Ethiopian Pharmaceutical Market, Forecast to 2020

Preference for Generic Prescription Drugs to Create New Market Dynamics, Demand for Anti-Infectives Rises

29-Jan-2016

Africa

Market Research

$4,950.00

Special Price $3,712.50 save 25 %

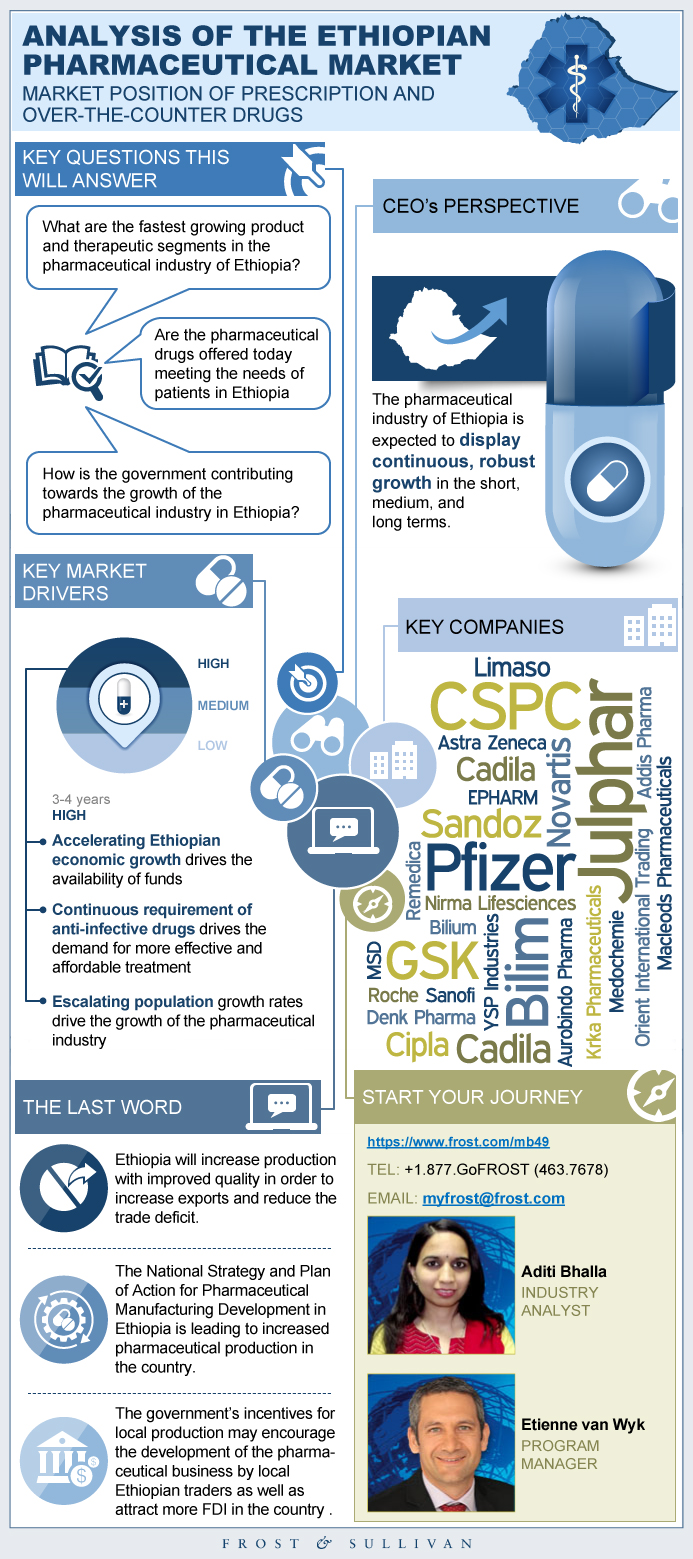

This study offers an insight into the pharmaceutical industry of Ethiopia, where preference for generic, prescription drugs is growing. There is information on recent reforms introduced by the government (like tax benefits for in-country production, national strategy, and plan of action for pharmaceutical manufacturing development, growth and transformation plan, and so on), key participants in the market, population and disease statistics, and so on. The study also describes the opportunities and constraints in the market and revenue forecasts for the total market from 2011–2020. Primary research interviews with industry stakeholders and secondary research through in-house Frost & Sullivan database and news reports were undertaken.

Key Findings

Scope and Segmentation

- Geographic coverage

- Study period

- Base year

- Forecast period

- Monetary unit

- Conversion rate

Market Engineering Measurements

- Market Stage

- Market Revenue

- Compound Annual Growth Rate

- Customer Price Sensitivity

- Degree of Technical Change

- Number of Competitors

CEO’s Perspective

Key Companies to Watch

3 Big Predictions

Ethiopia

Infrastructure and Economic Situation

Healthcare Industry

Healthcare Infrastructure

Disease Profile

Healthcare Financing Indicators

Pharmaceutical Market—Background

Process of Procurement and Distribution

Essential Requirements for Drug Registration

- Structure of Public Healthcare in Ethiopia

- Per cent of Healthcare Facilities, Ethiopia, 2012

- Total Number of Hospitals by Region, Ethiopia, 2012

Total Pharmaceutical Market—Segmentation

Increase in Generic Drugs’ Market Share

Per cent Sales Breakdown by Therapeutic Segment, Ethiopia, 2014

New Market Opportunities

Total Pharmaceutical Market: Game-changing Strategies, Ethiopia, 2014

Merger, Acquisition, and Partnership Assessment

Key Market Drivers, Ethiopia, 2015-2020

Key Market Restraints, Ethiopia, 2015–2020

Definitions

Revenue Forecast by Market Size

Per Cent Revenue Forecast by Non-prescription, Generic, and Branded Drugs

Key Therapeutic Segment Growth Analysis, Ethiopia, 2014–2020

Growth Forecast by Key Therapeutic Segments, Ethiopia, 2014

Total Pharmaceutical Market: PESTLE Analysis, Ethiopia, 2014

Market Share—Prescription Drugs and Non-prescription Drugs

Market Share—Prescription Drugs and Non-prescription Drugs

Branded Drugs Segment: Per cent Revenue Breakdown, Ethiopia, 2014

Companies to Watch

Legal Disclaimer

List of Companies in “Others”

Market Engineering Methodology

- 1. Disease Indicators, Ethiopia, 2011 and 2013

- 2. Total Pharmaceutical Market: Key Market Drivers, Ethiopia, 2015-2020

- 3. Total Pharmaceutical Market: Key Market Restraints, Ethiopia, 2015–2020

- 4. Total Pharmaceutical Market: Market Engineering Measurements, Ethiopia, 2014

- 5. Total Pharmaceutical Market: Growth Forecast by Key Therapeutic Segments, Ethiopia, 2014

- 1. Total Pharmaceutical Market: Market Engineering Measurements, Ethiopia, 2014

- 2. Population Split by Gender, Ethiopia, 2014

- 3. Inflation at Consumer Prices, Ethiopia, 2010–2014 Annual Infrastructural Improvements, Ethiopia, 2011–2015

- 4. Per cent of Healthcare Facilities, Ethiopia, 2012

- 5. Total Number of Hospitals by Region, Ethiopia, 2012

- 6. Healthcare Expenditures, Ethiopia, 2010–2013

- 7. Healthcare Expenditures, Ethiopia, 2010–2013

- 8. Total Pharmaceutical Market: Procurement Process, Ethiopia, 2014

- 9. Total Pharmaceutical Market: Per cent Sales Breakdown by Therapeutic Segment, Ethiopia, 2014

- 10. Total Pharmaceutical Market: Revenue Forecast, Ethiopia, 2011–2020

- 11. Total Pharmaceutical Market: Per cent Revenue Forecast by Non-prescription, Generic and Branded Drugs, Ethiopia, 2011–2020

- 12. Total Pharmaceutical Market: Key Therapeutic Segment Growth Analysis, Ethiopia, 2014–2020

- 13. Total Pharmaceutical Market: Per cent Revenue Breakdown, Ethiopia, 2014

- 14. Generic Drugs Segment: Per cent Revenue Breakdown, Ethiopia, 2014

- 15. Branded Drugs Segment: Per cent Revenue Breakdown, Ethiopia, 2014

- 16. GDP Per Capita, Ethiopia, 2010–2014

- 17. Health Financing Sources, Ethiopia, 2013

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Scope and Segmentation~ ||| Geographic coverage~ ||| Study period~ ||| Base year~ ||| Forecast period~ ||| Monetary unit~ ||| Conversion rate~ || Market Engineering Measurements~ ||| Market Stage~ ||| Market Revenue~ ||| Compound Annual Growth Rate~ ||| Customer Price Sensitivity~ ||| Degree of Technical Change ~ ||| Number of Competitors~ || CEO’s Perspective~ || Key Companies to Watch~ || 3 Big Predictions~ | Market Overview~ || Ethiopia~ || Infrastructure and Economic Situation~ || Healthcare Industry~ || Healthcare Infrastructure~ ||| Structure of Public Healthcare in Ethiopia~ ||| Per cent of Healthcare Facilities, Ethiopia, 2012~ ||| Total Number of Hospitals by Region, Ethiopia, 2012~ || Disease Profile~ || Healthcare Financing Indicators~ || Pharmaceutical Market—Background~ || Process of Procurement and Distribution~ || Essential Requirements for Drug Registration~ || Total Pharmaceutical Market—Segmentation~ || Increase in Generic Drugs’ Market Share~ || Per cent Sales Breakdown by Therapeutic Segment, Ethiopia, 2014~ | Competitive Playbook~ || New Market Opportunities~ || Total Pharmaceutical Market: Game-changing Strategies, Ethiopia, 2014~ || Merger, Acquisition, and Partnership Assessment~ | Drivers and Restraints~ || Key Market Drivers, Ethiopia, 2015-2020~ ||| Accelerating Ethiopian economic growth~ ||| Continuous requirement of anti-infective drugs~ ||| Escalating population~ ||| Increasing incidences of non-communicable diseases~ ||| Extension of healthcare coverage and improvements in infrastructure~ || Key Market Restraints, Ethiopia, 2015–2020~ ||| Shortage of FOREX with the National Bank~ ||| Deficiency of resources in medical institutions hampers the quality of workforce~ ||| Lengthy regulatory policies for the pharmaceutical industry~ | Forecast and Trends~ || Definitions~ || Revenue Forecast by Market Size~ ||| Revenue Forecast, Ethiopia, 2011–2020~ || Per Cent Revenue Forecast by Non-prescription, Generic, and Branded Drugs~ || Key Therapeutic Segment Growth Analysis, Ethiopia, 2014–2020~ || Growth Forecast by Key Therapeutic Segments, Ethiopia, 2014~ || Total Pharmaceutical Market: PESTLE Analysis, Ethiopia, 2014~ | Competitive Environment~ || Market Share—Prescription Drugs and Non-prescription Drugs~ || Market Share—Prescription Drugs and Non-prescription Drugs~ || Branded Drugs Segment: Per cent Revenue Breakdown, Ethiopia, 2014~ | Key Companies to Watch~ || Companies to Watch~ ||| Addis Pharmaceutical Factory PLC~ ||| Aurobindo Pharma Limited~ ||| Cadila Pharmaceutical~ ||| GlaxoSmithKline~ ||| Julphar~ ||| Novartis~ | The Last Word~ || Legal Disclaimer~ | Appendix~ || List of Companies in “Others”~ ||| Aurobindo Pharma ~ ||| GSK ~ ||| EPHARM ~ ||| Bilium ~ ||| Denk Pharma ~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Disease Indicators, Ethiopia, 2011 and 2013~ 2. Total Pharmaceutical Market: Key Market Drivers, Ethiopia, 2015-2020~ 3. Total Pharmaceutical Market: Key Market Restraints, Ethiopia, 2015–2020~ 4. Total Pharmaceutical Market: Market Engineering Measurements, Ethiopia, 2014~ 5. Total Pharmaceutical Market: Growth Forecast by Key Therapeutic Segments, Ethiopia, 2014~| 1. Total Pharmaceutical Market: Market Engineering Measurements, Ethiopia, 2014~ 2. Population Split by Gender, Ethiopia, 2014~ 3. Inflation at Consumer Prices, Ethiopia, 2010–2014 Annual Infrastructural Improvements, Ethiopia, 2011–2015~ 4. Per cent of Healthcare Facilities, Ethiopia, 2012~ 5. Total Number of Hospitals by Region, Ethiopia, 2012~ 6. Healthcare Expenditures, Ethiopia, 2010–2013~ 7. Healthcare Expenditures, Ethiopia, 2010–2013~ 8. Total Pharmaceutical Market: Procurement Process, Ethiopia, 2014~ 9. Total Pharmaceutical Market: Per cent Sales Breakdown by Therapeutic Segment, Ethiopia, 2014~ 10. Total Pharmaceutical Market: Revenue Forecast, Ethiopia, 2011–2020~ 11. Total Pharmaceutical Market: Per cent Revenue Forecast by Non-prescription, Generic and Branded Drugs, Ethiopia, 2011–2020~ 12. Total Pharmaceutical Market: Key Therapeutic Segment Growth Analysis, Ethiopia, 2014–2020~ 13. Total Pharmaceutical Market: Per cent Revenue Breakdown, Ethiopia, 2014~ 14. Generic Drugs Segment: Per cent Revenue Breakdown, Ethiopia, 2014~ 15. Branded Drugs Segment: Per cent Revenue Breakdown, Ethiopia, 2014~ 16. GDP Per Capita, Ethiopia, 2010–2014~ 17. Health Financing Sources, Ethiopia, 2013~ |

| Lightbox Content | World Cancer Day 2019|Get 15% discount for all Healthcare studies |https://store.frost.com/contacts/?utm_source=PD&utm_medium=lightbox&utm_campaign=HEALTHCARE_CANCER2019 |

| Author | Aditi Bhalla |

| Industries | Healthcare |

| WIP Number | MB49-01-00-00-00 |

| Is Prebook | No |