Cloud Security Posture Management Market, Forecast and Growth Opportunities, Global, 2024 – 2028

Cloud Security Posture Management Market, Forecast and Growth Opportunities, Global, 2024 – 2028

The Increasing Complexity of and Attack Surfaces in Hybrid and Multi-Cloud Environments Drive Future Growth Potential

19-Jun-2024

Global

Market Research

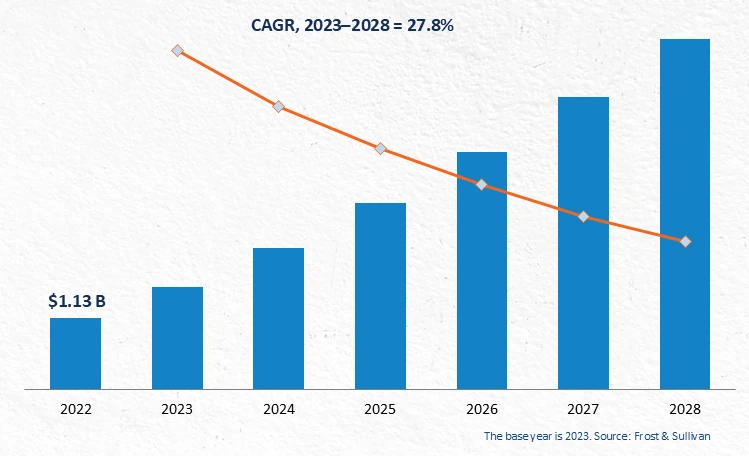

The Global Cloud Security Posture Management (CSPM) Market grew significantly in 2023 with 45.1% year-over-year (YOY) growth. The CSPM market size was estimated at $1,639.8 million in 2023. In the next 5 years, the sector is forecast to maintain solid growth, representing a compound annual growth rate (CAGR) of 27.8% from 2023 to 2028.

As more businesses are migrating to the cloud and using more cloud-native technologies, which adds complexity and a larger attack surface, they are recognizing the critical role of securing cloud environments and the need for cloud security posture management (CSPM) solutions to address these challenges. CSPM provides features such as misconfiguration management, continuous monitoring, vulnerability scanning, and compliance management.

CSPM tools are rising in demand and are becoming increasingly crucial for organizations to maintain robust security postures as they need to deal with the complexities of multi-cloud and cloud-native technology management and meet stringent regulatory requirements, which is set to remain the driving force behind CSPM adoption.

As demand increases for unified security to deliver granular visibility and protection across multiple layers of cloud-native application environments, organizations are shifting from stand-alone cloud security tools, including CSPM and cloud workload protection platforms (CWPPs), vulnerability management, infrastructure as code (IaC), and container security—which often lack unified coverage and context and lead to manual risk correlation across tools and operational complexities—toward fully integrated cloud-native application protection platforms (CNAPPs). Doing so will position organizations to gain comprehensive visibility, risk management, and security protection capabilities across different modern cloud deployments layers, including cloud infrastructure layers, workloads, application, and data layers.

This analysis only includes technology vendors that provide stand-alone/dedicated CSPM solutions or include them as part of their CNAPPs. It offers insights into the global Cloud Security Posture Management industry landscape, revenue forecasts, and CSPM market trends with regional breakdowns including growth metrics, revenue forecasts, CSPM market forecast analysis and CSPM market share by vendor for North America (NA); Europe, the Middle East, and Africa (EMEA); Asia-Pacific (APAC); and Latin America (LATAM).

This CSPM study derives information and insights from Frost & Sullivan’s secondary research and contributions from vendors, channel partners, and other industry stakeholders. However, all revenue estimates and forecasts are attributable to Frost & Sullivan’s analysis and modeling. The study period is 2022 to 2028.

Author: Anh Tien Vu

Research Highlights

CSPM: Revenue Forecast, Global, 2022–2028

Revenue Estimate Disclaimer

While Frost & Sullivan attempts to measure the CSPM industry separately from other cloud security technologies, such as CWPP, IaC security, CDR, CIEM, KSPM, container security, and the broader CNAPP platform, there are often big overlaps in revenue recognition among them.

Estimating revenue for CSPM alone from other components is challenging as many vendors have shifted away from the module or product-based pricing model to a more platform-based pricing model, which enables their customers to consume these components/functions based on their needs under a single license.

Many traditional CSPM vendors have strengthened their solutions by adding cloud workload and AppSec (e.g., scanning, visibility, micro-segmentation, and compliance) using either an agentless or agent-based approach, which no longer makes them a CSPM, but a CNAPP, and is sold as a platform. As such, it is impossible to break down the revenue for CSPM from the platform.

Similarly, companies that provide CSPM, CWPP, and other modules may package these modules as a total security package, allowing customers to use them without limits and based on their needs, so it is impossible to split the revenue of CSPM from other modules in this case.

These constraints make it impossible to separate the CSPM revenue from their total CNAPP business. As a result, in many cases, the revenue estimate for CSPM function is mainly based on customers’ consumption and the percentage of use cases.

In this study, CSPM revenue may also include revenue from CIEM, IaC security, CDR, DSPM, and SSPM (if these functions are integrated in the same platform).

Research Scope

Revenue from CSPM functionality on top of other solutions, such as attack surface management, is excluded from this analysis.

As customers embrace hybrid and multicloud strategies, a CSPM must support hybrid and multicloud environments. This study will only include vendors that provide dedicated and cloud-agnostic CSPMs that support these environments.

| Scope | |

|---|---|

| Geographic Coverage | Global |

| Study Period | 2022-2028 |

| Base Year | 2023 |

| Forecast Period | 2024-2028 |

| Monetary Unit | US Dollars |

Regional Segmentation

North America

- NA leads the global industry due to widespread and advanced adoption of public cloud and cloud-native technologies, which leads to more advanced needs for holistic security.

- These adoption trends increase demand for a unified platform that provides comprehensive, continuous visibility and monitoring, advanced threat detection, behavior analytics, and integrated code security capabilities.

- These features were traditionally managed by separate point solutions but are now being consolidated to enhance efficiency and effectiveness in security management.

- CSPM has become vital in continuous known/unknown threats and compliance monitoring, while other advanced capabilities are catching up for better threat detection and response to unknown threats.

- In particular, focus on container/K8s security in NA is significant due to high awareness of the threat landscape.

- Adoption of CSPM and other cloud security technologies is also driven by stringent regulatory requirements, particularly in the United States, and includes stringent standards such as FedRAMP, HIPAA, and HITRUST, which require robust security measures to protect sensitive data.

Europe, Middle East & Africa

- EMEA's cloud adoption is maturing, but its security practices and requirements are less mature, with on-premises and hybrid environments still common and an increase in Microsoft Azure use.

- EMEA organizations focus on data privacy regulations, with compliance requirements and the growing need for threat prevention/remediation driving demand.

- CSPM sees wide adoption with limited demand for other advanced capabilities despite their increased evaluation.

- Regional organizations are focusing more on visibility and vulnerability management, with a need for continuous scanning of vulnerabilities and visibility into an SBOM and DevOps tools to understand associated risks.

- A notable shift has occurred in the region’s leadership concerning cloud security initiatives, which drives greater integration of security with DevOps tools and sees security teams taking the lead in adoption of CSPM projects that were traditionally led by DevOps teams.

- Holistic security is seeing increased adoption in the region as organizations highly value flexibility in their security solutions to accommodate different technologies and cloud platforms, driven by the need to accommodate the regulations in different countries.

Asia Pacific

- APAC is experiencing rapid cloud migration. Public cloud adoption continues to increase, leading to a heightened need for cloud security adoption to gain visibility and protect cloud workloads across hybrid cloud environments.

- Misconfigurations are a major cause of cloud security breaches in APAC and drive the strong adoption of CSPM tools that can identify and rectify these vulnerabilities.

- Concerns about data localization and sovereignty are also driving many organizations to use CSPM to stay compliant with different regulatory frameworks.

- Organizations in China, Japan, and South Korea focus largely on compliance and visibility capabilities.

- Basic capabilities such as VMs and container vulnerability management see higher adoption, with lower demand for advanced services. The mainstream adoption of K8s and containers in some countries, such as Japan, South Korea, and China, accelerates CSPM demand.

- Interest is growing in consolidating and integrating other security technologies, such as endpoint and identity management, EDR with real-time cloud misconfiguration management, baseline assessment monitoring, and CI/CD pipeline security.

Latin America

- LATAM is the least mature region, with most organizations maintaining on-premises and hybrid environments with strong VM adoption; however, public and multicloud adoption lags.

- Cloud security adoption remains low because cloud security requirements remain basic across cloud environments.

- Most companies focus on vulnerability management and cloud visibility with less focus on runtime protection capabilities because of the complexity, overhead management costs, and lack of expertise.

- Organizations require agentless scanning for better deployment and management and increasingly demand CSPM tools that provide strong runtime protection and effective vulnerability management.

Competitive Environment

Number of Competitors | More than 35 |

Competitive Factors | Features, performance, user experience, cost, branding, unified management, sales support, technology, reliability, professional services, channel partners, long-term viability of vendor |

Key End-user Industry Verticals | Techs; banking, financial services, and insurance (BFSI), eCommerce/retail, media & entertainment (M&E), telco, internet service provider, healthcare |

Leading Competitors | Microsoft, Wiz, PANW, CrowdStrike, Lacework, Orca Security, Check Point |

Revenue Share of Top 5 Competitors (2023) | 55.2% |

Other Notable Competitors | Aqua Security, Sysdig, Qualys, Tenable, Uptycs, Algosec, Sonrai Security, Rapid7 |

Distribution Structure | Direct, distributors, resellers, system integrators, service providers |

Notable Acquisitions and Mergers | PANW acquired Bridgecrew, Cider, and Dig Security; Check Point acquired Spectral; Tenable acquired Accurics and Ermetic; Rapid7 acquired DivvyCloud; Aqua Security acquired Argon; Sysdig acquired Apolicy; Lacework acquired Soluble; Cisco acquired Lightspin and Oort; CrowdStrike acquired Bionic and Flow Security; Wiz acquired Gem Security |

Inclusion and Exclusion of Vendors

While Frost & Sullivan analysts attempt to include all qualified vendors in this analysis, including global and regional vendors (e.g., some just operate in China, Europe, or the US), some vendors may not be featured in the market share sections throughout the report due to the following reasons.

- Vendors Declined to Participate: Some vendors decided against participating in our study, which resulted in lack of visibility and insights from them.

- Vendors Declined to be Featured: Some vendors provided us with insights but declined to be featured separately in the report as a measure to keep their financial performance confidential.

- Limited Insights: Concerning vendors that declined to participate, we tried to estimate their revenue and business performance and conducted secondary research on their products and services, but these inputs are not sufficient to feature them separately in the study.

- Overlapped Functionalities: Some vendors do provide a CSPM functionality on top of other products (e.g., attack surface management, cloud management), but they do not promote the product as CSPM. These vendors are also not included in the study.

Key Competitors

Global

- Algosec

- Alibaba Cloud

- Aqua Security

- Check Point

- Cisco

- CrowdStrike

- JupiterOne

- Lacework

- Microsoft

- Orca Security

- Palo Alto Networks

- Rapid7

- Sonrai Security

- Sysdig

- Tenable

- Trellix

- Trend Micro

- Uptycs

- Wiz

Key Regulations and Frameworks

Regulations and cloud security frameworks are vital in the decision-making process around cloud-native security. Organizations aim to automate compliance monitoring and enable security teams to understand security risks and detect misconfigurations or violations that could lead to breaches and exposure.

Compliance requirements are often industry-specific, and organizations in various industries must comply with industry-specific guidelines and regulations. For example, the Payment Card Industry Data Security Standard (PCI DSS) is the primary regulation for the commercial sectors (retail/eCommerce), and organizations adopting cloud environments must comply with its standards. Industry-specific frameworks, such as the Health Insurance Portability and Accountability Act (HIPAA) and the National Institute of Standards and Technology (NIST) document NIST800-53, apply to the healthcare and defense industries and are the major drivers for the strong adoption of cloud compliance systems in these industries.

Organizations in less-regulated industries tend to comply with security frameworks such as the Center for Internet Security (CIS), NIST800-53, and MITRE to ensure adherence to industry best practices.

Most Frost & Sullivan customers request support for the following regulations:

- Service Organization Control 2 (critical)

- International Organization for Standardization (ISO) 27001

- CIS Benchmarks

- HIPAA

- PCI DSS

- NIST Cybersecurity Framework (becoming prevalent, especially in NA)

- MITRE Adversarial Tactics, Techniques, and Common Knowledge

- Cloud and platform provider security best practices/well-architected frameworks

- Cybersecurity and Infrastructure Security Agency (CISA) for container/K8s security hardening

- Some moving toward using the Cloud Security Alliance (CSA) Cloud Controls Matrix

- Regional/in-country regulations

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on the Cloud Security Posture Management (CSPM) Industry

Definitions: Cloud Security Posture Management (CSPM)

Definitions: Cloud Security Posture Management (CSPM) (continued)

CSPM Preferred Features

CSPM Preferred Features (continued)

CSPM in the Context of Cloud-native Security

CSPM in the Context of Cloud-native Security (continued)

Scope of Analysis

Revenue Estimate Disclaimer

Regional Segmentation

Regional Segmentation (continued)

Research Methodology

Competitive Environment

Inclusion and Exclusion of Vendors

Key Competitors

Industry Findings

Industry Findings (continued)

Industry Findings (continued)

Customer Preferences

Customer Preferences (continued)

Key Regulations and Frameworks

Growth Metrics

Growth Drivers

Growth Driver Analysis

Growth Driver Analysis (continued)

Growth Driver Analysis (continued)

Growth Driver Analysis (continued)

Growth Driver Analysis (continued)

Growth Restraints

Growth Restraint Analysis

Growth Restraint Analysis (continued)

Growth Restraint Analysis (continued)

Growth Restraint Analysis (continued)

Forecast Considerations

Forecast Considerations (continued)

Revenue Forecast

Revenue Forecast by Region

Revenue Forecast Analysis

Revenue Share

Pricing Trends and Forecast Analysis

Growth Metrics

Revenue Forecast

Forecast Analysis

Revenue Share

Growth Metrics

Revenue Forecast

Forecast Analysis

Revenue Share

Growth Metrics

Revenue Forecast

Forecast Analysis

Revenue Share

Growth Metrics

Revenue Forecast

Forecast Analysis

Revenue Share

Future of CSPM

Future of CSPM (continued)

Future of CSPM (continued)

CSPM Industry: CISOs' Concerns

CSPM Industry: CISOs' Concerns (continued)

CSPM Industry: CISOs' Concerns (continued)

Evaluating CSPM: Insights and Recommendations

Growth Opportunity 1: Increasing Requirements for Code-to-cloud Intelligence Drives Full-stack Cloud Security

Growth Opportunity 1: Increasing Requirements for Code-to-cloud Intelligence Drives Full-stack Cloud Security (continued)

Growth Opportunity 2: Strong Demand for Integrating CSPM with AI Security

Growth Opportunity 2: Strong Demand for Integrating CSPM with AI Security (continued)

Growth Opportunity 3: Increasing Need for Consolidated Vulnerability & Patch Management and TDR

Growth Opportunity 3: Increasing Need for Consolidated Vulnerability & Patch Management and TDR (continued)

Best Practices Recognition

Frost Radar

Benefits and Impacts of Growth Opportunities

Next Steps

Take the Next Step

List of Exhibits

Legal Disclaimer

- CSPM: Growth Metrics, Global, 2023

- CSPM: Growth Drivers, Global, 2024–2028

- CSPM: Growth Restraints, Global, 2024–2028

- CSPM: Revenue Forecast, Global, 2022–2028

- CSPM: Revenue Forecast by Region, Global, 2022–2028

- CSPM: Revenue Share of Primary Vendors, Global, 2023

- CSPM: Growth Metrics, NA, 2023

- CSPM: Revenue Forecast, NA, 2022–2028

- CSPM: Revenue Share of Primary Vendors, NA, 2023

- CSPM: Growth Metrics, EMEA, 2023

- CSPM: Revenue Forecast, EMEA, 2022–2028

- CSPM: Revenue Share of Primary Vendors, EMEA, 2023

- CSPM: Growth Metrics, APAC, 2023

- CSPM: Revenue Forecast, APAC, 2022–2028

- CSPM: Revenue Share of Primary Vendors, APAC, 2023

- CSPM: Growth Metrics, LATAM, 2023

- CSPM: Revenue Forecast, LATAM, 2022–2028

- CSPM: Revenue Share of Primary Vendors, LATAM, 2023

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| Author | Anh Tien Vu |

| Industries | Aerospace, Defence and Security |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | Cloud Security Posture Growth |

| Keyword 2 | Global Cloud Security |

| Keyword 3 | CSPM Opportunities |

| List of Charts and Figures | CSPM: Growth Metrics, Global, 2023~ CSPM: Growth Drivers, Global, 2024–2028~ CSPM: Growth Restraints, Global, 2024–2028~ CSPM: Revenue Forecast, Global, 2022–2028~ CSPM: Revenue Forecast by Region, Global, 2022–2028~ CSPM: Revenue Share of Primary Vendors, Global, 2023~ CSPM: Growth Metrics, NA, 2023~ CSPM: Revenue Forecast, NA, 2022–2028~ CSPM: Revenue Share of Primary Vendors, NA, 2023~ CSPM: Growth Metrics, EMEA, 2023~ CSPM: Revenue Forecast, EMEA, 2022–2028~ CSPM: Revenue Share of Primary Vendors, EMEA, 2023~ CSPM: Growth Metrics, APAC, 2023~ CSPM: Revenue Forecast, APAC, 2022–2028~ CSPM: Revenue Share of Primary Vendors, APAC, 2023~ CSPM: Growth Metrics, LATAM, 2023~ CSPM: Revenue Forecast, LATAM, 2022–2028~ CSPM: Revenue Share of Primary Vendors, LATAM, 2023~ |

| Podcast | No |

| WIP Number | PFE6-01-00-00-00 |