Wave (FMCW) Technology in LiDAR

Benchmarking Capabilities of FMCW and Time of Flight (ToF) LiDAR

Market Segmentation—ADAS and AD Features by Levels of Autonomy

Key Growth Opportunities for 2021 to 2025

Autonomous Driving—Companies to Watch Out for

2021 Predictions—US

2021 Predictions—Europe (Excluding the UK)

2021 Predictions—The UK

2021 Predictions—Japan

2021 Predictions—China

Growth Opportunity 1: L2 And L3 Piloted Driving Market

Growth Opportunity 1: L2 And L3 Piloted Driving Market (continued)

Growth Opportunity 2: Automotive LiDAR in the Environment Perception Market

Growth Opportunity 2: Automotive LiDAR in the Environment Perception Market (continued)

Growth Opportunity 3: Autonomous Software Stack

Growth Opportunity 3: Autonomous Software Stack (continued)

Key Conclusions

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Abbreviations And Acronyms Used

Learn More—Next Steps

Popular Topics

Key Issues Addressed

- What are the new business strategies adopted by OEMs and technology providers in 2021?

- How is the global autonomous market expected to grow by 2025 based on new SAE definitions?

- Which are the key companies expected to announce new innovations in 2021?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Varun Krishna Murthy |

| Industries | Automotive |

| WIP Number | MFCF-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9B13-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB