GCC Light Vehicle Aftermarket Outlook, 2021

GCC Light Vehicle Aftermarket Outlook, 2021

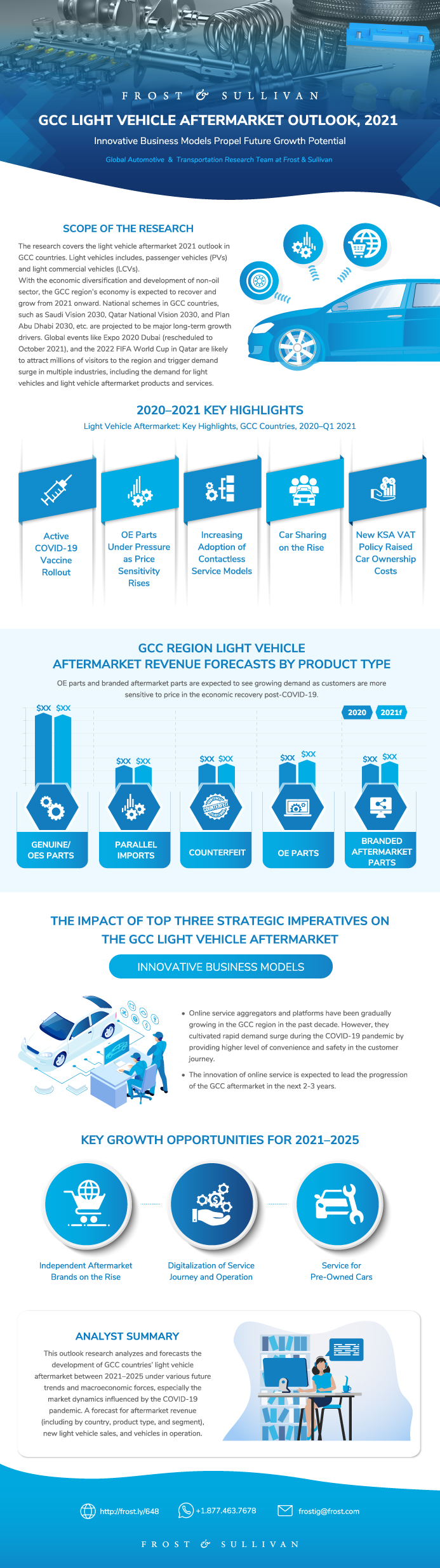

Innovative Business Models Propels Future Growth Potential

13-Jul-2021

South Asia, Middle East & North Africa

Market Research

$4,950.00

Special Price $3,712.50 save 25 %

Description

In 2020, the Gulf Cooperation Council (GCC) region faced significant challenges due to the COVID-19 pandemic and oil price crash. Gross domestic product (GDP) in GCC nations contracted by 5%–10% in 2020. The GCC population dropped by 3%–5% due to expatriate exodus. Every industry and sector faced multiple disruptions. The GCC light vehicle aftermarket also evolved due to a market demand decline as vehicle miles traveled (VMT) decreased, the supply chain was disrupted, and new business models (such as door-to-door service) emerged to serve the market in the new normal.

During an economic recovery, cost-efficiency is a prime purchase decision factor. For example, after establishing partnerships with 2 online platforms, a small, 6-year-old garage in Dubai grew by 30% in H2 2020 by offering cheaper service contracts targeting American vehicles to win over customers from dealer service centers nearby; China-made car tires in Kuwait gained market share from 38.0% in 2014 to over 50.0% in 2020. Overall, the market witnessed a trend of independent aftermarket brands overtaking the original equipment (OE) brands in 2020.

With the economic diversification and development of non-oil industries, the GCC region’s economy is expected to recover and grow from 2021 onward. National schemes in GCC countries, such as Saudi Vision 2030, Qatar 2030 and UAE 2030, are projected to be major long-term growth drivers. Global events like Expo 2020 Dubai (rescheduled to October 2021) and the 2022 FIFA World Cup in Qatar are likely to attract millions of visitors to the region and trigger a demand surge in multiple industries, including the light vehicle aftermarket.

Dubai’s efforts in building a smart sustainable city incorporate the Connected, Autonomous, Shared, Electric (CASE) mobility concept in automotive market. Innovation dealers use connective technology to record vehicle status remotely and help drivers book maintenance appointments. Several car-sharing start-ups in the region have major expansion plans in 2021, either for company-owned fleets or peer-to-peer sharing. Electric cars adoption is also growing in GCC countries, with Dubai registering the highest adoption currently. With mobility technology developing, the service market is expected to see many new market dynamics with the mobility industry’s advancement.

This outlook study analyzes and forecasts the development of GCC countries’ light vehicle aftermarket from 2021–2025 under various future trends and macroeconomic forces. It gives forecasts for aftermarket revenue (including by country, product type, and segment), sales, and vehicles in operation.

Author: Joslyn Li

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

2020–2021 Key Highlights

Impact of COVID-19 on the GCC Countries Light Vehicle Aftermarket in 2020

2020 GCC Light Vehicle Aftermarket—Actuals vs Forecast

GCC Countries Light Vehicle Aftermarket Revenue

GCC Light Vehicle Aftermarket Revenue by Segment

COVID-19 Impact on Light Vehicle Global Sales

Impact of Covid-19 on the GCC Light Vehicle Aftermarket

Top Predictions for 2021

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the GCC Light Vehicle Aftermarket

Growth Opportunities Fuel the Growth Pipeline Engine™

Research Scope

Parts Segmentation

Product/System Segmentation

After-Service Channels*

2021 GCC Region Economic Outlook—Top Predictions

GCC Region—Demographic Highlights

Middle East—Key Economic Developments

Regulations Set to Play a Major Role in the GCC Light Vehicle Aftermarket Beyond 2020

Distribution Channel Structure

2021 GCC Region Light Vehicle Aftermarket Revenue Forecast by Country

GCC Region Light Vehicle Aftermarket Revenue

GCC Region Light Vehicle Aftermarket Revenue Forecast by Country

GCC Region Light Vehicle Aftermarket Revenue Forecasts by Product Type

Key 2021 GCC Countries Light Vehicle Aftermarket Trends

Prediction 1: Supply Chain Decentralization

Predictions 2–4: Digital Penetration in Service, Online Aggregators, and Door-to-Door Service

Prediction 5: Cheaper Alternatives

Prediction 6: Growing Market for Used Cars

Prediction 7: Electric Vehicles

Prediction 8: Shared Cars on the Rise

2021 Market Snapshot

Vehicles in Operation* Analysis and Forecast

Vehicles in Operation Analysis*—Vehicle Age

New Vehicle* Sales Analysis and Outlook

GCC Countries Light Vehicle Aftermarket Industry Revenue

Segment Outlook 2021—Genuine/OES Parts

Segment Outlook 2021—OE Parts

Segment Outlook 2021—Branded Aftermarket Parts

Segment Outlook 2021—Parallel Imports

Segment Outlook 2021—Counterfeits

GCC Countries Light Vehicle Aftermarket Diagnostics—Companies to Watch

Key Growth Opportunities for 2021–2025

2021 Predictions—Kingdom of Saudi Arabia

2021 Predictions—United Arab Emirates

2021 Predictions—Qatar

2021 Predictions—Oman, Bahrain, and Kuwait

Growth Opportunity 1: Online Car Service for Safety and Convenience

Growth Opportunity 1: Online Car Service for Safety and Convenience (continued)

Growth Opportunity 2: Affordable IAM Parts for Higher Price Sensitivity

Growth Opportunity 2: Affordable IAM Parts for Higher Price Sensitivity (continued)

Growth Opportunity 3: Service for Used Cars

Growth Opportunity 3: Service for Used Cars (continued)

Key Conclusions

Abbreviations and Acronyms Used

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Vitali Bielski |

| Industries | Automotive |

| WIP Number | PBB9-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9801-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB