Global Commercial Avionics Market, Forecast to 2030

Global Commercial Avionics Market, Forecast to 2030

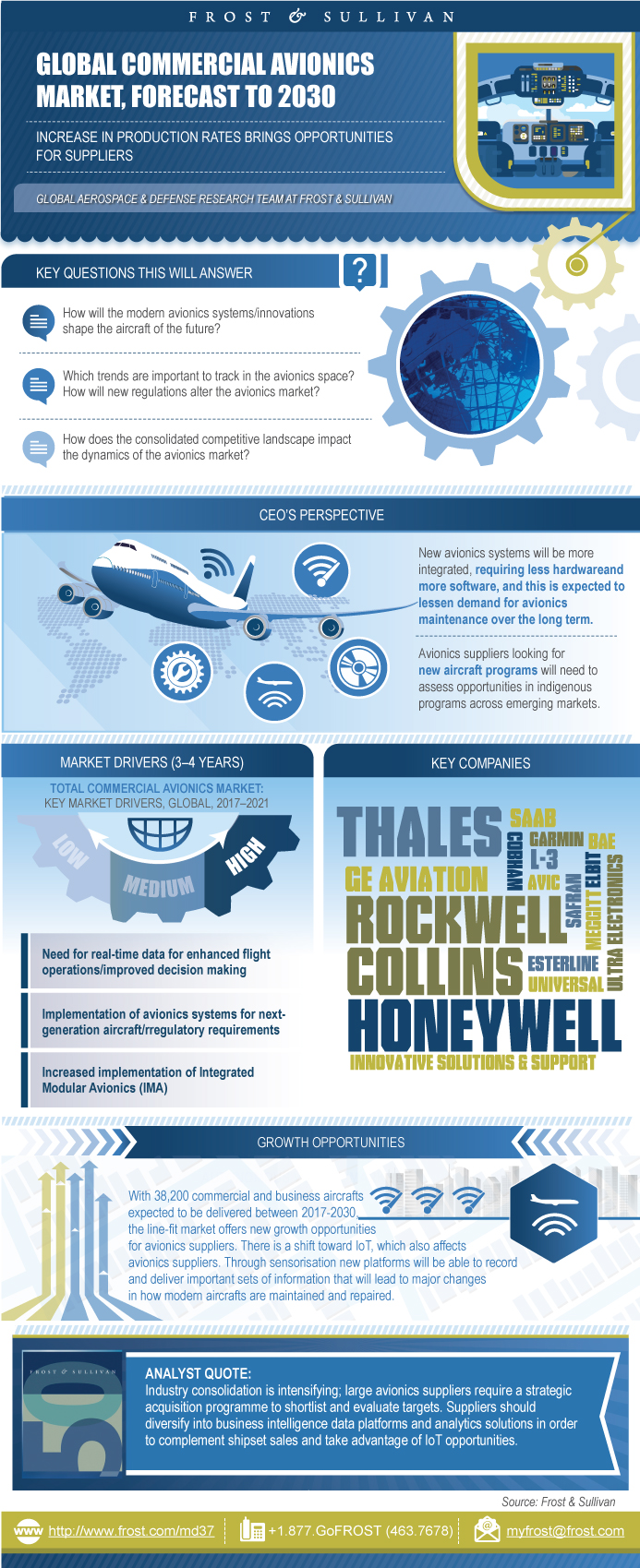

Increase in Production Rates Brings Opportunities for Suppliers

07-Jul-2017

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

The commercial avionics market will undergo a significant transformation from ground-based to satellite-based system of air traffic control changing end-user requirements in terms of speed and bandwidth among other equipment specifications. Worth $12.74 billion in 2016, revenues are expected to reach $16.65 billion by 2030 at a compound annual growth rate (CAGR) of 1.9% although revenue trajectory varies by every product segment.

Research scope

The research focuses on the Commercial Avionics market for Communication, Navigation, Surveillance and Integrated Systems. The research covers the global market and provides a 15 year forecast on where the industry is headed between the timeline 2017–2030 (with 2016 as the base year). The avionics forecast is based on new aircraft production of narrow body, wide body, regional, and business jets.

• Market trends (mandates, integrated modular avionics platform, IoT, multiple partnerships)

• Highlights growth opportunities for avionics suppliers

• Analyses by segment, revenue stream, aircraft platform

• Analyses avionics related segments – EFBs and drones

• Avionics Supply chain – market distribution channels, Supply chain trends

• Global commercial avionics competitive landscape

• Current innovations and future avionics concepts

• Aircraft platforms entering into service between 2016-2030

The studies highlights industry challenges, growth drivers and restraints as well as contain major avionics contracts. The impact of emerging avionics markets such as China, India, and Russia is discussed and the study provides a list of home grown suppliers emerging from these countries. It also features market share of Rockwell Collins, Cobham Plc, GE Aviation, Honeywell Aerospace, Garmin International, Thales Avionics, L-3 Communications, Esterline Technologies Corporation, Safran, SAAB Group, Aviation Industry Corporation of China (AVIC), Elbit Systems, BAE Systems, and Meggitt PLC.

Key Target Audience

• Avionics OEMs

• Component Suppliers

• System Integrators

• Aftermarket Suppliers

• Potential Investors

• Strategy growth managers

• Research & Educational Institutes

• Consulting firm

• Resellers and distributors

• Technology partners

Key Questions This Study Will Answer

• How will the modern avionics systems/innovations shape the aircraft of the future?

• Which trends are important to track in the avionics space? How will new regulations alter the avionics market?

• How will the increasing level of avionics integration change the market?

• What is the effect of drone and EFB startups on the avionics market?

• How does the consolidated competitive landscape impact the dynamics of the avionics market?

• What are the evolving opportunities and threats for avionics suppliers?

• What is the impact of emerging markets in the avionics supply chain?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

CEO’s Perspective

Definitions

Definitions (continued)

Definitions (continued)

Definitions (continued)

Market Definitions

Key Questions This Study Will Answer

Commercial Avionics Scope & Segmentation

Avionics Product Segmentation

Aircraft Platforms Considered for the Study

Market Overview

Market Roadmap 2016–2030

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Avionics Regulatory Requirements

Avionics Regulatory Requirements (continued)

Avionics Regulatory Requirements (continued)

Market Trends

Market Trends (continued)

Production History and Forecast, 2016–2030

New Aircraft Platforms 2016–2030

In Service Aircraft & On Order

New Aircraft Platforms 2016–2030

New Aircraft Platforms 2016–2030 (continued)

Market Engineering Measurements

Forecast Assumptions

Total Commercial Avionics Revenue Forecast

Total Revenue Forecast Discussion

Total Commercial Avionics Revenue Forecast by Revenue Stream

Total Revenue Forecast Discussion by Revenue Stream

Total Commercial Avionics Revenue Forecast by Segment

Total Revenue Forecast Discussion by Segment

Line-fit Commercial Avionics Market Revenue Forecast by Type of Platform

Revenue Forecast Discussion by Type of Platform (Line fit)

Competitive Analysis—Total Avionics Market Share (FY 2016)

Competitive Analysis

Competitive Analysis (continued)

Avionics Supply Chain—Market Distribution Channels

Supply Chain Trends

Avionics Market Challenges

Emerging Avionics Markets

Homegrown Avionics Suppliers in Emerging Economies

Avionics Related Market Segments—EFBs

Open World vs. Core Avionics

Related Market Segments—UAV

Key Platforms in Urban Aviation Market Segment

Case Study—Taxi Drones: Uber Elevate

Snapshot of UAV Cargo Segment

Commercial Drone Technology Development Trends

Key Suppliers—EFBs & Drone Avionics

Growth Opportunity—Avionics part of IoT Ecosystem

Growth Opportunity—UAVs

Strategic Imperatives for Success and Growth

Communication System Market Key Findings

Market Engineering Measurements

Revenue Forecast for Communication Systems Market

Revenue Forecast by Revenue Stream for Communication Systems Market

Revenue Forecast by Platform Type for Communication Systems Market (Line fit Only)

Revenue Forecast Discussion

Navigation System Market Key Findings

Market Engineering Measurements

Revenue Forecast for Navigation Systems Market

Revenue Forecast by Revenue Stream for Navigation Systems Market

Revenue Forecast by Platform Type for Navigation Systems (Line fit Only)

Revenue Forecast Discussion—Navigation Systems

Surveillance System Market—Key Findings

Market Engineering Measurements

Revenue Forecast for Surveillance Systems Market

Revenue Forecast by Revenue Stream for Surveillance Systems Market

Revenue Forecast by Platform Type for Surveillance Systems Market (Line fit Only)

Revenue Forecast Discussion—Surveillance Systems

Integration System Market—Key Findings

Market Engineering Measurements

Revenue Forecast for Integration Systems Market

Revenue Forecast by Revenue Stream for Integrated Systems Market

Revenue Forecast by Platform Type for Integrated System Market (Line fit Only)

Revenue Forecast Discussion—Integrated System

Current Innovation in Avionics

Current Innovation in Avionics (continued)

Future Avionic Concepts

Future Avionic Concepts (continued)

Case Study—Universal Avionics: Insight Display Engineering

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Additional Sources of Information on Commercial Avionics Market

Major Avionics Contracts 2011—2017

Major Avionics Contracts 2011—2017 (continued)

Major Avionics Contracts 2011—2017 (continued)

Major Avionics Contracts 2011—2017 (continued)

Major Avionics Contracts 2011—2017 (continued)

Major Avionics Contracts 2011—2017 (continued)

Major Avionics Contracts 2011—2017 (continued)

Major Avionics Contracts 2011—2017 (continued)

Company Profile—Thales Avionics

Company Profile—Rockwell Collins

Company Profile—Honeywell

Company Profile—United Technologies Corporation

Company Profile—Safran

Company Profile—Cobham PLC

Company Profile—Elbit Systems

Company Profile—Esterline Technologies Corporation

Company Profile—GE Aviation

References

Learn More—Next Steps

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Priyanka Chimakurthi |

| Industries | Aerospace, Defence and Security |

| WIP Number | MD37-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB