Global Airborne Maritime Surveillance Aircraft Market, Forecast to 2026

Global Airborne Maritime Surveillance Aircraft Market, Forecast to 2026

Upcoming Investment Hotspots, Defense Programs, and Country-wise Quantitative & Qualitative Requirement Assessment for Winnable Go-to-Market Strategie

23-Jun-2017

Global

$3,000.00

Special Price $2,250.00 save 25 %

Description

Geopolitical and economic factors such as territorial expansionism, security of Sea Lanes of Communications (SLOC)/offshore energy assets, expanding surface and submarine fleets, non-state actor-led to conflict, and the associated displacement of population mandate the need to increase maritime awareness and interdiction capabilities and to keep the airborne maritime surveillance buoyant. The maritime surveillance market is currently in an upward cycle due to the US Navy’s P-8 procurement program that has annual spends of approximately $2 billion, and recent sales of P-8 into Australia, Norway, and the United Kingdom.

Operators are also developing different approaches to the concepts of maritime patrol and surveillance through man-unmanned teaming (MUM-T), off-board integration of sensors, and multi-mission emphasis through roll-on/roll-off capabilities. Several nations are moving towards an integrated EEZ approach based on a layered surveillance architecture and multi-source surveillance assets such as satellites, surface fleets, UAVs, MPAs, MSAs, underwater combatants etc. belonging to multiple authorities. This Concept of Operations may reduce the need to field a large MPA/MSA fleet in the long run and may have a negative impact on the market (although this is not expected to be a deciding factor during the forecast period).

Through this research, Frost & Sullivan provides an assessment of airborne maritime surveillance programs, opportunities, forecasts, technology trends, and also a country wise assessment of capability analysis, opportunities, and future maritime surveillance aircraft acquisition plans.

The study covers the global market for fixed-wing Maritime Patrol and Maritime Surveillance aircraft. It lists key aircrafts fielded by different countries based on their mission types and traces their replacement timelines and upgrade evolution. The study does not cover Unmanned Air Systems (UAS) or Rotary Wing. The market is broken down by committed, planned, and forecasted revenues.

Key Questions This Study Will Answer

• What are the committed, planned, and upcoming opportunities in the airborne maritime surveillance aircraft market in the next 10 years?

• What geographical markets are growing?

• What are the key success factors that OEMs should consider in the market?

• What drives the need for MPA/MSA aircraft in different nations and how do their procurement preferences differ?

• What are the major programs underway and planned within these markets and what opportunities do they open up for OEMs/contractors?

• Are there any airborne maritime surveillance capability gaps that need to be anticipated?

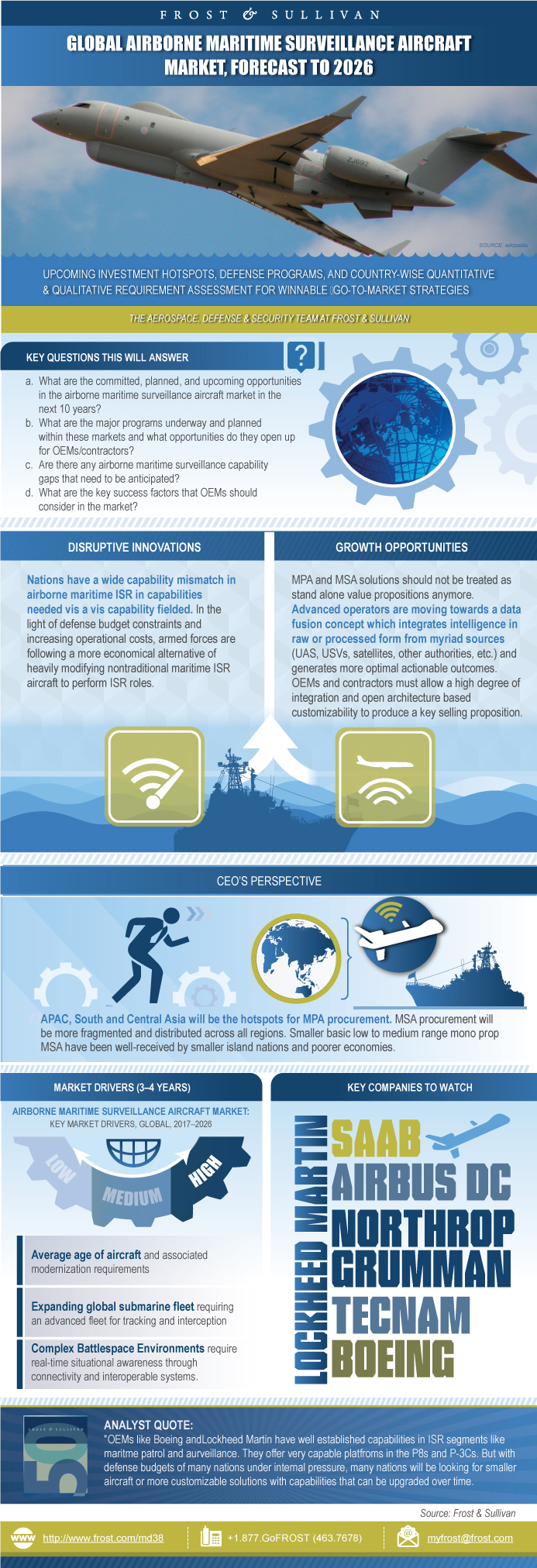

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

CEO’s Perspective

Market Definitions

Market Scope and Definitions

Market Drivers

Market Restraints

Airborne Maritime Surveillance Aircraft Market Challenges

Market Engineering Measurements

Airborne Maritime Surveillance Aircraft Market—Overview

Airborne Maritime Surveillance Aircraft Market—Forecast by Program Type

Airborne Maritime Surveillance Aircraft Market—Revenue Forecast by Region

MPA Market—Revenue Forecast by Region

MSA Market—Revenue Forecast by Region

MPA Market—Top 5 Prime Contractors Market Share Dynamics

MSA Market—Top 5 Prime Contractors Market share Dynamics

Technology Trends

Growth Opportunity 1—Changing Concepts: Manned-Unmanned Teaming (MUM-T)

Growth Opportunity 2—Changing Concepts: Integrated Exclusive Economic Zone (I-EEZ) Concept

Growth Opportunity 3—Affordability of Solutions

Growth Opportunity 4—Flexible Subsystem/Sensor Integration

Growth Opportunity 5—Multi Mission Capability

Strategic Imperatives for Success and Growth

North America—A Snapshot

MPA Budgets

MPA Inventory

MSA Budgets

MSA Inventory

Regional Developments and Opportunities

Programs and Contracts

Europe—A Snapshot

MPA Budgets

MPA Inventory

MSA Budgets

MSA Inventory

Regional Developments and Opportunities

Programs and Contracts

Central & South America—A Snapshot

MPA Budgets

MPA Inventory

MSA Budgets

MSA Inventory

Regional Developments and Opportunities

Programs and Contracts

APAC—A Snapshot

MPA Budgets

MPA Inventory

MSA Budgets

MSA Inventory

Regional Developments and Opportunities

Programs and Contracts

Central & South Asia—A Snapshot

MPA Budgets

MPA Inventory

MSA Budgets

MSA Inventory

Regional Developments and Opportunities

Programs and Contracts

Middle East—A Snapshot

MPA Budgets

MPA Inventory

MSA Budgets

MSA Inventory

Regional Developments and Opportunities

Programs and Contracts

Africa—A Snapshot

MPA Inventory

MSA Budgets

MSA Inventory

Regional Developments and Opportunities

Programs and Contracts

The Last Word—Conclusions

Legal Disclaimer

North America—Inventory List

Europe—Inventory List

Central and South America—Inventory List

APAC—Inventory List

Central and South Asia—Inventory List

Middle East—Inventory List

Africa—Inventory List

- 1. Airborne Maritime Surveillance Aircraft Market: Key Market Drivers, Global, 2017–2026

- 2. Airborne Maritime Surveillance Aircraft Market: Average Age of Airborne Maritime Surveillance Aircraft, Global, 2016

- 3. Airborne Maritime Surveillance Aircraft Market: Key Market Restraints, Global, 2017–2026

- 4. Airborne Maritime Surveillance Aircraft Market: Key Market Challenges, Global, 2017–2026

- 5. Airborne Maritime Surveillance Aircraft Market: Market Engineering Measurements, Global, 2016

- 6. Airborne Maritime Surveillance Aircraft Market: Technology Trends, Global, 2016–2026

- 7. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, North America, 2017

- 8. Airborne Maritime Surveillance Aircraft Market: Regional Developments & Opportunities, North America, 2016–2026

- 9. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, North America, 2016–2026

- 10. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Europe, 2017

- 11. MPA Market: Inventory and Average Age, Europe, 2017

- 12. MSA Market: Inventory and Average Age, Europe, 2017

- 13. Airborne Maritime Surveillance Aircraft Market: Regional Developments & Opportunities, Europe, 2016–2026

- 14. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Europe, 2016–2026

- 15. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Central & South America, 2017

- 16. MPA Market: Inventory and Average Age, Central & South America, 2017

- 17. MSA Market: Inventory and Average Age, Central & South America, 2017

- 18. Airborne Maritime Surveillance Aircraft Market: Regional Developments & Opportunities, Central & South America, 2016–2026

- 19. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Central & South America, 2016–2026

- 20. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, APAC, 2017

- 21. MPA Market: Inventory and Average Age, APAC, 2017

- 22. MSA Market: Inventory and Average Age, APAC, 2017

- 23. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, APAC, 2016–2026

- 24. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, APAC, 2016–2026

- 25. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Central & South Asia, 2017

- 26. MPA Market: Inventory and Average Age, Central & South Asia, 2017

- 27. MSA Market: Inventory and Average Age, Central & South Asia, 2017

- 28. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, Central & South Asia, 2016–2026

- 29. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Central & South Asia, 2016–2026

- 30. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Middle East, 2017

- 31. MPA Market: Inventory and Average Age, Middle East, 2017

- 32. MSA Market: Inventory and Average Age, Middle East, 2017

- 33. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, Middle East, 2016–2026

- 34. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Middle East, 2016–2026

- 35. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Africa, 2017

- 36. MPA Market: Inventory and Average Age, Africa, 2017

- 37. MSA Market: Inventory and Average Age, Africa, 2017

- 38. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, Africa, 2016–2026

- 39. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Africa, 2016–2026

- 40. Airborne Maritime Surveillance Aircraft Market: Inventory List, North America, 2017

- 41. Airborne Maritime Surveillance Aircraft Market: Inventory List, Europe, 2017

- 42. Airborne Maritime Surveillance Aircraft Market: Inventory List, Central and South America, 2017

- 43. Airborne Maritime Surveillance Aircraft Market: Inventory List, APAC, 2017

- 44. Airborne Maritime Surveillance Aircraft Market: Inventory List, Central and South Asia, 2017

- 45. Airborne Maritime Surveillance Aircraft Market: Inventory List, Middle East, 2017

- 46. Airborne Maritime Surveillance Aircraft Market: Inventory List, Africa, 2017

- 1. Total Airborne Maritime Surveillance Aircraft Market: Market Engineering Measurements, Global, 2016

- 2. Airborne Maritime Surveillance Aircraft Market: Revenue by Segment, Global, 2016

- 3. Airborne Maritime Surveillance Aircraft Market: Revenue by Region, Global, 2016

- 4. Airborne Maritime Surveillance Aircraft Market: Revenue Forecast by Program Type, Global, 2016–2026

- 5. Airborne Maritime Surveillance Aircraft Market: Revenue Forecast by Region, Global, 2016–2026

- 6. MPA Market: Revenue Forecast by Region, Global, 2016–2026

- 7. MSA Market: Revenue Forecast by Region, Global, 2016–2026

- 8. MPA Market: Prime Contractors Market Share, Global, 2016

- 9. MPA Market: Prime Contractors Projected Market Share, Global, 2017

- 10. MSA Market: Prime Contractors Market Share, Global, 2016

- 11. MPA Market: Prime Contractors Projected Market Share, Global, 2017

- 12. MPA Market: Percent Revenue Breakdown by Country, North America, 2017

- 13. MPA Market: Revenue Forecast by Country, North America, 2016–2026

- 14. MPA Market: Percent Inventory by Country, North America, 2017

- 15. MPA Market: Percent Inventory by Type, North America, 2017

- 16. MSA Market: Percent Revenue Breakdown by Country, North America, 2017

- 17. MSA Market: Revenue Forecast by Country, North America, 2016–2026

- 18. MSA Market: Percent Inventory by Country, North America, 2017

- 19. MSA Market: Percent Inventory by Type, North America, 2017

- 20. MPA Market: Percent Revenue Breakdown by Country, Europe, 2017

- 21. MPA Market: Revenue Forecast by Country, Europe, 2016–2026

- 22. MPA Market: Percent Inventory by Country, Europe, 2017

- 23. MPA Market: Percent Inventory by Type, Europe, 2017

- 24. MSA Market: Percent Revenue Breakdown by Country, Europe, 2017

- 25. MSA Market: Revenue Forecast by Country, Europe, 2016–2026

- 26. MSA Market: Percent Inventory by Country, Europe, 2017

- 27. MSA Market: Percent Inventory by Type, Europe, 2017

- 28. MPA Market: Percent Revenue Breakdown by Country, Central & South America, 2017

- 29. MPA Market: Revenue Forecast by Country, Central & South America, 2016–2026

- 30. MPA Market: Percent Inventory by Country, Central & South America, 2017

- 31. MPA Market: Percent Inventory by Type, Central & South America, 2017

- 32. MSA Market: Percent Revenue Breakdown by Country, Central & South America, 2017

- 33. MSA Market: Revenue Forecast by Country, Central & South America, 2016–2026

- 34. MSA Market: Percent Inventory by Country, Central & South America, 2017

- 35. MSA Market: Percent Inventory by Type, Central & South America, 2017

- 36. MPA Market: Percent Revenue Breakdown by Country, APAC, 2017

- 37. MPA Market: Revenue Forecast by Country, APAC, 2016–2026

- 38. MPA Market: Percent Inventory by Country, APAC, 2017

- 39. MPA Market: Percent Inventory by Type, APAC, 2017

- 40. MSA Market: Percent Revenue Breakdown by Country, APAC, 2017

- 41. MSA Market: Revenue Forecast by Country, APAC, 2016–2026

- 42. MSA Market: Percent Inventory by Country, APAC, 2017

- 43. MSA Market: Percent Inventory by Type, APAC, 2017

- 44. MPA Market: Percent Revenue Breakdown by Country, Central & South Asia, 2017

- 45. MPA Market: Revenue Forecast by Country, Central & South Asia, 2016–2026

- 46. MPA Market: Percent Inventory by Country, Central & South Asia, 2017

- 47. MPA Market: Percent Inventory by Type, Central & South Asia, 2017

- 48. MSA Market: Percent Revenue Breakdown by Country, Central & South Asia, 2017

- 49. MSA Market: Revenue Forecast by Country, Central & South Asia, 2016–2026

- 50. MSA Market: Percent Inventory by Country, Central & South Asia, 2017

- 51. MSA Market: Percent Inventory by Type, Central & South Asia, 2017

- 52. MPA Market: Revenue Forecast by Country, Middle East, 2016–2026

- 53. MPA Market: Percent Inventory by Country, Middle East, 2017

- 54. MPA Market: Percent Inventory by Type, Middle East, 2017

- 55. MSA Market: Percent Revenue Breakdown by Country, Middle East, 2017

- 56. MSA Market: Revenue Forecast by Country, Middle East, 2016–2026

- 57. MSA Market: Percent Inventory by Country, Middle East, 2017

- 58. MSA Market: Percent Inventory by Type, Middle East, 2017

- 59. MPA Market: Percent Inventory by Country, Africa, 2017

- 60. MPA Market: Percent Inventory by Type, Africa, 2017

- 61. MSA Market: Percent Revenue Breakdown by Country, Africa, 2017

- 62. MSA Market: Revenue Forecast by Country, Africa, 2016–2026

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Market Engineering Measurements~ || CEO’s Perspective~ || Market Definitions~ || Market Scope and Definitions~ | Drivers, Restraints, and Challenges~ || Market Drivers~ ||| Average age of aircraft~ ||| Expanding global submarine fleet~ ||| Complex Battlespace Environments~ ||| EEZ/SLOC protection, combating organized crime, and strengthening Homeland Security~ ||| Geographical instability~ || Market Restraints~ ||| Defense budget internally pressured~ ||| Growth in substitutes and new CONOPS~ ||| Economic instability~ || Airborne Maritime Surveillance Aircraft Market Challenges~ | Overview, Forecast, and Analysis~ || Market Engineering Measurements~ || Airborne Maritime Surveillance Aircraft Market—Overview~ || Airborne Maritime Surveillance Aircraft Market—Forecast by Program Type~ || Airborne Maritime Surveillance Aircraft Market—Revenue Forecast by Region~ || MPA Market—Revenue Forecast by Region~ || MSA Market—Revenue Forecast by Region~ || MPA Market—Top 5 Prime Contractors Market Share Dynamics~ || MSA Market—Top 5 Prime Contractors Market share Dynamics~ | Technology Trends~ || Technology Trends~ | Growth Opportunities~ || Growth Opportunity 1—Changing Concepts: Manned-Unmanned Teaming (MUM-T)~ || Growth Opportunity 2—Changing Concepts: Integrated Exclusive Economic Zone (I-EEZ) Concept~ || Growth Opportunity 3—Affordability of Solutions~ || Growth Opportunity 4—Flexible Subsystem/Sensor Integration~ || Growth Opportunity 5—Multi Mission Capability~ || Strategic Imperatives for Success and Growth~ | North America Analysis~ || North America—A Snapshot~ || MPA Budgets~ || MPA Inventory~ || MSA Budgets~ || MSA Inventory~ || Regional Developments and Opportunities~ || Programs and Contracts~ | Europe Analysis~ || Europe—A Snapshot~ || MPA Budgets~ || MPA Inventory~ || MSA Budgets~ || MSA Inventory~ || Regional Developments and Opportunities~ || Programs and Contracts~ | Central and South America Analysis~ || Central & South America—A Snapshot~ || MPA Budgets~ || MPA Inventory~ || MSA Budgets~ || MSA Inventory~ || Regional Developments and Opportunities~ || Programs and Contracts~ | APAC Analysis~ || APAC—A Snapshot~ || MPA Budgets~ || MPA Inventory~ || MSA Budgets~ || MSA Inventory~ || Regional Developments and Opportunities~ || Programs and Contracts~ | Central and South Asia Analysis~ || Central & South Asia—A Snapshot~ || MPA Budgets~ || MPA Inventory~ || MSA Budgets~ || MSA Inventory~ || Regional Developments and Opportunities~ || Programs and Contracts~ | Middle East Analysis~ || Middle East—A Snapshot~ || MPA Budgets~ || MPA Inventory~ || MSA Budgets~ || MSA Inventory~ || Regional Developments and Opportunities~ || Programs and Contracts~ | Africa Analysis~ || Africa—A Snapshot~ || MPA Inventory~ || MSA Budgets~ || MSA Inventory~ || Regional Developments and Opportunities~ || Programs and Contracts~ | Last Word and Recommendations~ || The Last Word—Conclusions~ || Legal Disclaimer~ | Inventory List~ || North America—Inventory List~ || Europe—Inventory List~ || Central and South America—Inventory List~ || APAC—Inventory List~ || Central and South Asia—Inventory List~ || Middle East—Inventory List~ || Africa—Inventory List~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Airborne Maritime Surveillance Aircraft Market: Key Market Drivers, Global, 2017–2026~ 2. Airborne Maritime Surveillance Aircraft Market: Average Age of Airborne Maritime Surveillance Aircraft, Global, 2016~ 3. Airborne Maritime Surveillance Aircraft Market: Key Market Restraints, Global, 2017–2026~ 4. Airborne Maritime Surveillance Aircraft Market: Key Market Challenges, Global, 2017–2026~ 5. Airborne Maritime Surveillance Aircraft Market: Market Engineering Measurements, Global, 2016~ 6. Airborne Maritime Surveillance Aircraft Market: Technology Trends, Global, 2016–2026~ 7. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, North America, 2017~ 8. Airborne Maritime Surveillance Aircraft Market: Regional Developments & Opportunities, North America, 2016–2026~ 9. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, North America, 2016–2026~ 10. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Europe, 2017~ 11. MPA Market: Inventory and Average Age, Europe, 2017~ 12. MSA Market: Inventory and Average Age, Europe, 2017~ 13. Airborne Maritime Surveillance Aircraft Market: Regional Developments & Opportunities, Europe, 2016–2026~ 14. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Europe, 2016–2026~ 15. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Central & South America, 2017~ 16. MPA Market: Inventory and Average Age, Central & South America, 2017~ 17. MSA Market: Inventory and Average Age, Central & South America, 2017~ 18. Airborne Maritime Surveillance Aircraft Market: Regional Developments & Opportunities, Central & South America, 2016–2026~ 19. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Central & South America, 2016–2026~ 20. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, APAC, 2017~ 21. MPA Market: Inventory and Average Age, APAC, 2017~ 22. MSA Market: Inventory and Average Age, APAC, 2017~ 23. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, APAC, 2016–2026~ 24. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, APAC, 2016–2026~ 25. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Central & South Asia, 2017~ 26. MPA Market: Inventory and Average Age, Central & South Asia, 2017~ 27. MSA Market: Inventory and Average Age, Central & South Asia, 2017~ 28. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, Central & South Asia, 2016–2026~ 29. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Central & South Asia, 2016–2026~ 30. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Middle East, 2017~ 31. MPA Market: Inventory and Average Age, Middle East, 2017~ 32. MSA Market: Inventory and Average Age, Middle East, 2017~ 33. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, Middle East, 2016–2026~ 34. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Middle East, 2016–2026~ 35. Airborne Maritime Surveillance Aircraft Market: Major Nations and Regional Dynamics, Africa, 2017~ 36. MPA Market: Inventory and Average Age, Africa, 2017~ 37. MSA Market: Inventory and Average Age, Africa, 2017~ 38. Airborne Maritime Surveillance Aircraft Market: Regional Developments and Opportunities, Africa, 2016–2026~ 39. Airborne Maritime Surveillance Aircraft Market: Programs and Contracts, Africa, 2016–2026~ 40. Airborne Maritime Surveillance Aircraft Market: Inventory List, North America, 2017~ 41. Airborne Maritime Surveillance Aircraft Market: Inventory List, Europe, 2017~ 42. Airborne Maritime Surveillance Aircraft Market: Inventory List, Central and South America, 2017~ 43. Airborne Maritime Surveillance Aircraft Market: Inventory List, APAC, 2017~ 44. Airborne Maritime Surveillance Aircraft Market: Inventory List, Central and South Asia, 2017~ 45. Airborne Maritime Surveillance Aircraft Market: Inventory List, Middle East, 2017~ 46. Airborne Maritime Surveillance Aircraft Market: Inventory List, Africa, 2017~| 1. Total Airborne Maritime Surveillance Aircraft Market: Market Engineering Measurements, Global, 2016~ 2. Airborne Maritime Surveillance Aircraft Market: Revenue by Segment, Global, 2016~ 3. Airborne Maritime Surveillance Aircraft Market: Revenue by Region, Global, 2016~ 4. Airborne Maritime Surveillance Aircraft Market: Revenue Forecast by Program Type, Global, 2016–2026~ 5. Airborne Maritime Surveillance Aircraft Market: Revenue Forecast by Region, Global, 2016–2026~ 6. MPA Market: Revenue Forecast by Region, Global, 2016–2026~ 7. MSA Market: Revenue Forecast by Region, Global, 2016–2026~ 8. MPA Market: Prime Contractors Market Share, Global, 2016~ 9. MPA Market: Prime Contractors Projected Market Share, Global, 2017~ 10. MSA Market: Prime Contractors Market Share, Global, 2016~ 11. MPA Market: Prime Contractors Projected Market Share, Global, 2017~ 12. MPA Market: Percent Revenue Breakdown by Country, North America, 2017~ 13. MPA Market: Revenue Forecast by Country, North America, 2016–2026~ 14. MPA Market: Percent Inventory by Country, North America, 2017~ 15. MPA Market: Percent Inventory by Type, North America, 2017~ 16. MSA Market: Percent Revenue Breakdown by Country, North America, 2017~ 17. MSA Market: Revenue Forecast by Country, North America, 2016–2026~ 18. MSA Market: Percent Inventory by Country, North America, 2017~ 19. MSA Market: Percent Inventory by Type, North America, 2017~ 20. MPA Market: Percent Revenue Breakdown by Country, Europe, 2017~ 21. MPA Market: Revenue Forecast by Country, Europe, 2016–2026~ 22. MPA Market: Percent Inventory by Country, Europe, 2017~ 23. MPA Market: Percent Inventory by Type, Europe, 2017~ 24. MSA Market: Percent Revenue Breakdown by Country, Europe, 2017~ 25. MSA Market: Revenue Forecast by Country, Europe, 2016–2026~ 26. MSA Market: Percent Inventory by Country, Europe, 2017~ 27. MSA Market: Percent Inventory by Type, Europe, 2017~ 28. MPA Market: Percent Revenue Breakdown by Country, Central & South America, 2017~ 29. MPA Market: Revenue Forecast by Country, Central & South America, 2016–2026~ 30. MPA Market: Percent Inventory by Country, Central & South America, 2017~ 31. MPA Market: Percent Inventory by Type, Central & South America, 2017~ 32. MSA Market: Percent Revenue Breakdown by Country, Central & South America, 2017~ 33. MSA Market: Revenue Forecast by Country, Central & South America, 2016–2026~ 34. MSA Market: Percent Inventory by Country, Central & South America, 2017~ 35. MSA Market: Percent Inventory by Type, Central & South America, 2017~ 36. MPA Market: Percent Revenue Breakdown by Country, APAC, 2017~ 37. MPA Market: Revenue Forecast by Country, APAC, 2016–2026~ 38. MPA Market: Percent Inventory by Country, APAC, 2017~ 39. MPA Market: Percent Inventory by Type, APAC, 2017~ 40. MSA Market: Percent Revenue Breakdown by Country, APAC, 2017~ 41. MSA Market: Revenue Forecast by Country, APAC, 2016–2026~ 42. MSA Market: Percent Inventory by Country, APAC, 2017~ 43. MSA Market: Percent Inventory by Type, APAC, 2017~ 44. MPA Market: Percent Revenue Breakdown by Country, Central & South Asia, 2017~ 45. MPA Market: Revenue Forecast by Country, Central & South Asia, 2016–2026~ 46. MPA Market: Percent Inventory by Country, Central & South Asia, 2017~ 47. MPA Market: Percent Inventory by Type, Central & South Asia, 2017~ 48. MSA Market: Percent Revenue Breakdown by Country, Central & South Asia, 2017~ 49. MSA Market: Revenue Forecast by Country, Central & South Asia, 2016–2026~ 50. MSA Market: Percent Inventory by Country, Central & South Asia, 2017~ 51. MSA Market: Percent Inventory by Type, Central & South Asia, 2017~ 52. MPA Market: Revenue Forecast by Country, Middle East, 2016–2026~ 53. MPA Market: Percent Inventory by Country, Middle East, 2017~ 54. MPA Market: Percent Inventory by Type, Middle East, 2017~ 55. MSA Market: Percent Revenue Breakdown by Country, Middle East, 2017~ 56. MSA Market: Revenue Forecast by Country, Middle East, 2016–2026~ 57. MSA Market: Percent Inventory by Country, Middle East, 2017~ 58. MSA Market: Percent Inventory by Type, Middle East, 2017~ 59. MPA Market: Percent Inventory by Country, Africa, 2017~ 60. MPA Market: Percent Inventory by Type, Africa, 2017~ 61. MSA Market: Percent Revenue Breakdown by Country, Africa, 2017~ 62. MSA Market: Revenue Forecast by Country, Africa, 2016–2026~ |

| Author | Arjun Sreekumar |

| Industries | Aerospace, Defence and Security |

| WIP Number | MD38-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB