Growth Opportunities in the APAC Fintech Market

Growth Opportunities in the APAC Fintech Market

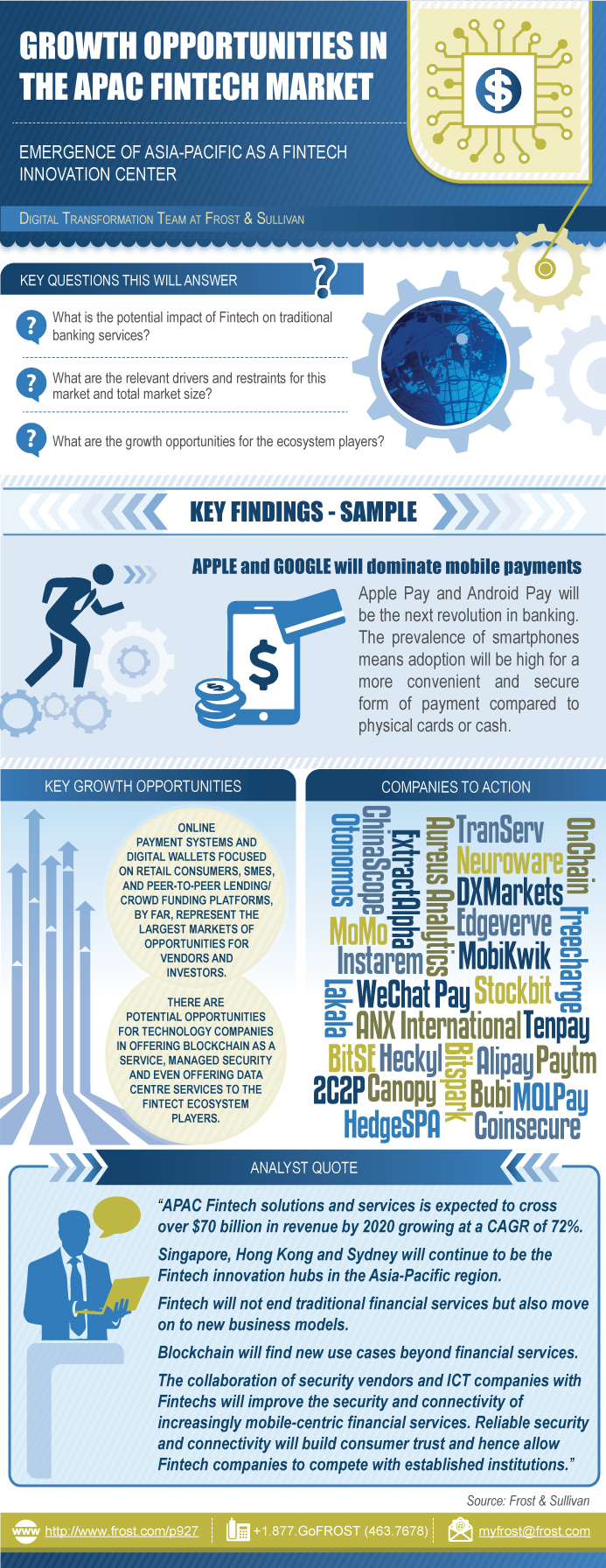

Emergence of Asia-Pacific as a Fintech Innovation Center

RELEASE DATE

27-Oct-2016

27-Oct-2016

REGION

Asia Pacific

Asia Pacific

Deliverable Type

Market Research

Market Research

Research Code: P927-01-00-00-00

SKU: IT03274-AP-MR_19828

$4,950.00

In stock

SKU

IT03274-AP-MR_19828

This research service explores the financial technology (fintech) market in Asia-Pacific and the potential impact on traditional banking services, with the advent of disruptive technologies such as Blockchain. For the purpose of this study, fintech is categorized into Digital Payments, Personal & Business Finance, and Financial Infrastructure & Data Analysis. The study defines the key stakeholders in the fintech ecosystem and provides detailed industry and investment analysis along with market forecasts, drivers, and restraints. Also included are insights into growth opportunities for the ecosystem participants and profiles of key companies operating in this space.

Introduction and Special Thanks

Key Findings—APAC Fintech 2016–2020

Key Findings—APAC Fintech 2016–2020 (continued)

APAC Fintech to Take Away More Than $15 Billion from Traditional Financial Services by 2020

VC-backed Fintech Investment within APAC Reached about $4.6 Billion in 2015

Key Investors and Deals in APAC—China

Key Investors and Deals in APAC—India

Key Investors and Deals in APAC—Southeast Asia (SEA)

Mobile Payments to Take Off in 12–18 Months

Wealth Management Fintech Solutions to Grow Strongly

Digital Ecosystems Key to Fintech and Traditional Bank Success

Blockchain to Fundamentally Change Financial Services and Find New Use Cases

Companies Profiled in this Study

The Next Generation of Disruption is in Financial Services

The Next Generation of Disruption is in Financial Services (continued)

Research Scope and Market Segments

Definitions and Methodology

Market Offering by Segment

Business Models in the Fintech Industry

Fintech Ecosystem

Global Fintech Environment

Global Fintech Environment (continued)

Global Fintech Dispersion

APAC Fintech Investments

APAC Fintech Environment

APAC Innovation Hubs

APAC Fintech Forecast

Digital Payments Segment Forecast

Personal and Business Finance Segment Forecast

Financial Infrastructure and Data Analysis Segment Forecast

APAC Forecast Conclusions

Digital Wallets—Overview

Digital Wallets—Mobile Payment Systems

Mobile Payments

Mobile Payments—Apple Pay Analyzed

Mobile Payments—Android Pay Analyzed

Apple and Google can Threaten PayPal

Challenges for Digital Wallets in Asia-Pacific

Mobile Payments Summary

Cryptocurrencies

Cryptocurrencies and Volatility

Growth Drivers and Inhibitors for Cryptocurrencies

Cryptocurrencies and the New Payments Platform (NPP)

Bitcoin—Most Popular Cryptocurrency

Cryptocurrency Summary

FX and Remittance—Overview

FX and Remittance—APAC Trends

Bitcoin as a Remittance Platform

Drivers

Drivers Explained

Restraints

Restraints Explained

Digital Payments—APAC Landscape

Digital Payment Services Provider Landscape

APAC Company Snapshot

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

Top Predictions

What is Algo-Banking?

Micro-Investing Offers Low-cost Model for Digital Natives

Self-learning AI is the Analytics Product for the Future of Financial Services

AI Hardware Architecture is the Foundation for Customized AI Software

Hypothetical Digital Banking Ecosystem

Drivers

Drivers Explained

Restraints

Restraints Explained

APAC Company Snapshot

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

Blockchain—Unexpected Disruption

Blockchain—How Does it Work?

Collaboration for Blockchain is International

Blockchain-as-a-Service

Drivers

Drivers Explained

Restraints

Restraints Explained

Data Analysis in Fintech

Financial Data Analysis Technology Requirements

Drivers

Drivers Explained

Restraints

Restraints Explained

Financial Infrastructure and Data Analysis Service Provider Landscape

APAC Company Snapshot

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

APAC Company Snapshot (continued)

Regulatory Framework Across APAC Fintech Hubs

Regulation—India

Regulation—Singapore

Regulation—Singapore (continued)

Regulation—China

Growth Opportunity 1—Disruption and Collaboration

Growth Opportunity 2—Connected Communities

Growth Opportunity 3—Foreign Exchange (FX) and Remittance

Growth Opportunity 4—Organic/Inorganic Growth

Growth Opportunity 5—Untapped Market Opportunities

Growth Opportunity 6—Industry Collaboration

Growth Opportunity 7—Big Data Analytics Capabilities

TranServ Pvt. Ltd.

Coinsecure

Paytm

MobiKwik

Alipay

Instarem

Tenpay

2C2P

MOLPay

Freecharge

Lakala

Bitspark

WeChat Pay

MoMo

Aureus Analytics

Otonomos BCC Pte. Ltd.

Neuroware

BitSE

DXMarkets

Stockbit

Bubi.cn

Edgeverve

Canopy

ChinaScope Financial

Heckyl

ANX International

OnChain

ExtractAlpha

HedgeSPA

Lessons for APAC Fintech from the Global Industry

Legal Disclaimer

Market Engineering Methodology

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

This research service explores the financial technology (fintech) market in Asia-Pacific and the potential impact on traditional banking services, with the advent of disruptive technologies such as Blockchain. For the purpose of this study, fintech is categorized into Digital Payments, Personal & Business Finance, and Financial Infrastructure & Data Analysis. The study defines the key stakeholders in the fintech ecosystem and provides detailed industry and investment analysis along with market forecasts, drivers, and restraints. Also included are insights into growth opportunities for the ecosystem participants and profiles of key companies operating in this space.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Ayush Kachru |

| Industries | Information Technology |

| WIP Number | P927-01-00-00-00 |

| Is Prebook | No |