Eight Transformational Trends Influencing the Global Trucking Industry’s Growth Trajectory

Eight Transformational Trends Influencing the Global Trucking Industry’s Growth Trajectory

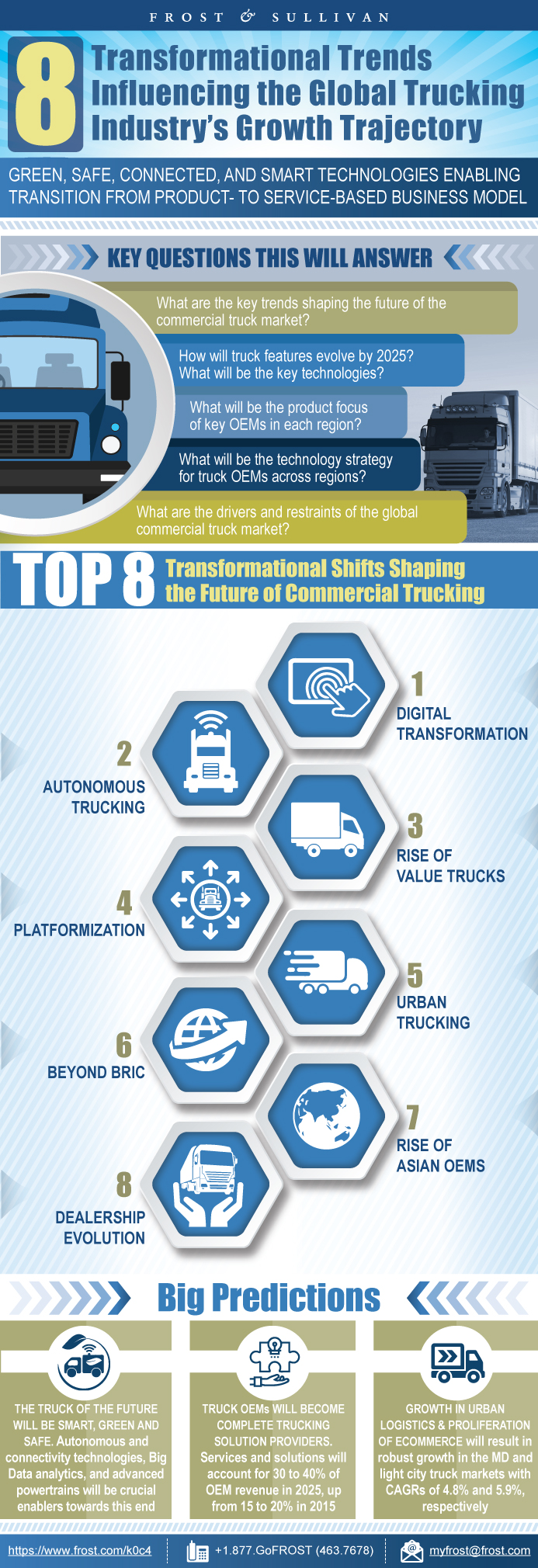

Green, Safe, Connected, and Smart Technologies Enabling Transition from Product- to Service-Based Business Model

26-Aug-2016

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

Technological, demographic, environmental, and geopolitical shifts are altering the commercial truck market globally. Integration of digital technologies primarily for resource management and total cost optimization will result in the evolution of truck technology from basic telematics services to advanced traffic modeling, weather prediction, and social media analytics. Autonomous driving technologies are gaining traction and are expected to garner significant OEM support to reach scalability by 2025, when level 3 autonomous trucks are expected to reach the market. Significant portion of global truck market growth in the next decade will come from Next 11, ASEAN, Middle East, and African countries. Africa’s truck market will be buoyed by the establishment of the African corridor, expansion of free trade agreements within the continent, and better utilization of natural resources. In conjunction with the growth of emerging markets, value trucks will be the fastest- growing segment in the next decade — nearly tripling in volume to account for 31% of total truck sales globally by 2025. Demand for this segment will be driven by fleet modernization efforts in China and India, which are the dominant low-cost truck markets. More global platforms are expected as global OEMs look to expand in Asian markets.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Top 8 Transformational Shifts Shaping the Future of Commercial Trucking

- Digital Transformation

- Autonomous Trucking

- Rise of Value Trucks

- Platformization

- Urban Trucking

- Beyond BRIC

- Rise of Asian OEMs

- Dealership

Executive Summary—Industry Transformation

Executive Summary—Top 5 Insights

Research Scope

Research Aims and Objectives

Research Background

Research Methodology

Key OEMs Compared in this Study

Commercial Vehicle Definitions and Vehicle Segmentation

Transformational Shift No.1—Digital Transformation

Subtrend 1—Technology Enabling New Modes of Fulfillment

Subtrend 2—Uber for Trucks

Subtrend 3—Digital Services Value Stream Stakeholders

Subtrend 4—Emergence of Smart Payment Service in Trucking

Key Strategic Implications for the Trucking Industry

Transformational Shift No.2—Autonomous Trucking

Subtrend 1—Technologies Enabling Autonomous Trucking

Subtrend 2—Skilled Driver Shortage

Subtrend 3—Shortage of Trained Technicians

- Big Data Analytics

- Logistics Management

- Data Sharing

- Hardware

- Wireless Networks

- Enterprise Integration

- Application Providers

Key Strategic Implications for the Trucking Industry

Transformational Shift No.3—Rise of Value Trucks

- OEMs

- Tier I Suppliers

- End Users

Key Focal Points for Product Planning in a Value Truck

- Safety Technologies

- Rising Interests Among Fleets

- Government Regulations

- Connectivity and Convergence

Global Truck Sales

Key Strategic Implications for the Trucking Industry

Transformational Shift No.4—Platformization

Subtrend 1—Medium- and Heavy-Duty Truck Platforms

- OEMs

- Tier I Suppliers

- End Users

Medium- and Heavy-Duty Truck Platforms of Key OEMs

HD Engine Platform Design Harmonization

Key Strategic Implications for the Trucking Industry

Transformational Shift No.5—Urban Trucking

- OEMs

- Tier I Suppliers

- End Users

Subtrend 1—Evolving Customer Base for Urban Logistics

- Time to Market

- Driver-Friendly

- Regulatory Harmonization

- Convergence of Consumer Requirements

- Alliances & Partnerships

- Modularity

Subtrend 2—New Business Models in Logistics

Key Strategic Implications for the Trucking Industry

Transformational Shift No.6—Beyond BRIC

Subtrend 1—Winds of Change in Next 11 and Others

- OEMs

- Tier I Suppliers

- End Users

Future Corridors of Africa—Road to Prosperity

- Future Packing

- e-Shopping

- Hub and Spokes

- Last-Mile Retailing

- Logistical Efficiency

- Driver-Friendly Trucks

Africa Truck Sales Growth Forecast

Key Strategic Implications for the Trucking Industry

Transformational Shift No.7—Rise of Asian OEMs

- OEMs

- Tier I Suppliers

- End Users

Subtrend 1—Asian OEMs Dominate Some Value Truck Markets

Timeline of CNHTC’s Strategic Partnerships

Snapshot of Indian OEMs’ International Operations

Hyundai’s Strong Intent to Grow its Commercial Vehicle Business

Key Strategic Implications for the Trucking Industry

- OEMs

- Tier I Suppliers

- End Users

Transformational Shift No.8—Dealership Evolution

- Growth of technological prowess

- Low-cost/value truck market focused product strategy

- Growth opportunities in Next 11 and other emerging markets

- Chinese truck market slowdown

Subtrend 1—Dealership and OEM Convergence Opportunities

Subtrend 2—Predictive Analytics: Big Data Leverage by Dealerships

Renault Truck eRetailing

Alliance Truck Parts

Key Strategic Implications for the Trucking Industry

- OEMs

- Tier I Suppliers

- End Users

Summary and Recommendations

The Last Word—3 Big Predictions

Legal Disclaimer

Abbreviations and Acronyms Used

- 1. Commercial Vehicle Market: Definitions and Segmentation, Global, 2015

- 1. Transformational Shifts: Top 5 Insights, Global, 2015–2025

- 2. Transformational Shifts: Evolution of Digital Technologies in Trucks, Global, 2015

- 3. Transformational Shifts: Modes of Order Fulfillment, Global, 2015

- 4. Mobile-Based Freight Brokerage Market: Revenue, North America, 2014 and 2025

- 5. Transformational Shifts: Mobile-Freight Brokerage Cycle, Global, 2015

- 6. Transformational Shifts: Stakeholders, Digital Services for Trucking, Global 2015

- 7. Transformational Shifts: Digital Money Applications in Trucking, 2015

- 8. Trucking Industry: Driver Demographics—Percent of Age Group, Canada, 2012

- 9. Trucking Industry: Demand and Supply of For-Hire Drivers, Canada, 2012–2020

- 10. Transformational Shifts: Shortage of Trained Technicians, Europe and North America, 2015–2025

- 11. Transformational Shifts: Truck Segmentation, Global, 2015

- 12. Transformational Shifts: Truck Segment Features, Global, 2015

- 13. Transformational Shifts: MD-HD Truck Sales, Global, 2015 and 2025

- 14. Transformational Shifts: Truck Platform Key Drivers, Global, 2015–2025

- 15. Transformational Shifts: Platforms of Key OEMs, Global, 2015

- 16. Transformational Shifts: Truck Platforms of Key OEMs, Global, 2015

- 17. Transformational Shifts: Harmonization of HD Engine Platforms, Global, 2015 and 2022

- 18. Transformational Shifts: Urban Trends Impacting Trucks, Global, 2015–2025

- 19. Transformational Shifts: Evolution of Customer Base, Urban Logistics, 2015–2025

- 20. Transformational Shifts: Economic Reforms, Key New Markets, Up to 2015

- 21. Transformational Shifts: MD-HD Truck Sales, Next 11, 2015–2025

- 22. Present and Future Corridors of Africa, 2015–2030

- 23. Transformational Shifts: MD-HD Truck Sales, Africa, 2015–2025

- 24. Transformational Shifts: Value Truck Partial Product Portfolio, Select Markets, 2015

- 25. Transformational Shifts: CNHTC Strategic Partnership Timeline, China, 1983–2015

- 26. Commercial Vehicles Market: Indian OEM Assembly Manufacturing Footprint, Global, 2014–2022

- 27. Hyundai Motor Group Commercial Vehicle Business Outlook: Regional Market Position, Global, 2015

- 28. Transformational Shifts: Degree of Digitization in Dealership Retailing, Global, 2015–2025

- 29. Transformational Shifts: Dealership and OEM Convergence Strategy Analysis, Global, 2015

- 30. Transformational Shifts: Dealership Big Data Opportunities, Global, 2015–2025

- 31. Transformational Shifts: eRetailing Value Stream, Europe, 2015

- 32. Transformational Shifts: Multipronged Dealership Strategy, Alliance Truck Parts, 2015

- 33. Transformational Shifts in the Trucking Industry: Opportunities, Global, 2015–2025

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Executive Summary—Top 8 Transformational Shifts Shaping the Future of Commercial Trucking~ ||| Digital Transformation~ ||| Autonomous Trucking~ ||| Rise of Value Trucks~ ||| Platformization~ ||| Urban Trucking~ ||| Beyond BRIC~ ||| Rise of Asian OEMs~ ||| Dealership~ || Executive Summary—Industry Transformation~ || Executive Summary—Top 5 Insights~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ ||| Research Methodology~ ||| Secondary Research~ ||| Primary Research~ ||| Note on Images~ || Key OEMs Compared in this Study~ | Definitions and Segmentation~ || Commercial Vehicle Definitions and Vehicle Segmentation~ | Top 8 Transformational Shifts Shaping the Future of Commercial Trucking~ || Transformational Shift No.1—Digital Transformation~ || Subtrend 1—Technology Enabling New Modes of Fulfillment~ || Subtrend 2—Uber for Trucks~ || Subtrend 3—Digital Services Value Stream Stakeholders~ ||| Big Data Analytics~ ||| Logistics Management~ ||| Data Sharing~ ||| Hardware~ ||| Wireless Networks~ ||| Enterprise Integration~ ||| Application Providers~ || Subtrend 4—Emergence of Smart Payment Service in Trucking~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Tier I Suppliers~ ||| End Users~ || Transformational Shift No.2—Autonomous Trucking~ ||| Safety Technologies~ ||| Rising Interests Among Fleets~ ||| Government Regulations~ ||| Connectivity and Convergence~ || Subtrend 1—Technologies Enabling Autonomous Trucking~ || Subtrend 2—Skilled Driver Shortage~ || Subtrend 3—Shortage of Trained Technicians~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Tier I Suppliers~ ||| End Users~ || Transformational Shift No.3—Rise of Value Trucks~ || Key Focal Points for Product Planning in a Value Truck~ || Global Truck Sales~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Tier I Suppliers~ ||| End Users~ || Transformational Shift No.4—Platformization~ ||| Time to Market~ ||| Driver-Friendly~ ||| Regulatory Harmonization~ ||| Convergence of Consumer Requirements~ ||| Alliances & Partnerships~ ||| Modularity~ || Subtrend 1—Medium- and Heavy-Duty Truck Platforms~ || Medium- and Heavy-Duty Truck Platforms of Key OEMs~ || HD Engine Platform Design Harmonization~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Tier I Suppliers~ ||| End Users~ || Transformational Shift No.5—Urban Trucking~ ||| Future Packing~ ||| e-Shopping~ ||| Hub and Spokes~ ||| Last-Mile Retailing~ ||| Logistical Efficiency~ ||| Driver-Friendly Trucks~ || Subtrend 1—Evolving Customer Base for Urban Logistics~ || Subtrend 2—New Business Models in Logistics~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Tier I Suppliers~ ||| End Users~ || Transformational Shift No.6—Beyond BRIC~ || Subtrend 1—Winds of Change in Next 11 and Others~ || Future Corridors of Africa—Road to Prosperity~ || Africa Truck Sales Growth Forecast~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Tier I Suppliers~ ||| End Users~ || Transformational Shift No.7—Rise of Asian OEMs~ ||| Growth of technological prowess~ ||| Low-cost/value truck market focused product strategy~ ||| Growth opportunities in Next 11 and other emerging markets~ ||| Chinese truck market slowdown~ || Subtrend 1—Asian OEMs Dominate Some Value Truck Markets~ || Timeline of CNHTC’s Strategic Partnerships~ || Snapshot of Indian OEMs’ International Operations~ || Hyundai’s Strong Intent to Grow its Commercial Vehicle Business~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Tier I Suppliers~ ||| End Users~ || Transformational Shift No.8—Dealership Evolution~ || Subtrend 1—Dealership and OEM Convergence Opportunities~ || Subtrend 2—Predictive Analytics: Big Data Leverage by Dealerships~ || Renault Truck eRetailing~ || Alliance Truck Parts~ || Key Strategic Implications for the Trucking Industry~ ||| OEMs~ ||| Dealerships~ ||| End Users~ | Conclusions~ || Summary and Recommendations~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Abbreviations and Acronyms Used~ |

| List of Charts and Figures | 1. Commercial Vehicle Market: Definitions and Segmentation, Global, 2015~| 1. Transformational Shifts: Top 5 Insights, Global, 2015–2025~ 2. Transformational Shifts: Evolution of Digital Technologies in Trucks, Global, 2015~ 3. Transformational Shifts: Modes of Order Fulfillment, Global, 2015~ 4. Mobile-Based Freight Brokerage Market: Revenue, North America, 2014 and 2025~ 5. Transformational Shifts: Mobile-Freight Brokerage Cycle, Global, 2015~ 6. Transformational Shifts: Stakeholders, Digital Services for Trucking, Global 2015~ 7. Transformational Shifts: Digital Money Applications in Trucking, 2015~ 8. Trucking Industry: Driver Demographics—Percent of Age Group, Canada, 2012~ 9. Trucking Industry: Demand and Supply of For-Hire Drivers, Canada, 2012–2020~ 10. Transformational Shifts: Shortage of Trained Technicians, Europe and North America, 2015–2025~ 11. Transformational Shifts: Truck Segmentation, Global, 2015~ 12. Transformational Shifts: Truck Segment Features, Global, 2015~ 13. Transformational Shifts: MD-HD Truck Sales, Global, 2015 and 2025~ 14. Transformational Shifts: Truck Platform Key Drivers, Global, 2015–2025~ 15. Transformational Shifts: Platforms of Key OEMs, Global, 2015~ 16. Transformational Shifts: Truck Platforms of Key OEMs, Global, 2015~ 17. Transformational Shifts: Harmonization of HD Engine Platforms, Global, 2015 and 2022~ 18. Transformational Shifts: Urban Trends Impacting Trucks, Global, 2015–2025~ 19. Transformational Shifts: Evolution of Customer Base, Urban Logistics, 2015–2025~ 20. Transformational Shifts: Economic Reforms, Key New Markets, Up to 2015~ 21. Transformational Shifts: MD-HD Truck Sales, Next 11, 2015–2025~ 22. Present and Future Corridors of Africa, 2015–2030~ 23. Transformational Shifts: MD-HD Truck Sales, Africa, 2015–2025~ 24. Transformational Shifts: Value Truck Partial Product Portfolio, Select Markets, 2015~ 25. Transformational Shifts: CNHTC Strategic Partnership Timeline, China, 1983–2015~ 26. Commercial Vehicles Market: Indian OEM Assembly Manufacturing Footprint, Global, 2014–2022~ 27. Hyundai Motor Group Commercial Vehicle Business Outlook: Regional Market Position, Global, 2015~ 28. Transformational Shifts: Degree of Digitization in Dealership Retailing, Global, 2015–2025~ 29. Transformational Shifts: Dealership and OEM Convergence Strategy Analysis, Global, 2015~ 30. Transformational Shifts: Dealership Big Data Opportunities, Global, 2015–2025~ 31. Transformational Shifts: eRetailing Value Stream, Europe, 2015~ 32. Transformational Shifts: Multipronged Dealership Strategy, Alliance Truck Parts, 2015~ 33. Transformational Shifts in the Trucking Industry: Opportunities, Global, 2015–2025~ |

| Author | Silpa Paul |

| Industries | Automotive |

| WIP Number | K0C4-01-00-00-00 |

| Keyword 1 | Global Trucking Industry |

| Keyword 2 | commercial truck |

| Keyword 3 | Integration of digital technology |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB