Global Agriculture UAS Application Growth Opportunities

Global Agriculture UAS Application Growth Opportunities

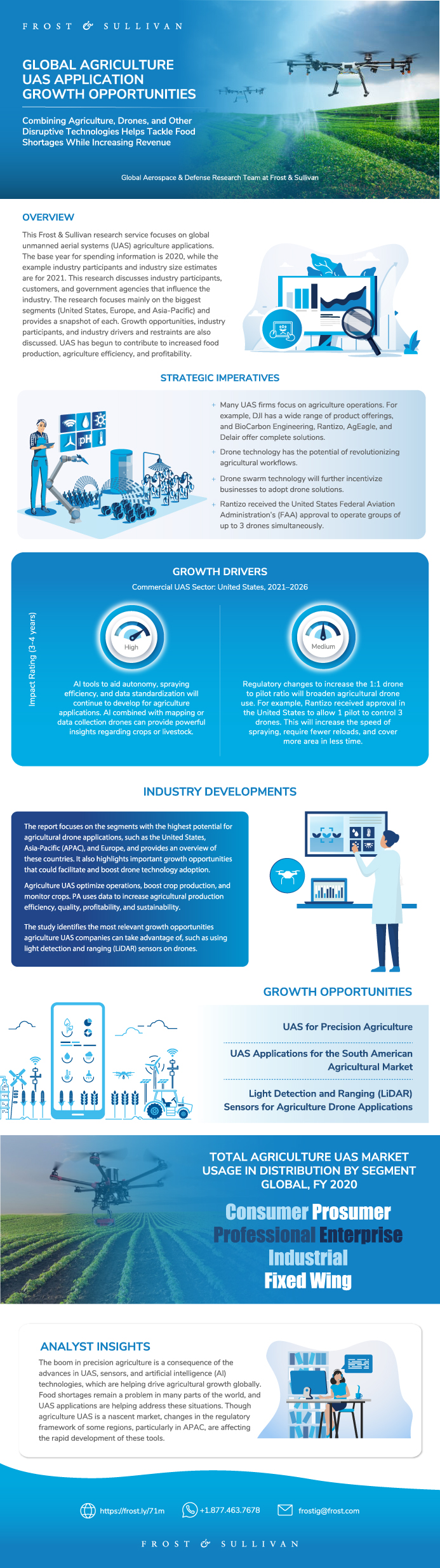

Combining Agriculture, Drones, and Other Disruptive Technologies Helps Tackle Food Shortages While Increasing Revenue

16-Feb-2022

Global

Description

This Frost & Sullivan research service focuses on global unmanned aerial systems (UAS) agriculture applications. The base year for spending information is 2020, while example market participants and market size estimates are for 2021. This study discusses market participants, customers, and government agencies that influence the industry. The research focuses mainly on the biggest markets (United States, Europe, and Asia-Pacific) and provides a snapshot of each. Growth opportunities, industry participants, and market drivers and restraints are also discussed. UAS have begun to contribute to increased food production, agriculture efficiency, and profitability. The boom in precision agriculture is a consequence of the advances in UAS, sensors, and artificial intelligence (AI) technologies, which are helping drive agricultural growth globally. Food shortages remain a problem in many parts of the world, and UAS applications are helping address these situations. Though agriculture UAS is a nascent market, changes in the regulatory framework of some regions, particularly in APAC, are affecting the rapid development of these tools. Regulatory environment improvements are contributing to the growth in the sector. The goal of this study is to help firms identify growth opportunities and potential markets for their operation in order to increase market share. The research presented in the study was obtained by combining primary and secondary sources that provided quantitative and qualitative information. Information was also garnered from existing reports within the Frost & Sullivan database, including data from technical papers, magazines, seminars, webinars, and internet research. Senior consultants/industry analysts have conducted telephone interviews with original equipment suppliers, services providers, distributors, customers, and government authorities. Primary research accounts for approximately 25% of the total research.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on the Agriculture Unmanned Ariel Systems (UAS) Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Purpose/Overview/Trends/Challenges

Why are UAS Useful for Farmers?

Global Agriculture UAS Revenue by Region in 2021

Commercial UAS Platform Segmentation

Usage in Agriculture by Segment

Revenue by Region for Professional and Fixed Wing UAS

Growth Drivers

Growth Restraints

Companies To Watch Out For

Representative Industry Participants

2021 Snapshot—United States

2021 Snapshot—Europe

2021 Snapshot—APAC

Growth Opportunity 1: UAS for Precision Agriculture

Growth Opportunity 1: UAS for Precision Agriculture (continued)

Growth Opportunity 2: UAS Applications for the South American Agricultural Market

Growth Opportunity 2: UAS Applications for the South American Agricultural Market (continued)

Growth Opportunity 3: Light Detection and Ranging (LiDAR) Sensors for Agriculture Drone Applications

Growth Opportunity 3: Light Detection and Ranging (LiDAR) Sensors for Agriculture Drone Applications (continued)

Conclusions and Future Outlook

List of Exhibits

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Juan Perl |

| Industries | Aerospace, Defence and Security |

| WIP Number | K6D3-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9000-A1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB