Electric Vehicle (EV) Regulation Overview in Key European Markets 2020

Electric Vehicle (EV) Regulation Overview in Key European Markets 2020

Cash Incentives to be Discontinued in the Next 3–5 years; Non-cash Incentives to Prevail for at least 10 Years

22-Jan-2021

Europe

$2,450.00

Special Price $1,837.50 save 25 %

Description

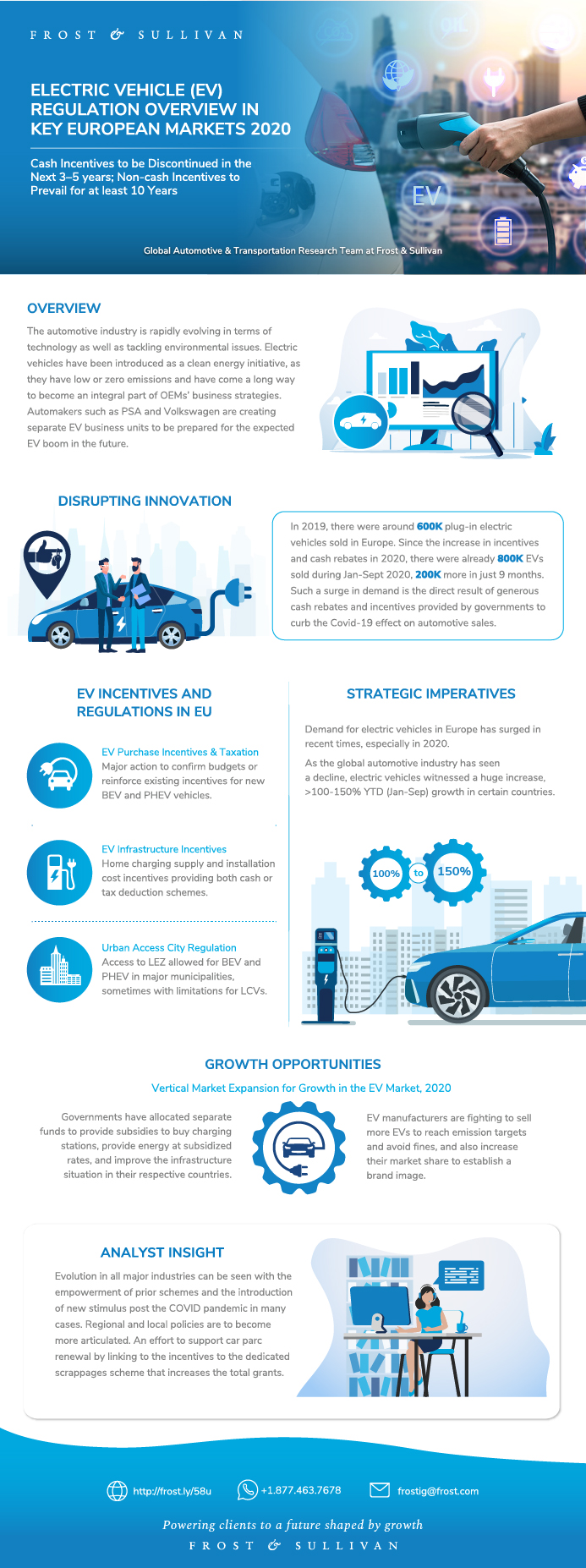

The automotive industry is rapidly evolving in terms of technology as well as tackling environmental issues. Electric vehicles have been introduced as a clean energy initiative, as they have low or zero emissions and have come a long way to become an integral part of OEMs’ business strategies. Automakers such as PSA and Volkswagen are creating separate EV business units to be prepared for the expected EV boom in the future.

Asia has been dominating the market up until recently but things have changed in 2020. Europe has emerged as the clear leader as of September 2020 with the continent registering sales of about 800,000 units. Due to the COVID-19 crisis, China registered only 700,000 units compared to around 1,115,000 units in September 2019. Although Europe had also gone into a temporary lockdown in Q2 2020, to curb the effect, governments have announced stimulus packages that include generous EV subsidies and incentives (doubled in few countries) that have resulted in almost doubling of sales compared to January to September 2019.

Countries across Europe have similar approaches with various types of EV purchase incentives, EV taxation policies, EV infrastructure incentives, and urban access regulations. By far, EV purchase incentives such as cash rebates and scrappage incentives have impacted the most on EV sales as is evident in Germany and France where sales have grew more than 140% and 160%, respectively, in January to September 2020 compared to the same period in 2019. Favorable EV taxation policies (e.g., exemption from registration and ownership tax on purchase of EVs) have also led to an increase in demand in Italy and Norway. Creation of low and ultra-low emission zones have also pushed consumers into buying plug-in electric vehicles, especially in the UK, where driving a petrol (below Euro 4) or diesel (before Euro 6) vehicle can attract a fine of £12.50 per day in certain low emission zones (LEZs).

This study gives a detailed analysis of EV incentives, subsidies, and taxation scenarios in each European country and their impact on EV sales.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of Strategic Imperative 8™ on the EV Battery Recycling Market

Growth Opportunities Fuel the Growth Pipeline EngineTM

European EV Market Overview

European EV Market Segmentation

EV Incentives and Regulations in EU—Executive Summary

Market Evaluation Dashboard—EU Overview

Market Evaluation Dashboard—Overview of Other EU28 Markets

Market Evaluation Dashboard—Overview of Other EU28 Markets (continued)

Market Evaluation Dashboard—Overview of Other EU28 Markets (continued)

Market Evaluation Dashboard—Overview of Other EU28 Markets (continued)

Market Evaluation Dashboard—Overview of Other EU28 Markets and Norway

EV Incentives and Policies—Germany

EV Incentives and Policies—Germany

EV Incentives and Policies—Germany

EV Incentives and Policies—France

EV Incentives and Policies—France

EV Incentives and Policies—France

EV Incentives and Policies—UK

EV Incentives and Policies—UK

EV Incentives and Policies—Italy

EV Incentives and Policies—Italy (continued)

EV Incentives and Policies—Italy (continued)

EV Incentives and Policies—Spain

EV Incentives and Policies—Spain

EV Incentives and Policies—Spain

EV Incentives and Policies—Austria

EV Incentives and Policies—Belgium

EV Incentives and Policies—Belgium (continued)

EV Incentives and Policies—Denmark

EV Incentives and Policies—Denmark (continued)

EV Incentives and Policies—Portugal

EV Incentives and Policies—Sweden

EV Incentives and Policies—Norway

EV Incentives and Policies—The Netherlands

EV Incentives and Policies—The Netherlands (continued)

EV Incentives and Policies—The Netherlands (continued)

EV Incentives and Policies—Poland

EV Incentives and Policies—Luxembourg

EV Incentives and Policies—Luxembourg (continued)

EV Incentives and Policies—Ireland

EV Incentives and Policies—Finland

EV Incentives and Policies—Bulgaria

EV Incentives and Policies—Bulgaria (continued)

EV Incentives and Policies—Romania

EV Incentives and Policies—Romania (continued)

EV Incentives and Policies—Romania

EV Incentives and Policies—Hungary

EV Incentives and Policies—Hungary (continued)

EV Incentives and Policies—Greece

EV Incentives and Policies—Greece

EV Incentives and Policies—Cyprus

EV Incentives and Policies—Cyprus (continued)

EV Incentives and Policies—Croatia

EV Incentives and Policies—Croatia (continued)

EV Incentives and Policies—The Czech Republic

EV Incentives and Policies—The Czech Republic (continued)

EV Incentives and Policies—Slovakia

EV Incentives and Policies—Slovenia

EV Incentives and Policies—Slovenia (continued)

EV Incentives and Policies—Malta

EV Incentives and Policies—Estonia

EV Incentives and Policies—Latvia

EV Incentives and Policies—Lithuania

Growth Opportunity 1—Vertical Market Expansion for Growth in the EV Market, 2020

Growth Opportunity 1—Vertical Market Expansion for Growth in the EV Market, 2020 (continued)

Your Next Steps

Why Frost, Why Now?

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Prajyot Sathe |

| Industries | Automotive |

| WIP Number | MFA1-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9807-A6,9882-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB