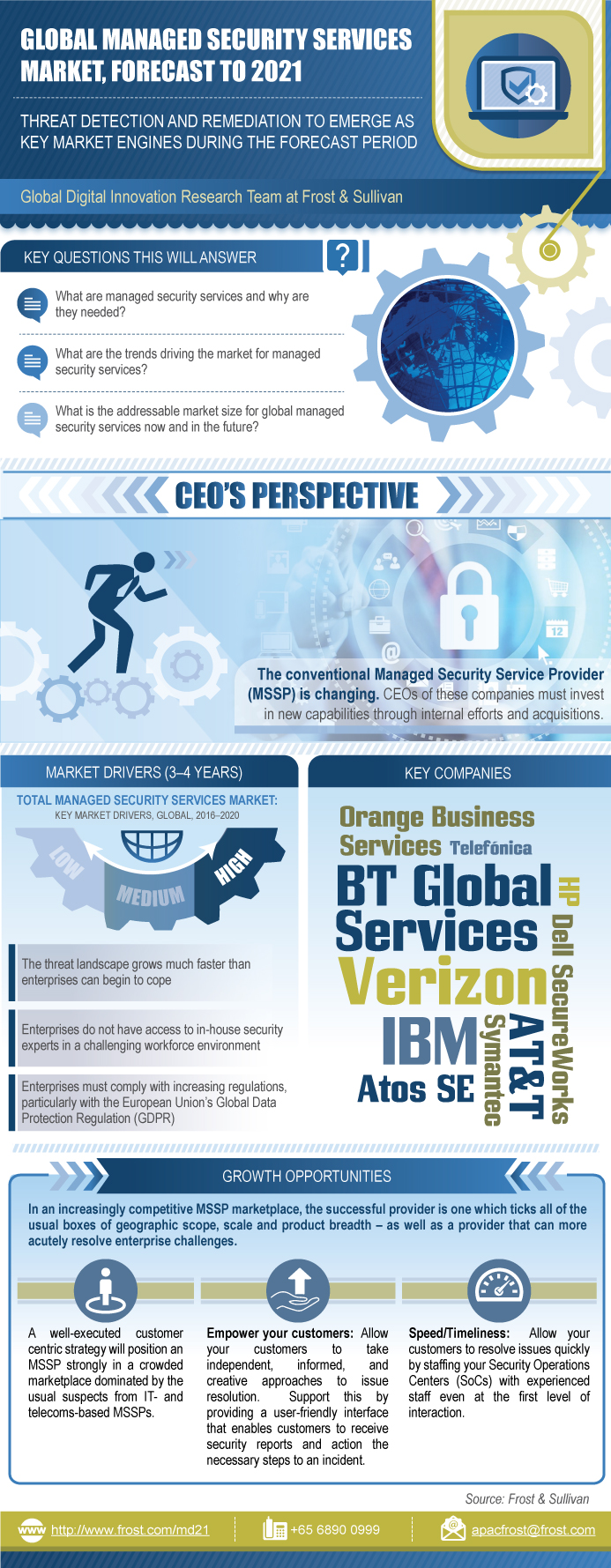

Global Managed Security Services Market, Forecast to 2021

Global Managed Security Services Market, Forecast to 2021

Threat Detection and Remediation to Emerge as a Key Market Engine During the Forecast Period

26-Oct-2017

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

Frost & Sullivan’s research, Global Managed Security Services Market, Forecast to 2021, analyses current market dynamics, external challenges, drivers, restraints, forecasts, and trends. Market share and competitive analysis of key participants are provided. This research service provides a consolidated, top-level view of Frost & Sullivan’s regional research into the global Managed Security Services (MSS) market. It draws on previous detailed research by Frost & Sullivan’s security experts across Asia-Pacific, Europe, the Middle East and Africa (EMEA), Latin America, and North America.

For more in-depth analysis on each of these regions, please see the following region-specific studies:

• 2016 Managed Security Services in North America (K12F-74)

• EMEA Managed Security Services Market (MA60-74)

• Asia-Pacific Managed Security Services Market, Forecast to 2020 (P811-74)

• Managed Security Services Market in Latin America, Forecast to 2021 (K167-72)

The global MSS market grew 17.0% in 2016, after a 16.8% year-on-year increase in 2015. The trend for number of suppliers has remained on an upward path, while the combined market share of the top 3 participants has fallen. Mergers and acquisition activity continued in 2016, with several similar-sized companies pooling their expertise to compete with improved geographic scope, scale, and product breadth. At least 2 leading telecoms service providers (Vodafone and Deutsche Telekom) relaunched their security services in 2016, and every other security vendor is also offering services to counter an expected decline in the growth momentum for security hardware. All these supply-side activities are reflective of a buoyant market; however, the key to longevity and success is an MSS provider agile that is astute enough to stay ahead of the competition by demonstrating the following characteristics:

• Positioned to capture the next wave of higher value MSS: According to Frost & Sullivan’s research, the 2 growth MSS segments in the next 5 years are threat intelligence and research and detection services.

• Strong ability to retain security talent: Retaining security experts through not only competitive remuneration, but also with the nature of jobs by providing interesting, varied, and collaborative work.

• Grow the mid-sized market segment with the right pricing strategy: According to Frost & Sullivan’s research, the mid-sized market segment is relatively underdeveloped; largely ignored by many tier I MSS providers and underserved by the niche, pure-play vendors.

• A customer-centric approach: Retaining existing customers and attracting new ones by delivering solutions that meet customer demands.

• Technology-led approach to service delivery: Unburden tedious tasks from security staff through automation and a collaborative solution approach.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Key Findings (continued)

Market Engineering Measurements

CEO’s Perspective

Introduction

Market Definitions

Geographic Coverage

Managed Security Services Versus Professional Services

Professional Services are not Included in Managed Security Services Forecasts

Managed Security Services Segments

Managed Security Service Providers

Questions this Study will Answer

Market Overview—Service Technology Roadmap

Global Regional Analysis by Maturity

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Restraints Explained (continued)

Forecast Assumptions

Revenue Forecast

Revenue Forecast Discussion

Percent Revenue Forecast by Region

Revenue Forecast by Region

Revenue Forecast Discussion by Region

Revenue Forecast by Vertical Market

Total Managed Security Services Market—Business Size

Total Managed Security Services Market—Business Size Discussion

Competitive Analysis—Market Share

Market Share Analysis

Growth Opportunity 1—Customer Centric MSSPs

Growth Opportunity 2—Digital Transformation Journeys

Growth Opportunity 3—Vertical Focus

Strategic Imperatives for Success and Growth

Revenue Forecast—EMEA

Composite of Managed Security Services Revenues—EMEA

Composite of Managed Security Services Revenues—EMEA (continued)

Revenue Forecast—APAC

Revenue Forecast Discussion—APAC

Revenue Forecast—NA

Revenue Forecast Discussion—NA

Revenue Forecast—LATAM

Revenue Forecast Discussion—LATAM

The Last Word—Predictions

The Last Word—Recommendations

Legal Disclaimer

Market Engineering Methodology

Market Engineering Measurements

Market Engineering Measurements (continued)

Partial List of Other Companies Included for Market Sizing Purposes

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Yiru Zhong |

| Industries | Information Technology |

| WIP Number | MD21-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB