Groupe PSA’s Automotive Growth Strategies, 2019–2025

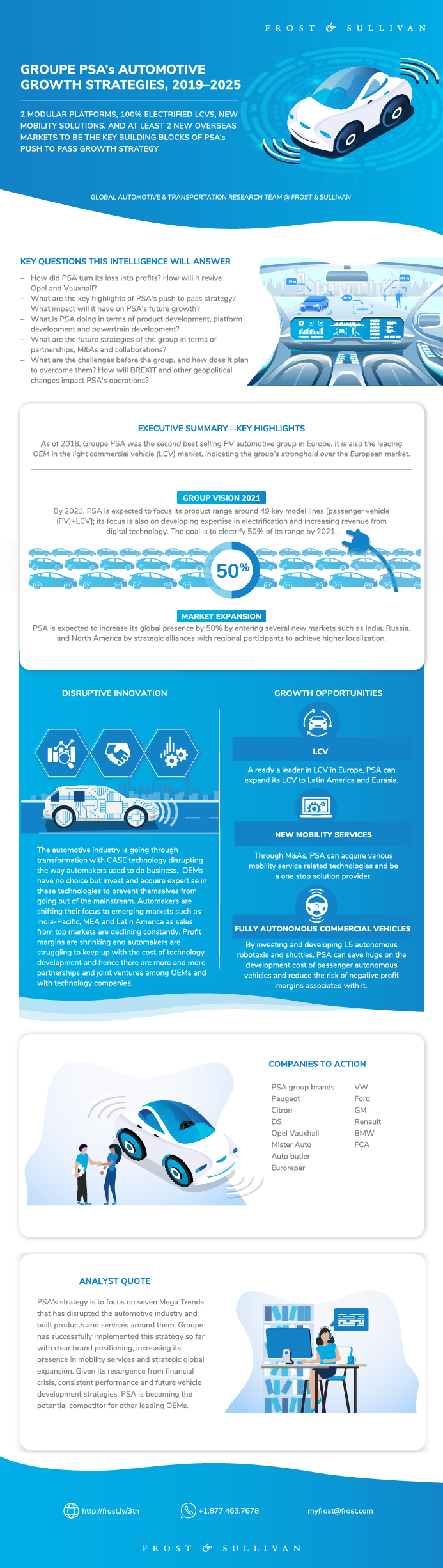

2 Modular Platforms, 100% Electrified LCVs, New Mobility Solutions, and At Least 2 New Overseas Markets to be the Key Building Blocks of PSA’s Push to Pass Growth Strategy

15-Oct-2019

North America

Market Research

$4,950.00

Special Price $3,712.50 save 25 %

Groupe PSA has gained significant attention from the automotive industry, with its turnaround from loss making to generating profit. Since then, the company has shown impressive growth, with 35% revenue increase from 2014 to 2018, and became the second largest OEM in Europe in terms of passenger vehicle sales. It also acquired another loss-making automotive group Opel and Vauxhall from GM and turned it around.

In 2018, Opel Vauxhall added €18.3 billion to the group’s revenue and more than 1 million vehicles sales. This increased group’s total sales volume to 3.8 million. Addition of Opel Vauxhall has strengthened the group’s sales volume and provided opportunities for its UK entry. PSA, after its resurgence from financial crisis, has emerged as a competitive OEM, giving competition not only to European participants but also to the global ones. To grow sustainably, PSA has designed a 3-phase growth plan for itself called “Push to Pass Strategy”. It has a fundamental role in making the group strong enough to compete against the competition. It has successfully achieved phase I objectives and is entering in the phase II in 2019. This study analyzes in details PSA’s Push to Pass strategy, discusses PSA’s performance till date, and its future development strategies. As per PSA’s 2018 target, the group surpassed its target of 10% group revenue increase (against 2015) with almost 35% increase, highest among the top 5 European automakers during the period 2015 to 2018. Successful implementation of Phase I of Push to Pass has made PSA not only the second bestselling PV automotive group in Europe but also the lead OEM in the LCV segment, indicating the group’s stronghold over the European market. PSA’s focus is on seven Mega Trends that have disrupted the automotive industry and build products and services around them. With consistently positive financial results and 70 regional launches in 2 years, PSA, along with Opel Vauxhall, is moving toward sustainably competitive global automotive OEM.

With Push to Pass II, PSA aims to improve its product quality, adopt new technologies, offer mobility services, and expand to new geographies to become a global vehicle manufacturer.

Research Highlights

PSA’s vision to not restrict its growth to Europe but establish itself as a global mobility company requires strong brands, huge investment in CASE technologies, and visibility of its businesses across the globe.

Future of group PSA:

In 2019, PSA entered phase II of its Push to Pass strategy. Highlights of phase II Push to Pass, 2019–2021 are:

- Platform consolidation

- Focus on LCV growth

- Execution of India entry plan

- Establish new mobility services

- Strengthen aftermarket business

Key Issues Addressed

- How PSA turned its loss into profits? How it revived Opel Vauxhall?

- What are the key highlights of PSA's Push to Pass strategy? What impact it will have on PSA’s future growth?

- What is PSA doing in terms of product development, platform development, and powertrain development?

- What are the future strategies of the group in terms of partnerships, M&As, and collaboration?

- What are the challenges before the group, and how it plans to overcome them? How BREXIT and other geopolitical changes will impact PSA’s operations?

Executive Summary—Key Highlights

Executive Summary—PSA’s Core Focus Areas

Executive Summary—Global Expansion Plans, 2025

Executive Summary—LCV Offensive Strategy

Executive Summary—CMP Platform to Drive Electrification

Executive Summary—EMP2 Platform for Commercial Autonomous Vehicles

Executive Summary—Multi-brand Aftermarket Strategy

Executive Summary—Current and Future Outlook

Research Scope

Research Aims and Objectives

Key Questions this Study will Answer

Research Methodology

Definition and Assumptions

Business Overview

Group Revenue and Profitability

Group Brand and Model Performance

Top Markets Performance

Back in the Race, 2014–2015—Emergence from Bankruptcy

PACE !—OV’s Revival, 2017–2018

Push to Pass Phase I Analysis, 2016–2018

Push to Pass Phase II Target, 2019–2021

Overview of Financial Performance

Overview of European Market Share Performance

Overview of Sales Performance in Top 5 Markets in Europe

Overview of R&D Spending

R&D Portfolio

Manufacturing Strategy and Future Plans

EMP2

EMP2 (continued)

CMP

CMP (continued)

Brand Strategy—Peugeot Citroen DS

Significance of DS

Brand Strategy—OV

Brand Strategy—LCV

Focus on Europe—Future of PSA Electrification (eLCV)

eLCV—Future Solution by Vehicle Usage (Based on Interview)

Global Expansion, 2019–2021

Future of PSA Connectivity Strategy

Advanced Technology Partnerships

Future of PSA Automated Driving Strategy

Autonomous Vehicle Rollout

Future of PSA New Mobility Strategy

Free2Move—PSA’s Transition from Automaker to Mobility Provider

Smart Car strategy—PSA’s Entry in India and Emerging Markets

Challenges in India

Opportunity for PSA in India

PSA Retail—Multi-brand Retail Strategy

Online Retail Strategy

Used Car—Multi-brand, Multi-channel, and Multi-service Strategy

Future of Financial Services

Aftermarket Business Overview

PSA’s Aftermarket Diversification Strategy

Multi-brand Aftermarket Strategy

Key Mega Trends—Aftermarket Opportunities

Entry to North American Market—Free2Move to Set Ground for PSA

North American Shared Mobility—Opportunity Analysis for PSA

Impact of Brexit

Future of PSA in China

Newer Alliances for CASE Collaborations

Keeping Up with Electric and Autonomous Technologies

Growth Opportunity for PSA

Strategic Imperatives for Success and Growth

The Last Word—3 Big Predictions

Legal Disclaimer

List of Acronyms

Market Engineering Methodology

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Speak directly with our analytics experts for tailored recommendations.

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

Research Highlights

PSA’s vision to not restrict its growth to Europe but establish itself as a global mobility company requires strong brands, huge investment in CASE technologies, and visibility of its businesses across the globe.

Future of group PSA:

In 2019, PSA entered phase II of its Push to Pass strategy. Highlights of phase II Push to Pass, 2019–2021 are:

- Platform consolidation

- Focus on LCV growth

- Execution of India entry plan

- Establish new mobility services

- Strengthen aftermarket business

Key Issues Addressed

- How PSA turned its loss into profits? How it revived Opel Vauxhall?

- What are the key highlights of PSA's Push to Pass strategy? What impact it will have on PSA’s future growth?

- What is PSA doing in terms of product development, platform development, and powertrain development?

- What are the future strategies of the group in terms of partnerships, M&As, and collaboration?

- What are the challenges before the group, and how it plans to overcome them? How BREXIT and other geopolitical changes will impact PSA’s operations?

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Shruti Pathak |

| Industries | Automotive |

| WIP Number | ME92-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9673-A6,9800-A6,9807-A6,9813-A6,9801-A6,9882-A6,9965-A6,9AF6-A6 |