Fintech

The global experience with COVID-19 gave financial services companies a unique opportunity to refocus and rebuild the trust of their customers, ultimately leading to their loyalty. Banking is now embedded in the customers’ lifestyle; and as part of banks' continued digital transformation, they can serve their customers through multiple channels and technologies. The use of technology to automate processes removes internal obstacles and creates a seamless customer experience. Key to this automation is advances like AI, data analytics, and systems that can react quickly to the market.

The acceleration of work-from-home culture and convergence of technology with financial services (Fintech) aligns with Frost & Sullivan's own breadth and depth of expertise. Frost & Sullivan tracks the digital transformation of financial services companies and fintech disruptors. The Fintech industry is extensive. It is comprised of multiple subsectors; each of which have trends specific to them, and to each global region. Having a 360-degree view of emerging technologies, the global financial services industry, and regional expertise creates a unique perspective that is valuable to our research and advisory for clients.

The Fintech subsectors we cover include:

• Verticals: Digital Banking, Insurtech, Wealthtech

• Enablers: Cloud, Data and Analytics, Blockchain, Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT)

• Services: Lending Platforms, Regtech, Paytech

-

27 Oct 2016 | Asia Pacific | Market Research

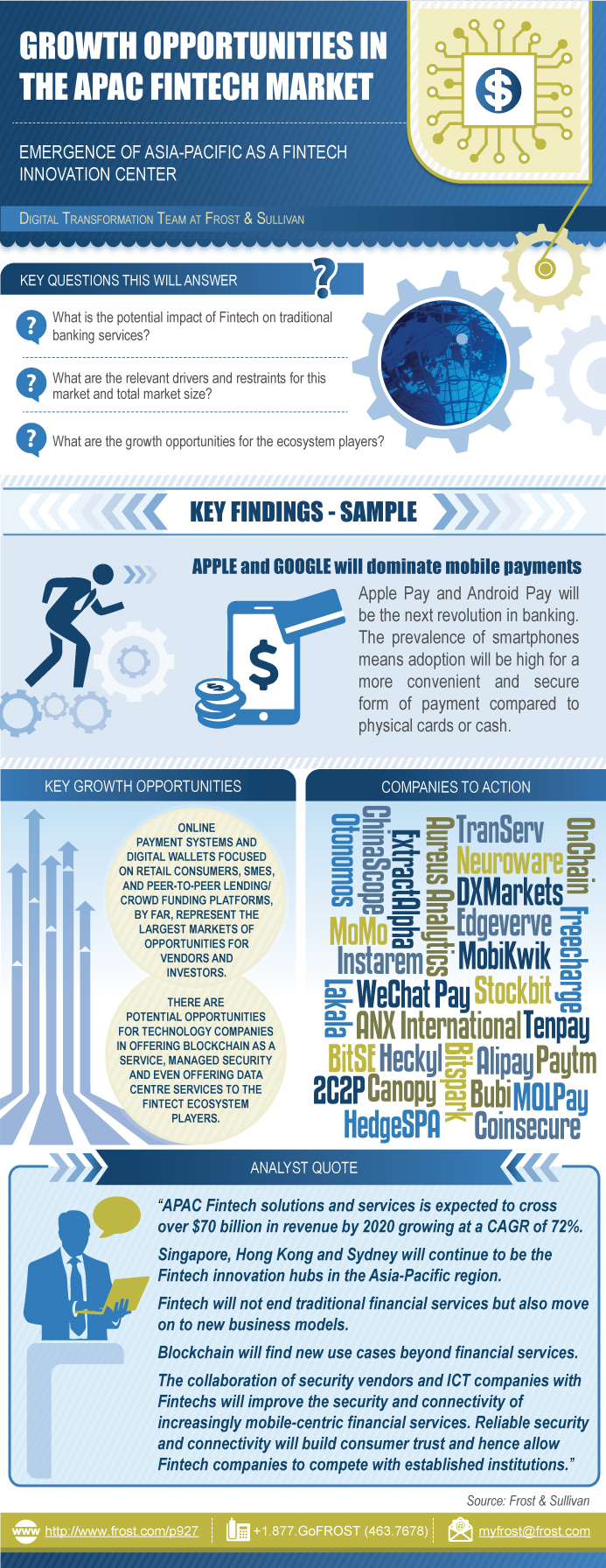

Growth Opportunities in the APAC Fintech Market

Emergence of Asia-Pacific as a Fintech Innovation Center

This research service explores the financial technology (fintech) market in Asia-Pacific and the potential impact on traditional banking services, with the advent of disruptive technologies such as Blockchain. For the purpose of this study, fintech is categorized into Digital Payments, Personal & Business Finance, and Financial Infrastructure & Dat...

$4,950.00

Special Price $3,712.50 save 25 %

-

30 Sep 2016 | Global | Megatrends

Future of Financial Services

Growth in FinTech is Shaping the Future of Invisible Finance & Virtual Banking

The financial services industry is on the brink of disruption, as the use of technology poses a challenge to market players and their existing products and services and associated costs. Thus it is important to revisit one of the oldest industries and re-conceptualize how it will thrive in the future aligning itself to looming social and technologi...

$4,950.00

Special Price $3,712.50 save 25 %

-

27 Sep 2016 | Asia Pacific | Market Research

Asia-Pacific Mobile Payments

Spearheading Cashless Societies

Countries within Asia-Pacific are trying to go cashless; mobile payment has been identified as an ideal solution to spearhead the transformation from cash-based to cashless solutions. Asia-Pacific is expected to continue to lead the world in mobile payment developments with smartphone penetration being the highest in the world. With standardization...

$4,950.00

Special Price $3,712.50 save 25 %

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB