Strategic Analysis of the Canadian Automotive Aftermarket, Forecast to 2025

Strategic Analysis of the Canadian Automotive Aftermarket, Forecast to 2025

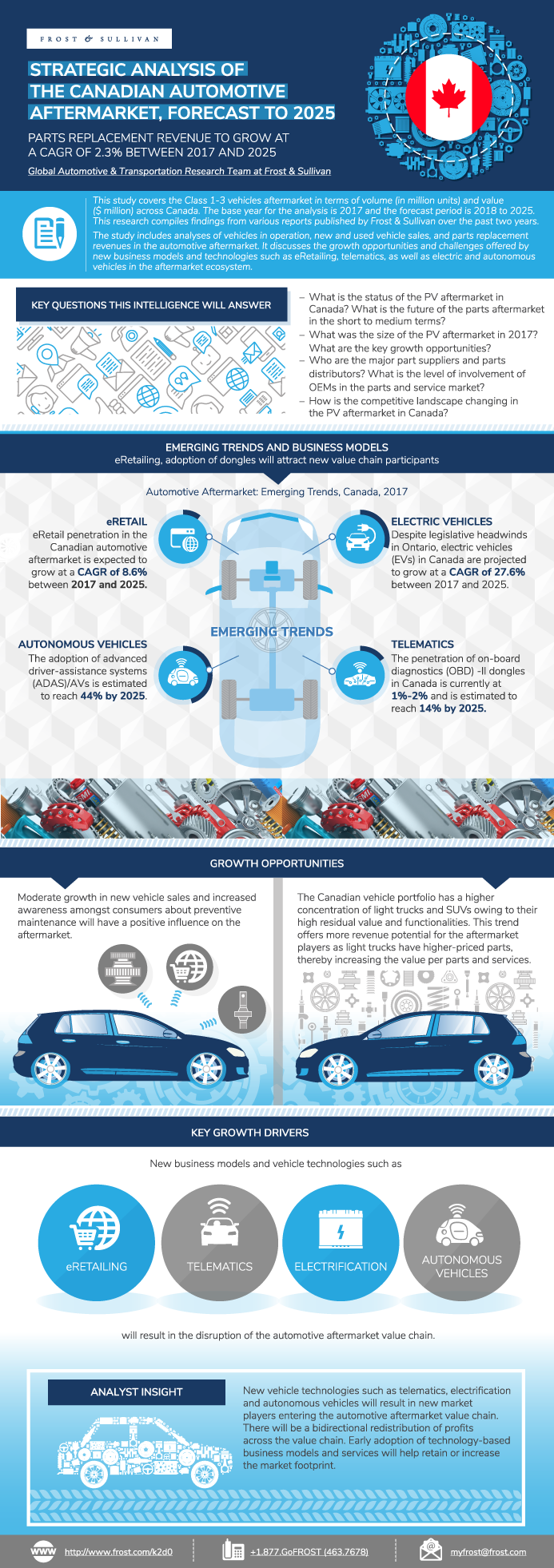

Parts Replacement Revenue to Grow at a CAGR of 2.3% between 2017 and 2025

26-Dec-2018

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

This study covers the Class 1-3 vehicles aftermarket in terms of volume (in million units) and value ($ million) across Canada. The base year for the analysis is 2017 and the forecast period is 2018 to 2025. This research compiles findings from various reports published by Frost & Sullivan over the past two years.

The study includes analyses of vehicles in operation, new and used vehicle sales, and parts replacement revenues in the automotive aftermarket. It discusses the growth opportunities and challenges offered by new business models and technologies such as eRetailing, telematics, as well as electric and autonomous vehicles in the aftermarket ecosystem. It also includes profiling of major aftermarket players such as Uni-select, Wakefield, Vast-Auto Distribution Ltée, Lordco Parts, UAP, Inc. (NAPA Canada), WORLDPAC, Spectra Premium, MAS Automotive Distribution, Mevotech, Gates Canada, and other establishments.

The Canadian vehicle portfolio has a greater concentration of light trucks and SUVs owing to their high residual value and functionalities. This trend offers more revenue potential for the aftermarket players, as light trucks have higher priced parts, which increases the value per parts and services. Moderate economic growth, inflation, and higher interest rates are expected to dampen the growth of new car sales to less than 1% CAGR till 2025. The used vehicle sales, however, are expected to rise steadily during the forecast period. The share of 4-7 year old vehicles is likely to remain stable. The large population of out-of-warranty vehicles, fueled by the growth of used vehicle sales, boosts the revenue-generation opportunities for the independent aftermarket (IAM). Early adoption of technology-based business models and services such as eRetailing, service aggregations, and telematics-based prognostics will help increase the market share of aftermarket participants. The eRetail channel for automotive parts and services in the Canadian aftermarket is expected to grow at a CAGR of 8.6% during 2017-2025. The growth is due to the strong penetration of Internet/smartphone usage and online discounts.

Research Scope

This study's objectives are to:

- Estimate the total market opportunity based on a top-down analysis of vehicles in operation, replacement rates, and available pricing data.

- Identify the top automotive parts distributors and service providers in the Canadian automotive aftermarket.

- Provide insights into new business models and vehicle technologies and how it could disrupt the Canadian automotive aftermarket value chain.

- Identify the growth opportunities and challenges that exist within the Canadian automotive aftermarket and how it would impact market participants.

Key Issues Addressed

- What is the short- to medium-term outlook for the Canadian automotive aftermarket?

- What is the structure of the Canadian automotive aftermarket? Who are the key industry participants?

- Which products and services will offer the highest future growth opportunities?

- How is the competitive landscape changing?

- What are the impacts of Mega Trends such as eRetailing, electric vehicles, telematics, and ADAS/autonomous vehicles on the Canadian aftermarket? How is it going to affect the market participants?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Takeaways

Emerging Trends and Business Models

Parts Replacement Revenue

Key Findings and Future Outlook

Research Scope and Definitions

Research Aim and Objectives

Research Background

Research Methodology

Product/System Segmentation

Market Definitions

Vehicle Segmentation

Distribution Channel Structure

Canadian Demographic Highlights

Overall Canadian Economy

Average Annual Kilometers Travelled

Automotive Repair and Service Centers

Automotive Repair and Service Technicians

New Vehicle Sales Analysis and Outlook

Total Vehicles in Operation

Vehicle in Operation Analysis—Key Takeaways

Vehicle in Operation by Age

Vehicle in Operation by Age—Opportunity Analysis

Vehicle in Operation by Brand

Fleet Vehicle Sales

Fleet Vehicle Segment—Opportunity Analysis

Parts Replacement Revenue Forecast

Percentage of Revenue by Distribution Channel

Value Channel Analysis

eRetailing—Overview

eRetailing—Key Influencers

Comparative Benchmarking of Key eRetailers—Web Traffic

OEM Aftersales Transition

Customer Service Strategies for Aftersales 2.0

eCommerce—BMW Direct eStore

IAM Parts—Ford’s Omnicraft

New Service Models—Ford’s Quick Lane

Digital Engagement—Chevrolet Owner Center

Connected Repair—GM OnStar

OBD and Embedded Telematics Systems

Canadian Embedded Telematics—Unit Shipment Forecast

Canadian OBDII Telematics—Unit Shipment Forecast

Impact of Telematics on the Aftermarket—Key Takeaways

Geotab, Inc.

Fleet Complete

Mojio, Inc.

Pitstop

Electric Vehicles—New Vehicle Sales

Key Demand Drivers in EV/PHEV Adoption

Parts Overview and Expected Trend—EV vs ICV

Emerging Services in the EV/PHEV Eco Systems

Automation Levels—Society of Automotive Engineers (SAE) Definitions

Autonomous Vehicles and Impact on VIO

Impact of ADAS/Autonomous Vehicles on the Aftermarket

Growth Opportunity—Invest in New-age Diagnostic Equipment and Up-skill Service Professionals

Strategic Imperatives for Success

Key Conclusions and Future Outlook

The Last Word—3 Big Predictions

Legal Disclaimer

Company Profile—Uni-Select, Inc.

Uni-Select—Key Business Model

Automotive Highlights—Uni-Select, Inc.

Wakefield Canada, Inc.

Vast-Auto Distribution Ltée

Lordco Parts Ltd.

UAP, Inc. (NAPA Canada)

WORLDPAC, Inc.

Carquest Corporation

Automotive Highlights—Canadian Tire Group

Canadian Tire Subsidiaries and Auto Segment

Automotive Business Review

Market Engineering Methodology

Spectra Premium Industries, Inc.

MAS Automotive Distribution, Inc.

Mevotech, Inc.

Gates Canada, Inc.

Company Overview—Amazon

Automotive Business Strategy—Amazon

Company Overview—eBay

Business Strategy—Fee Structure for Sellers

Business Strategy—eBay

Impact of Service Aggregators

List of Exhibits

- 1. Automotive Aftermarket: Current and Future Outlook, Canada, 2017 and 2025

- 2. Automotive Aftermarket: Vehicle Segmentations, Canada, 2017

- 3. Automotive Aftermarket: Parts Replacement Revenue Forecast, Canada, 2017–2025

- 4. Automotive Aftermarket: Competitive Benchmarking, Canada, 2018

- 5. Automotive Aftermarket: Telematics Systems, Canada, 2017

- 6. Automotive Aftermarket: Automotive Business Strategy, Canada, 2017

- 7. Automotive Aftermarket: eBay Seller Plans, Canada, 2017

- 1. Automotive Aftermarket: Key Takeaway, Canada, 2017

- 2. Automotive Aftermarket: Emerging Trends, Canada, 2017

- 3. Automotive Aftermarket: Parts Replacement Revenue, Canada, 2017

- 4. Automotive Aftermarket: Market Definitions, Canada, 2017

- 5. Automotive Aftermarket: Distribution Channel Structure, Canada, 2017

- 6. Automotive Aftermarket: Overview – Demographic Highlights, Canada, 2017

- 7. Automotive Aftermarket: Economic Overview, Canada, 2017

- 8. Automotive Aftermarket: Average Annual Kilometers Travelled Forecast, Canada, 2015–2025

- 9. Automotive Aftermarket: Number of Automotive Repair and Service Centers Forecast, Canada, 2015–2025

- 10. Automotive Aftermarket: Number of Automotive Repair and Service Technicians Forecast, Canada, 2015–2025

- 11. Automotive Aftermarket: New Vehicle Sales Forecast, Canada, 2015–2025

- 12. Automotive Aftermarket: Vehicle In Operation Forecast, Canada, 2015–2025

- 13. Automotive Aftermarket: Vehicle In Operation, Canada, 2017–2025

- 14. Automotive Aftermarket: Percent VIO Forecast by Age, Canada, 2017 and 2025

- 15. Automotive Aftermarket: VIO by Age, Canada, 2017–2025

- 16. Automotive Aftermarket: Percent VIO Forecast by Brand, Canada, 2017 and 2025

- 17. Automotive Aftermarket: Fleet Vehicle Sales Forecast, Canada, 2015–2025

- 18. Automotive Aftermarket: Fleet Vehicle Sales, Canada, 2017–2025

- 19. Automotive Aftermarket: Revenue by Distribution Channel, Canada, 2017

- 20. Automotive Aftermarket: eRetailing Revenue Forecast, Canada, 2015–2025

- 21. Automotive Parts and Services eRetailing Market: Percent Revenue by Component Split, Canada, 2017

- 22. Automotive Aftermarket: eRetailing – Key Influencers, Canada, 2017

- 23. Automotive Aftermarket: OEM Aftersales Management, Canada, 2017–2025

- 24. Automotive Aftermarket: Aftersales 2.0 Pillars, Canada, 2017–2025

- 25. Automotive Aftermarket: Embedded Telematics Unit Shipment Forecast, Canada, 2015–2025

- 26. Automotive Aftermarket: OBD Telematics – Unit Shipment Forecast, Canada, 2015–2025

- 27. Automotive Aftermarket: Impact of Telematics, Canada, 2017–2025

- 28. Automotive Aftermarket: Company Profile – Geotab, Canada, 2017–2025

- 29. Automotive Aftermarket: Company Profile – Fleet Complete, Canada, 2017–2025

- 30. Automotive Aftermarket: Company Profile – Mojio, Canada, 2017–2025

- 31. Automotive Aftermarket: Company Profile – Pitstop, Canada, 2017–2025

- 32. Automotive Aftermarket: Electric Vehicle Sales and VIO Forecast, Canada, 2015–2025

- 33. Automotive Aftermarket: Key Demand Drivers, EV/PHEV, Canada, 2017–2025

- 34. Automotive Aftermarket: Parts Overview, EV versus ICV, Canada, 2017–2025

- 35. Automotive Aftermarket: Emerging Service in the EV Ecosystem, Canada, 2017–2025

- 36. Automotive Aftermarket: Levels to Automation, Canada, 2017–2025

- 37. Automotive Aftermarket: Penetration Forecast of Autonomous Vehicles in VIO, Canada, 2015–2025

- 38. Automotive Aftermarket: Impact of Telematics, Canada, 2017–2025

- 39. Automotive Aftermarket: Key Conclusion and Future Outlook, Canada, 2017–2025

- 40. Automotive Aftermarket: Company Profile – Uni-Select, Canada, 2017–2025

- 41. Automotive Aftermarket: Uni-Select – Key Business Model, Canada, 2017–2025

- 42. Automotive Aftermarket: Company Profile – Wakefield, Canada, 2017–2025

- 43. Automotive Aftermarket: Company Profile – Vast-Auto, Canada, 2017–2025

- 44. Automotive Aftermarket: Company Profile – Lordco, Canada, 2017–2025

- 45. Automotive Aftermarket: Company Profile – UAP, Canada, 2017–2025

- 46. Automotive Aftermarket: Company Profile – Worldpac, Canada, 2017–2025

- 47. Automotive Aftermarket: Company Profile – Carquest, Canada, 2017–2025

- 48. Automotive Aftermarket: Company Profile – Spectra Premium, Canada, 2017–2025

- 49. Automotive Aftermarket: Company Profile – Mas Automotive, Canada, 2017–2025

- 50. Automotive Aftermarket: Company Profile – Mevotech, Canada, 2017–2025

- 51. Automotive Aftermarket: Company Profile – Gates, Canada, 2017–2025

- 52. Automotive Aftermarket: Company Overview – Amazon, Canada, 2017–2025

- 53. Automotive Aftermarket: Company Profile – eBay, Canada, 2017–2025

- 54. Automotive Aftermarket: Business Strategy – eBay, Canada, 2017–2025

- 55. Automotive Aftermarket: Fleet Vehicle Sales, Canada, 2017–2025

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Takeaways~ || Emerging Trends and Business Models~ || Parts Replacement Revenue~ || Key Findings and Future Outlook~ | Research Scope, Definitions, and Vehicle Segmentation~ || Research Scope and Definitions~ | Research Objectives, Background, and Methodology~ || Research Aim and Objectives~ || Research Background~ || Research Methodology~ | Definitions and Segmentation~ || Product/System Segmentation~ || Market Definitions~ || Vehicle Segmentation~ || Distribution Channel Structure~ | Market Overview~ || Canadian Demographic Highlights~ || Overall Canadian Economy~ || Average Annual Kilometers Travelled~ || Automotive Repair and Service Centers~ || Automotive Repair and Service Technicians~ | Aftermarket—Demand Analysis~ || New Vehicle Sales Analysis and Outlook~ || Total Vehicles in Operation~ || Vehicle in Operation Analysis—Key Takeaways~ || Vehicle in Operation by Age~ || Vehicle in Operation by Age—Opportunity Analysis~ || Vehicle in Operation by Brand~ || Fleet Vehicle Sales~ || Fleet Vehicle Segment—Opportunity Analysis~ || Parts Replacement Revenue Forecast~ | Distribution Channel Analysis~ || Percentage of Revenue by Distribution Channel~ || Value Channel Analysis~ | Automotive Trends—eRetailing~ || eRetailing—Overview~ || eRetailing—Key Influencers~ || Comparative Benchmarking of Key eRetailers—Web Traffic~ | Automotive Trends—OES Aftersales 2.0~ || OEM Aftersales Transition~ || Customer Service Strategies for Aftersales 2.0~ || eCommerce—BMW Direct eStore~ || IAM Parts—Ford’s Omnicraft~ || New Service Models—Ford’s Quick Lane~ || Digital Engagement—Chevrolet Owner Center~ || Connected Repair—GM OnStar~ | Automotive Trends—Telematics~ || OBD and Embedded Telematics Systems~ || Canadian Embedded Telematics—Unit Shipment Forecast~ || Canadian OBDII Telematics—Unit Shipment Forecast~ || Impact of Telematics on the Aftermarket—Key Takeaways~ | Aftermarket Telematics Service Providers/Data Platform Profiles~ || Geotab, Inc.~ || Fleet Complete~ || Mojio, Inc.~ || Pitstop~ | Automotive Trends—Electric Vehicles~ || Electric Vehicles—New Vehicle Sales~ || Key Demand Drivers in EV/PHEV Adoption~ || Parts Overview and Expected Trend—EV vs ICV~ || Emerging Services in the EV/PHEV Eco Systems~ | Automotive Mega Trends—Autonomous Vehicles~ || Automation Levels—Society of Automotive Engineers (SAE) Definitions~ || Autonomous Vehicles and Impact on VIO~ || Impact of ADAS/Autonomous Vehicles on the Aftermarket~ | Growth Opportunities and Companies to Action~ || Growth Opportunity—Invest in New-age Diagnostic Equipment and Up-skill Service Professionals~ || Strategic Imperatives for Success~ | Conclusion and Future Outlook~ || Key Conclusions and Future Outlook~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix—Key Distributors/Retailer Profiles~ || Company Profile—Uni-Select, Inc.~ || Uni-Select—Key Business Model~ || Automotive Highlights—Uni-Select, Inc.~ || Wakefield Canada, Inc.~ || Vast-Auto Distribution Ltée~ || Lordco Parts Ltd.~ || UAP, Inc. (NAPA Canada)~ || WORLDPAC, Inc.~ || Carquest Corporation~ || Automotive Highlights—Canadian Tire Group~ || Canadian Tire Subsidiaries and Auto Segment~ || Automotive Business Review~ || Market Engineering Methodology~ | Key Supplier Profiles~ || Spectra Premium Industries, Inc.~ || MAS Automotive Distribution, Inc.~ || Mevotech, Inc.~ || Gates Canada, Inc.~ | Amazon~ || Company Overview—Amazon~ || Automotive Business Strategy—Amazon~ | eBay~ || Company Overview—eBay~ || Business Strategy—Fee Structure for Sellers~ || Business Strategy—eBay~ || Impact of Service Aggregators~ || List of Exhibits~ |

| List of Charts and Figures | 1. Automotive Aftermarket: Current and Future Outlook, Canada, 2017 and 2025~ 2. Automotive Aftermarket: Vehicle Segmentations, Canada, 2017~ 3. Automotive Aftermarket: Parts Replacement Revenue Forecast, Canada, 2017–2025~ 4. Automotive Aftermarket: Competitive Benchmarking, Canada, 2018~ 5. Automotive Aftermarket: Telematics Systems, Canada, 2017~ 6. Automotive Aftermarket: Automotive Business Strategy, Canada, 2017~ 7. Automotive Aftermarket: eBay Seller Plans, Canada, 2017~| 1. Automotive Aftermarket: Key Takeaway, Canada, 2017~ 2. Automotive Aftermarket: Emerging Trends, Canada, 2017~ 3. Automotive Aftermarket: Parts Replacement Revenue, Canada, 2017~ 4. Automotive Aftermarket: Market Definitions, Canada, 2017~ 5. Automotive Aftermarket: Distribution Channel Structure, Canada, 2017~ 6. Automotive Aftermarket: Overview – Demographic Highlights, Canada, 2017~ 7. Automotive Aftermarket: Economic Overview, Canada, 2017~ 8. Automotive Aftermarket: Average Annual Kilometers Travelled Forecast, Canada, 2015–2025~ 9. Automotive Aftermarket: Number of Automotive Repair and Service Centers Forecast, Canada, 2015–2025~ 10. Automotive Aftermarket: Number of Automotive Repair and Service Technicians Forecast, Canada, 2015–2025~ 11. Automotive Aftermarket: New Vehicle Sales Forecast, Canada, 2015–2025~ 12. Automotive Aftermarket: Vehicle In Operation Forecast, Canada, 2015–2025~ 13. Automotive Aftermarket: Vehicle In Operation, Canada, 2017–2025~ 14. Automotive Aftermarket: Percent VIO Forecast by Age, Canada, 2017 and 2025~ 15. Automotive Aftermarket: VIO by Age, Canada, 2017–2025~ 16. Automotive Aftermarket: Percent VIO Forecast by Brand, Canada, 2017 and 2025~ 17. Automotive Aftermarket: Fleet Vehicle Sales Forecast, Canada, 2015–2025~ 18. Automotive Aftermarket: Fleet Vehicle Sales, Canada, 2017–2025~ 19. Automotive Aftermarket: Revenue by Distribution Channel, Canada, 2017 ~ 20. Automotive Aftermarket: eRetailing Revenue Forecast, Canada, 2015–2025~ 21. Automotive Parts and Services eRetailing Market: Percent Revenue by Component Split, Canada, 2017~ 22. Automotive Aftermarket: eRetailing – Key Influencers, Canada, 2017~ 23. Automotive Aftermarket: OEM Aftersales Management, Canada, 2017–2025~ 24. Automotive Aftermarket: Aftersales 2.0 Pillars, Canada, 2017–2025~ 25. Automotive Aftermarket: Embedded Telematics Unit Shipment Forecast, Canada, 2015–2025 ~ 26. Automotive Aftermarket: OBD Telematics – Unit Shipment Forecast, Canada, 2015–2025 ~ 27. Automotive Aftermarket: Impact of Telematics, Canada, 2017–2025~ 28. Automotive Aftermarket: Company Profile – Geotab, Canada, 2017–2025~ 29. Automotive Aftermarket: Company Profile – Fleet Complete, Canada, 2017–2025~ 30. Automotive Aftermarket: Company Profile – Mojio, Canada, 2017–2025~ 31. Automotive Aftermarket: Company Profile – Pitstop, Canada, 2017–2025~ 32. Automotive Aftermarket: Electric Vehicle Sales and VIO Forecast, Canada, 2015–2025~ 33. Automotive Aftermarket: Key Demand Drivers, EV/PHEV, Canada, 2017–2025~ 34. Automotive Aftermarket: Parts Overview, EV versus ICV, Canada, 2017–2025~ 35. Automotive Aftermarket: Emerging Service in the EV Ecosystem, Canada, 2017–2025~ 36. Automotive Aftermarket: Levels to Automation, Canada, 2017–2025~ 37. Automotive Aftermarket: Penetration Forecast of Autonomous Vehicles in VIO, Canada, 2015–2025~ 38. Automotive Aftermarket: Impact of Telematics, Canada, 2017–2025~ 39. Automotive Aftermarket: Key Conclusion and Future Outlook, Canada, 2017–2025~ 40. Automotive Aftermarket: Company Profile – Uni-Select, Canada, 2017–2025~ 41. Automotive Aftermarket: Uni-Select – Key Business Model, Canada, 2017–2025~ 42. Automotive Aftermarket: Company Profile – Wakefield, Canada, 2017–2025~ 43. Automotive Aftermarket: Company Profile – Vast-Auto, Canada, 2017–2025~ 44. Automotive Aftermarket: Company Profile – Lordco, Canada, 2017–2025~ 45. Automotive Aftermarket: Company Profile – UAP, Canada, 2017–2025~ 46. Automotive Aftermarket: Company Profile – Worldpac, Canada, 2017–2025~ 47. Automotive Aftermarket: Company Profile – Carquest, Canada, 2017–2025~ 48. Automotive Aftermarket: Company Profile – Spectra Premium, Canada, 2017–2025~ 49. Automotive Aftermarket: Company Profile – Mas Automotive, Canada, 2017–2025~ 50. Automotive Aftermarket: Company Profile – Mevotech, Canada, 2017–2025~ 51. Automotive Aftermarket: Company Profile – Gates, Canada, 2017–2025~ 52. Automotive Aftermarket: Company Overview – Amazon, Canada, 2017–2025~ 53. Automotive Aftermarket: Company Profile – eBay, Canada, 2017–2025~ 54. Automotive Aftermarket: Business Strategy – eBay, Canada, 2017–2025~ 55. Automotive Aftermarket: Fleet Vehicle Sales, Canada, 2017–2025~ |

| Author | Sandeep Iruppam Veedu |

| Industries | Automotive |

| WIP Number | K2D0-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9801-A6,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB