Global Automotive Cybersecurity Market, Forecast to 2025

Global Automotive Cybersecurity Market, Forecast to 2025

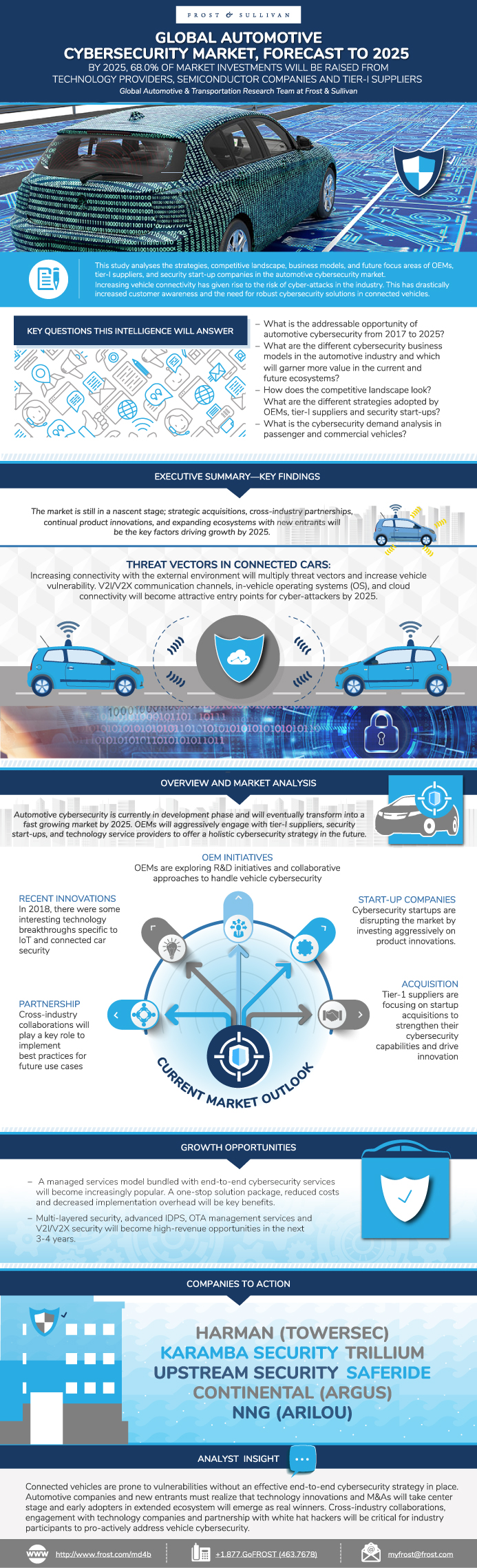

By 2025, 68.0% of Market Investments Will be Raised from Technology Providers, Semiconductor Companies and Tier-I Suppliers

12-Sep-2018

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

This study analyses the strategies, competitive landscape, business models, and future focus areas of OEMs, tier-I suppliers, and security start-up companies in the automotive cybersecurity market.

Increasing vehicle connectivity has given rise to the risks of potential cyber-attacks in the industry. This has drastically increased customer awareness and need for robust cybersecurity solutions in connected vehicles. OEMs have started taking the cybersecurity issue seriously and are evaluating ways to ensure the deployment of strategic security measures across the automotive value chain. Partnerships and collaborations are playing a vital role for OEMs, as they lack the necessary capabilities within the organisation. Companies such as Groupe PSA, Jaguar, and BMW are proactively identifying ways to ensure strong security mechanisms in their next-generation connected vehicles through partnerships and ethical hacking programs.

The automotive cybersecurity market is nascent and is currently in its experimental phase. Connected cars are the primary use cases of automotive cybersecurity. Cybersecurity-embedded cars are already in production and about 60% of connected cars are expected to have built-in security solutions by 2025. Though connected cars will be early adopters, Frost & Sullivan expects autonomous vehicles and connected trucks to become critical use cases for automotive cybersecurity in the future. Hence, it is necessary for OEMs to gear up security adoption in connected trucks, as cyber attacks in this segment tend to be massive and extremely harmful for organisations.

With the growing need for security in connected vehicles, industry participants (tier-I suppliers, technology providers, semiconductor companies, and security start-up companies) are expected to increase market investments to $2.7 billion till 2025. Automotive cybersecurity will remain a key concern in the coming years and OEMs have to aggressively engage and partner with ecosystem participants to ensure a holistic cybersecurity approach across the automotive value chain. Tier-I suppliers will continue with the trend of start-up acquisition strategy in order to maintain a competitive advantage in the market. Pure-play security start-up companies will intensify market competition through OEM partnerships and continuous product innovations.

Key Issues Addressed

- What are the different business models adopted for vehicle cybersecurity and which one will garner value in the current and future ecosystem?

- How does the competitive landscape look like? What are the different strategies adopted by OEMs, tier-I suppliers, and security startups?

- What is the addressable opportunity for automotive cybersecurity from 2017 to 2025?

- How is the cybersecurity demand in passenger and commercial vehicles?

- What is the impsact of regional regulations on the market?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

2017 Highlights—Predictions Versus Actuals

Executive Summary—Key Findings

Trend 1—Threat Vectors in Connected Cars Analysis

Trend 2—Automotive Cybersecurity Features Analysis

Trend 3—Connected Cars Vs. Connected Trucks Cybersecurity Analysis

Trend 4—Mergers and Acquisitions of Key Market Participants

Trend 5—Innovation Will be Key for Cybersecurity Start-ups

Trend 6—OEMs are Transitioning to Ethernet Networks

Executive Summary—Comparison of 2017 and 2025

Research Scope

Research Aims and Objectives

Research Background

Research Methodology

Automotive Cybersecurity Current Market Outlook

Cybersecurity Emerging From the Shadows at CES 2018

Key Cybersecurity Features—2017 Overview

Automotive Cybersecurity Ecosystem

OEM Strategies and Key Focus Areas

Automotive Ecosystem Participants—Strategy Analysis

Automotive Ecosystem Participants—Strategies and Analysis

Automotive Cybersecurity Start-up Companies

OEM Ethernet Adoption for IVN

Connected Cars—Market Demand Analysis

Connected Cars (CC)—Cybersecurity Analysis

Acquisition Analysis—Investments and Future Opportunities

Automotive Cybersecurity Market Opportunity

Global Connected Trucks—Market Demand Analysis

Connected Trucks—Cybersecurity Analysis

Automotive Cybersecurity—Business Model Analysis

Automotive Cybersecurity—Key Challenges

Automotive Cybersecurity Regulations—Roadmap

Regional Regulations and Impact—US

Regional Regulations and Impact—Europe

Automotive Cyber Hacking Incidents—Highlights

Ethical Hacking—BMW’s Partnership With Keen Lab

Overview of RNA Hack Incidents and Data Security

VW Group Vehicle Hack Incident and Security Initiatives

BMW ConnectedDrive Hacking Incident

Overview of BMW Data Security

GM Security Capability

Mercedes-Benz Connectivity Services—Data Protection and IT Security

Overview of Toyota Data Security

Arilou Cyber Security (Part of NNG Group) Solutions

NNG’s Navigation and Infotainment Solutions with Enhanced Security

Arilou Software IDPS Line Fit Solution

Argus Cyber Security

Continental AG’s End-to-End Solution

Harman Cybersecurity (TowerSec)

Trillium Incorporated

Karamba Security

GuardKnox

SafeRide Technologies Ltd.

CYMOTIVE

Upstream Security

Bosch Cybersecurity

Renesas Security Solutions

Irdeto (Part of Naspers)

Irdeto’s Cybersecurity Roadmap

Panasonic Cybersecurity

Automotive Cybersecurity Companies

Growth Opportunity—Partnerships and Business Models

Strategic Imperatives for Success and Growth—Automotive Cybersecurity

Key Conclusions and Future Outlook

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Table of Acronyms Used

List of Exhibits

- 1. Automotive Cybersecurity Market: Key Findings, Global, 2017–2025

- 2. Automotive Cybersecurity Market: Threat Vector Analysis, Global, 2017

- 3. Automotive Cybersecurity Market: Features Analysis, Global, 2017–2025

- 4. Automotive Cybersecurity Market: Connected Cars Versus Connected Trucks Analysis, Global, 2017–2025

- 5. Automotive Cybersecurity Market: Mergers and Acquisitions, Global, 2016–2018

- 6. Automotive Cybersecurity Market: Current Versus Future, Global, 2017 and 2025

- 7. Automotive Cybersecurity Market: Key Participants, Global, 2018

- 8. Automotive Cybersecurity Market: Key Cybersecurity Features, Global, 2017

- 9. Automotive Cybersecurity Market: OEMs Strategic Initiatives, Global, 2016–2018

- 10. Automotive Cybersecurity Market: Mergers and Acquisitions, Global, 2016–2018

- 11. Automotive Cybersecurity Market: Ecosystem Participants, Strategies and Analysis, Global, 2016–2018

- 12. Automotive Cybersecurity Market: Security Start-up Companies, Global, 2016–2018

- 13. Automotive Cybersecurity Market: OEM Ethernet Adoption, Global, 2017–2025

- 14. Automotive Cybersecurity Market: Connected Cars Analysis, Global, 2017–2025

- 15. Automotive Cybersecurity Market: Connected Trucks Analysis, Global, 2017–2025

- 16. Automotive Cybersecurity Market: Business Models and Pricing Parameters, Global, 2017

- 17. Automotive Cybersecurity Market: Key Challenges, Global, 2017

- 18. Automotive Cybersecurity Market: Regulation Roadmap, Global, 2015–2025

- 19. Automotive Cybersecurity Market: Regulations and Impact, US, 2017

- 20. Automotive Cybersecurity Market: Regulations and Impact, Europe, 2017

- 21. Automotive Cybersecurity Market: Hacking Incidents Highlights, Global, 2015-2018

- 22. Automotive Cybersecurity Market: Strategic Imperatives, Global, 2017–2025

- 23. Automotive Cybersecurity: Key Conclusions and Future Outlook, Global, 2017–2025

- 1. Automotive Cybersecurity Market: Threat Vector Analysis, Global, 2017

- 2. Automotive Cybersecurity Market: Strategic Analysis of Security Start-ups, Global, 2016–2018

- 3. Automotive Cybersecurity Market: OEM Ethernet Adoption, Global, 2017

- 4. Automotive Cybersecurity Market: Ecosystem Participants, Global, 2017

- 5. Automotive Cybersecurity Market: Comparative Sales Forecast Analysis of LV and Connected Cars, Global, 2017–2025

- 6. Automotive Cybersecurity Market: Key Investments and Future Opportunities, Global, 2016–2025

- 7. Automotive Cybersecurity Market: Addressable Market Opportunity, Global, 2017–2025

- 8. Automotive Cybersecurity Market: Connected Trucks, Demand Analysis, Global, 2017–2025

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || 2017 Highlights—Predictions Versus Actuals~ || Executive Summary—Key Findings~ || Trend 1—Threat Vectors in Connected Cars Analysis~ || Trend 2—Automotive Cybersecurity Features Analysis~ || Trend 3—Connected Cars Vs. Connected Trucks Cybersecurity Analysis~ || Trend 4—Mergers and Acquisitions of Key Market Participants~ || Trend 5—Innovation Will be Key for Cybersecurity Start-ups~ || Trend 6—OEMs are Transitioning to Ethernet Networks~ || Executive Summary—Comparison of 2017 and 2025~ | Research Scope, Objectives, Methodology, and Background~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ | Automotive Cybersecurity—Overview and Market Analysis~ || Automotive Cybersecurity Current Market Outlook~ || Cybersecurity Emerging From the Shadows at CES 2018~ || Key Cybersecurity Features—2017 Overview~ || Automotive Cybersecurity Ecosystem~ || OEM Strategies and Key Focus Areas~ || Automotive Ecosystem Participants—Strategy Analysis~ || Automotive Ecosystem Participants—Strategies and Analysis~ || Automotive Cybersecurity Start-up Companies~ || OEM Ethernet Adoption for IVN~ | Passenger Cars and Connected Trucks Cybersecurity—Market Analysis, Business Models and Revenue Opportunities~ || Connected Cars—Market Demand Analysis~ || Connected Cars (CC)—Cybersecurity Analysis~ || Acquisition Analysis—Investments and Future Opportunities~ || Automotive Cybersecurity Market Opportunity~ || Global Connected Trucks—Market Demand Analysis~ || Connected Trucks—Cybersecurity Analysis~ || Automotive Cybersecurity—Business Model Analysis~ | Automotive Cybersecurity Market—Key Challenges and Regional Regulations~ || Automotive Cybersecurity—Key Challenges~ || Automotive Cybersecurity Regulations—Roadmap~ || Regional Regulations and Impact—US~ || Regional Regulations and Impact—Europe~ | Automotive Hacking Incidents—Overview, Incident Impact, and OEM Security Initiatives~ || Automotive Cyber Hacking Incidents—Highlights~ || Ethical Hacking—BMW’s Partnership With Keen Lab~ || Overview of RNA Hack Incidents and Data Security~ || VW Group Vehicle Hack Incident and Security Initiatives~ || BMW ConnectedDrive Hacking Incident~ || Overview of BMW Data Security~ || GM Security Capability~ || Mercedes-Benz Connectivity Services—Data Protection and IT Security~ || Overview of Toyota Data Security~ | Solution Provider Profiles—Security Start-ups, Tier-I Suppliers and Technology Companies~ || Arilou Cyber Security (Part of NNG Group) Solutions~ || NNG’s Navigation and Infotainment Solutions with Enhanced Security~ || Arilou Software IDPS Line Fit Solution~ || Argus Cyber Security~ || Continental AG’s End-to-End Solution~ || Harman Cybersecurity (TowerSec)~ || Trillium Incorporated~ || Karamba Security~ || GuardKnox~ || SafeRide Technologies Ltd.~ || CYMOTIVE~ || Upstream Security~ || Bosch Cybersecurity~ || Renesas Security Solutions~ || Irdeto (Part of Naspers)~ || Irdeto’s Cybersecurity Roadmap~ || Panasonic Cybersecurity~ | Growth Opportunity Analysis~ || Automotive Cybersecurity Companies~ || Growth Opportunity—Partnerships and Business Models~ || Strategic Imperatives for Success and Growth—Automotive Cybersecurity~ | Key Conclusions and Future Outlook~ || Key Conclusions and Future Outlook~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Table of Acronyms Used~ || List of Exhibits~ |

| List of Charts and Figures | 1. Automotive Cybersecurity Market: Key Findings, Global, 2017–2025~ 2. Automotive Cybersecurity Market: Threat Vector Analysis, Global, 2017~ 3. Automotive Cybersecurity Market: Features Analysis, Global, 2017–2025~ 4. Automotive Cybersecurity Market: Connected Cars Versus Connected Trucks Analysis, Global, 2017–2025~ 5. Automotive Cybersecurity Market: Mergers and Acquisitions, Global, 2016–2018~ 6. Automotive Cybersecurity Market: Current Versus Future, Global, 2017 and 2025~ 7. Automotive Cybersecurity Market: Key Participants, Global, 2018~ 8. Automotive Cybersecurity Market: Key Cybersecurity Features, Global, 2017~ 9. Automotive Cybersecurity Market: OEMs Strategic Initiatives, Global, 2016–2018~ 10. Automotive Cybersecurity Market: Mergers and Acquisitions, Global, 2016–2018~ 11. Automotive Cybersecurity Market: Ecosystem Participants, Strategies and Analysis, Global, 2016–2018~ 12. Automotive Cybersecurity Market: Security Start-up Companies, Global, 2016–2018~ 13. Automotive Cybersecurity Market: OEM Ethernet Adoption, Global, 2017–2025~ 14. Automotive Cybersecurity Market: Connected Cars Analysis, Global, 2017–2025~ 15. Automotive Cybersecurity Market: Connected Trucks Analysis, Global, 2017–2025~ 16. Automotive Cybersecurity Market: Business Models and Pricing Parameters, Global, 2017~ 17. Automotive Cybersecurity Market: Key Challenges, Global, 2017~ 18. Automotive Cybersecurity Market: Regulation Roadmap, Global, 2015–2025~ 19. Automotive Cybersecurity Market: Regulations and Impact, US, 2017~ 20. Automotive Cybersecurity Market: Regulations and Impact, Europe, 2017~ 21. Automotive Cybersecurity Market: Hacking Incidents Highlights, Global, 2015-2018~ 22. Automotive Cybersecurity Market: Strategic Imperatives, Global, 2017–2025~ 23. Automotive Cybersecurity: Key Conclusions and Future Outlook, Global, 2017–2025~| 1. Automotive Cybersecurity Market: Threat Vector Analysis, Global, 2017~ 2. Automotive Cybersecurity Market: Strategic Analysis of Security Start-ups, Global, 2016–2018~ 3. Automotive Cybersecurity Market: OEM Ethernet Adoption, Global, 2017~ 4. Automotive Cybersecurity Market: Ecosystem Participants, Global, 2017~ 5. Automotive Cybersecurity Market: Comparative Sales Forecast Analysis of LV and Connected Cars, Global, 2017–2025~ 6. Automotive Cybersecurity Market: Key Investments and Future Opportunities, Global, 2016–2025~ 7. Automotive Cybersecurity Market: Addressable Market Opportunity, Global, 2017–2025~ 8. Automotive Cybersecurity Market: Connected Trucks, Demand Analysis, Global, 2017–2025~ |

| Author | Dorothy Amy |

| Industries | Automotive |

| WIP Number | MD4B-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9807-A6,9813-A6,9AF6-A6,9AF7-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB