Global Automotive Composites Market, Forecast to 2021

Global Automotive Composites Market, Forecast to 2021

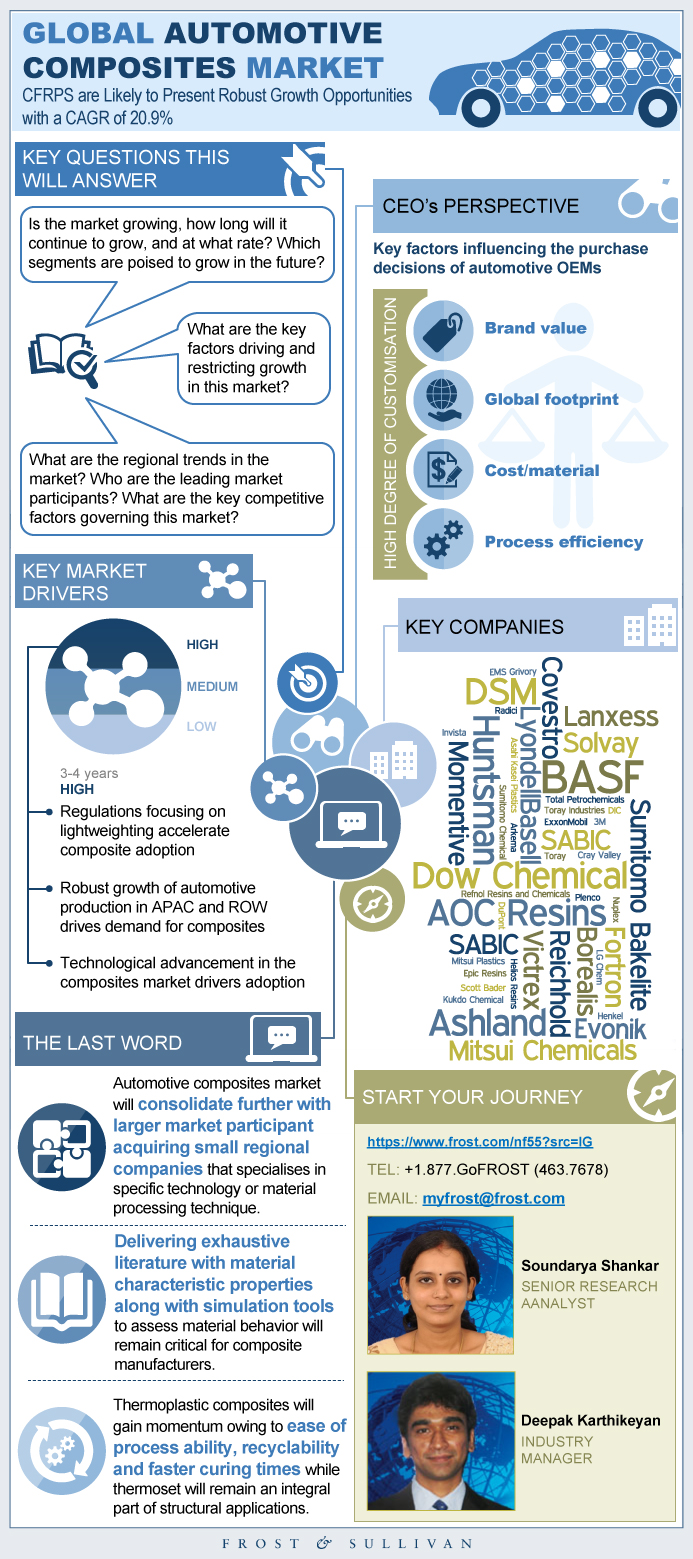

Carbon Fibre Reinforced Polymers (CFRPs) to Offer Robust Growth Opportunities

09-Mar-2016

North America

Market Research

$4,950.00

Special Price $3,712.50 save 25 %

Description

This research service identifies the major industry drivers, restraints, regional trends, and technology segment trends in the global automotive composites market. The research covers 4 regions: North America, Europe, Asia-Pacific, and Rest of World. The study provides an in-depth analysis of carbon, glass, and natural fibre composites along with a detailed analysis on the different types of resins used in each of these applications. Regional trends and application level analysis of different resins has also been provided. Competitive structure and market share analyses have been provided at the total market level. Unit shipment, revenue forecasts, and pricing trends have been provided for each segment. The base year is 2014, and the forecast period ends in 2021.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Revenue Forecast 2014-2022

Market Engineering Measurements Global, 2014

CEO’s Perspective

Market Definition

Geographic Scope

Market Segmentation

Market Chain Analysis

Key Market Drivers – Global (2014- 2022)

Key Market Restraints – Global (2015 -2021)

Revenue Forecast - Automotive composites market is likely to experience robust growth

Percent Unit Shipment Forecast by Region

Percent Unit Shipment Forecast by Segment

Market Share

Competitive Environment

Product Matrix

CEO’s 360 Degree Perspective

Key Findings

Segment Overview and Introduction

Revenue and Unit Shipment Forecast

Key Focus Areas for CFRP Manufacturers

Pricing Trends and Forecasts

Percent Unit Shipment Forecast by Region

Percent Revenue Forecast by Region

Competitive Environment

Thermoplastics – PA Resin Analysis

Thermoplastics - HPP Resin Analysis

Thermosets – Epoxy Resins Analysis

Other Resin Matrices

Key Findings

Segment Overview and Introduction

Revenue and Unit Shipment Forecast

Pricing Trends and Forecast

Percent Unit Forecast by Region

Regional Trends

Competitive Environment

Thermoplastics and Thermosets

Thermoplastics – PP Resins Analysis

Thermoplastics – PA Resins Analysis

Thermoplastics – HPP Resins Analysis

Other Resins Analysis

Key Findings

Segment Overview and Introduction

Revenue and Unit Shipment Forecast

Pricing Trends and Forecast

Percent Unit Shipment Forecast by Region

Percent Revenue Forecast by Region

Regional Trends

Competitive Environment

Thermoplastics and Thermosets

Thermoplastics – PP Resins Analysis

Other Resins in NFC

Legal Disclaimer

Market Engineering Methodology

Partial List of Companies Interviewed

Learn More – Next Steps

Abbreviations and Acronyms Used

- 1. Total Automotive Composites Market: Market Engineering Measurements, Global, 2014

- 2. Total Automotive Composites Market: Key Market Drivers, Global, 2015–2021

- 3. Automotive Composites Market: US Emission Targets, North America, 2016–2025

- 4. Total Automotive Composites Market: Light Vehicle Production Forecast, APAC and ROW

- 5. Automotive Composites Market: Japan Emission Targets, Japan, 2004 and 2015

- 6. Total Automotive Composites Market: Light Vehicle Production Forecast, APAC and ROW, 2011–2021

- 7. Total Automotive Composites Market: Key Market Restraints, Global, 2015–2021

- 8. Total Automotive Composites Market: Material Price Trends, Global, 2014

- 9. Total Automotive Composites Market: OEM Material Strategies in Key Applications, Global, 2014

- 10. Total Automotive Composites Market: Market Engineering Measurements, Global, 2014

- 11. Total Automotive Composites Market: Unit Shipment and Revenue Forecast, Global, 2011–2021

- 12. Total Automotive Composites Market: Percent Unit Shipment by Region,2014 and 2021

- 13. Total Automotive Composites Market: Percent Unit Shipment by Segment, Global 2014 and 2021

- 14. Total Automotive Composites Market: Percent Revenue by Participant, Global, 2014

- 15. Total Automotive Composites Market: Competitive Structure for PP Composite Resins, Global 2014

- 16. Total Automotive Composites Market: Competitive Structure for HPP Composite Resins, Global 2014

- 17. Total Automotive Composites Market: Competitive Structure for Other Composite Resins, Global 2014

- 18. Total Automotive Composites Market: Competitive Structure for Epoxy Composite Resins, Global 2014

- 19. Total Automotive Composites Market: Competitive Structure for PU Composite Resins, Global 2014

- 20. Total Automotive Composites Market: Competitive Structure for Polyester Composite Resins, Global 2014

- 21. Total Automotive Composites Market: Competitive Structure for Vinyl Ester Composite Resins, Global 2014

- 22. Total Automotive Composites Market: Competitive Structure for Phenolic Composite Resins, Global 2014

- 23. Total Automotive Composites Market: Product Matrix, Global, 2014

- 24. CFRP - Important Segment Characteristics

- 25. CFRP Segment: Market Engineering Measurements, Global, 2014

- 26. CFRP Segment: Revenue and Unit Shipment Forecast, Global, 2011–2021

- 27. CFRP Segment: Average Price, Global, 2011–2021

- 28. CFRP Segment: Average Price of Carbon Fibres, Global, 2011–2021

- 29. CFRP Segment: Percent Unit Shipment by Region, Global, 2014 and 2021

- 30. CFRP Segment: Percent Revenue by Region, Global, 2014 and 2021

- 31. Regional Trends

- 32. CFRP Segment: Competitive Structure, Global, 2014

- 33. CFRP Segment: Percent Unit Shipment Split between Thermoplastics and Thermosets, Global, 2014 and 2021

- 34. PA Resins in CFRP Segment: Volume Forecast, Global, 2014 and 2021

- 35. HPP Resins Market in CFRP: Sub-Segment Splits, Global, 2014

- 36. Epoxy Resins in CFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 37. Epoxy Resins Market in CFRP: Regional Splits, Global, 2014

- 38. GFRP Segment Key Findings

- 39. GFRP Segment: Market Engineering Measurements, Global, 2014

- 40. GFRP Segment: Revenue and Unit Shipment Forecast, Global, 2011–2021

- 41. GFRP Segment: Mass of GFRP in an Average Car, Global, 2011–2021

- 42. GFRP Segment: Average Price, Global, 2011–2021

- 43. GFRP Segment: Average Price of Glass Fibres, Global, 2011–2021

- 44. GFRP Segment: Percent Unit Shipment by Region, Global, 2014 and 2021

- 45. GFRP Segment: Percent Revenue by Region, Global, 2014 and 2021

- 46. GFRP Segment: Competitive Structure, Global, 2014

- 47. GFRP Segment: Percent Split between Thermoplastics and Thermosets, Global, 2014 and 2021

- 48. PP Resins Market in GFRP: Volume Forecast, Global, 2014 and 2021

- 49. Global PP Resins Market in GFRP: Application Analysis, Global, 2014

- 50. PA Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 51. PA Resins in GFRP Segment: Application Analysis, Global, 2014

- 52. HPP Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 53. Other Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 54. Polyester Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 55. Polyester Resins in GFRP Segment: Application Analysis, Global, 2014

- 56. Vinyl Ester Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 57. Epoxy Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 58. PU Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 59. Phenolic Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021

- 60. NFC Segment: Characteristic Properties of Natural Fibres, Global, 2014

- 61. NFC Segment: Market Engineering Measurements, Global, 2014

- 62. NFC Segment: Revenue and Unit Shipment Forecast, Global, 2011–2021

- 63. NFC Segment: Ford’s Bio-based Portfolio, Global,

- 64. NFC Segment: Natural Fibre Usage Across Applications, Global, 2014

- 65. NFC Segment: Average Price, Global, 2011–2021

- 66. NFC Segment: Average Price of Natural Fibres, Global, 2011–2021

- 67. NFC Segment: Percent Unit Shipment by Region, Global, 2014 and 2021

- 68. NFC Segment: Percent Revenue by Region, Global, 2014 and 2021

- 69. NFC Segment: Percent Split between Thermoplastics and Thermosets, Global, 2014 and 2021

- 70. PP Resins Market in NFC: Volume Forecast, Global, 2014 and 2021

- 71. PP Resins Market in NFC: Application Analysis, Global, 2014

- 72. Total Automotive Composites Market: Unmet Needs, Global, 2014

- 73. Total Automotive Composites Market: Material Selection Attributes, Global, 2014

- 74. Total Automotive Composites Market: Key Focus Areas, Global, 2014

- 75. Competitive Factors and Assessment—CFRP

- 76. Competitive Factors and Assessment—GFRP

- 77. Competitive Factors and Assessment—NFC

- 78. Value Chain Scenario

- 79. Value Chain Trends

- 80. Total Automotive Composites Market: Industry Integration, Global, 2009–2015

- 81. Market Integration and Consolidation

Popular Topics

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary- Total Automotive Composites Market Global~ || Revenue Forecast 2014-2022~ || Market Engineering Measurements Global, 2014~ || CEO’s Perspective~ | Market Overview~ || Market Definition~ || Geographic Scope~ || Market Segmentation~ || Market Chain Analysis~ | Market Drivers and Restraints – Global Automotive Composites Market~ || Key Market Drivers – Global (2014- 2022)~ ||| Regulations Focusing on Lightweighting Accelerate Composite Adoption~ ||| US Emission Targets, North America, 2016–2025~ ||| Japan Emission Targets, Japan, 2004 and 2015~ ||| Automotive Production in APAC and ROW ~ ||| Composites Market Drives Adoption~ ||| Composites that Aid Lightweighting Drives Penetration into New Automotive Applications~ || Key Market Restraints – Global (2015 -2021)~ ||| Carbon Fibre Composites ~ ||| Technological Advancements in Competing Materials Curbs Opportunities ~ ||| Lack of Awareness and Skepticism Limit Penetration in Certain Applications~ ||| Adoption of Composites in Automotive Applications~ | Forecast and Trends – Total Automotive Composites Market~ || Revenue Forecast - Automotive composites market is likely to experience robust growth~ || Percent Unit Shipment Forecast by Region~ || Percent Unit Shipment Forecast by Segment~ | Competitive Analysis and Market Share —Total Automotive Composites Market~ || Market Share~ || Competitive Environment~ || Product Matrix~ || CEO’s 360 Degree Perspective ~ | CFRP Segment Breakdown~ || Key Findings~ || Segment Overview and Introduction~ || Revenue and Unit Shipment Forecast~ || Key Focus Areas for CFRP Manufacturers~ || Pricing Trends and Forecasts~ || Percent Unit Shipment Forecast by Region~ || Percent Revenue Forecast by Region~ || Competitive Environment~ | CFRP Resins~ || Thermoplastics – PA Resin Analysis~ || Thermoplastics - HPP Resin Analysis~ || Thermosets – Epoxy Resins Analysis~ || Other Resin Matrices~ | GFRP Segment Breakdown~ || Key Findings~ || Segment Overview and Introduction~ || Revenue and Unit Shipment Forecast~ || Pricing Trends and Forecast~ || Percent Unit Forecast by Region~ || Regional Trends~ || Competitive Environment~ | GFRP Resins~ || Thermoplastics and Thermosets~ || Thermoplastics – PP Resins Analysis~ || Thermoplastics – PA Resins Analysis~ || Thermoplastics – HPP Resins Analysis~ || Other Resins Analysis~ | NFC Segment Breakdown~ || Key Findings~ || Segment Overview and Introduction~ || Revenue and Unit Shipment Forecast~ || Pricing Trends and Forecast~ || Percent Unit Shipment Forecast by Region~ || Percent Revenue Forecast by Region~ || Regional Trends~ || Competitive Environment~ | NFC Resins~ || Thermoplastics and Thermosets~ || Thermoplastics – PP Resins Analysis~ || Other Resins in NFC~ | End User Analysis~ | The Last Word – 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Partial List of Companies Interviewed~ || Learn More – Next Steps~ || Abbreviations and Acronyms Used~ |

| List of Charts and Figures | 1. Total Automotive Composites Market: Market Engineering Measurements, Global, 2014~ 2. Total Automotive Composites Market: Key Market Drivers, Global, 2015–2021~ 3. Automotive Composites Market: US Emission Targets, North America, 2016–2025~ 4. Total Automotive Composites Market: Light Vehicle Production Forecast, APAC and ROW~ 5. Automotive Composites Market: Japan Emission Targets, Japan, 2004 and 2015~ 6. Total Automotive Composites Market: Light Vehicle Production Forecast, APAC and ROW, 2011–2021~ 7. Total Automotive Composites Market: Key Market Restraints, Global, 2015–2021~ 8. Total Automotive Composites Market: Material Price Trends, Global, 2014~ 9. Total Automotive Composites Market: OEM Material Strategies in Key Applications, Global, 2014~ 10. Total Automotive Composites Market: Market Engineering Measurements, Global, 2014~ 11. Total Automotive Composites Market: Unit Shipment and Revenue Forecast, Global, 2011–2021~ 12. Total Automotive Composites Market: Percent Unit Shipment by Region,2014 and 2021~ 13. Total Automotive Composites Market: Percent Unit Shipment by Segment, Global 2014 and 2021~ 14. Total Automotive Composites Market: Percent Revenue by Participant, Global, 2014~ 15. Total Automotive Composites Market: Competitive Structure for PP Composite Resins, Global 2014~ 16. Total Automotive Composites Market: Competitive Structure for HPP Composite Resins, Global 2014~ 17. Total Automotive Composites Market: Competitive Structure for Other Composite Resins, Global 2014~ 18. Total Automotive Composites Market: Competitive Structure for Epoxy Composite Resins, Global 2014~ 19. Total Automotive Composites Market: Competitive Structure for PU Composite Resins, Global 2014~ 20. Total Automotive Composites Market: Competitive Structure for Polyester Composite Resins, Global 2014~ 21. Total Automotive Composites Market: Competitive Structure for Vinyl Ester Composite Resins, Global 2014~ 22. Total Automotive Composites Market: Competitive Structure for Phenolic Composite Resins, Global 2014~ 23. Total Automotive Composites Market: Product Matrix, Global, 2014~ 24. CFRP - Important Segment Characteristics~ 25. CFRP Segment: Market Engineering Measurements, Global, 2014~ 26. CFRP Segment: Revenue and Unit Shipment Forecast, Global, 2011–2021~ 27. CFRP Segment: Average Price, Global, 2011–2021~ 28. CFRP Segment: Average Price of Carbon Fibres, Global, 2011–2021~ 29. CFRP Segment: Percent Unit Shipment by Region, Global, 2014 and 2021~ 30. CFRP Segment: Percent Revenue by Region, Global, 2014 and 2021~ 31. Regional Trends~ 32. CFRP Segment: Competitive Structure, Global, 2014~ 33. CFRP Segment: Percent Unit Shipment Split between Thermoplastics and Thermosets, Global, 2014 and 2021~ 34. PA Resins in CFRP Segment: Volume Forecast, Global, 2014 and 2021~ 35. HPP Resins Market in CFRP: Sub-Segment Splits, Global, 2014~ 36. Epoxy Resins in CFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 37. Epoxy Resins Market in CFRP: Regional Splits, Global, 2014~ 38. GFRP Segment Key Findings~ 39. GFRP Segment: Market Engineering Measurements, Global, 2014~ 40. GFRP Segment: Revenue and Unit Shipment Forecast, Global, 2011–2021~ 41. GFRP Segment: Mass of GFRP in an Average Car, Global, 2011–2021~ 42. GFRP Segment: Average Price, Global, 2011–2021~ 43. GFRP Segment: Average Price of Glass Fibres, Global, 2011–2021~ 44. GFRP Segment: Percent Unit Shipment by Region, Global, 2014 and 2021~ 45. GFRP Segment: Percent Revenue by Region, Global, 2014 and 2021~ 46. GFRP Segment: Competitive Structure, Global, 2014~ 47. GFRP Segment: Percent Split between Thermoplastics and Thermosets, Global, 2014 and 2021~ 48. PP Resins Market in GFRP: Volume Forecast, Global, 2014 and 2021~ 49. Global PP Resins Market in GFRP: Application Analysis, Global, 2014~ 50. PA Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 51. PA Resins in GFRP Segment: Application Analysis, Global, 2014~ 52. HPP Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 53. Other Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 54. Polyester Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 55. Polyester Resins in GFRP Segment: Application Analysis, Global, 2014~ 56. Vinyl Ester Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 57. Epoxy Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 58. PU Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 59. Phenolic Resins in GFRP Segment: Revenue Forecast, Global, 2014 and 2021~ 60. NFC Segment: Characteristic Properties of Natural Fibres, Global, 2014~ 61. NFC Segment: Market Engineering Measurements, Global, 2014~ 62. NFC Segment: Revenue and Unit Shipment Forecast, Global, 2011–2021~ 63. NFC Segment: Ford’s Bio-based Portfolio, Global, ~ 64. NFC Segment: Natural Fibre Usage Across Applications, Global, 2014~ 65. NFC Segment: Average Price, Global, 2011–2021~ 66. NFC Segment: Average Price of Natural Fibres, Global, 2011–2021~ 67. NFC Segment: Percent Unit Shipment by Region, Global, 2014 and 2021~ 68. NFC Segment: Percent Revenue by Region, Global, 2014 and 2021~ 69. NFC Segment: Percent Split between Thermoplastics and Thermosets, Global, 2014 and 2021~ 70. PP Resins Market in NFC: Volume Forecast, Global, 2014 and 2021~ 71. PP Resins Market in NFC: Application Analysis, Global, 2014~ 72. Total Automotive Composites Market: Unmet Needs, Global, 2014~ 73. Total Automotive Composites Market: Material Selection Attributes, Global, 2014~ 74. Total Automotive Composites Market: Key Focus Areas, Global, 2014~ 75. Competitive Factors and Assessment—CFRP~ 76. Competitive Factors and Assessment—GFRP~ 77. Competitive Factors and Assessment—NFC~ 78. Value Chain Scenario~ 79. Value Chain Trends~ 80. Total Automotive Composites Market: Industry Integration, Global, 2009–2015~ 81. Market Integration and Consolidation~ |

| Author | Soundarya Shankar |

| Industries | Chemicals and Materials |

| WIP Number | NF55-01-00-00-00 |

| Keyword 1 | Automotive Composites |

| Keyword 2 | Automotive Composites |

| Keyword 3 | Automotive Composites Forecast |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB