European Energy Savings Contract and Performance Contracting Market, Forecast to 2020

European Energy Savings Contract and Performance Contracting Market, Forecast to 2020 Updated Research Available

Changing Focus of Energy Management from Products to Services Promotes Strong Growth

RELEASE DATE

07-Mar-2016

07-Mar-2016

REGION

Europe

Europe

Research Code: MB27-01-00-00-00

SKU: EN00840-EU-MR_17082

$4,950.00

In stock

SKU

EN00840-EU-MR_17082

Description

The management of energy efficiency is witnessing a fundamental shift away from investment in products and systems, towards investment in outcomes, managed services, and guaranteed energy savings. The European energy savings and performance contracting market is still young and shows great potential with strong growth projected throughout the forecast period. Different regions are in different stages of development as a result of various country-specific legal and political frameworks, incentive programs, and the availability of project financing.

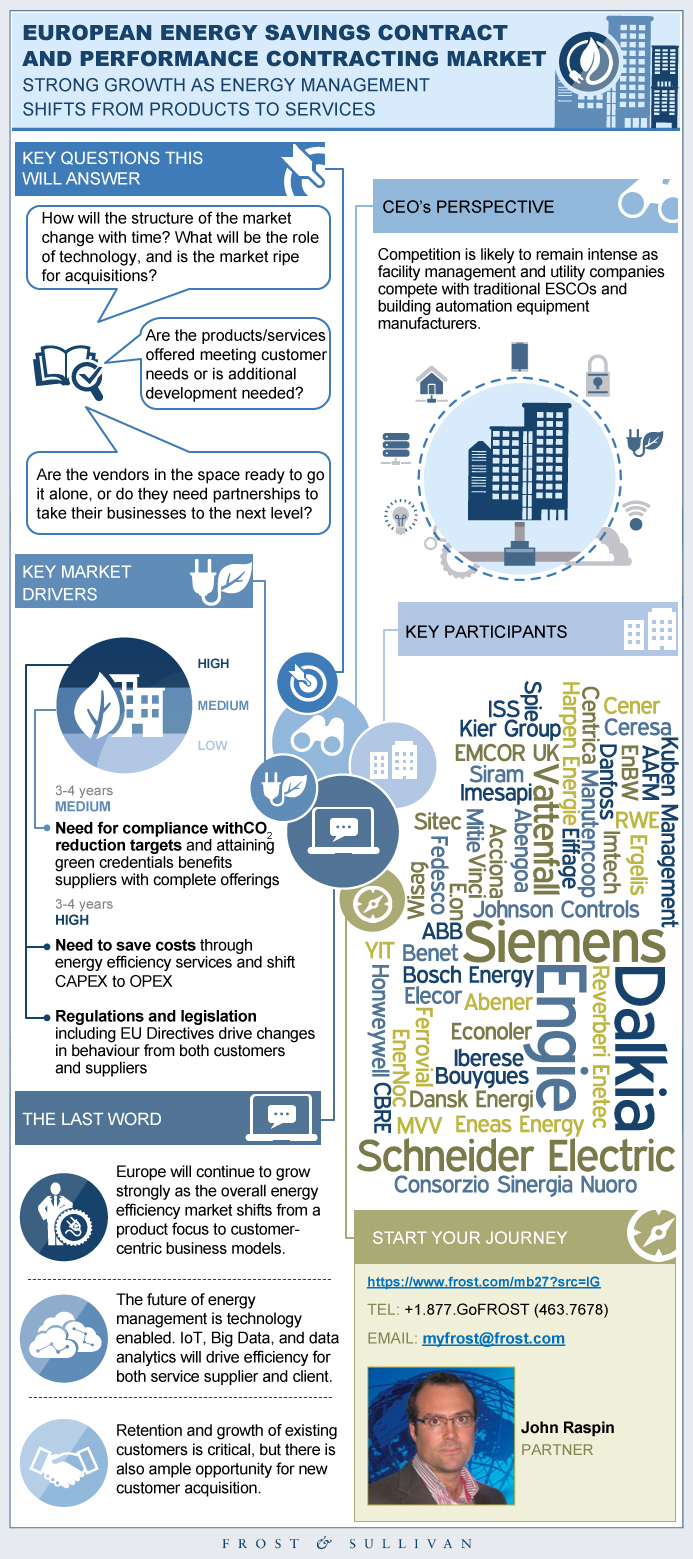

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings - Energy Savings Contract and Performance Contracting Market

Life Cycle Analysis by Geography

- By Country, Europe, 2014

Market Engineering Measurements

- Market Overview

- Competitor Overview

- Total Addressable Market

CEO’s Perspective

Associated Multimedia

Market Definitions

Market Segmentation

Market Drivers, 2015–2020

Energy Price Indicators, Europe, 2012–2014

Market Restraints

Market Engineering Measurements, Europe, 2014

Revenue Forecast, Europe, 2012–2020

Per Cent Revenue Forecast by Country, Europe, 2012–2020

Revenue Forecast by Country, Europe, 2012–2020

Service Type by Country

Customer Sector by Country

Revenue Forecast by End-user Vertical, 2014 and 2020

Service Type by End-user Vertical, 2014

Revenue Forecast by Service Type, Europe, 2012–2020

Market Share

Market Share Evolution by Company Type

Per Cent Revenue by Service Type and Company, Europe, 2014

Market Share Analysis

Competitive Structure, Europe, 2014

Competitive Convergence from Neighbouring Markets

Energy Management: Recent Strategic Moves

Key Findings

Revenue Forecast, 2012–2020

Revenue Forecast by Service Type, 2012-2020

Revenue Forecast by End-user Vertical, 2014 and 2020

Market Share

Market Share Analysis

Competitive Structure, 2014

Key Findings

Revenue Forecast, 2012–2020

Revenue Forecast by Service Type, 2012–2020

Revenue Forecast by End-user Vertical, 2014 and 2020

Market Share

Market Share Analysis

Structure, 2014

Key Findings

Revenue Forecast, 2012–2020

Revenue Forecasts by Service Type, 2012–2020

Revenue Forecast by End-user Vertical, 2014 and 2020

Market Share

Market Share Analysis

Competitive Structure, 2014

Key Findings

Revenue Forecast, 2012–2020

Revenue Forecasts by Service Type, 2012–2020

Revenue Forecast by End-user Vertical, 2014 and 2020

Market Share

Market Share Analysis

Competitive Structure, 2014

Key Findings

Revenue Forecast, 2012–2020

Revenue Forecast by Service Type, 2012–2020

Revenue Forecast by End-user Vertical, 2014 and 2020

Market Share

Market Share Analysis

Competitive Structure, 2014

Key Findings

Revenue Forecast, 2012–2020

Revenue Forecast by Service Type, 2012–2020

Revenue Forecast by End-user Vertical, 2014 and 2020

Market Share

Market Share Analysis

Competitive Structure, 2014

Key Findings

Revenue Forecast, 2012–2020

Revenue Forecasts by Service Type, 2012–2020

Revenue Forecast by End-user Vertical, 2014 and 2020

Market Share

Market Share Analysis

Competitive Structure, 2014

3 Big Predictions

Disclaimer

Market Methodology

List of Companies in “Others”

Abbreviations and Acronyms Used

- 1. Building Energy Efficiency Market: Research Focus, Europe, 2014

- 2. Energy Services Ecosystem

- 3. Total Energy Savings Contract and Performance Contracting Market: Key Market Drivers, Europe, 2015–2020

- 4. Total Energy Savings Contract and Performance Contracting Market: Key Market Restraints, Europe, 2015–2020

- 5. Total Energy Savings Contract and Performance Contracting Market: Market Engineering Measurements, Europe, 2014

- 6. Total Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Country, Europe, 2012–2020

- 7. Total Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of the Top 8 Participants, Europe, 2014

- 8. Total Energy Savings Contract and Performance Contracting Market: Competitive Structure, Europe, 2014

- 9. Competitive Convergence from Neighbouring Markets: Examples of Tier-1 Participants

- 10. Competitive Convergence from Neighbouring Markets: Examples of New Entrants and Emerging Participants

- 11. Competitive Convergence from Neighbouring Markets: Complexity from Varying Service Models

- 12. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 5 Participants, France, 2014

- 13. Energy Savings Contract and Performance Contracting Market: Competitive Structure, France, 2014

- 14. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 5 Participants, Germany, 2014

- 15. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Germany, 2014

- 16. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants UK, 2014

- 17. Energy Savings Contract and Performance Contracting Market: Competitive Structure, UK, 2014

- 18. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants, Italy, 2014

- 19. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Italy, 2014

- 20. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants, Spain, 2014

- 21. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Spain, 2014

- 22. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 5 Participants, Benelux, 2014

- 23. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Benelux, 2014

- 24. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants, Nordics, 2014

- 25. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Nordics, 2014

- 1. Total Energy Savings Contract and Performance Contracting Market: Life Cycle Analysis by Country, Europe, 2014

- 2. Total Energy Savings Contract and Performance Contracting Market: Market Engineering Measurements, Europe, 2014

- 3. Total Energy Savings Contract and Performance Contracting Market: Typical Service Types, Europe, 2014

- 4. Total Energy Savings Contract and Performance Contracting Market: Selection of Common Contract Models and Market Segmentation, Europe, 2014

- 5. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown by Service Type, Europe, 2014

- 6. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown by Country and Service Type, Europe, 2014

- 7. Total Energy Savings Contract and Performance Contracting Market: Technology Timeline, Europe, 2009–2020

- 8. Total Energy Savings Contract and Performance Contracting Market: Energy Price Indicators, Europe, 2012–2014

- 9. Total Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Europe, 2012–2020

- 10. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Forecast by Country, Europe, 2012–2020

- 11. Total Energy Savings Contract and Performance Contracting Market: Absolute Revenue Breakdown by Country and Service Type, Europe, 2014

- 12. Total Energy Savings Contract and Performance Contracting Market: CAGR by Country and Service Type, Europe, 2014–2020

- 13. Customer Sector by Country

- 14. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Europe, 2014 and 2020

- 15. Total Energy Savings Contract and Performance Contracting Market: Absolute Market Size by End-user Vertical, Europe, 2014 and 2020

- 16. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by Service Type by End-user Vertical, Europe, 2014

- 17. Total Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Europe, 2012–2020

- 18. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Europe, 2014

- 19. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by Company Type, Europe, 2012, 2014 and 2020

- 20. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by Service Type and Company, Europe, 2014

- 21. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, France, 2012–2020

- 22. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, France, 2012–2020

- 23. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, France, 2014 and 2020

- 24. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, France, 2014 and 2020

- 25. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, France, 2014

- 26. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Germany, 2012–2020

- 27. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Germany, 2012–2020

- 28. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Germany, 2014 and 2020

- 29. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Germany, 2014 and 2020

- 30. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Germany, 2014

- 31. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, UK, 2012–2020

- 32. Energy Savings Contract and Performance Contracting Market: Revenue Forecasts by Service Type, UK, 2012–2020

- 33. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, UK, 2014 and 2020

- 34. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, UK, 2014 and 2020

- 35. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, UK, 2014

- 36. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Italy, 2012–2020

- 37. Energy Savings Contract and Performance Contracting Market: Revenue Forecasts by Service Type, Italy, 2012–2020

- 38. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Italy, 2014 and 2020

- 39. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Italy, 2014 and 2020

- 40. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Italy, 2014

- 41. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Spain, 2012–2020

- 42. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Spain, 2012–2020

- 43. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Spain, 2014 and 2020

- 44. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Spain, 2014 and 2020

- 45. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Spain, 2014

- 46. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Benelux, 2012–2020

- 47. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Benelux, 2012–2020

- 48. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Benelux, 2014 and 2020

- 49. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Benelux, 2014 and 2020

- 50. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Benelux, 2014

- 51. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Nordics, 2012–2020

- 52. Energy Savings Contract and Performance Contracting Market: Revenue Forecasts by Service Type, Nordics, 2012–2020

- 53. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Nordics, 2014 and 2020

- 54. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Nordics, 2014 and 2020

- 55. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Nordics, 2014

Popular Topics

The management of energy efficiency is witnessing a fundamental shift away from investment in products and systems, towards investment in outcomes, managed services, and guaranteed energy savings. The European energy savings and performance contracting market is still young and shows great potential with strong growth projected throughout the forecast period. Different regions are in different stages of development as a result of various country-specific legal and political frameworks, incentive programs, and the availability of project financing.--BEGIN PROMO--

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings - Energy Savings Contract and Performance Contracting Market~ || Life Cycle Analysis by Geography~ ||| By Country, Europe, 2014~ || Market Engineering Measurements~ ||| Market Overview~ ||| Competitor Overview~ ||| Total Addressable Market~ || CEO’s Perspective~ || Associated Multimedia~ | Market Overview~ || Market Definitions~ ||| By Regions~ ||| By End-user Groups~ |||| Private Sector~ |||| Public Sector~ ||| Building Energy Efficiency Market - Research Focus, Europe, 2014~ ||| Typical Service Types, Europe, 2014 - Total Energy Savings Contract and Performance Contracting Market~ |||| Market~ |||| Business Model~ |||| Arrangement/ Service Type~ ||| Selection of Common Contract Models and Market Segmentation, Europe, 2014 ~ ||| Energy Services Ecosystem~ |||| By Demand-Side Services~ |||| By Supply-Side Services~ || Market Segmentation~ ||| Per Cent Revenue Breakdown, Europe, 2014~ |||| By Service Type~ |||| By Country and Service Type~ ||| Technology Development and Impact on Energy Services~ |||| Technology Timeline, Europe, 2009–2020~ | Drivers and Restraints—Total Energy Savings Contract and Performance Contracting Market~ || Market Drivers, 2015–2020~ ||| Need to save costs~ ||| Regulations and legislation~ ||| Need for compliance with CO2 reduction targets~ ||| Favourable financing options~ ||| The boom of smart technology~ ||| Efforts by facilitators and associations~ || Energy Price Indicators, Europe, 2012–2014~ ||| Electricity prices Indicators~ ||| Gas prices Indicators~ || Market Restraints~ ||| Lack of end-user education~ ||| Lack of common definitions and harmonised processes~ ||| Difficulty in procurement procedures~ | Forecasts and Trends—Total Energy Savings Contract and Performance Contracting Market~ || Market Engineering Measurements, Europe, 2014~ || Revenue Forecast, Europe, 2012–2020~ || Per Cent Revenue Forecast by Country, Europe, 2012–2020~ || Revenue Forecast by Country, Europe, 2012–2020~ || Service Type by Country~ ||| Absolute Revenue Breakdown by Country and Service Type, Europe, 2014~ ||| CAGR by Country and Service Type, Europe, 2014–2020~ || Customer Sector by Country~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| Per Cent Revenue~ ||| Absolute Market Size~ || Service Type by End-user Vertical, 2014~ ||| Per Cent Revenue~ || Revenue Forecast by Service Type, Europe, 2012–2020~ | Market Share and Competitive Analysis—Total Energy Savings Contract and Performance Contracting Market~ || Market Share~ ||| Per Cent Revenue Breakdown, Europe, 2014~ || Market Share Evolution by Company Type~ ||| Per Cent Revenue by Company Type, Europe, 2012, 2014 and 2020~ || Per Cent Revenue by Service Type and Company, Europe, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of the Top 8 Participants, Europe, 2014~ |||| Engie~ |||| Dalkia~ |||| Siemens~ |||| Schneider Electric~ |||| Vattenfall~ |||| Others~ || Competitive Structure, Europe, 2014~ || Competitive Convergence from Neighbouring Markets~ ||| Examples of Tier-1 Participants~ ||| Examples of New Entrants and Emerging Participants~ ||| Complexity from Varying Service Models~ || Energy Management: Recent Strategic Moves~ | France Breakdown~ || Key Findings~ || Revenue Forecast, 2012–2020~ || Revenue Forecast by Service Type, 2012-2020~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| By Absolute Revenue~ ||| By Per Cent Revenue~ || Market Share~ ||| Per Cent Revenue Breakdown, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of Top 5 Participants, France, 2014~ |||| Engie~ |||| Dalkia (Group EDF)~ |||| Vinci Energies~ |||| Bouygues Energies & Services~ |||| Eiffage Energie~ |||| Others~ || Competitive Structure, 2014~ | Germany Breakdown~ || Key Findings~ || Revenue Forecast, 2012–2020~ || Revenue Forecast by Service Type, 2012–2020~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| By Absolute Revenue~ ||| By Per Cent Revenue~ || Market Share~ ||| Per Cent Revenue Breakdown, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of Top 5 Participants, Germany, 2014~ |||| RWE~ |||| Vattenfall~ |||| EnBW~ |||| MVV~ |||| E.On~ |||| Others~ || Structure, 2014~ | The United Kingdom Breakdown~ || Key Findings~ || Revenue Forecast, 2012–2020~ || Revenue Forecasts by Service Type, 2012–2020~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| By Absolute Revenue~ ||| By Per Cent Revenue~ || Market Share~ ||| Per Cent Revenue Breakdown, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of Top 8 Participants, UK, 2014~ |||| Mitie~ |||| Dalkia (Veolia)~ |||| Centrica~ |||| CBRE~ |||| Engie~ |||| Others~ || Competitive Structure, 2014~ | Italy Breakdown~ || Key Findings~ || Revenue Forecast, 2012–2020~ || Revenue Forecasts by Service Type, 2012–2020~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| By Absolute Revenue~ ||| By Per Cent Revenue~ || Market Share~ ||| Per Cent Revenue Breakdown, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of Top 8 Participants, Italy, 2014~ |||| Manutencoop~ |||| Siram~ |||| Ceresa~ |||| Sitec~ |||| JCI~ |||| Others~ || Competitive Structure, 2014~ | Spain Breakdown~ || Key Findings~ || Revenue Forecast, 2012–2020 ~ || Revenue Forecast by Service Type, 2012–2020~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| By Absolute Revenue~ ||| By Per Cent Revenue~ || Market Share~ ||| Per Cent Revenue Breakdown, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of Top 8 Participants, Spain, 2014~ |||| Acciona~ |||| Abengoa~ |||| Cener~ |||| Iberese~ |||| Engie~ |||| Others~ || Competitive Structure, 2014~ | Benelux Breakdown~ || Key Findings~ || Revenue Forecast, 2012–2020~ || Revenue Forecast by Service Type, 2012–2020~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| By Absolute Revenue~ ||| By Per Cent Revenue~ || Market Share~ ||| Per Cent Revenue Breakdown, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of Top 5 Participants, Benelux, 2014~ |||| Dalkia~ |||| Engie~ |||| Siemens~ |||| Imtech~ |||| Fedesco~ |||| Others~ || Competitive Structure, 2014~ | Nordics Breakdown~ || Key Findings~ || Revenue Forecast, 2012–2020~ || Revenue Forecasts by Service Type, 2012–2020~ || Revenue Forecast by End-user Vertical, 2014 and 2020~ ||| By Absolute Revenue~ ||| By Per Cent Revenue~ || Market Share~ ||| Per Cent Revenue Breakdown, 2014~ || Market Share Analysis~ ||| Company Market Share Analysis of Top 8 Participants, 2014~ |||| Schneider Electric~ |||| Siemens ~ |||| YIT~ |||| Dansk Energi~ |||| Kuben Management~ |||| Others~ || Competitive Structure, 2014~ | The Last Word~ || 3 Big Predictions~ || Disclaimer~ | Appendix~ || Market Methodology~ || List of Companies in “Others”~ || Abbreviations and Acronyms Used~ |

| List of Charts and Figures | 1. Building Energy Efficiency Market: Research Focus, Europe, 2014~ 2. Energy Services Ecosystem~ 3. Total Energy Savings Contract and Performance Contracting Market: Key Market Drivers, Europe, 2015–2020~ 4. Total Energy Savings Contract and Performance Contracting Market: Key Market Restraints, Europe, 2015–2020~ 5. Total Energy Savings Contract and Performance Contracting Market: Market Engineering Measurements, Europe, 2014~ 6. Total Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Country, Europe, 2012–2020~ 7. Total Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of the Top 8 Participants, Europe, 2014~ 8. Total Energy Savings Contract and Performance Contracting Market: Competitive Structure, Europe, 2014~ 9. Competitive Convergence from Neighbouring Markets: Examples of Tier-1 Participants~ 10. Competitive Convergence from Neighbouring Markets: Examples of New Entrants and Emerging Participants~ 11. Competitive Convergence from Neighbouring Markets: Complexity from Varying Service Models~ 12. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 5 Participants, France, 2014~ 13. Energy Savings Contract and Performance Contracting Market: Competitive Structure, France, 2014~ 14. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 5 Participants, Germany, 2014~ 15. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Germany, 2014~ 16. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants UK, 2014~ 17. Energy Savings Contract and Performance Contracting Market: Competitive Structure, UK, 2014~ 18. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants, Italy, 2014~ 19. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Italy, 2014~ 20. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants, Spain, 2014~ 21. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Spain, 2014~ 22. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 5 Participants, Benelux, 2014~ 23. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Benelux, 2014~ 24. Energy Savings Contract and Performance Contracting Market: Company Market Share Analysis of Top 8 Participants, Nordics, 2014~ 25. Energy Savings Contract and Performance Contracting Market: Competitive Structure, Nordics, 2014~| 1. Total Energy Savings Contract and Performance Contracting Market: Life Cycle Analysis by Country, Europe, 2014~ 2. Total Energy Savings Contract and Performance Contracting Market: Market Engineering Measurements, Europe, 2014~ 3. Total Energy Savings Contract and Performance Contracting Market: Typical Service Types, Europe, 2014~ 4. Total Energy Savings Contract and Performance Contracting Market: Selection of Common Contract Models and Market Segmentation, Europe, 2014~ 5. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown by Service Type, Europe, 2014~ 6. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown by Country and Service Type, Europe, 2014~ 7. Total Energy Savings Contract and Performance Contracting Market: Technology Timeline, Europe, 2009–2020~ 8. Total Energy Savings Contract and Performance Contracting Market: Energy Price Indicators, Europe, 2012–2014~ 9. Total Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Europe, 2012–2020~ 10. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Forecast by Country, Europe, 2012–2020~ 11. Total Energy Savings Contract and Performance Contracting Market: Absolute Revenue Breakdown by Country and Service Type, Europe, 2014~ 12. Total Energy Savings Contract and Performance Contracting Market: CAGR by Country and Service Type, Europe, 2014–2020~ 13. Customer Sector by Country~ 14. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Europe, 2014 and 2020~ 15. Total Energy Savings Contract and Performance Contracting Market: Absolute Market Size by End-user Vertical, Europe, 2014 and 2020~ 16. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by Service Type by End-user Vertical, Europe, 2014~ 17. Total Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Europe, 2012–2020~ 18. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Europe, 2014~ 19. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by Company Type, Europe, 2012, 2014 and 2020~ 20. Total Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by Service Type and Company, Europe, 2014~ 21. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, France, 2012–2020~ 22. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, France, 2012–2020~ 23. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, France, 2014 and 2020~ 24. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, France, 2014 and 2020~ 25. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, France, 2014~ 26. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Germany, 2012–2020~ 27. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Germany, 2012–2020~ 28. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Germany, 2014 and 2020~ 29. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Germany, 2014 and 2020~ 30. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Germany, 2014~ 31. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, UK, 2012–2020~ 32. Energy Savings Contract and Performance Contracting Market: Revenue Forecasts by Service Type, UK, 2012–2020~ 33. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, UK, 2014 and 2020~ 34. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, UK, 2014 and 2020~ 35. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, UK, 2014~ 36. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Italy, 2012–2020~ 37. Energy Savings Contract and Performance Contracting Market: Revenue Forecasts by Service Type, Italy, 2012–2020~ 38. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Italy, 2014 and 2020~ 39. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Italy, 2014 and 2020~ 40. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Italy, 2014~ 41. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Spain, 2012–2020~ 42. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Spain, 2012–2020~ 43. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Spain, 2014 and 2020~ 44. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Spain, 2014 and 2020~ 45. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Spain, 2014~ 46. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Benelux, 2012–2020~ 47. Energy Savings Contract and Performance Contracting Market: Revenue Forecast by Service Type, Benelux, 2012–2020~ 48. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Benelux, 2014 and 2020~ 49. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Benelux, 2014 and 2020~ 50. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Benelux, 2014~ 51. Energy Savings Contract and Performance Contracting Market: Revenue Forecast, Nordics, 2012–2020 ~ 52. Energy Savings Contract and Performance Contracting Market: Revenue Forecasts by Service Type, Nordics, 2012–2020~ 53. Energy Savings Contract and Performance Contracting Market: Absolute Revenue by End-user Vertical, Nordics, 2014 and 2020~ 54. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue by End-user Vertical, Nordics, 2014 and 2020~ 55. Energy Savings Contract and Performance Contracting Market: Per Cent Revenue Breakdown, Nordics, 2014~ |

| Author | John Raspin |

| Industries | Environment |

| WIP Number | MB27-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB