Fintech

The global experience with COVID-19 gave financial services companies a unique opportunity to refocus and rebuild the trust of their customers, ultimately leading to their loyalty. Banking is now embedded in the customers’ lifestyle; and as part of banks' continued digital transformation, they can serve their customers through multiple channels and technologies. The use of technology to automate processes removes internal obstacles and creates a seamless customer experience. Key to this automation is advances like AI, data analytics, and systems that can react quickly to the market.

The acceleration of work-from-home culture and convergence of technology with financial services (Fintech) aligns with Frost & Sullivan's own breadth and depth of expertise. Frost & Sullivan tracks the digital transformation of financial services companies and fintech disruptors. The Fintech industry is extensive. It is comprised of multiple subsectors; each of which have trends specific to them, and to each global region. Having a 360-degree view of emerging technologies, the global financial services industry, and regional expertise creates a unique perspective that is valuable to our research and advisory for clients.

The Fintech subsectors we cover include:

• Verticals: Digital Banking, Insurtech, Wealthtech

• Enablers: Cloud, Data and Analytics, Blockchain, Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT)

• Services: Lending Platforms, Regtech, Paytech

-

04 Mar 2024 | Asia Pacific

Indonesian Financial Technology Growth Opportunities, Forecast to 2028

Digital Payment Trends are Fueling the Industry s Growth Potential

Indonesia is undergoing a paradigm shift toward a digital economy, actively integrating financial services and emerging technologies to drive growth. Increasing digitalization, a high internet penetration rate, and a conducive policy and regulatory environment that supports financial inclusion make financial technology (fintech) services a popular ...

$2,450.00 -

20 Feb 2024 | Asia Pacific

Growth Opportunities and Trends in the Asia-Pacific Digital Payment Market Forecast to 2027

Transformative Mega Trends Enabling Growth and Innovation

The growing use of digital payments in Asia-Pacific (APAC) paves the way for innovation and new use cases that address user pain points payment solutions, such as self-checkout, enhance customer experience while software point-of-sale (softPOS) accelerates the merchant onboarding process. The APAC market will become more aware of the benefits of ne...

$4,950.00 -

21 May 2020 | Asia Pacific

Payments Services Market in Cambodia, Laos, Myanmar (CLM), and Vietnam, Forecast to 2025

Market Potential for Payments in all 4 Countries Indicates Favorable Investment Opportunities

China’s Belt and Road Initiative (BRI) launched in 2013 aims to boost global trade connectivity and cross-border transactions between China and countries on the new Silk Road, including Cambodia, Laos, Myanmar (collectively called as CLM), and Vietnam. It is expected to enhance financial cooperation in the region, and eventually bolster the growt...

$3,000.00 -

12 Mar 2020 | Asia Pacific

Growth Opportunities in the Asia-Pacific B2B Payments Market, Forecast to 2025

Emerging Digital Payment Trends such as Blockchain-based Hyperledger Frameworks and Strategic Partnerships to Create New Business Models and Revenue Streams

Digital payments technology adoption in Asia-Pacific remains in a nascent stage, and unlike digital payment methods used by consumers in which streamlined checkout processes accept instant payment using credit cards, the bulk of B2B payments is still tied to paper checks and manual processes. The future of digital payments is driven by applicatio...

$1,500.00 -

19 Dec 2019 | Asia Pacific

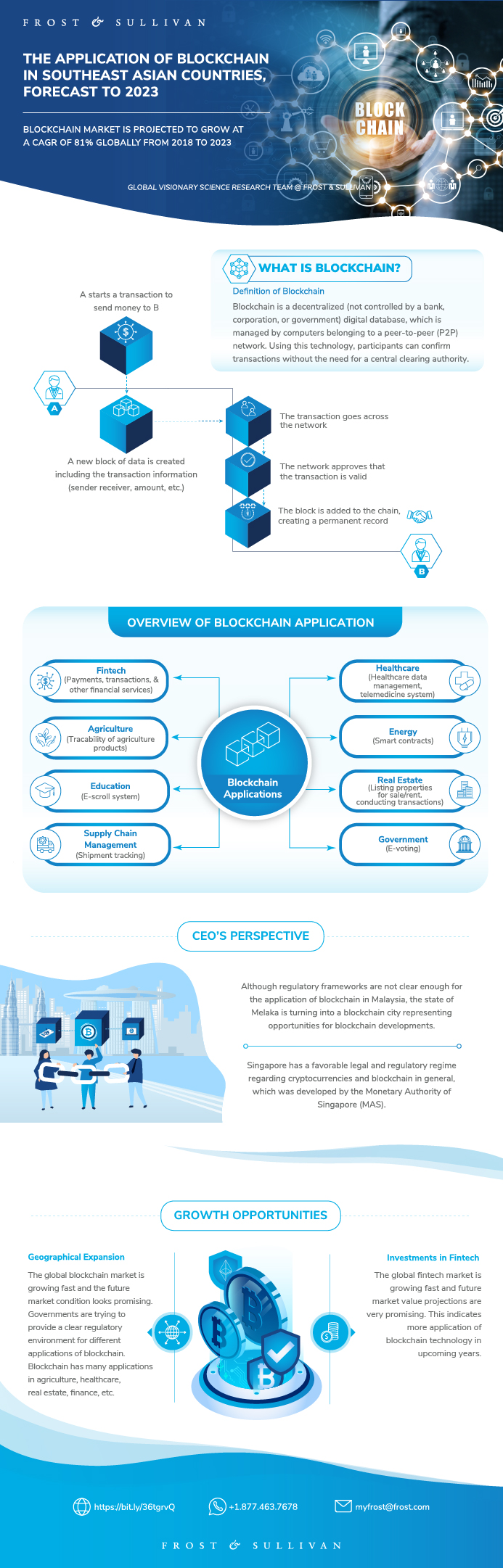

The Application of Blockchain in Southeast Asian Countries, Forecast to 2023

Blockchain Market is Projected to Grow at a CAGR of 81% Globally from 2018 to 2023

Blockchain, which is a decentralized digital database, supports participants when they confirm their transactions without the need for a central authority to approve/accept the transaction. Although this technology has been recognized mainly by digital currencies such as Bitcoin and other cryptocurrencies, it has several other applications in diffe...

$3,000.00 -

18 Dec 2019 | Asia Pacific

The Malaysian FinTech Landscape, 2019

The Malaysian Banking Industry is on the Brink of Technological Disruption

This study covers the reaction of traditional banks and other financial service companies, the Malaysian regulators and supporting organisations to the new-generation trend of FinTech and explores FinTech start-ups active in the Malaysian market. A regulator holds the key to growing markets; this is true of FinTech in Malaysia. We have captured ke...

$1,500.00 -

28 Aug 2019 | Asia Pacific

The Malaysian InsurTech Landscape, 2019

Insurtech Players Spur Growth in the Malaysian Insurance Industry

This study covers the reaction of traditional insurance companies, the Malaysian government and supporting organisations to the new-generation trend of InsurTech and explores InsurTech start-ups active in the Malaysian market. The Malaysian insurance industry has been showing good growth since its inception as Bank Negara Malaysia (BNM; the centra...

$1,500.00 -

16 Jul 2018 | Asia Pacific

Global Blockchain Applications, 2018

Blockchain has Evolved beyond Cryptocurrency Applications and is Finding its Way into Other Industry Applications

Blockchain has been receiving much attention over the past two years. It was originally considered as synonymous with Bitcoin and cryptocurrencies. However, with time, the technology has started to find its way into many other applications. The future of Blockchain is one of growth and adoption in multiple domains. This study seeks to provide an ov...

$1,500.00 -

07 Jul 2017 | Asia Pacific

Life Insurance Industry Outlook in Singapore

How Insurtech is Disrupting the Industry

The ecosystem is expected to experience a paradigm shift with increasing number of insurers looking at digital transformation to stay competitive and to engage customers better by offering more partnerships and collaborations with digital disruptors, relaxed insurance regime, customer-centric product innovations, infrastructure enhancement to reduc...

$1,500.00 -

27 Oct 2016 | Asia Pacific

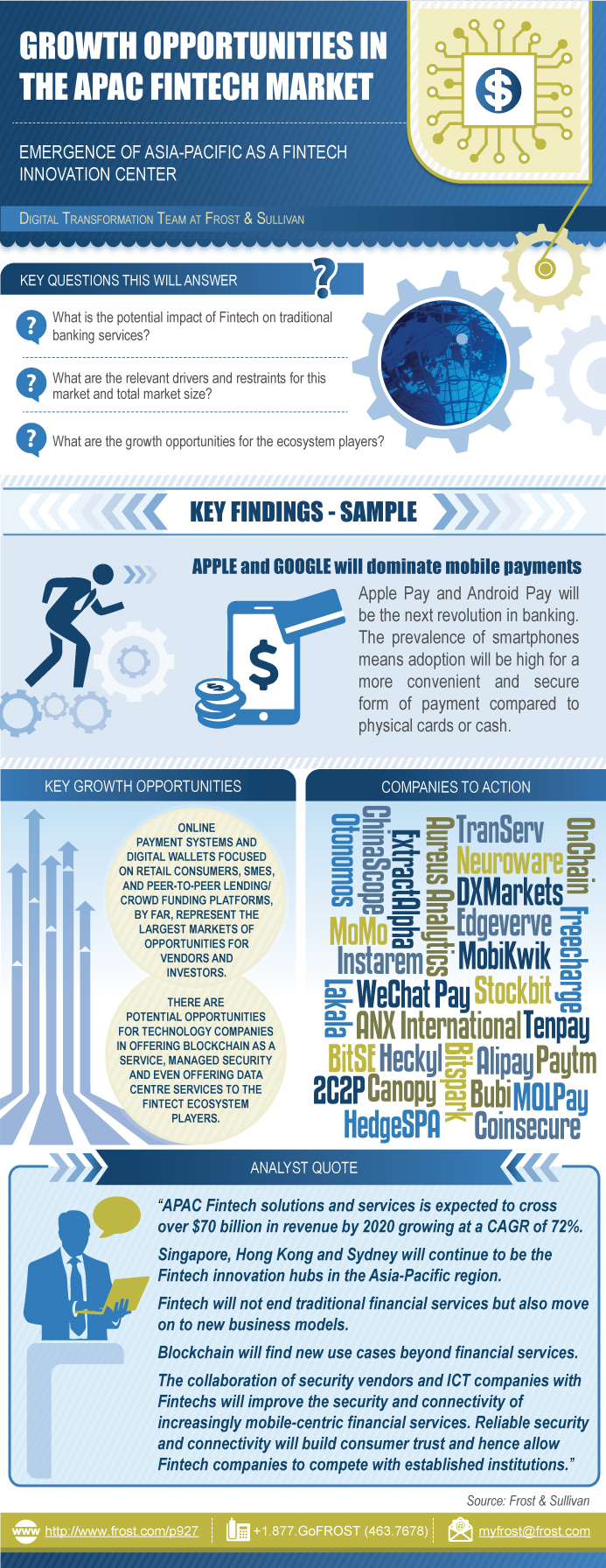

Growth Opportunities in the APAC Fintech Market

Emergence of Asia-Pacific as a Fintech Innovation Center

This research service explores the financial technology (fintech) market in Asia-Pacific and the potential impact on traditional banking services, with the advent of disruptive technologies such as Blockchain. For the purpose of this study, fintech is categorized into Digital Payments, Personal & Business Finance, and Financial Infrastructure & Dat...

$4,950.00

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB